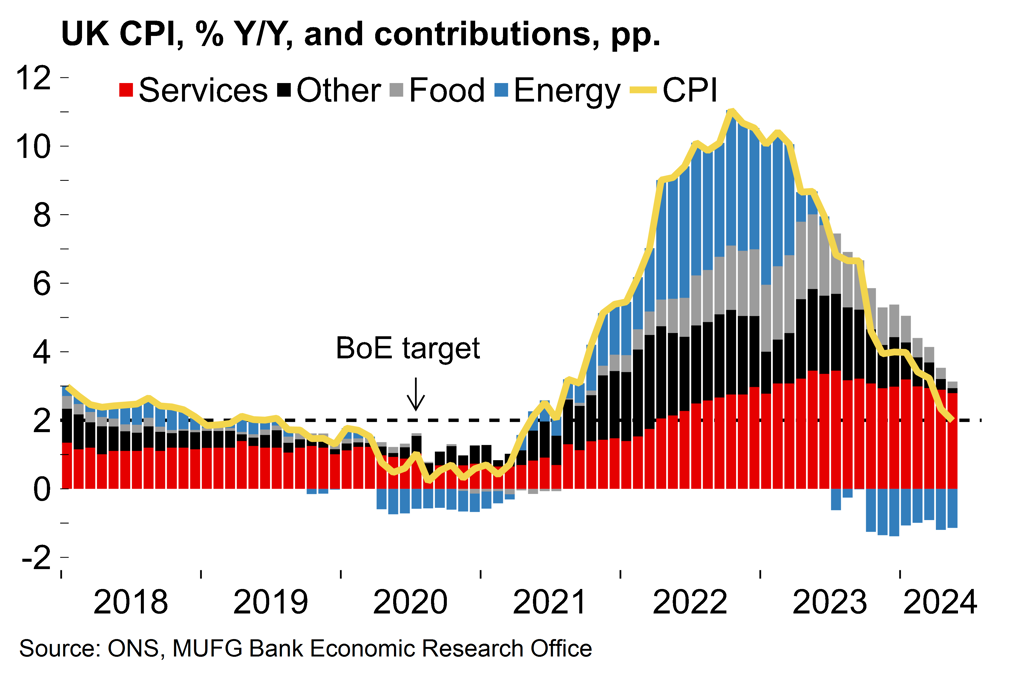

- The UK’s economic recovery continues with consecutive quarters of robust growth now looking likely at the start of the year. While certainly a good inheritance for the new government this might complicate matters for the BoE. Officials remain notably divided over the persistence of inflationary pressures and the Bank’s chief economist has mentioned concerns about the economy’s “speed limit”. Given that, next week’s figures on the labour market and inflation look key with an initial rate cut at the next policy meeting in August seemingly hanging in the balance.

- Next week’s ECB meeting is set to be a low-key affair ahead of the summer break. After getting the ball rolling on rate cuts just five weeks ago, officials have no intention to go back-to-back. Another move in September seems a reasonable assumption but for now policymakers will want to retain flexibility around the easing schedule going forward (unlike with the well-telegraphed June cut).

