- We expect a low-key BoE meeting next week ahead of the upcoming UK election. The higher-than-expected April inflation data had already nixed the chances of a rate cut in June even before the election announcement, and policymakers will be happy to sit this one out. The May CPI figures will likely be more consequential – better news on services inflation could help to clear the path for an initial cut by the end of the summer.

- The Labour party, on course to be the next UK government, set out its election manifesto. No surprises – everything had been announced previously. It’s an assuming set of policies, with little in the way of radical pledges. Essentially, the pitch is that sound management and political stability will create better growth conditions. There’s likely some truth to that: the UK economy probably would benefit from the period of relative calm and stability that a new government with a sizeable majority would bring after the Brexit years. But there will still be very little fiscal leeway in the case of a shock or disappointing growth.

- In France, initial polling has consistently suggested that Le Pen’s RN party will achieve around a third of the vote at the upcoming parliamentary election, while the newly formed left/green alliance (the ‘New Popular Front’) is polling around 25%. The two-round vote system (first on 30 June, second 7 July) makes the election hard to predict, but on current projections RN would win the election while falling short of an absolute majority. Fiscal risks will remain in sharp focus.

BoE preview: The MPC will be comfortable with sitting this one out

At its last meeting in May the BoE signalled a clear willingness to cut rates but retained a degree of flexibility over the timing of the initial move, emphasising that it would be data dependent.

Since then, headline April CPI came in at 2.3%, down from 3.2% but above consensus and the BoE’s latest short-term projection (both 2.1%). The fall in the headline rate was mostly driven by the energy component following the fall in the household price cap. However, it was the services component that was most concerning at 5.9% (cons: 5.4%, BoE: 5.5%).

The picture from other releases has been more mixed – pay growth remains uncomfortably high from a monetary policy perspective at around 6% Y/Y, but signs of labour market slack continue to emerge: unemployment rate up, vacancies down. The initial estimate of monthly GDP in April (0.0% M/M, cons: 0.1%) will have also tempered any concerns about demand pressures after the 0.6% Q/Q expansion in the first quarter. (MUFG: 0.3% Q/Q in Q2). Forward-looking survey indicators continue to point to further easing of labour market conditions and price pressures. The latest RICS survey also pointed to cracks appearing in the housing market.

To our minds, the CPI data had already nixed any chance of a policy change at the June meeting, despite the groundwork laid in May. But policymakers now have a clear reason to sit this one out following the announcement of the earlier-than-expected UK election. All public statements and speeches by BoE officials have been cancelled in the run-up to the vote on 4 July and there will be no appetite to introduce any policy shifts. We expect it will be a low-key meeting, likely with an unchanged vote split (7-2).

All eyes on July, then, when we could see firmer guidance around the timing of the initial move. Indeed, next week’s CPI release for May will likely be more significant for market expectations than the BoE’s updated statement. Signs of easing core inflation pressures could pave the way for an initial move in August, which is our current base case. But risks are skewed in the hawkish direction – the 7-2 vote last time out belies a degree of division with recent speeches suggesting that several members of the ‘no change’ camp of seven are still wary about underlying inflation pressures. It wouldn’t take much of an upside surprise on services inflation next week (cons: 5.6%) for an August rate cut to fall out the picture.

All told, the BoE won’t mind the timing of the election: recent data means that a cut wasn’t on cards at this meeting, and further ahead it no longer faces the prospect of navigating the political sensitivities of an initial rate cut prior to the vote.

Chart 1: Sticky services inflation poses questions about the disinflation process

Chart 2: Nominal pay growth remains uncomfortably high from a monetary policy perspective

UK election: Labour spells out its cautious policy agenda

In terms of policy, we don’t see much that would shake up the BoE’s long-term thinking either. The Labour party clearly remains on course to win the election. At the time of the announcement, prediction markets implied an 85% probability of this, which has since increased to around 95%. That follows a rise in support for the right-wing populist Reform UK party since Nigel Farage, the architect of Brexit, entered as a candidate. This will make it harder for the governing Conservative party – which has also suffered various campaign missteps – to win marginal seats. One poll has even put Reform ahead of the Conservatives.

So, all eyes on Labour’s proposals. The party’s election manifesto released yesterday (see here) contained no surprises, with very little in the way of tax or spend shifts. Indeed, Labour has ruled out any increases in income tax, national insurance, VAT or corporation tax (together these sources account for around 90% of revenue). There are some sensible plans about reforming the UK’s restrictive planning regulations, and some US-inspired (but modest) industrial strategy suggestions, which could be fairly growth-friendly. But overall it is quite an unassuming set of policies. Essentially, the pitch is that sound management and political stability will create better growth conditions.

There’s likely some truth to that: the UK economy probably would benefit from the period of relative calm and stability that a new government with a sizeable majority would bring after the Brexit years and five prime ministers in eight years. The incoming government also stands to enjoy favourable growth conditions as inflationary pressures diminish and the BoE moves ahead with rate cuts (we look for 1.6% growth in 2025). But there will still be very little fiscal leeway in the case of a shock or disappointing growth, and it wouldn’t be a huge surprise if Labour were forced to backtrack on their pledge not to increase personal tax rates.

