- A range of UK data this week gave mixed signals about the strength of underlying price pressures. Headline, core and services inflation moved lower in March but still came in slightly above consensus. The official measure of pay growth remains high despite further signs that labour market slack is increasing. Meanwhile, flat retail sales for March were a reminder that overall growth is likely to remain relatively muted despite the economy's swift exit from recession.

- So, a lot for policymakers to process. We remain confident that the UK disinflation process remains on track despite the upside surprises on inflation. Indeed, in isolation the UK economy may now be approaching the point where a degree of easing would be appropriate – but the topic of divergence with the Fed will remain in focus.

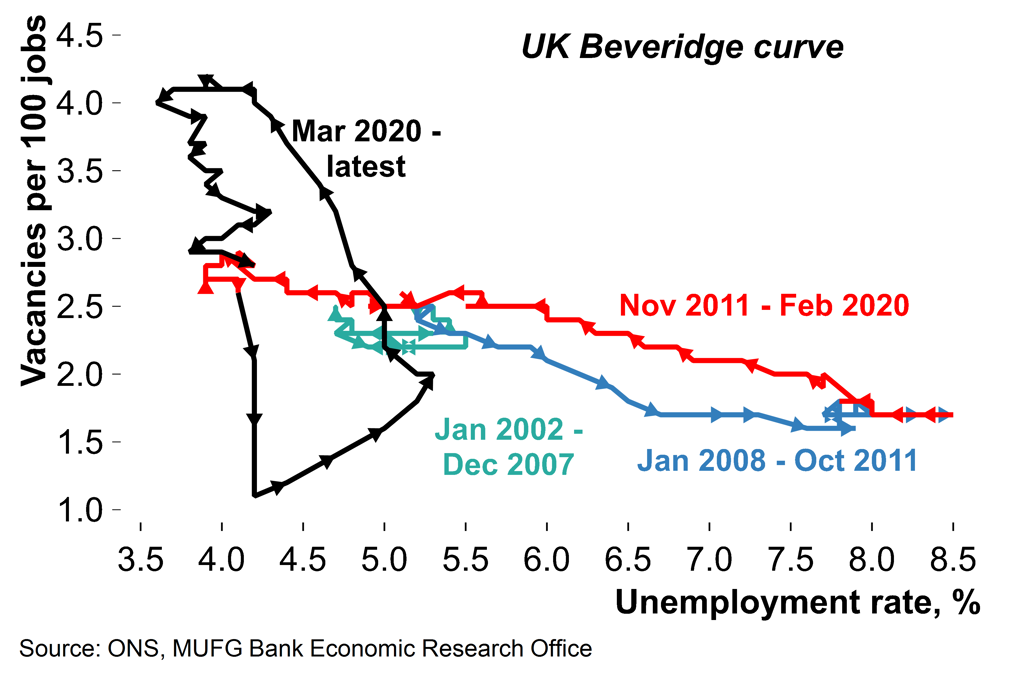

- Next week attention will be on a slew of survey data. Overall we expect to see further signs of improving momentum in the European economy at the start of Q2.

Mixed signals from recent UK data

With the prospects for cross-Atlantic monetary policy divergence remaining in focus, a range of key UK data this week painted a mixed picture for the Bank of England. Inflation and earnings growth came in slightly above expectations, but the unemployment rate rose more than expected and flat retail sales figures tempered expectations about the pace of the Q1 GDP rebound.

