- The BoE kept rates unchanged this week, as expected, but has now indicated that the next move on rates will be downwards. The updated inflation projections show headline rates may return to target temporarily in Q2 before edging back up towards 3% by year-end. That suggests the window for the first rate cut could be tight if policymakers want to avoid the communication challenge of starting to ease policy when inflation is on the up again.

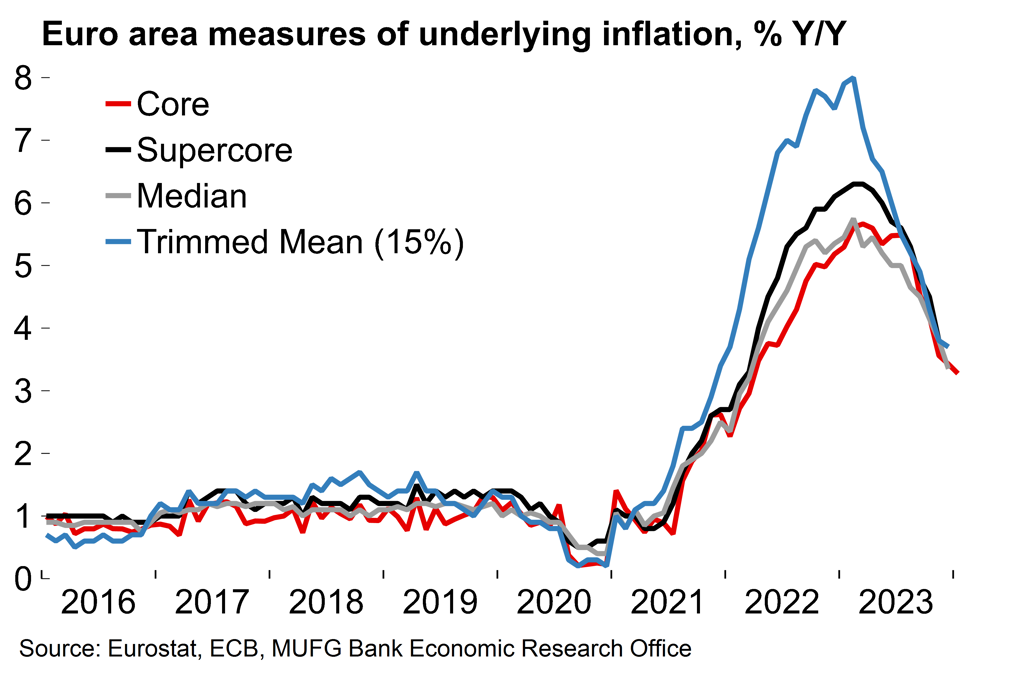

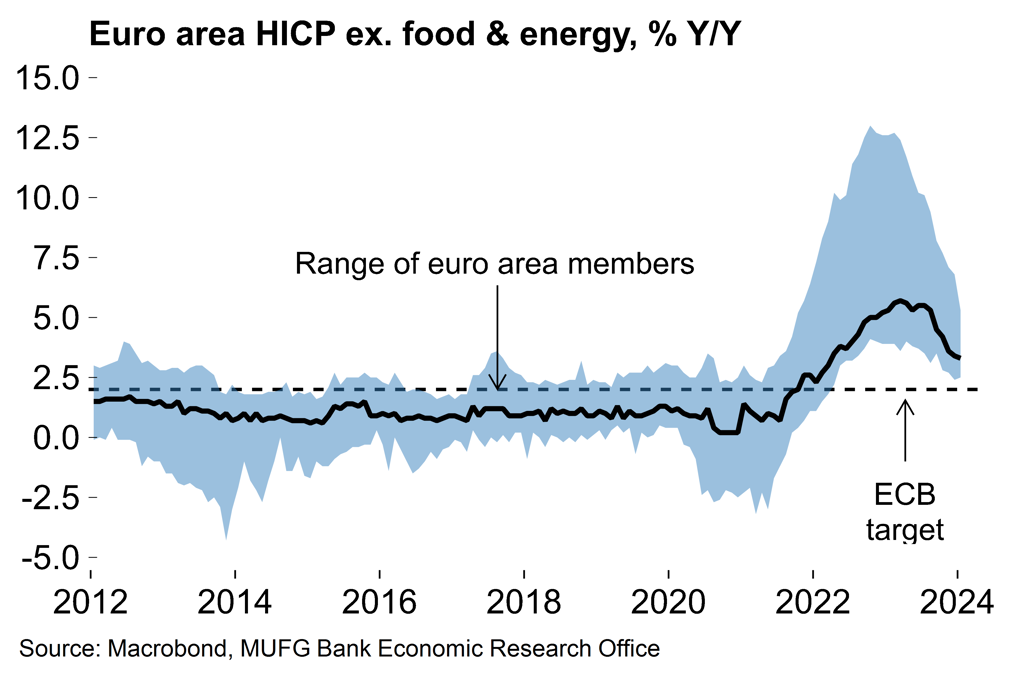

- Euro area inflation edged lower in January but still looks sticky with the services rate unchanged on the month. The general trend in inflation remains downward however, with headline rates set to decline further in coming months.

