- The UK recession was mild and short-lived: the economy started 2024 with a bang, posting robust growth of 0.6% Q/Q in Q1. After a protracted period of stagnation this may well mark an inflection point given the ongoing improvement in consumer conditions. We expect solid growth through the rest of the year.

- The prospect of BoE rate cuts may also boost sentiment. Yesterday the central bank made substantial strides towards a summer rate cut, pushing back against the US-led hawkish market repricing of rates expectations. The data dependent approach remains – CPI and wage data will be in sharp focus over coming weeks – but there is probably enough groundwork now for easing at the next policy meeting in June, provided that monthly indicators move in the right direction.

The UK economy bounces back

The UK economy started the year with a bang. Q1 GDP growth came in at 0.6% Q/Q, the fastest rate since 2021. On a per capita basis, real GDP expanded by 0.4% after seven consecutive quarters without positive growth.

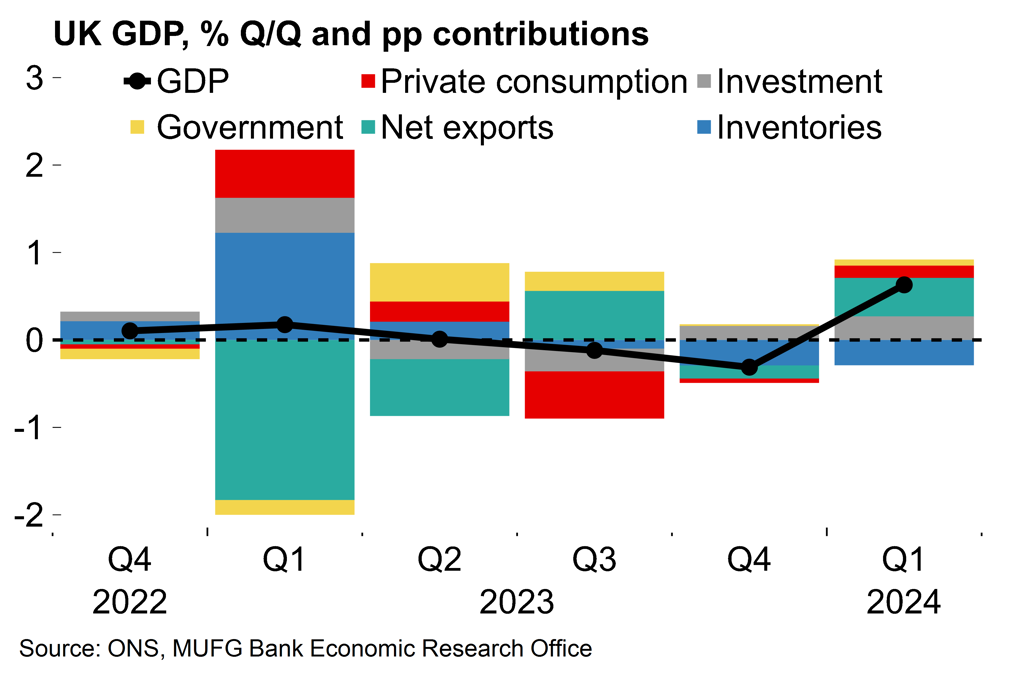

The expenditure breakdown showed that growth was broad-based, driven by net trade and investment in particular, but with positive contributions from private consumption and government expenditure too. Falling inflation will continue to boost real household incomes and the Bank of England looks poised to get the ball rolling on rate cuts by the summer which would further boost confidence and activity. On the production side, there were healthy expansions in services (0.7% Q/Q) and industry (0.8%). Construction fell by 0.9%, likely related to bad weather in Q1.