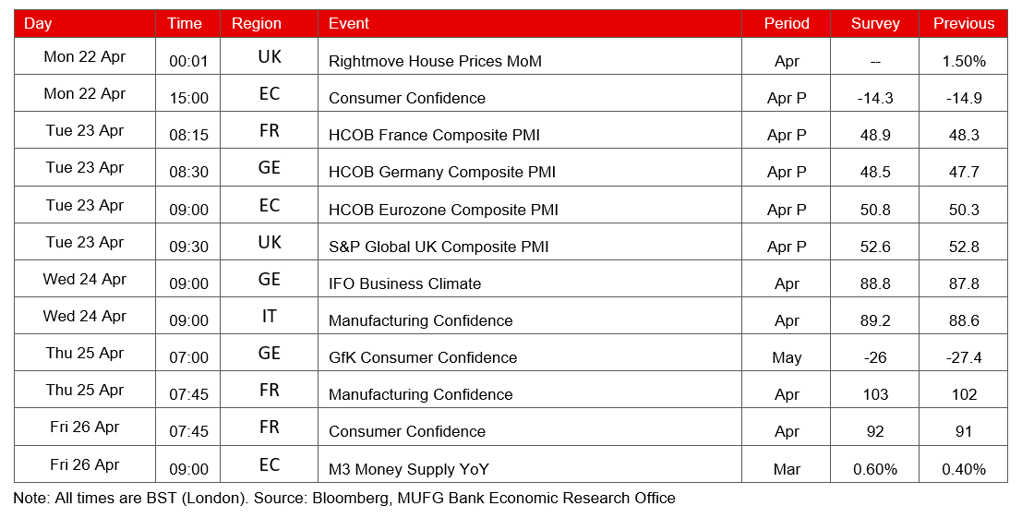

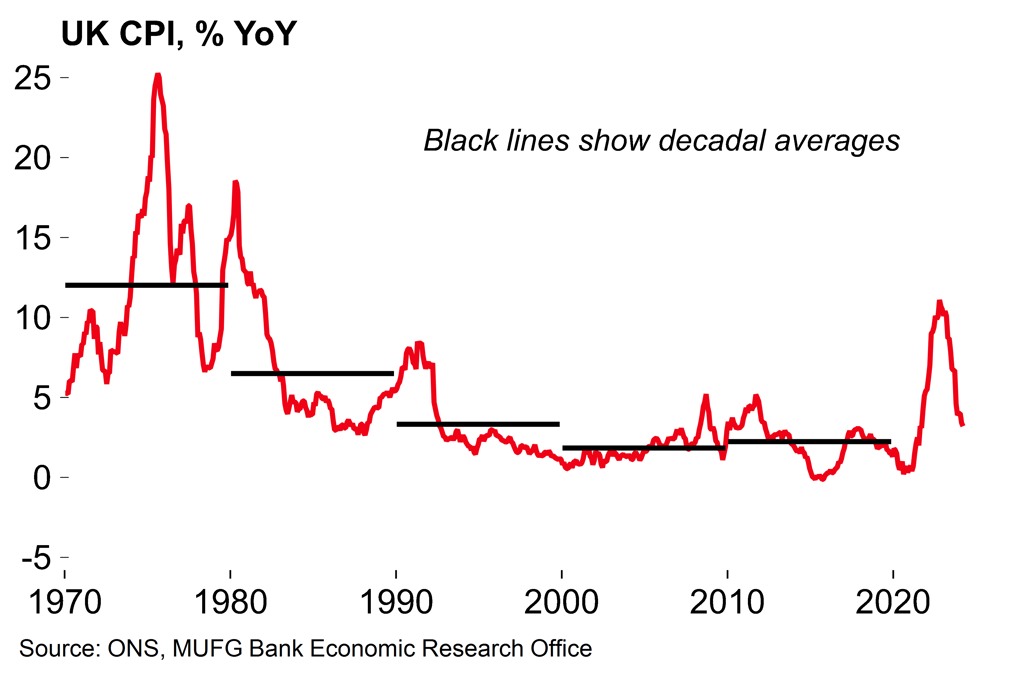

On prices, headline CPI inflation came in at 3.2% in March – down from 3.4% in February but slightly above both the consensus expectation and the BoE’s latest forecast. The core rate fell from 4.5% to 4.2%, again a tick higher than consensus. Services inflation edged down only slightly to 6.0%. With oil prices having trended upwards since the start of the year, this persistence in underlying price prices makes it less likely that headline inflation will dip below the BoE’s target rate in the April data, despite the fall in the household energy price cap this month (we still expect that inflation will temporarily hit the target later in Q2, however).