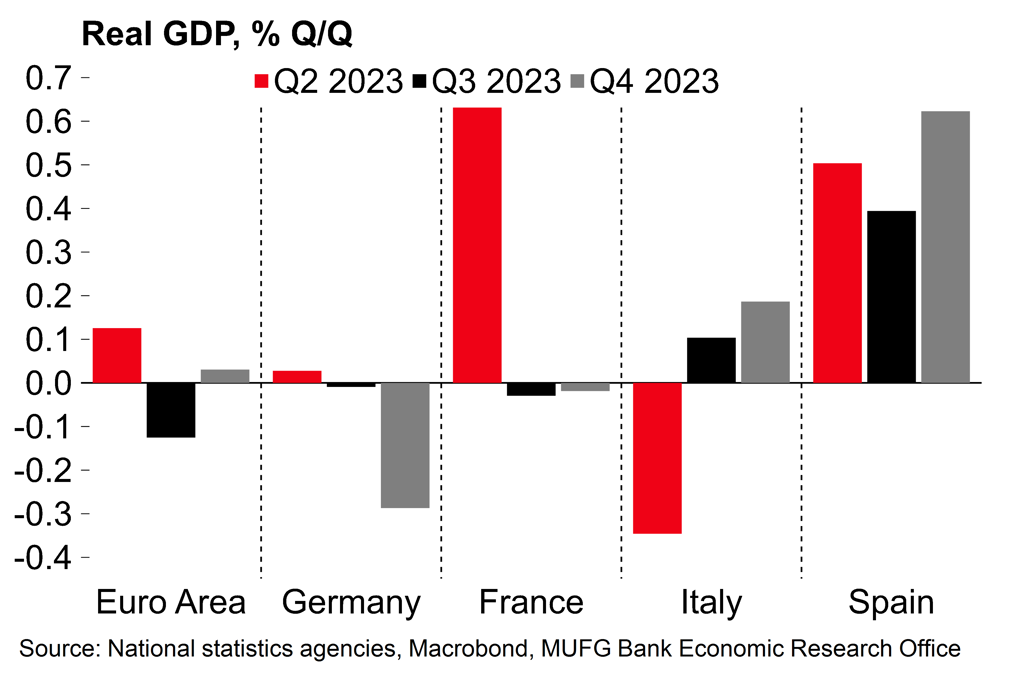

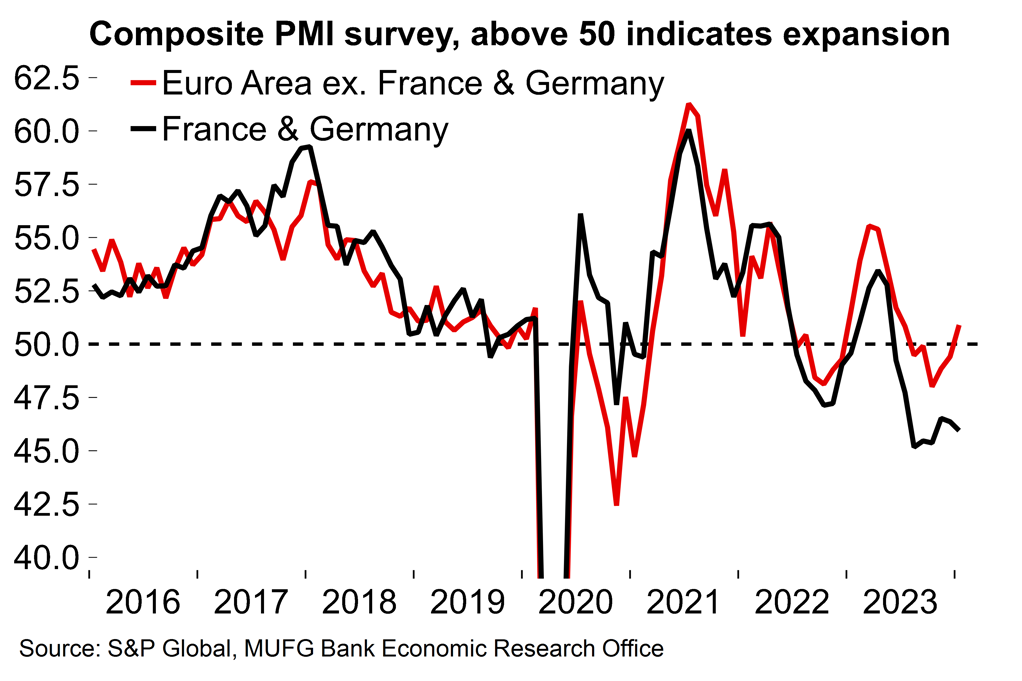

- The euro area economy narrowly skirted recession at the end of 2023 with flat growth at the end of the year. The overall picture remains one of stagnation but surveys have stabilised somewhat in 2024 and we expect cyclical momentum will gradually pick up over coming months.

Bank of England Review: Rate cuts are coming

The Bank of England left rates unchanged at 5.25%, as expected. The previous tightening bias was dropped and there were some important shifts in communication which acknowledge that the next move on rates will be downward. Governor Bailey noted that the question now is about how long the current restrictive policy needs to be maintained for inflation to return to target. While the nine-strong MPC was notably divided, with two members voting for a further hike and one for a cut, the overall picture was one of a central bank that is increasingly confident that inflation is coming down sustainably towards the target but is not quite ready to pull the trigger on rate cuts.

