- Monthly GDP figures show that the UK economy remains at risk of slipping into a technical recession. Whether a small contraction or flat growth in Q4, the broader picture remains one of stagnation through the course of 2023. We expect conditions will improve slightly this year with a return to modest growth.

- The news remains bleak for the German industrial sector. With output falling in November, GDP in the euro area looks more likely to have contracted in Q4 2023. There are some signs of improving cyclical momentum for the economy as a whole around the turn of the year, but a meaningful manufacturing recovery does not feel imminent.

The UK economy is teetering close to recession but conditions should improve in 2024

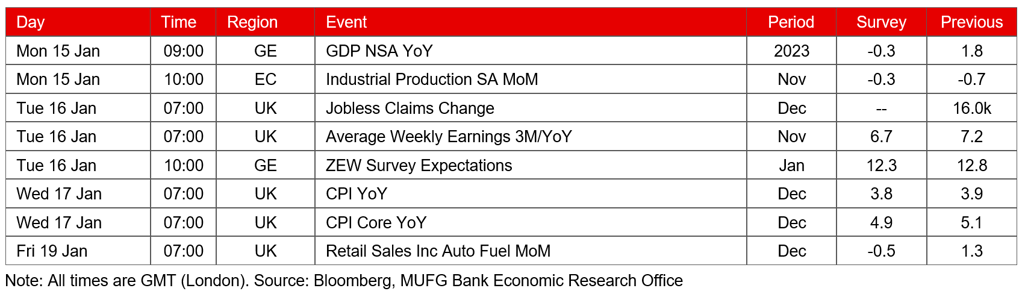

UK monthly GDP growth for November came in at 0.3% M/M, slightly above the consensus (0.2%). The series is volatile and prone to revision, and growth in September was revised down slightly to leave the 3m/3m growth rate at -0.2%.

The quarterly GDP numbers showed a small contraction in Q3 (-0.1% Q/Q) and this latest monthly data has done nothing to change the notion that the UK economy is teetering close to a technical recession (i.e. two consecutive quarters of negative growth). Unchanged monthly GDP in December and no revisions to the historic data would put the 3m/3m growth figure at -0.03% – so it really is hanging in the balance.

Chart 1: UK growth momentum tailed off in H2 2023 leaving the economy on the brink of recession