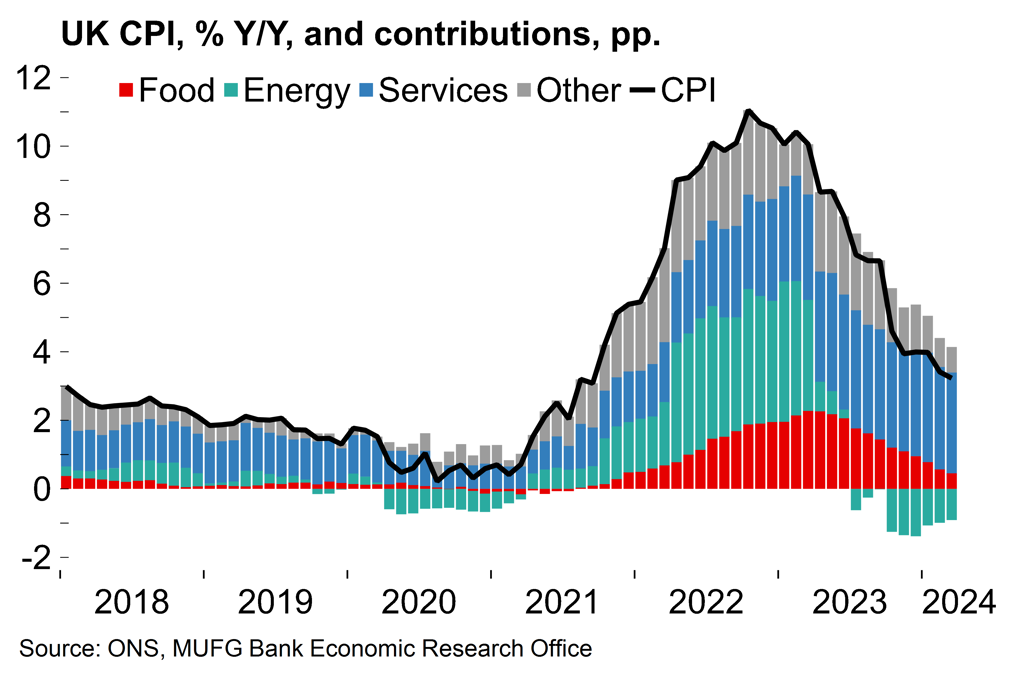

The labour market data also showed broad pay strength, with the annual growth in regular earnings (ex. bonuses) at 6.0% in the three months to February (cons: 5.8%). There were few signs that firms had pre-empted the 10% rise in the UK minimum wage from April, with pay growth in the distribution, hotel and restaurant sector, which is most sensitive to minimum wage regulation, slowing slightly. From a monetary policy perspective there was better news in the form of the slightly timelier PAYE measure which showed pay growth slowed to 5.6% in March from 6.2% in February. But it does now look as though private sector regular wage growth will slightly overshoot the BoE’s projection of 5.7% in Q1.

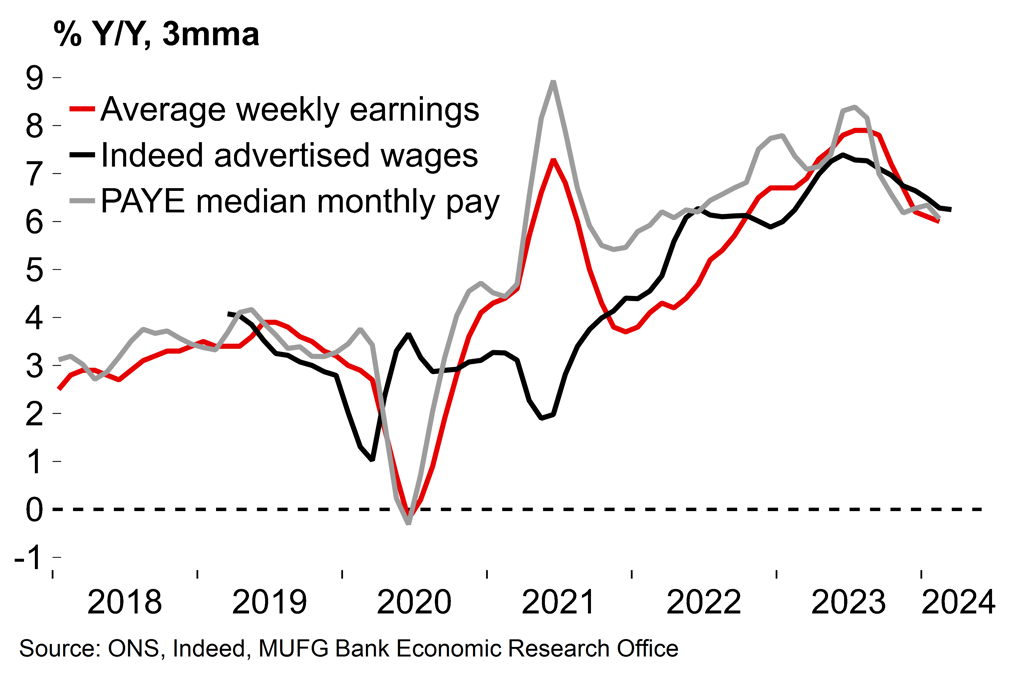

Sticky wage pressures contrasted with signs of a cooling labour market. The headline unemployment rate increased from 3.9% to 4.2% in the three months to February. Employment fell sharply over the same period, by 156,000. The caveat that there are ongoing issues with the reliability of the Labour Force Survey data remains – the ONS continued to note that the numbers “should be treated with additional caution”. It was also notable that the decrease in employment has largely centred on part-time employees and that overall hours worked has continued to rise. But the overall sense from the latest release is that a few more cracks are now appearing in the labour market, which is consistent with the signals we're seeing from a range of business surveys.