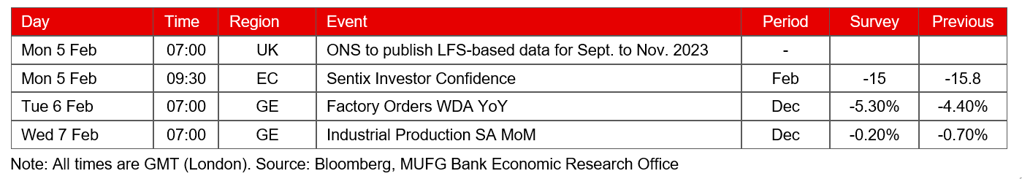

The updated projections show a considerably more constructive inflation outlook with CPI returning to 2% in Q2 on the back of a sizable fall in the UK household energy price cap in April. However, headline rates are then expected to move higher again in H2 this year, towards 3%, due to more persistent core pressures. That forecast is conditioned on pre-meeting market interest rate expectations for rates to fall by around 100bp this year. In the alternative scenario of unchanged policy (i.e. rates maintained at 5.25%), inflation falls sharply below target from end-2025. Taken together, the projections give a clear indication that the BoE believes that monetary easing is required this year to prevent inflation undershooting the target further down the line, but perhaps not quite to the extent that market participants expect.

Chart 1: The BoE’s projections suggest unchanged policy would cause inflation to undershoot the target