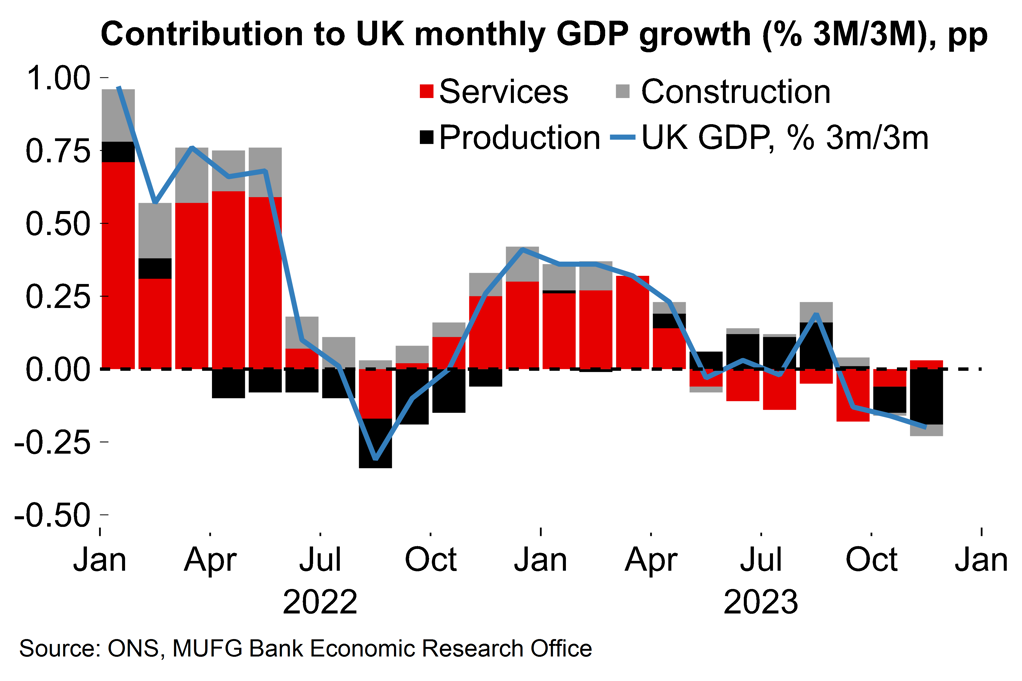

Chart 2: Business surveys suggest that the economy may carry more momentum into 2024

A technical recession, if there is one, would likely occur by the slimmest of margins. The broader picture is one of a stagnant UK economy that has drifted sideways through 2023 as monetary policy tightening and squeezed household finances have weighed on activity. Monthly output in November was 0.1% lower than the first month of the year – the general trend has essentially been horizontal.

We expect better news (i.e. some actual growth) to come in 2024. There are now some signs in business surveys that the UK economy has carried slightly stronger momentum into the New Year. The composite PMI figure for December continued to improve into expansion territory (in contrast to the euro area equivalent – see Chart 2).

The main driver of the UK expansion this year is likely to be the ongoing recovery in households’ real purchasing power as the disinflation process continues. Monetary policy easing should also provide a boost to confidence. There are already signs of lower quoted mortgage rates following the Fed’s dovish pivot in December, providing better news for households whose fixed rate deals expire this year. The downward shift in interest rate expectations also gives the Chancellor more room to implement some tax cuts ahead of the general election this year.

Our latest GDP forecast is for annual average growth of 0.6% in 2024. A low number, yes, but it’s important to note that the carryover effect from 2023 will be unusually low (likely to be negative, in fact – for the first time since 2009) after the weak end to the year. Our forecast is actually slightly above consensus and we expect better quarterly growth figures by the end of the year.