Chart 1: The UK disinflation process continues

Chart 2: Pay growth remains high

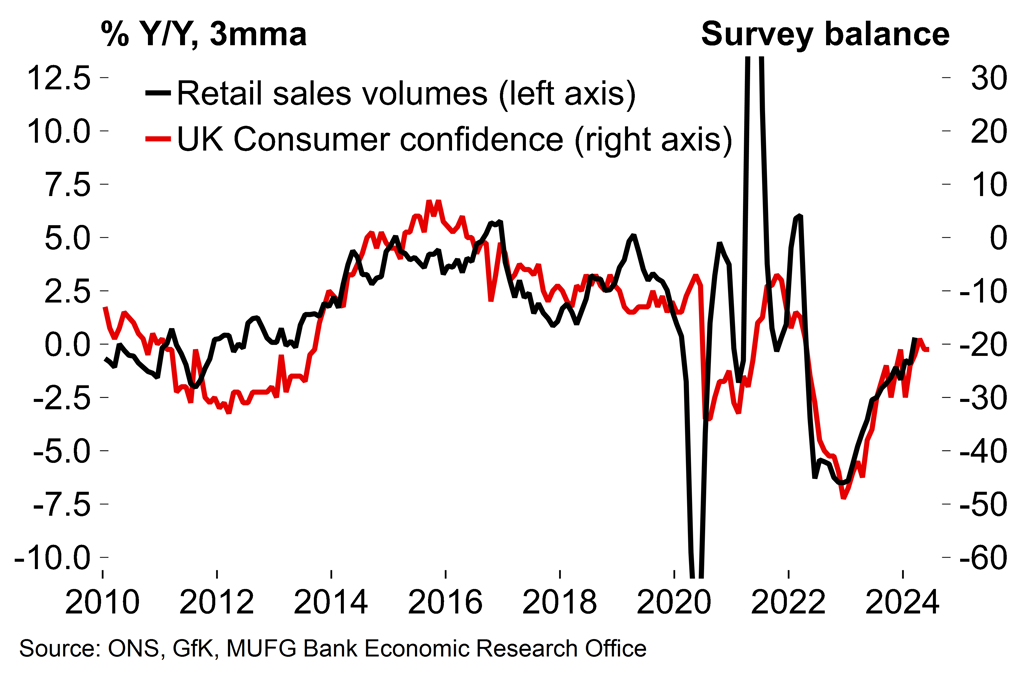

On economic activity, today’s retail sales figures for March came in flat (0.0% M/M) after muted growth (0.1%) in February. Excluding auto fuel, retail sales contracted slightly (-0.3%). These figures were disappointing against the backdrop of gradually improving real income growth as headline inflation falls. It was likely the case that notably damp weather in the first half of the month weighed on spending to an extent.

Last week we noted that the UK economy has almost certainly exited recession at the start of 2024 (see here) – but these numbers underscore that the recovery is likely to relatively muted. We continue to track Q1 GDP at 0.3% Q/Q, and expect similar growth rates through the rest of the year. Some actual, sustained growth would be welcome news after an extend period of what has essentially been stagnation for the UK economy. But, while consumer spending is set to steadily become a more reliable growth engine, overall activity growth is likely to be tempered by the lagged effects of monetary policy tightening.

