The ECB responded to what has been an almost uniformly positive data flow by cutting rates for the third time this year, as expected. Officials are clearly more confident about the inflation outlook and this was reflected with the shift to back-to-back cuts. The guidance was entirely unchanged, however, and there was no sense of any urgency to make up for lost ground. With data over coming months likely to be more mixed we assume that the now-established pace of 25bp cuts at every meeting will continue into next year but downside risks to growth will remain in focus.

ECB review: Same script, faster action

The ECB cut rates again, just five weeks after the last move in September, to take the deposit rate to 3.25%. After initially embarking on what seemed like a default pace of cuts at quarterly projection meetings, officials are now happy to go back-to-back. The simple reality is that the central bank emphasised its data dependence and recent news has almost uniformly supported a faster pace of easing, as we noted in our preview (here) – and that is something Lagarde acknowledged in the press conference.

Policymakers are clearly more confident now about the inflation outlook with the statement noting that “the disinflationary process is well on track”. Headline rates are still expected to rise above target again from the current low, but the ECB now believes that headline inflation will return to target “in the course of next year” rather than in H2 2025. Significantly, Lagarde also suggested that there’s “probably more downside risk than upside risk” on inflation.

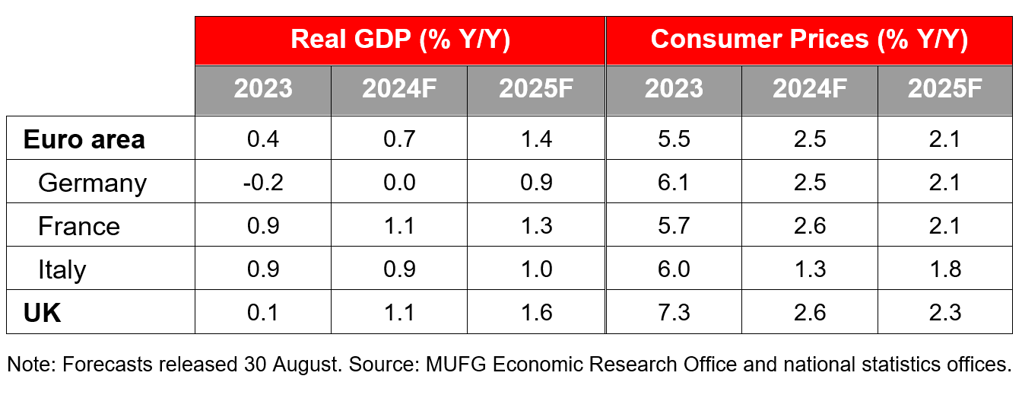

Chart 1: Easing momentum in services inflation

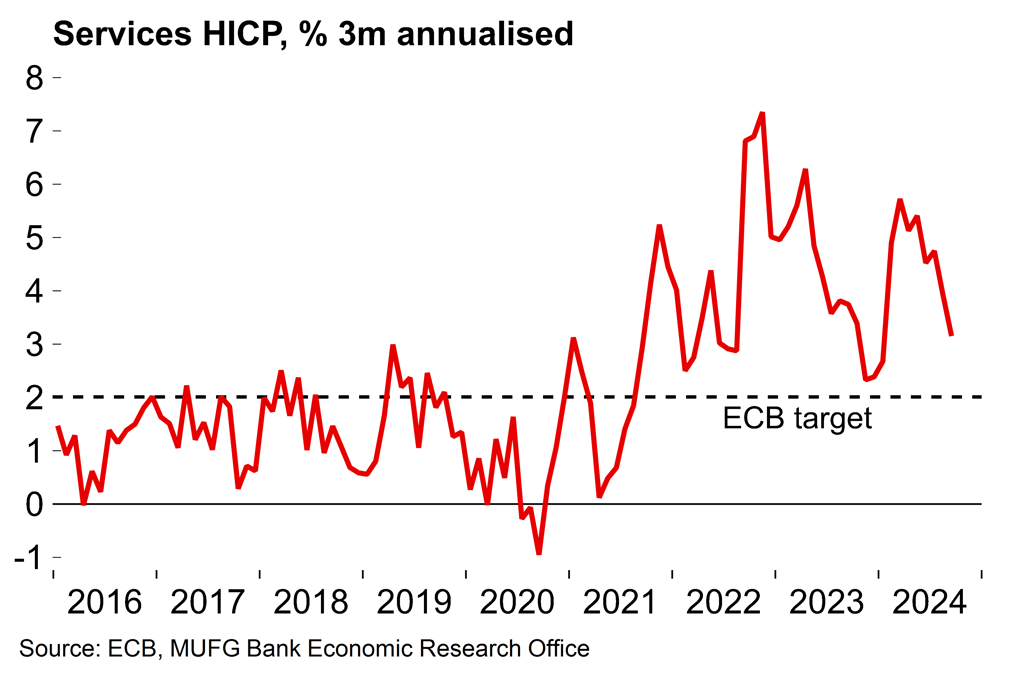

Chart 2: Signs of cooling wage pressure in September

But, with services price growth and wage pressures still slightly too high for comfort, the ECB is not yet ready to say ‘all clear’ on the inflation front. The ECB may have stepped up the pace of easing by going to back-to-back cuts but it is steadfastly sticking to the same script in terms of guidance. The relevant passage in the statement was entirely unchanged: “a data-dependent and meeting-by-meeting approach” will continue. The message seems to be that that the accelerated pace of easing is a recalibration in response to incoming data rather than a sign of an urgent need to make up for lost ground. Lagarde stressed that the ECB is “going to continue to do the same thing”.