The news isn’t getting any better for the German industrial sector

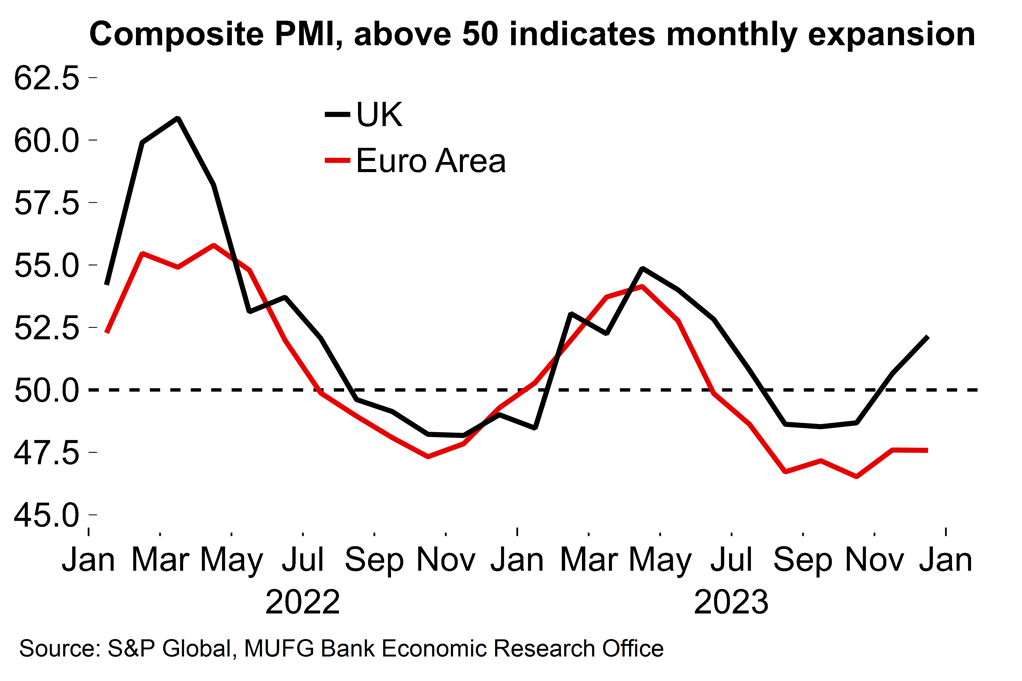

Data this week showed that German industrial production decreased by 0.7% M/M in November, while factory orders couldn’t muster anything more than 0.3% growth after a 3.7% plunge in the previous month. It really is a challenging picture for German industry, with a range of cyclical and structural pressures weighing on activity. Manufacturing output is 13.4% below the peak recorded in November 2017 so we’re essentially talking about a six-year manufacturing depression now.

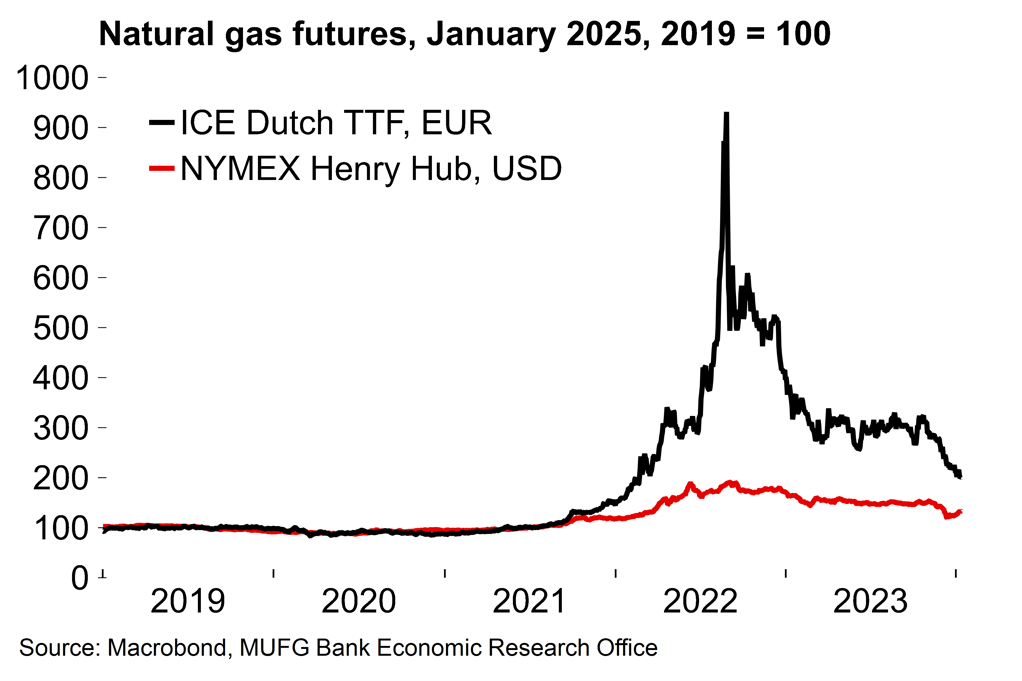

There were signs of worsening cyclical momentum prior to the pandemic, which was then compounded by supply-chain issues. However, it’s increasing clear that increased competition from China, especially in the EV market, poses a structural challenge to Germany’s large automobile sector. German passenger car exports are around 30% below the 2018 average level. At the same time, there are longer-term consequences for industry after Europe weaned itself off cheap Russian pipeline gas. Futures pricing suggests that energy is set to remain relatively more expensive than prior to the crisis (Chart 2), placing European industry at a comparative disadvantage relative to the US and other exporters. With these longer-term issues weighing on activity, it’s hard to see a meaningful turnaround in German/euro area manufacturing output in the absence of a significant global upswing, which is not our base case (see here).