Chart 1: A robust, broad-based expansion in Q1

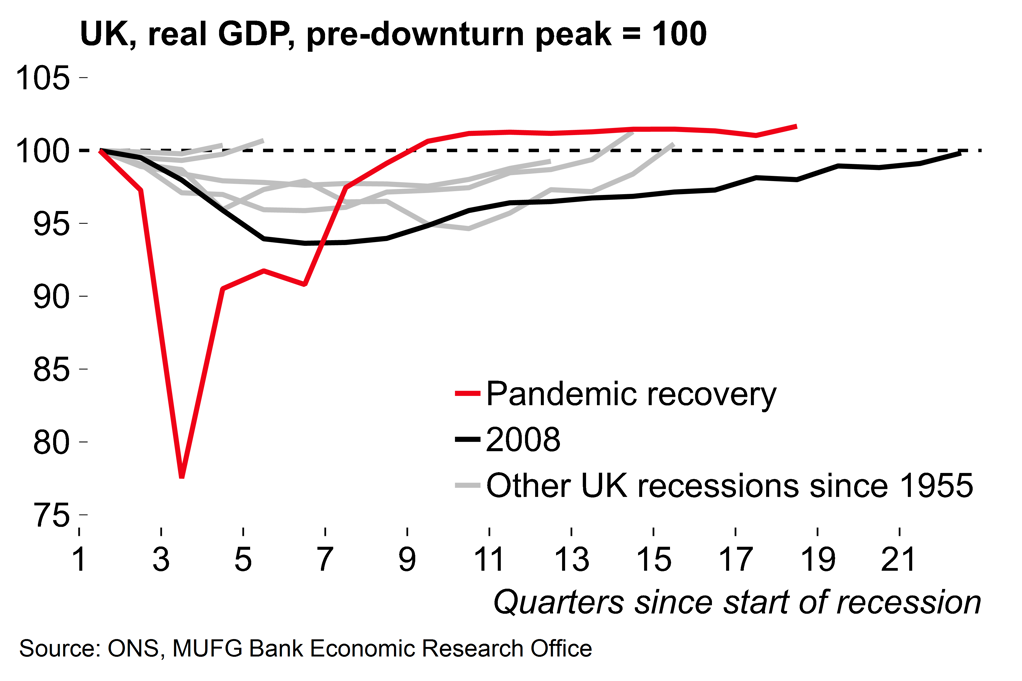

Chart 2: An inflection point after the period of stagnation?

While the economy slipped into a mild and short-lived recession in H2 2023, it now seems that the UK has managed to navigate the energy crisis and period of rapid monetary tightening without experiencing a protracted downturn. Instead, the broader picture has, until now, been one of stagnation since post-pandemic rebound effects became less relevant. But GDP is now 1.7% above the Q4 2019 level and these latest growth figures may well mark an inflection point with the UK economy well-placed to return to sustained growth this year. While we expect some moderation in the growth rate in Q2, forward-looking indicators suggest that decent growth momentum will be maintained this quarter. Consumer expenditure is set to increasingly be a key growth driver as real household incomes recover. We will hold our quarterly forecast round later this month, but applying our previous quarterly profile through the rest of the year lifts the annual average growth rate to 0.9% after today’s data.