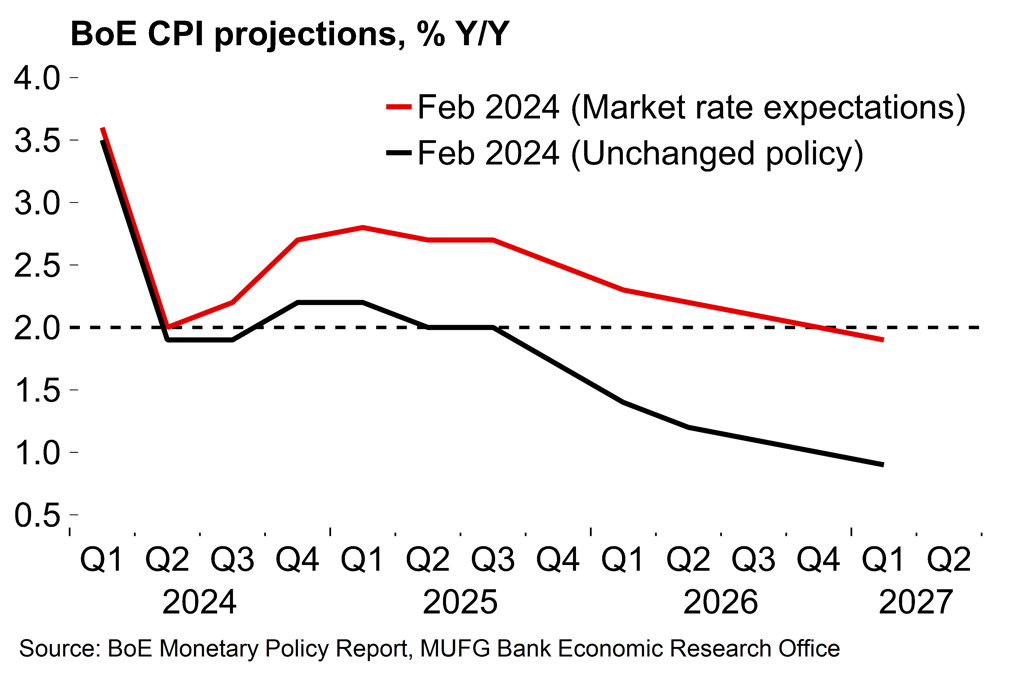

Chart 2: There have been signs of easing underlying inflation pressures in recent months

In many ways the BoE followed the ECB playbook from last week (see here) with policymakers looking to retain flexibility over the timing of easing. There was not that much in the way of explicit pushback against earlier rate cuts from Bailey in the press conference, with the emphasis on data dependence in coming months leaving the door ajar to cuts sooner if required. However, nor was there any indication that the BoE is in a rush to get the ball rolling. The broad market reaction was muted with no significant shift in expectations around the future path of interest rates. The BoE will likely be content that it has managed to maintain its holding pattern and avoid a premature loosening of financial conditions while still edging closer towards easing policy.

There are some reasons to be cautious. Nominal pay growth remains uncomfortably high from a monetary policy perspective (and it’s unlikely that fresh data will change that story before the next meeting in March). There may also be private concerns that the BoE’s restrictive monetary policy setting could be pitted against more accommodative fiscal policy. The UK Chancellor has looked to play down speculation around pre-election fiscal giveaways but we expect the government will still implement some personal tax cuts at the upcoming Budget in March.

However, the projection for inflation to fall back to target temporarily suggests that the window for the initial rate cut could be narrow. Embarking on an easing cycle when headline inflation is rising again later in the year, as the BoE expects, would pose a communication challenge. The means that the current market pricing for the first cut in May or June looks appropriate to our minds, although there may still be concerns by some on the MPC over the persistence of underlying inflation pressures.

Euro area services inflation remains sticky at the start of the year

After rising to 2.9% Y/Y in December, euro area headline inflation edged down again to 2.8% in the flash release for January. This was slightly above the consensus expectation. Core inflation also declined by 10bp, to 3.3%, although the services component remained unchanged at 4.0%. Food price inflation was also a little higher than expected given the ongoing fall in producer prices.

By country, there was better news in Germany where headline HICP inflation fell back to 3.1% after rising to 3.8% in December. French HICP inflation also eased markedly, from 4.1% to 3.4%. These falls were offset by higher rates in the next largest euro area economies (Italy, Spain and the Netherlands).

The overall picture in the euro area as a whole is one of somewhat persistent underlying price pressures. The January data gives more hawkish members of the ECB some ammunition when it comes to making the case for later rate cuts. In particular, the fact that services inflation is holding steady will have bolstered concerns about second-round effects on wage growth. The ECB emphasised that it’s on a data-dependent footing last week and there was nothing in these HICP figures to boost the chances of an earlier rate cut.