The UK economy continues to bounce back

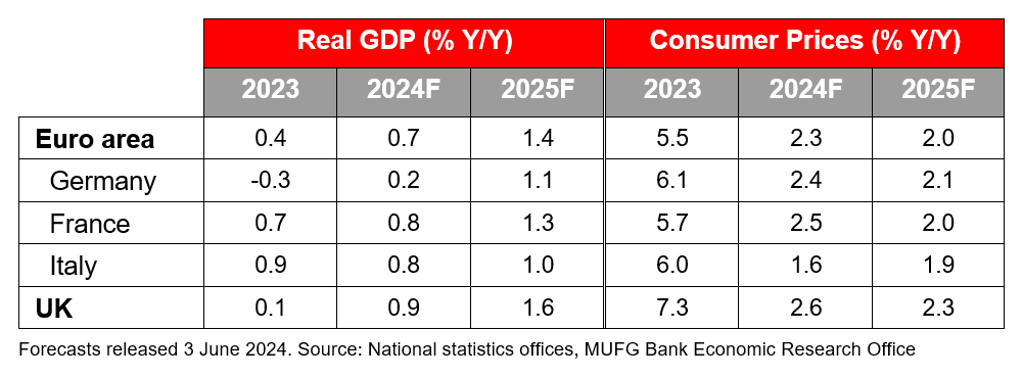

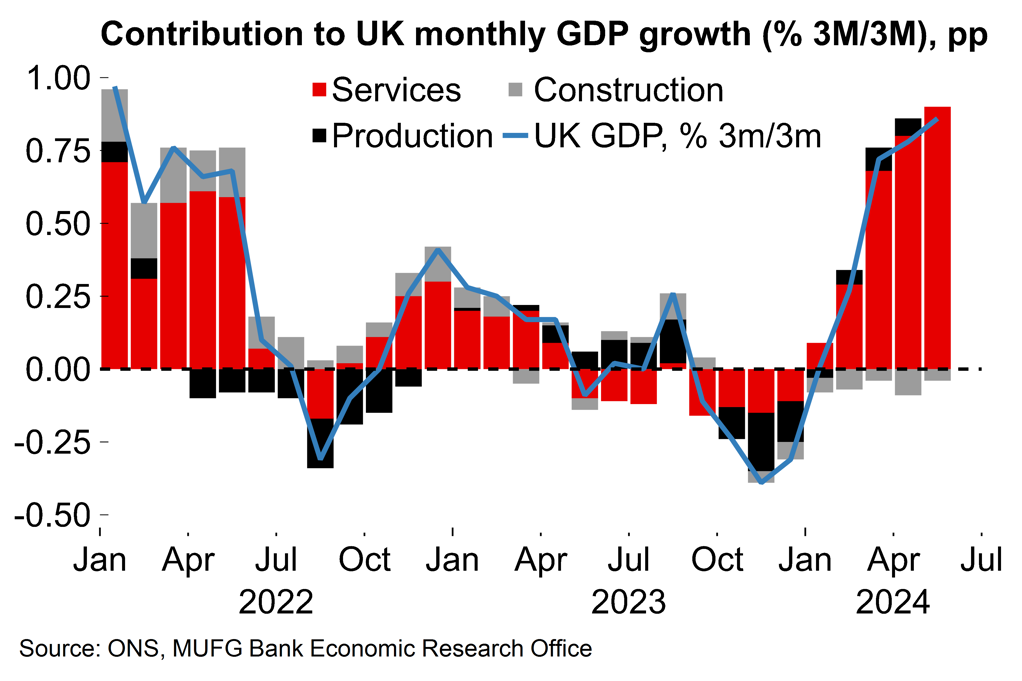

There was more good news on the UK economy this week with the monthly estimate of GDP showing 0.4% M/M growth in May. This was driven by a broad-based expansion in the services sectors, which was likely supported by both the decline in public sector industrial action (Chart 2) and better weather after an unusually soggy April. We’ve said before that the healthy Q1 growth figure (0.7% Q/Q) may have marked an inflection point for the UK after an extended period of stagnation and it certainly has been a strong start to the year with 1.5% growth since December 2023.

On a quarterly basis, we are now tracking growth in Q2 as a whole at 0.6% Q/Q. Beyond that we expect a slight deceleration as the boost from reduced industrial action fades, but consumer spending should at least partially offset this as real incomes continue to recover. We’ve been relatively optimistic on the UK outlook but may revise up our current above-consensus forecast (0.9% in 2024) in our next update given the likelihood of strong back-to-back quarters of growth at the start of the year.

Chart 1: The UK economy has started the year brightly

Chart 2: Public sector strike action has faded

It’s certainly not a bad inheritance for the new Labour government which has made explicit its focus on economic growth (see our take on the new policy agenda here). However, the rapid recovery of the UK economy poses questions for the BoE. At the last policy meeting in June policymakers made several tweaks to the statement language which seemed to leave the door open to a summer rate cut. This felt significant at what could reasonably have been expected to be a more low-key meeting ahead of the UK election. Given that, we thought that BoE officials might use speeches after the election blackout period to further tee up an initial move once free of political sensitivities. But the opposite has been true – Huw Pill, the BoE’s chief economist, spoke on Wednesday (text here) and did not give the impression that he is about to vote for a rate cut. In reference to inflation now being back at 2% he said that “it is not enough to meet the target in a transitory or fleeting way” and highlighted that there are “upside risks” to his assessment of inflation persistence. We were in the room and Pill also mentioned the economy’s “speed limit” several times suggesting that there may be some concern around inflationary pressures generated by the UK economy’s upshift since the start of the year.