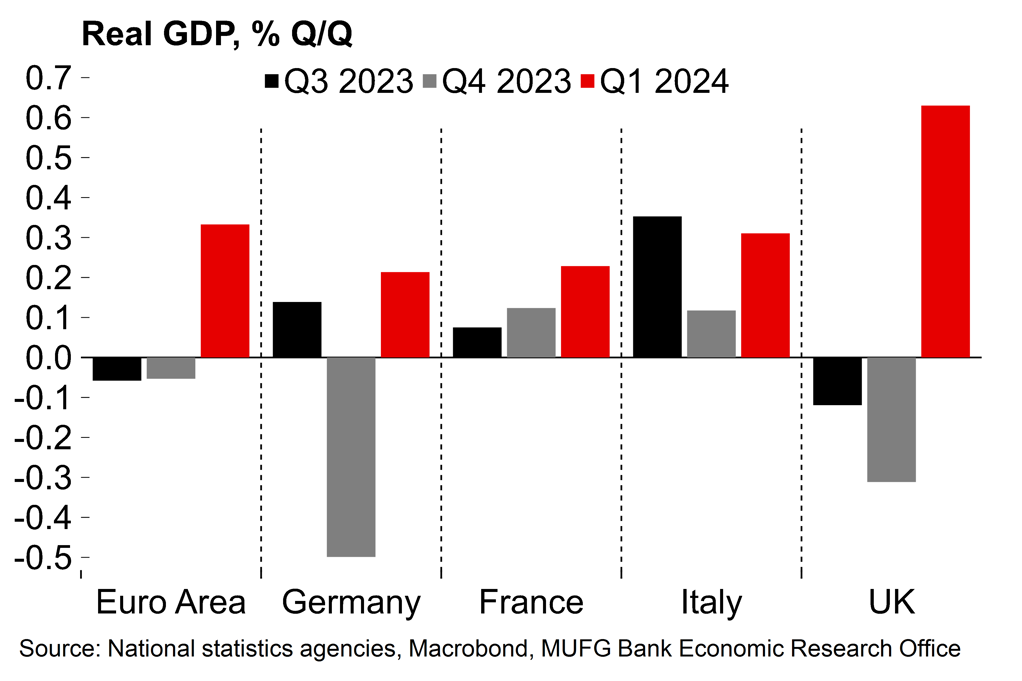

Chart 3: Growth has picked up across Europe

Chart 4: Surveys point to ongoing momentum

From a wider European perspective, the upside surprise on UK GDP follows on from better news on euro area activity in Q1 (see here). A return to growth is certainly not a shock – we’ve been fairly upbeat on the prospects for the European economy this year (see e.g. here) against the background of ongoing disinflation. But the Q1 GDP figures for both the euro area and the UK came in above our expectations. The question now is: is this a matter of timing – with the recovery starting earlier than we expected in 2024, but following a similar path – or is growth set to be fundamentally stronger than we had assumed?

We still lean towards the former and expect solid but unspectacular growth from here. Growth is unlikely to sustainably exceed potential with monetary policy set to remain restrictive even if the ECB and BoE do start to cut rates over coming months. Our US economist also expects that high interest rates, depleted household savings and deteriorating credit conditions point to slowing US growth later this year. That would weigh on global sentiment somewhat. Nonetheless, the Q1 data has been plainly good news and we see it as a sign that the worst is over for the European economy.

Bank of England review – Ready to cut

The Bank of England made substantial strides towards a summer rate cut at yesterday’s meeting with tweaks to the statement language and more significant comments from Governor Bailey. To our minds, the door is wide open for a cut at the next meeting if data on inflation and wage pressures evolve favourably over coming weeks.