Chart 3: Polling still points to a sizeable Labour victory

Chart 4: The UK economy has drifted since the pandemic

French election: Fiscal risks in focus

While there is now the prospect of a return to greater stability in the UK, political risk in the euro area has risen sharply. We’ve written about the European Parliament elections and fallout in France separately (see here). The market reaction has only become more pronounced since then with the CAC 40 equities index down around 6.5% on the week and the spread with 10Y German bund yields widening sharply.

Initial polling has consistently suggested that Le Pen’s RN party will achieve around a third of the vote at the upcoming parliamentary election, while the newly formed left/green alliance (the ‘New Popular Front’) is polling around 25%. The two-round vote system (first on 30 June, second 7 July) makes the election hard to predict, but on current projections RN would win the election while falling short of an absolute majority. Whether or not RN would lead a government in the case is not certain – a wide coalition of more mainstream parties might be a possibility. But it does look as though France is set for several years of domestic policy inertia at a time when the French economy is facing lacklustre growth (MUFG: 0.8% in 2024) and difficult spending decisions to trim its wide budget deficit.

Against that background, fiscal risks will remain in sharp focus. France has the highest debt-to-GDP ratio in the euro area after Greece and Italy, and, while the President decides on foreign policy and defence matters, the government determines national policy. That includes tax and pensions. Both RN and the New Popular Front have expressed a clear intention to lower the retirement age after Macron bypassed parliament to raise it from 62 to 64 last year. Any such move would see fiscal sustainability concerns rise sharply. There are also more fundamental political risks ahead of the 2027 presidential election. Macron, who won’t be able to stand again but will be concerned with his legacy, might hope that RN will be exposed as incompetent as it comes under increased scrutiny. On the other hand, a strong showing for RN in a national election could increase the party’s legitimacy. The party would seek to use the result as a springboard for victory in 2027. RN is Eurosceptic and has been strongly critical of NATO, and a Le Pen presidency would likely have far-reaching consequences for the EU and Ukraine, as well as France. After a period of relative stability since it became clear that incoming Italian PM Giorgia Meloni would take a pragmatic approach to governing, euro area political risk is now once again in sharp focus.

Chart 5: French government debt is amongst the highest in the euro area

Chart 6: Markets reflect an increase in fiscal risks

Next week: How strong is growth momentum in Q2?

As mentioned above, the focus next week will be on the BoE outlook, with the May inflation print perhaps more significant than the policy meeting given the upcoming election. Otherwise it looks set to be a quiet week, at least on the data front. There will also be initial survey evidence for June in the form of the flash PMIs, German ZEW survey and consumer confidence numbers. We expect numbers consistent with a continued, steady expansion.

Key data releases and events (week commencing Monday 17 June)

MUFG European Macro Outlook: Key points

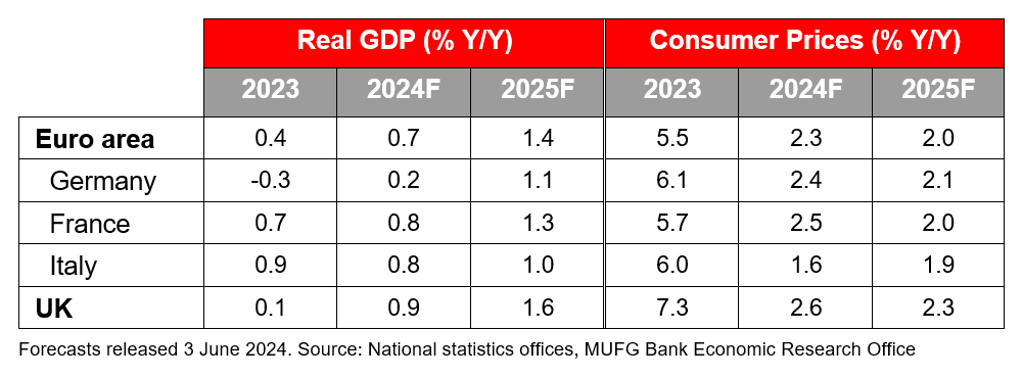

- The euro area economy expanded by 0.3% Q/Q in the first quarter of the year, with all the major national economies growing at a faster-than-expected rate. The UK economy started the year strongly (0.6% Q/Q). While we look for slower growth rates in Q2, the recent uptick in momentum may well mark an inflection point after an extended period of stagnation. Broader growth conditions are set to continue to improve over coming months as real incomes recover and central banks start to ease policy.

- Nonetheless, it’s likely to be a case of moderate recovery this year rather than a rapid rebound. The ECB followed through with its well-signposted cut in June, but the relatively hawkish tone suggested that policymakers remain wary about the inflation outlook. Monetary policy is set to remain in restrictive territory for some time. Meanwhile, many governments will need to make fiscal consolidation efforts after expansive spending in recent years, and structural pressures are set to continue to weigh on European manufacturing. The sudden increase in political risk following the European Parliament elections is also likely to weigh on sentiment. For these reasons we do not see growth sustainably exceeding potential this year or next. We expect average growth of 1.4% in the euro area in 2025 and 1.6% in the UK.

- Despite recent upside surprises in monthly inflation figures we expect that the disinflation process will reassert itself in H2 this year. Forward-looking survey indicators point to easing price pressures, household inflation expectations are well-anchored and there are mounting signs of increased slack in labour markets. We expect annual average euro area headline inflation will ease from 2.3% in 2024 to 2.0% next year. We expect a similar path in the UK, albeit with rates remaining slightly higher (2.3% in 2024).