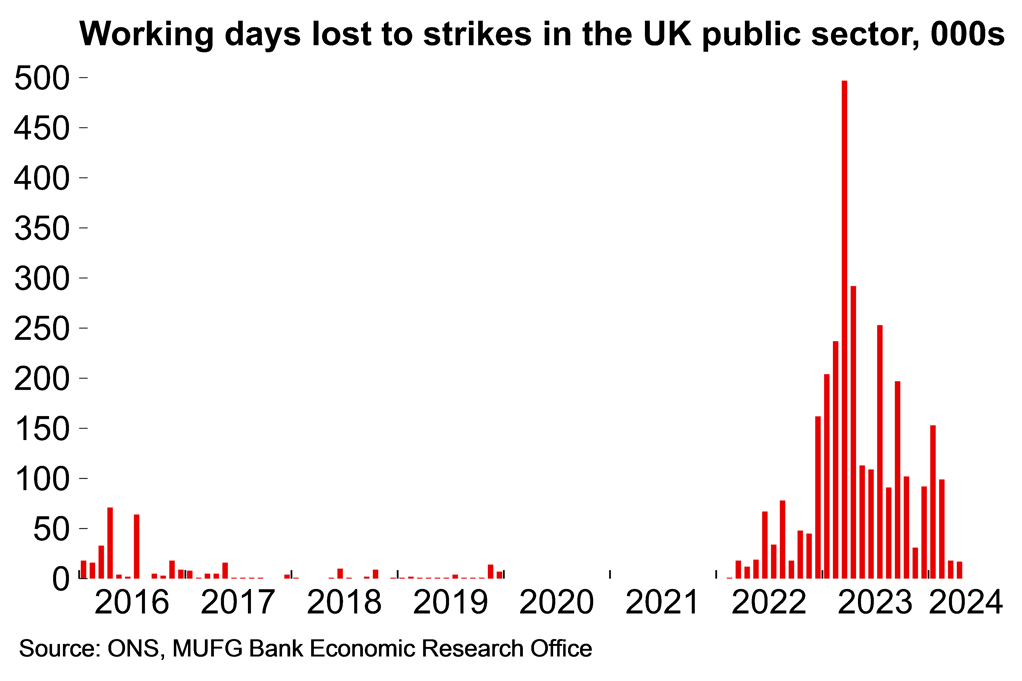

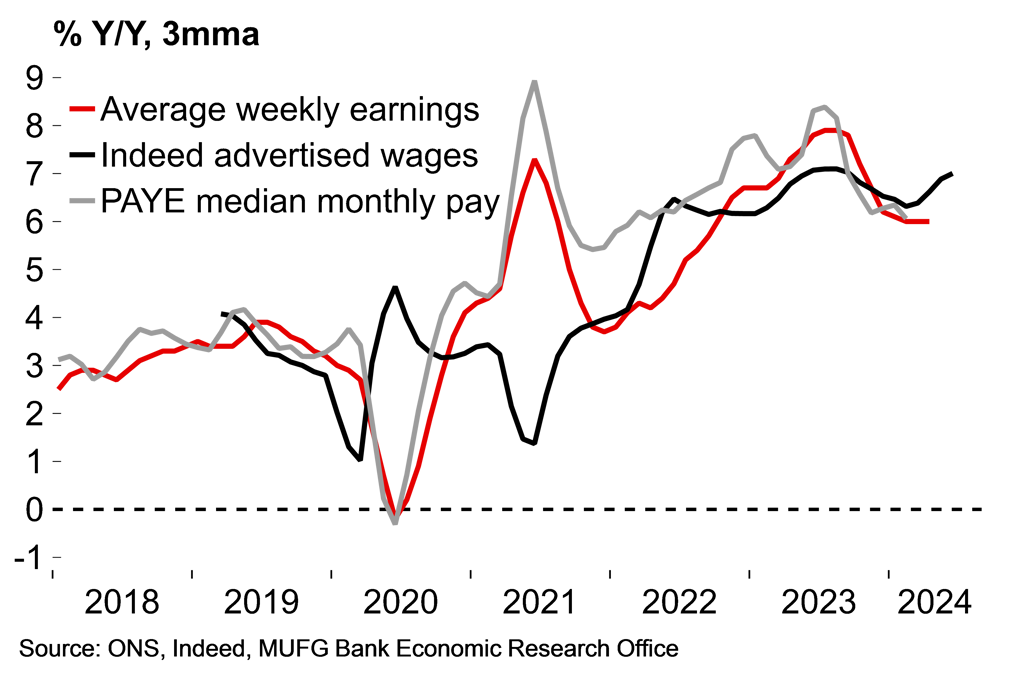

The BoE is still edging closer to easing policy – Pill acknowledged that it’s a question of “when rather than if” – but market pricing now suggests that a rate cut at the next meeting (1 August) is a 50-50 call. That seems appropriate, and the decision may well hinge on next week’s data on inflation and the labour market. The MPC is clearly very divided on the persistence of underlying inflationary pressures and some members may be swayed by single month developments in pay growth or services prices. If there is a cut in August it could well come with a 5-4 vote split – and without the backing of the chief economist, it seems.

Chart 3: Inflation is back at target – but the services component looks sticky

Chart 4: Nominal wage pressures remain high

ECB preview – On hold for the summer

Next week’s ECB meeting is set to be a low-key affair with rates left unchanged and no new policy signals. The last meeting was just five weeks ago and officials have indicated that they have no plans for back-to back rate cuts. At that meeting the ECB found itself in the strange position of cutting rates while raising its inflation forecasts (see our review of last meeting here). Indeed, after telegraphing June for the initial rate cut months in advance, we think that policymakers will now want to retain much more flexibility around the timing of the next move, with an emphasis on data dependency.