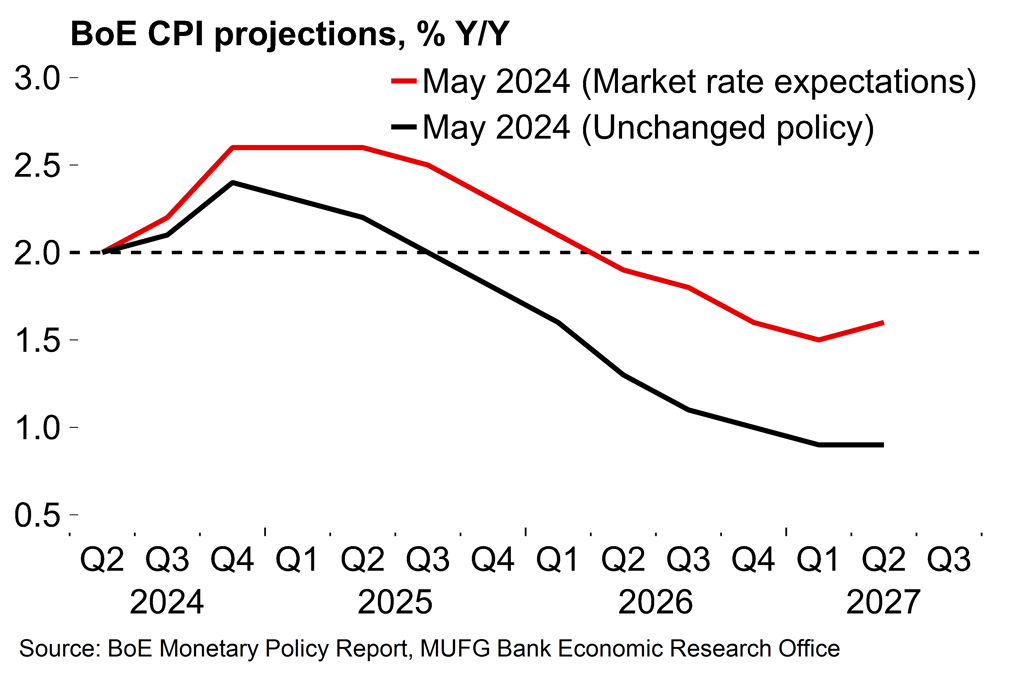

There was a clear sense that the BoE wanted to push back on the recent hawkish repricing of UK rate expectations following hot US data. The updated CPI projections show inflation undershooting the target in 2026. These are conditioned on the market-implied path for rates (two cuts this year and a further two in 2025) and, as Bernanke noted in his recent review of BoE policy (here), can be interpreted as a tool for communicating policy plans. In this case, the message is clear – market participants should expect more in the way of easing.

Bailey went further by saying that it is likely that the BoE will need to cut rates “over coming quarters”. He added that the prospect of a rate cut in June should not be ruled out, but neither is it a “fait accompli”. The explicit mention of the possibility of a move in June feels significant. Bailey also said in a later interview that the BoE has changed its view on the “likely persistence of inflation”. All told, it does look as though policymakers have laid what looks like sufficient groundwork now for a cut as soon as the next meeting, in the absence of upside surprises on inflation or pay pressures. Market participants are currently pricing in around a 60% chance of a June cut.