Chart 3: German industry is in a six-year depression with little sign of any improving momentum

Chart 4: Energy in Europe set to remain comparatively more expensive than before the price surge

There was a small increase for French industrial production in November (0.5%, vs consensus of 0.0%) but output for the euro area a whole is set to have decreased in the month. This means that another quarterly contraction, and hence a technical recession, is now more likely in the Q4 GDP data

However, despite the ongoing weakness in the manufacturing sector, survey evidence this week continued to show hints that cyclical momentum in the euro area economy as a whole may have turned for the better at the end of last year. The European Commission’s Economic Confidence gauge for December backed up what we saw in the PMIs – conditions are no longer deteriorating, and there are some tentative signs of recovery now. Most notable was a decent improvement in the services component last month, more than offsetting the industrial stagnation. The first evidence of sentiment in 2024 also looked better with the Sentix investor confidence number improving in January. We expect confidence indicators will trend higher over coming months as inflation continues to recede (the pick-up in December was probably just a blip – see here) and the ECB moves closer to easing policy. Our latest forecast is for annual average euro area growth of 0.7% in 2024, which is slightly above consensus.

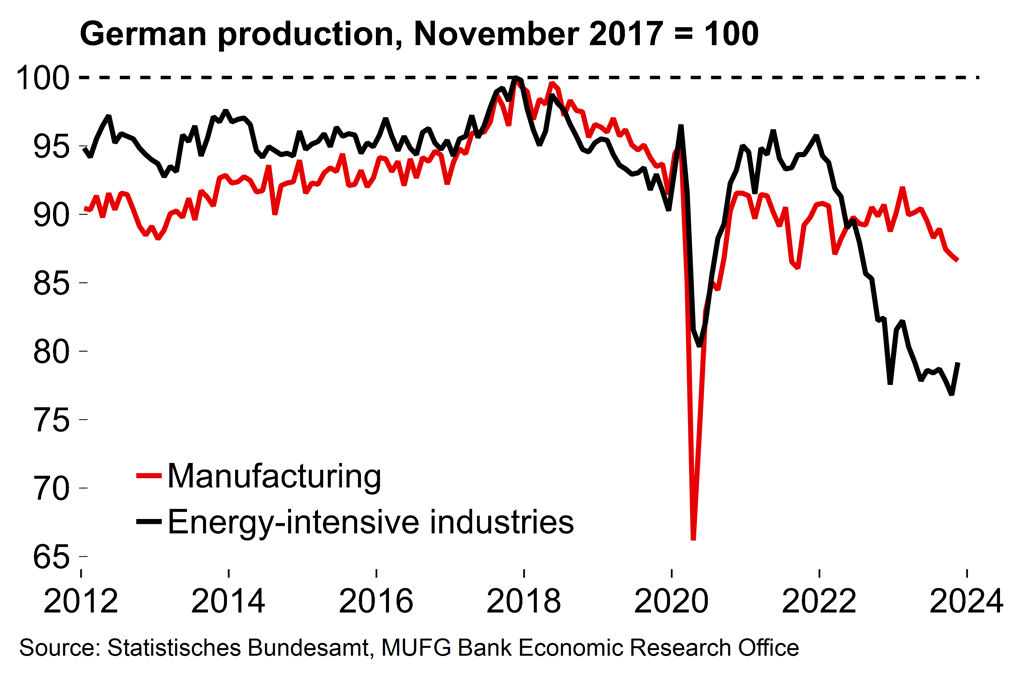

The week ahead – UK labour market and inflation in focus

Next week will see the release of euro area industrial production stats, the final estimate for HICP, and the ECB minutes of its December meeting. The German ZEW survey will offer the major gauge of sentiment in the euro area for 2024 and we expect the recent signs of stabilisation/slight improvement will continue into the New Year. There will also be an early official estimate of German GDP growth for 2023 (released prior to the Q4 national accounts). We look for a figure of -0.3%.

In the UK, there will be an update on both the labour market and December CPI. We expect pay growth will have eased further but it’s likely to remain too high for the BoE’s comfort. UK inflation may have also edged down – but the recent prints for the US and euro area serve as a reminder that the disinflation process could be bumpy.