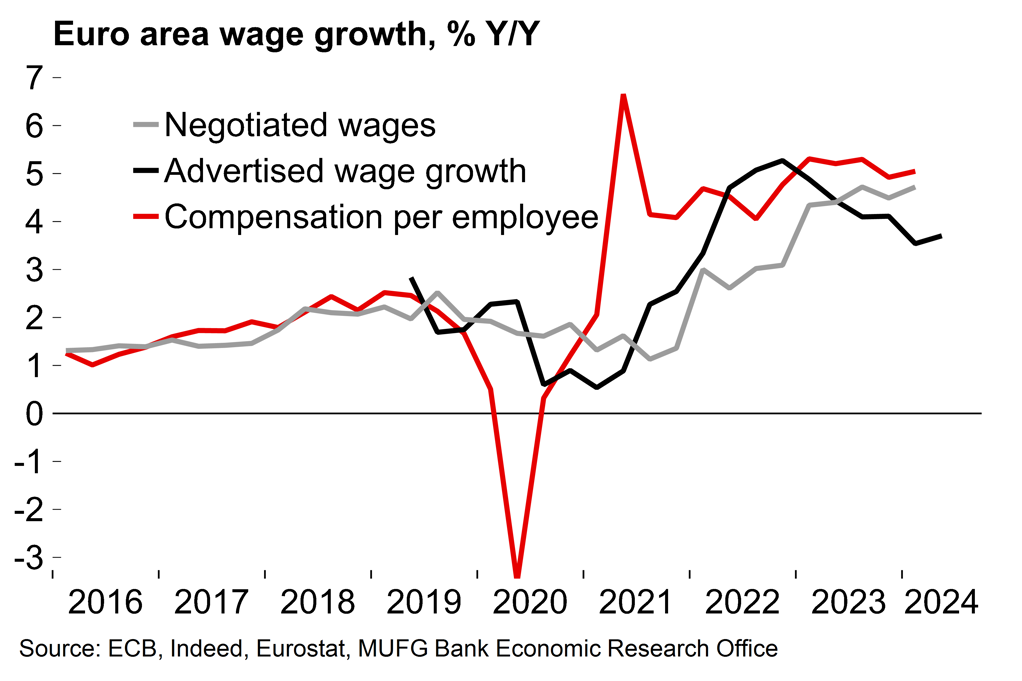

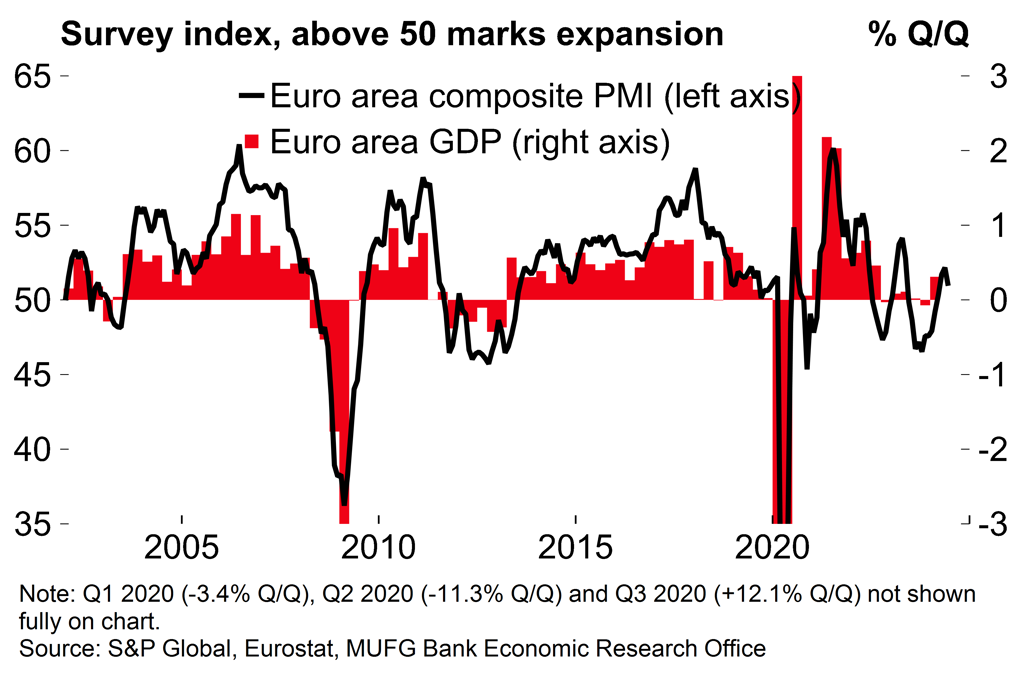

The data flow has been quite mixed of late. Core inflation at 2.8% in Q2 was slightly higher than the ECB’s forecast, while compensation per employee accelerated at the start of the year and the euro area unemployment rate has fallen to an all-time low of 6.4%. On the other hand – and in contrast to the UK – growth momentum seems to have faded somewhat in the euro area. The ECB’s forecast of 0.4% in Q2 now looks optimistic after bad news on industrial production (especially in Germany, which continues to act as a brake on overall euro area activity) and soft-ish retail sales figures. Sentiment has weakened too, with the euro area composite PMI slipping to 50.9 in June, although that may have been affected by uncertainty in France and could recover in July after the more extreme election scenarios did not materialise.

Against that background, ECB officials are likely to play it with a straight bat for now and look for more convincing evidence that underlying inflation pressures have eased over the summer. By the next meeting in September there will be plenty more data, with quarterly figures on wage growth likely to be most consequential. Our base case is that pay pressures will ease and the path will clear for another rate cut in September. We expect it will be a gradual easing cycle with just three cuts in total this year, coming at a quarterly pace.

Chart 5: Better official wage figures in Q2 could pave the way for further easing after the summer

Chart 6: Weaker survey data in Q2 points to subdued economic growth

MUFG European Macro Outlook: Key points