Chart 3: A less-distorted UK labour market

Chart 4: The consumer environment has generally improved

The prospects for monetary policy divergence remain in focus

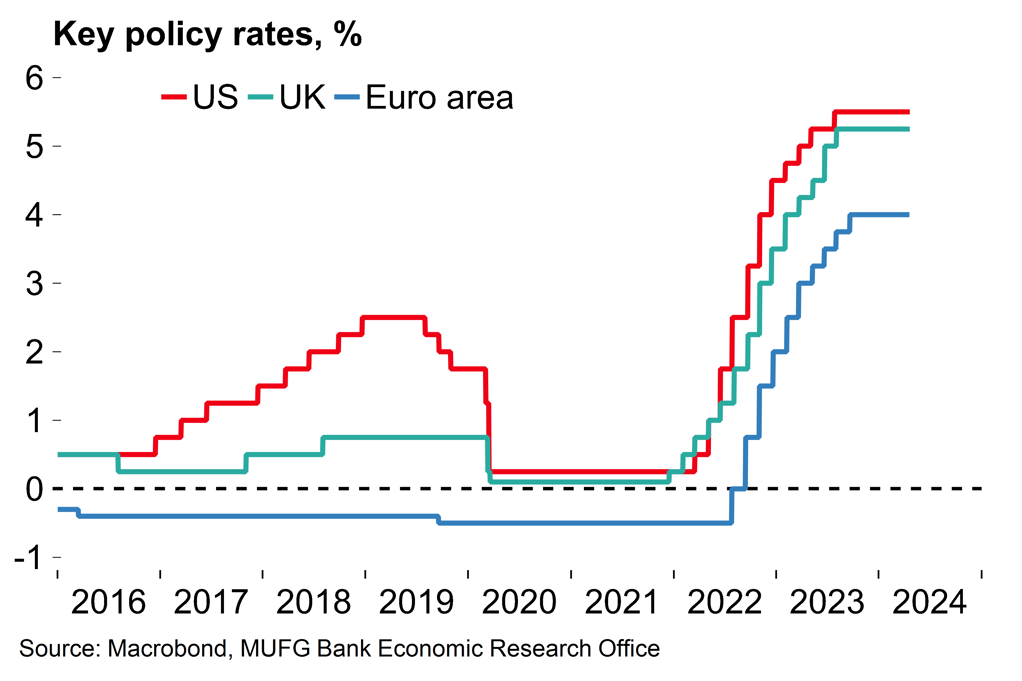

All told, this week’s data was a mixed bag for the Bank of England, with still-high rates of underlying inflation and wage growth contrasting with some signs of cracks appearing in the labour market and only a moderate recovery in activity. To our minds, the slightly-above consensus numbers on inflation and pay this week should be kept in perspective. The longer-term trend of disinflation remains intact and wage growth is a lagging indicator. Indeed, we are likely now approaching the point where a degree of easing would be appropriate, for the UK economy in isolation at least.

However, the recent upside surprises in US inflation and activity data have complicated the outlook. After a significant repricing of US rates expectations, the BoE will be keen to stress that it will plot its own course. This week Governor Bailey highlighted how inflation dynamics in Europe are not the same as in the US. The different drivers (robust demand in the US vs energy-related supply shocks in Europe) have been well noted. We would also highlight that core inflation is still strongly affected by energy prices, especially in the less wage-sensitive components. That means there is less reason to be concerned about underlying inflation with the effects of the Europe-focused energy shock set to continue to unwind.

Nonetheless, developments across the Atlantic cannot be ignored – sterling weakness as a result of divergence with the Fed would have a positive effect on UK inflation through higher import prices. The UK has relatively recent experience of this: the sterling shock following the Brexit referendum pushed headline inflation up to 3.1% in late 2017 (after the recent inflation surge, context is important – the 2014-16 average rate was just 0.7%).

The BoE would likely be comfortable with making the first step alone – after all, it did raise rates before the Fed in 2021 – but further down the line it will be hard to ignore what happens in the US. The response of the BoE during the tightening phase was also revealing. It may have made the first move, but the BoE was soon playing catch-up with the Fed’s hiking path. Despite the difference inflation drivers and growth backdrops, the monetary policy treatment was remarkably similar in timing and magnitude. So it seems reasonable to expect a degree of synchronisation with the Fed on the way down as well, although initial divergence is very plausible.

Chart 5: UK inflation – a longer-term view

Chart 6: The Fed soon led the way during the tightening phase

Next week – How strong was growth momentum at the start of Q2?

The focus next week will be on a range of business survey for April, including flash PMIs and the reliable German ifo survey, which will give an indication of activity at the start of Q2. We expect to see further signs that momentum in Europe has continued to improve this year after stagnant growth in H2 2023. Survey evidence out of Germany has been notably weaker than in other euro area countries (the euro area composite PMI stood at 50.3 in March vs 47.7 in Germany) but there were tentative signs last month that sentiment is also now improving in the single currency area’s largest economy.

Key data releases and events (week commencing Monday 22 April)