- UK growth slowed markedly to 0.1% Q/Q in Q3, but the details were more encouraging with healthy expansions in household consumption and business investment. That points to better underlying conditions and a more durable recovery ahead once Budget-related noise fades (a range of data next week will give an indication of the initial effect of the announcement on sentiment and activity).

- We remain constructive on the medium-term UK growth outlook and expect annual average growth will improve from 0.9% in 2024 to 1.6% next year, driven by better consumer conditions and government support.

- Our base case is that the UK will avoid new US tariffs next year with the UK’s goods trade deficit likely placing it low on the target list. The services-oriented UK economy is less directly exposed to any increase in global protectionism, but there are clear risks from any associated slowdown in euro area activity.

The UK economy has lost steam after a strong start to the year

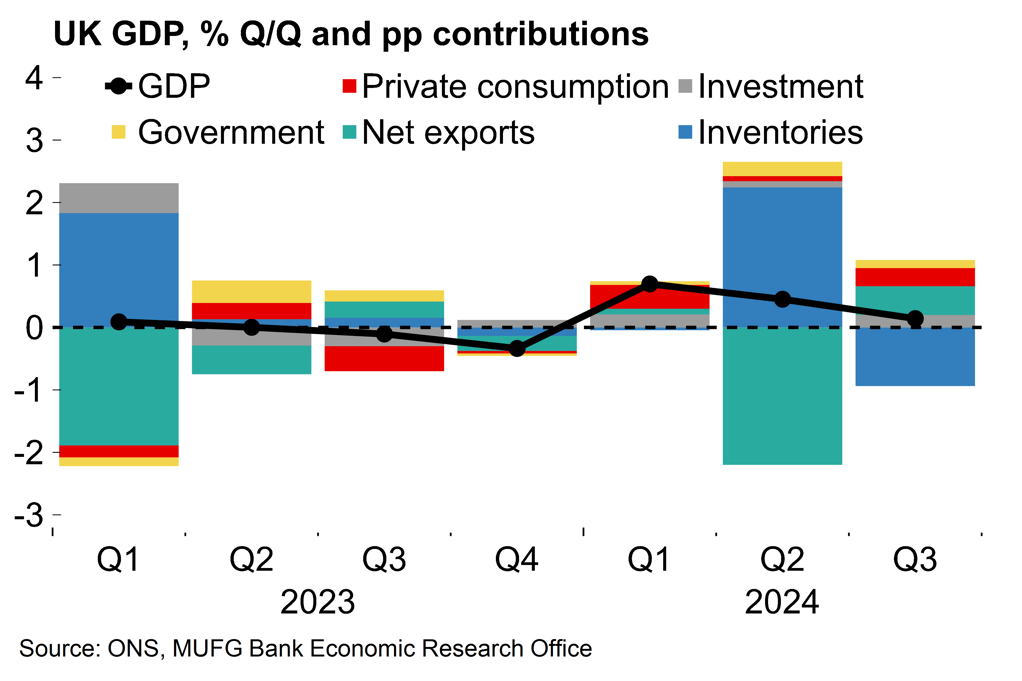

Today’s UK GDP released confirmed that the economy has lost momentum in the second half of the year with a marked slowdown in quarterly growth to 0.1% Q/Q in Q3 (from 0.5%). The downshift follows the fading boost from earlier one-off factors and a protracted period of uncertainty around possible Budget measures. The downside surprise means that annual average growth in 2024 now looks to come in under 1%, which would be disappointing after the strong start to the year.