Looking ahead, the December meeting looks a possible juncture for a shift away from the current stance. There will be a wide range of key data points between now and then which will provide greater clarity on the persistence of underlying inflation, as well as a fresh set of projections which are likely to feature downward revisions to both the growth and inflation figures. That could tee up firmer guidance around the likely future path for rates. Lagarde hinted at the possibility of a shift by saying “we will determine what is the best rate, what is the best speed, how far and how deep we have to go in order to return inflation to its 2% medium-term target. This is what we will do in December”.

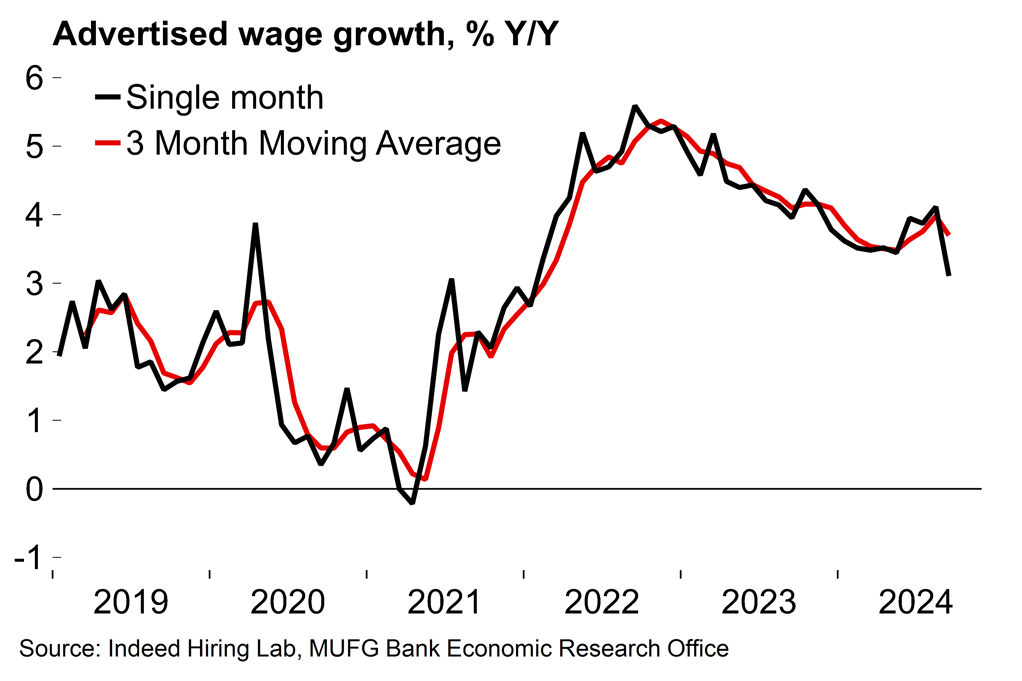

Against that background, markets are now pricing in 35bp of easing at the December meeting, from 25bp at the start of the week. We’d note that it’s unlikely that the data will all move in the same direction between now and then (as was almost uniformly the case before this week’s meeting). Base effects are set to push up headline inflation over coming months and quarterly wage growth numbers may also edge up due to volatility in the German figures. Despite the recent gloom in business surveys and likely technical recession in Germany, overall Q3 growth in the euro area is set to be supported by the Olympic boost from France. Indeed, Lagarde said that “the euro area is not heading for recession” and that the ECB “is still looking at a soft landing”. So our assumption remains that the ECB will resist any temptation to ease more forcefully and will continue with back-to-back 25bp moves unless we see a further slide in sentiment indicators (the flash PMIs for October will be released next week) and downside surprises to inflation over coming months.

Chart 3: Germany continues to act as a brake – but growth across the euro area as a whole remains steady