- The euro area economy expanded by 0.3% Q/Q in the first quarter of the year, with all the major national economies growing at a faster-than-expected rate. The UK economy started the year strongly (0.7% Q/Q). While we look for slower growth rates in Q2, the recent uptick in momentum may well mark an inflection point after an extended period of stagnation. Broader growth conditions are set to continue to improve over coming months as real incomes recover and central banks start to ease policy.

- Nevertheless, it’s likely to be a case of moderate recovery this year rather than a rapid rebound. Business surveys have reinforced that message. The ECB followed through with its well-signposted cut in June, but the relatively hawkish tone suggested that policymakers remain wary about the inflation outlook. Monetary policy is set to remain in restrictive territory for some time. Meanwhile, many governments will need to make fiscal consolidation efforts after expansive spending in recent years, and structural pressures are set to continue to weigh on European manufacturing. For these reasons we do not see growth sustainably exceeding potential this year or next. We expect average growth of 1.4% in the euro area in 2025 and 1.6% in the UK.

- Despite recent upside surprises in monthly inflation figures we expect that the disinflation process will reassert itself in H2 this year. Forward-looking survey indicators point to easing price pressures, household inflation expectations are well-anchored and there are mounting signs of increased slack in labour markets. We expect annual average euro area headline inflation will ease from 2.3% in 2024 to 2.0% next year. We expect a similar path in the UK, albeit with rates remaining slightly higher (2.3% in 2024).