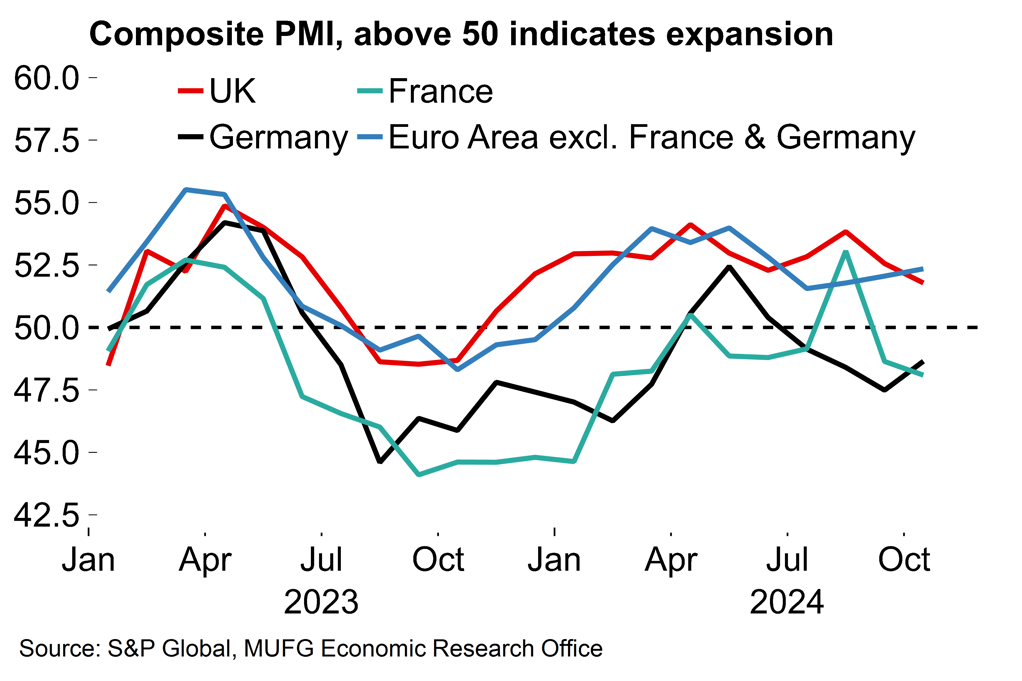

However, the details are more encouraging than the headline growth figure. The volatile inventories component was the only drag. Household consumption expanded by a healthy 0.5%, up from 0.2% previously, in a sign that the recovery in real incomes may now be boosting activity more reliably. Business investment also continues to recover from the extended period of post-Brexit stagnation: it was up 1.2% on the quarter and 4.5% on the year. This all points to reasonable underlying momentum and we expect a growth rebound in Q4, but note that the slew of data next week (retail sales, consumer confidence, flash PMIs) will give a good indication of the initial Budget effect on sentiment and activity.

Chart 1: The UK economy lost momentum in Q3

Chart 2: UK survey data remains relatively strong

The conditions are there for a sustained period of healthier growth ahead

We have been constructive on UK growth for some time (see e.g. here) and the medium-term outlook remains relatively bright. The turbulence of the Brexit years has moved into the rear-view mirror after this summer’s election and the UK now looks well set for a period of relative political stability, which is set to support private investment. The new government has added a hefty dose of fiscal stimulus to the mix which will be growth-friendly over coming years (see our review of last month’s Budget here).

The Budget did include a significant tax rise in the form of higher employer national insurance contributions (NICs). The impact of that is likely to be seen in higher prices charged but also lower profit margins, lower private sector wage growth and lower employment. That creates a lot of uncertainty about how the measure will shake out in terms of overall price pressures but the Budget package as a whole is likely to be inflationary. We currently estimate that UK CPI will average 2.5% next year with the headline rate set to move back above the BoE’s target next week on the back of the upward shift in the energy price cap from October.

Despite that, we continue to expect that consumer conditions will remain supportive. Today’s GDP numbers were encouraging with consumer spending picking up from 0.2% to 0.5%. Private sector real pay growth averages a very healthy 2.8% Y/Y in 2024. We see that falling to around 1.5% next year but that would still be close to the pre-pandemic (2015-19) average of 1.3%.