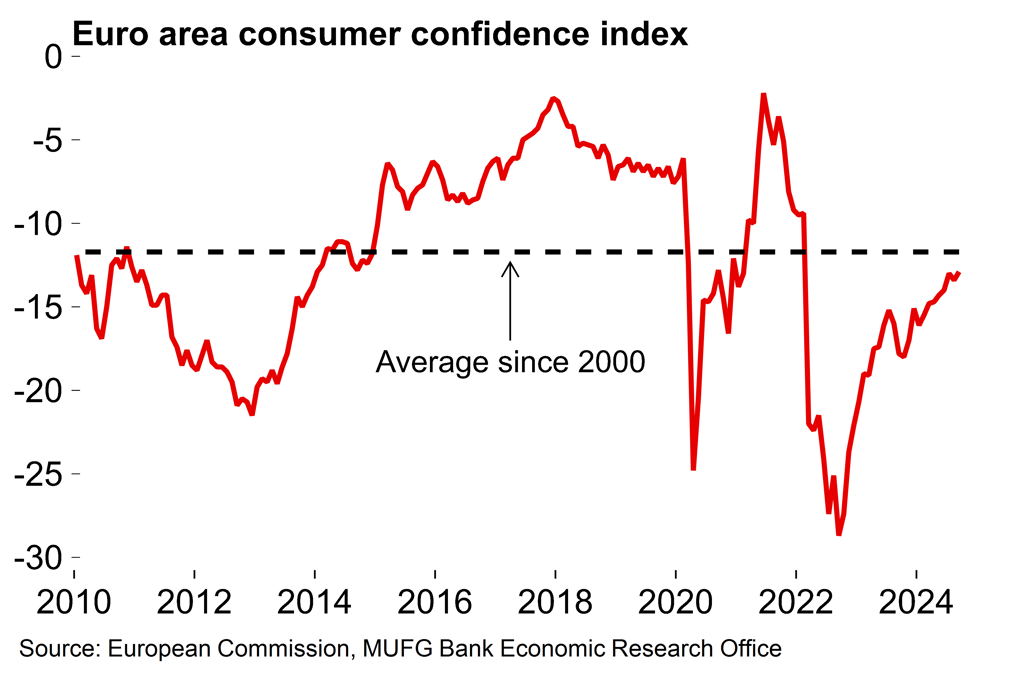

Chart 4: Consumer conditions are gradually improving

But the ECB’s flexible stance means that expectations can change quickly, as we’ve seen over the last few weeks. On the growth outlook, which is increasingly in focus as underlying inflation normalises, we essentially agree with the ECB’s base scenario and still look for a consumer-led rebound next year. Real incomes are continuing to recover and household confidence is improving. A more proactive ECB moving now to back-to-back cuts will also help.

However, we acknowledge that risks to growth over coming quarters (and indeed the medium term) are tilted to the downside. In particular, a second Trump presidency – which prediction markets now suggest is now more likely than not – would pose clear risks to Europe’s open and trade-intensive economy given his protectionist rhetoric. Despite fragile European manufacturing sentiment, the euro area labour market has so far proved broadly resilient to the challenging conditions in industry. It’s possible that firms been resisting starting redundancy processes in the hope of improving conditions – but there could be a shift if Trump were to be re-elected and make clear that tariffs on economies with trade surpluses with the US would be an immediate priority. Uncertainty around this is one reason for the ECB to continue its flexible/wait-and-see stance rather than pre-commit to any particular easing schedule. Things could change if conditions deteriorate markedly or, conversely, policymakers sense that markets are pricing too much in the way of rate cuts – but for now the holding pattern is likely to be maintained.

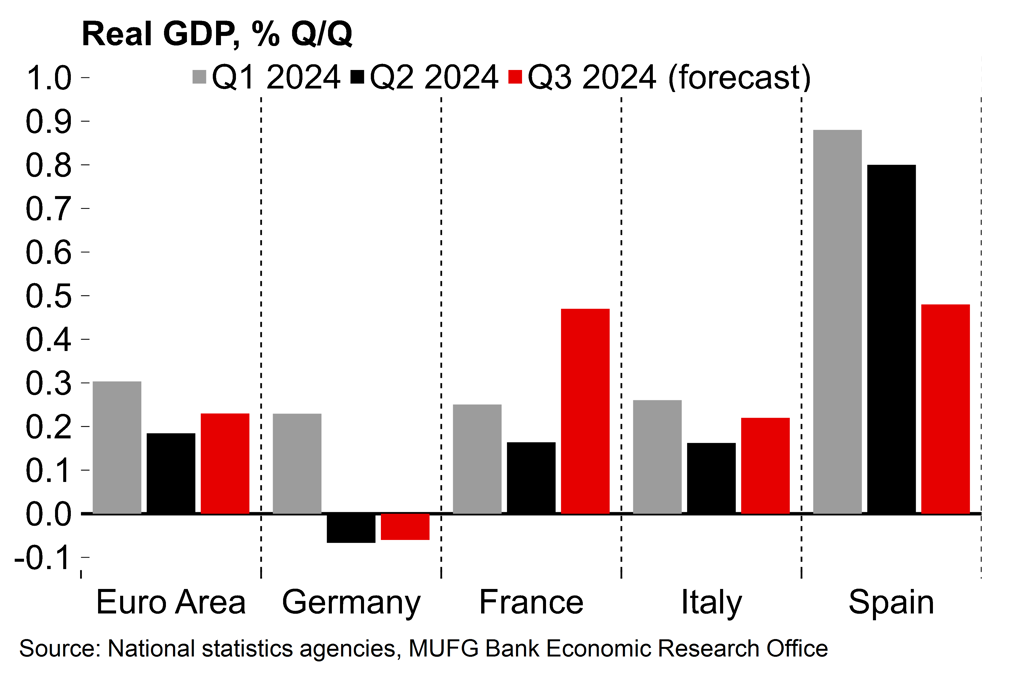

GDP & CPI forecasts