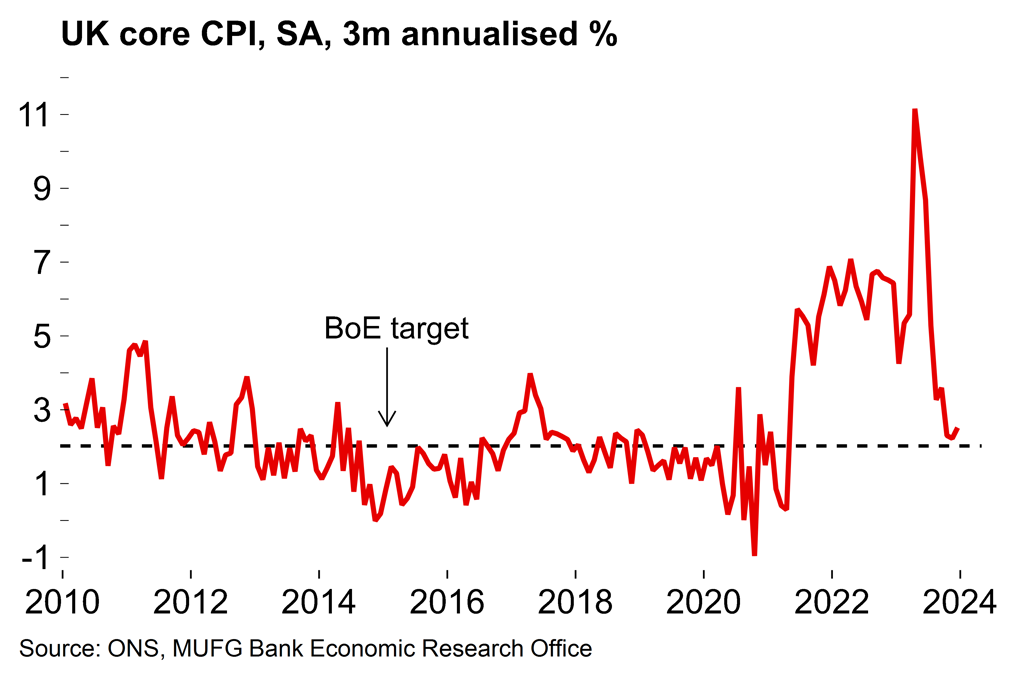

However, we remain optimistic about the path for euro area inflation. In the near-term, we expect food price inflation will continue its downward trend at a slightly faster pace in coming months and contribute less to the headline rate. More fundamentally, core inflation is still falling, however you slice it (Chart 3) and will expect rates will continue to ease over coming months. More forward-looking indicators suggest that pay pressures will continue to ease and so focus on second-round wage effects should gradually diminish. All told, we look for euro area headline HICP to average a little over 2% this year.

Chart 3: Core inflation is falling (however you slice it)

Chart 4: The national range of core rates continues to narrow

The euro area economy narrowly dodged recession last year

The euro area economy narrowly avoided a technical recession in H2 2023 with flat growth in the final quarter. After the German statistical agency had already flagged a 0.3% Q/Q contraction in Q4 (which was confirmed in the national accounts data) it had looked a tough ask for the euro area as a whole to avoid a negative figure and we had pencilled in a small contraction. However, upside surprises in Italy (+0.2%) and Spain (+0.6%) bolstered overall growth. Activity in France was again flat (0.0%) on the quarter.

The overall picture is one of stagnation rather than crisis. We don’t yet have the expenditure breakdown for the euro area as a whole, but based on figures and comments from the national releases it seems that investment and consumer spending probably dragged on growth. This would be no surprise to see after the real terms squeeze on household incomes and ongoing pass-through of tighter ECB policy.

While there are some signs of stabilisation, business surveys suggest limited momentum at the start of the year. However, we expect this will change with some cyclical improvement over coming quarters as households’ real purchasing power recovers and financial conditions ease. Overall, we are tracking annual average growth at around 0.5% this year with consumer spending set to become the key driver.

Chart 5: The euro area as a whole stagnated in H2 2023 but just managed to avoid a technical recession

Chart 6: Surveys suggest that the relative struggles of Germany and France may continue in Q1 2024

The week ahead: German industry in focus

Next week looks light on the data front after a busy period of central bank meetings, inflation readings and national accounts releases. We know the German economy struggled in Q4 (GDP contracted by 0.3% Q/Q) but German factory orders and industrial production will give some clues as to how much momentum the beleaguered manufacturing sector had going into 2024. Aside from the downward move in wholesale gas prices over the last few months, there’s been very little good news in recent times (see here).

In the euro area there will also be the final PMIs for January (and first look at Italy and Spain), as well as the Sentix gauge of sentiment at the start of February.

Lastly, the UK statistics office will resume publication of its labour force survey after undertaking work to improve the data. A low response rate had prompted concerns about the validity of the numbers. Other data released in the interim period suggests that the UK labour market has loosened a little in recent months but the unemployment rate remains low by historical standards.