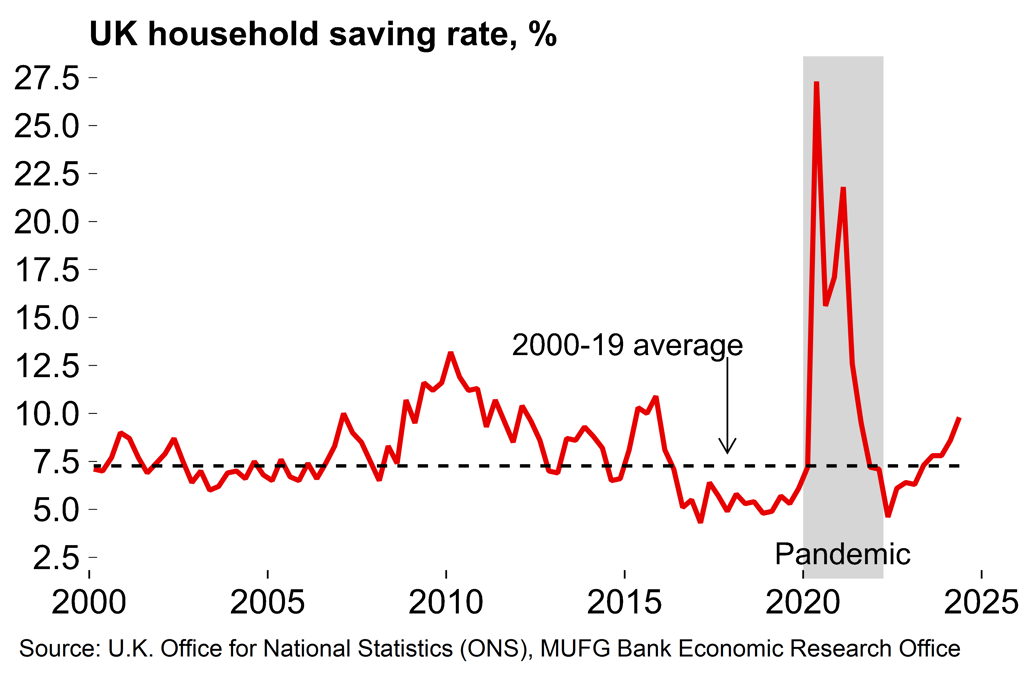

The effect of this real wage recovery has been restrained by households increasingly opting to raise savings rates (chart 4). That reflects a greater desire for precautionary holdings after the shocks of recent years, as well as a reaction to better nominal returns on offer after the BoE’s 2021-23 hiking cycle. In the absence of fresh shocks, and with the BoE now cutting rates (gradually – see here), we see savings rates normalising slightly next year which would provide a tailwind for consumer spending.

On the labour market, this week’s release showed the unemployment rate move up sharply to 4.3% in the three months to August, but the ONS still readily acknowledges problems with the survey’s quality (see here). The release noted that alternative sources may indicate that unemployment may not have increased that much, and the Bank of England maintains that the labour market is still “relatively tight”. We assume some loosening through 2025 – the NICs rise will likely contribute to this – but not to the extent that the consumer-led recovery is derailed.