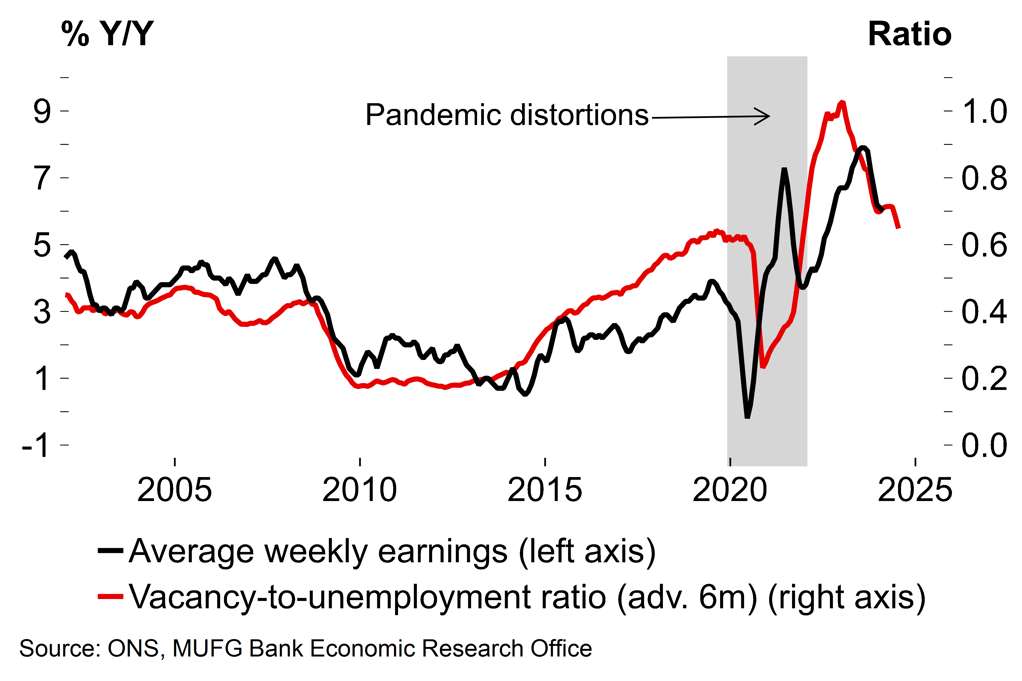

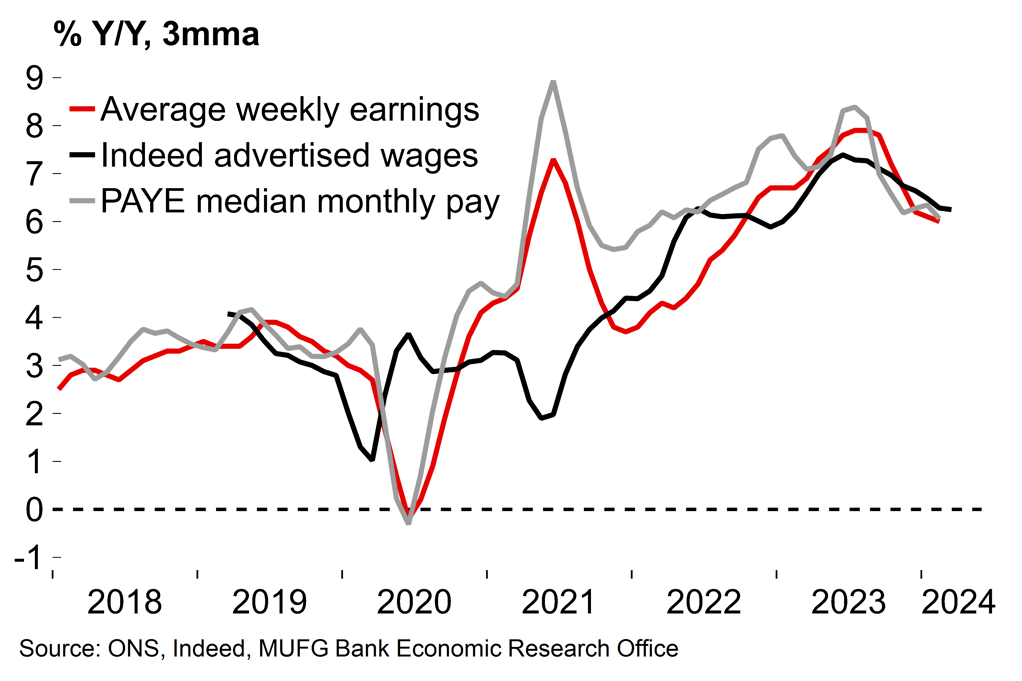

But unlike the ECB, which looks poised to go in June, the BoE has opted not to signpost a specific meeting for the initial cut. Instead, there’s a preference to retain a degree of flexibility over the timing of upcoming easing. The data-dependent approach seems credible so there will be intense market scrutiny on the upcoming CPI and wage releases. The Monetary Policy Report highlighted that wage data for April – a key month for annual pay settlements – will be particularly important.

Chart 5: The BoE’s new projections suggest that pre-meeting market rate expectations would see CPI undershoot the target

Chart 6: Nominal pay pressures have started to ease in the UK

The vote split was 7-2 with Deputy Governor Ramsden joining Swati Dhingra in calling for a cut (this was no surprise after his recent dovish speech). We suspect that the vote belies a degree of division – recent speeches suggest that several members of the ‘no change’ camp of seven are still wary about underlying inflation pressures. Today’s robust GDP report (see above) may also have given some members pause for thought. In isolation we think strong growth in Q1 is unlikely to derail initial monetary easing, with the BoE likely to stress that monetary policy would remain restrictive even after several rate cuts (we agree). But if there is indeed a rate cut in June or August it is unlikely to be a unanimous decision with nominal pay growth likely to remain uncomfortably high for some, not least against a backdrop of firmer domestic demand.

Lastly, on the prospect of cross-Atlantic monetary policy divergence, Bailey echoed a recent speech and repeatedly emphasised that inflation dynamics are not the same, saying that the US is “facing a different situation”. Looking back, the BoE did hike rates before the Fed back in 2021. We suspect that UK policymakers would be happy to make another statement of ‘Fed independence’ by easing before their US counterparts.

Next week: UK labour market in focus

Next week looks set to be fairly quiet in terms of data releases and events. After the BoE reiterated its data-dependent setting, the focus will be on UK labour market data on Tuesday. There will also be the German ZEW survey and final euro area HICP release.

Key data releases and events (week commencing Monday 13 May)