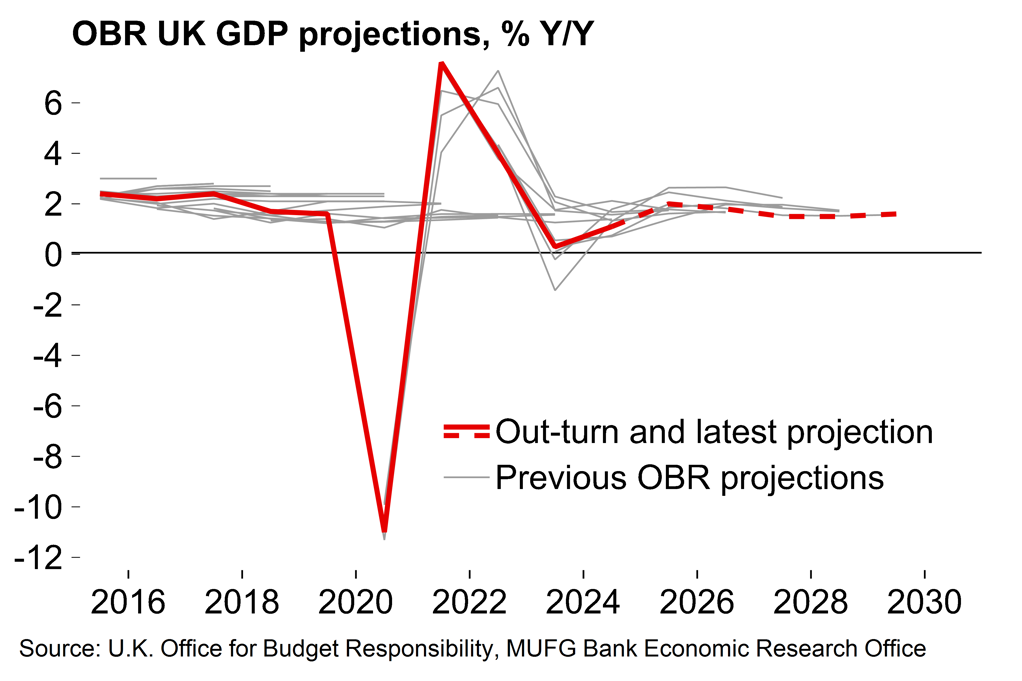

Chart 3: The OBR has often been over-optimistic on UK growth

Chart 4: Clear scope for lower saving to support household spending

The UK is less exposed to any Trump tariffs

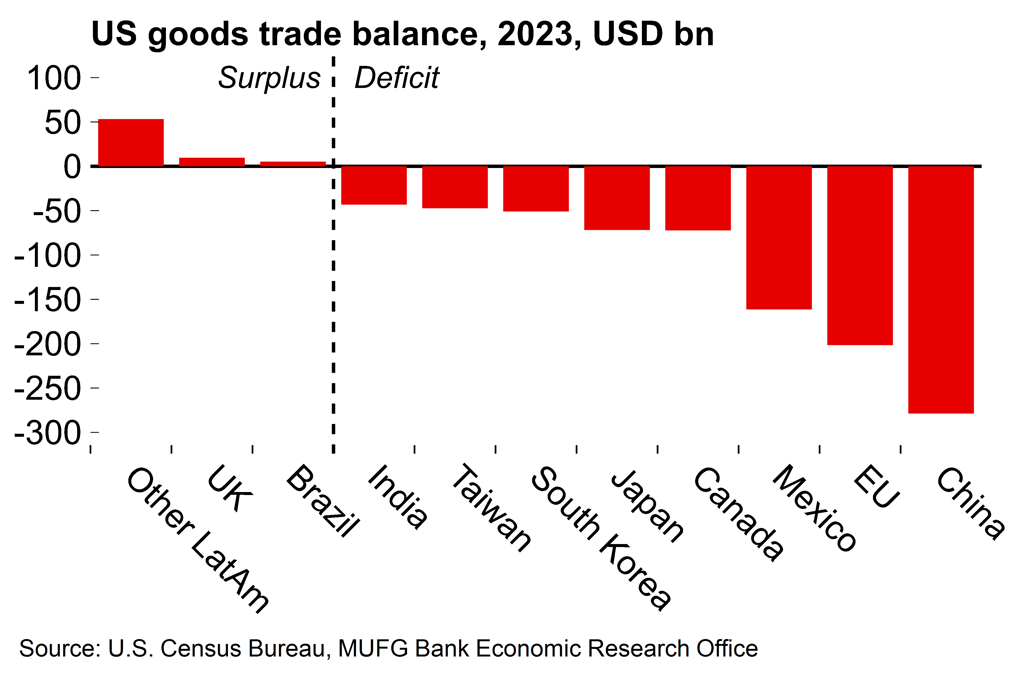

The UK also looks less exposed to any post-election increase in US protectionism. It is unclear to what extent Trump’s campaign rhetoric will translate into actual policy, but our current base case is that the UK will avoid new US tariffs next year. Trump has previously placed a lot of significance on the US goods trade balance with other economies. The US has a goods surplus with the UK and so we see the UK being low on the target list for new tariff measures. It is certainly plausible that the EU could face some targeted measures but not the UK, in what would be a Brexit benefit.

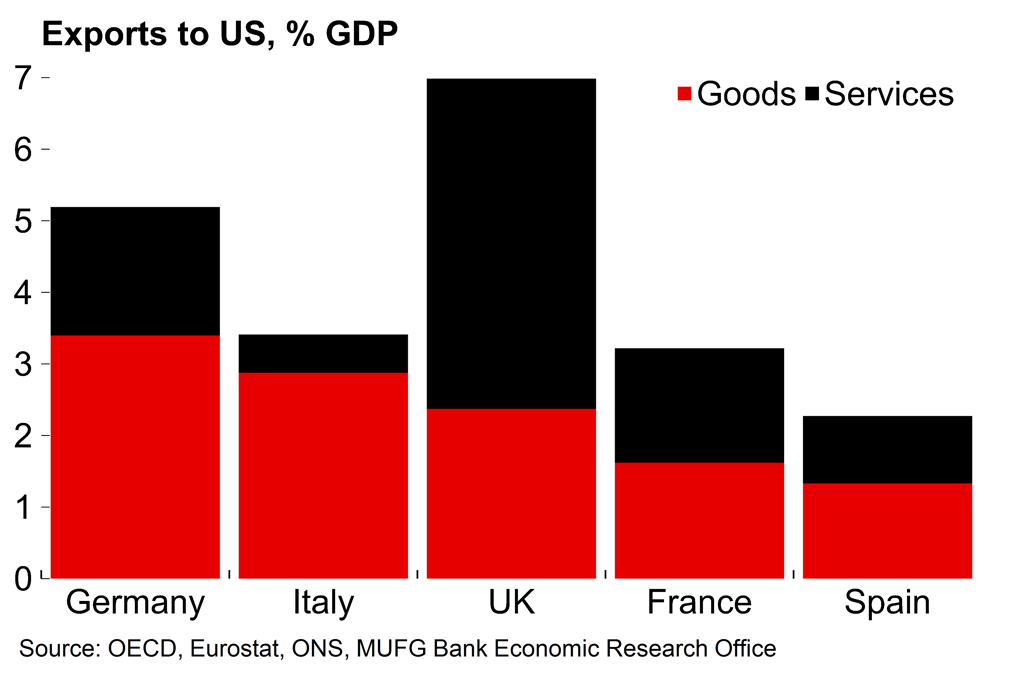

Chart 5: UK exports are orientated towards services

Chart 6: The US has a goods trade surplus with the UK

At any rate, if Trump were to go ahead with his mooted universal tariffs the UK would be less vulnerable than many European economies. Services form the bulk of UK exports to the US – largely in the form business, financial and technology services, as well as tourism. Trump seems to focus entirely on goods trade balances and there has been no indication of any desire to impose non-tariff barriers (i.e. regulation) on countries with services surpluses with the US.

As we’ve noted previously, Germany – the UK’s second largest trade partner after the US – looks notably vulnerable to second round effects on confidence and the labour market from an increase in US goods tariffs. A euro area slump is a key downside risk for the UK outlook. However, it’s plausible that US demand for UK services could benefit from the introduction of any expansive fiscal policies in the US which may work to offset weaker external demand elsewhere.

A brighter 2025 growth outlook

Our central scenario sees UK growth at 1.6% in 2025. That’s below the OBR’s post-Budget figure of 2%. While we’re not quite there, we would note that the OBR has a track record of over-optimism on UK growth (Chart 3) and we still consider our broad view on the UK economy to be positive. Despite recent (and perhaps upcoming) survey weakness, we expect the mood music to improve as noise around Budget measures fade and the government proceeds with its front-loaded spending plans. We also see better conditions for business investment from a more stable political environment and believe that consumers will become less cautious over coming quarters.