- The UK prime minister took the surprise decision to call an election in six weeks’ time, despite his Conservative party trailing well behind in the polls. A comfortable victory for the opposition, the Labour party, clearly looks like the most likely outcome at this stage. In that case, a significant policy shift is unlikely. Labour has emphasised that it would follow a pro-business approach and err on the side of caution when it comes to public finances. In the short-term, clarity around the date of the election is welcome. Further ahead, the UK economy stands to benefit from the period of relative calm and stability that a new government with a sizeable majority would bring after the Brexit years and subsequent leadership churn. Indeed, the risk scenario is a hung parliament and protracted period of policy uncertainty for the UK.

- An early election means that political considerations will not complicate the BoE’s easing plans. Sticky services inflation in April had already nixed the chances of a June rate cut before the prime minister announced the July election date. Nonetheless, we still expect better news on underlying price pressures over coming months which would allow the BoE to start easing.

- In the euro area, negotiated wage growth accelerated from 4.5 to 4.7% in Q1 but the ECB was quick to highlight that one-off factors had played a big part. The message is clear: the well-sign posted June rate cut has not been derailed.

UK Election Preview: The return of political stability?

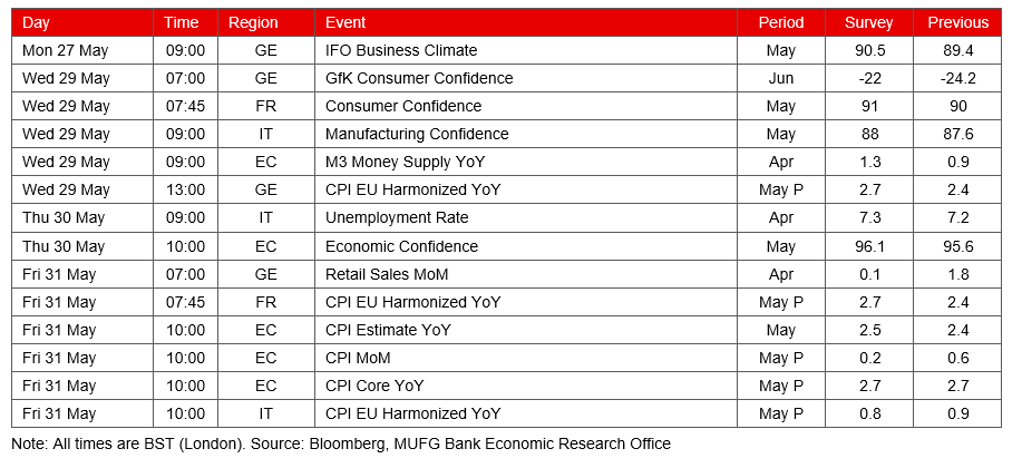

The UK prime minister, Rishi Sunak, made the surprise decision to call a UK general election on 4 July. Most observers – including us – had expected an autumn vote. On paper, the timing seems odd. Sunak’s Conservative Party is trailing the opposition, Labour, by over 20pp in the polls (Chart 1). The UK economy has just returned to growth and consumer conditions seem likely to continue to improve over coming months (see here).

It’s hard to see how Labour’s lead can be overturned in just six weeks. There’s been nothing in recent local election and by-election results to raise doubts about recent polling trends. The gap might narrow slightly before the election – approval ratings show that the public is not completely sold on Labour’s leader, Keir Starmer – but there is a desire for change after 14 years of Conservative government. Prediction markets currently show an implied probability of around an 85% for a Labour majority and 13% chance of a hung parliament (i.e. no overall majority). This suggests that, as it stands, there is less uncertainty around this UK election than usual.

The Labour Party in its current incarnation is moderate and centrist. It has indicated that it would follow a pro-business approach and err on the side of caution when it comes to public finances. ‘Market unfriendly’ policies (of the sort proposed by some previous Labour leaders or actually implemented in the Liz Truss government’s ill-fated ‘mini Budget’) do not look likely.

We would expect only slightly more in terms of both tax and spend under Labour. The recent National Insurance cuts (which can be seen as pre-election giveaways) may well be reversed, with Labour in turn looking to increase expenditure in areas such as health, education and policing. However, UK public finances don’t afford a great deal of wiggle room and, with the Liz Truss debacle still fresh in memories, there is no desire to rock the boat when it comes to fiscal policy. The shadow chancellor, Rachel Reeves, is a former BoE economist and seems instinctively cautious.

Chart 1: Labour’s lead has remained stable since Sunak became prime minister

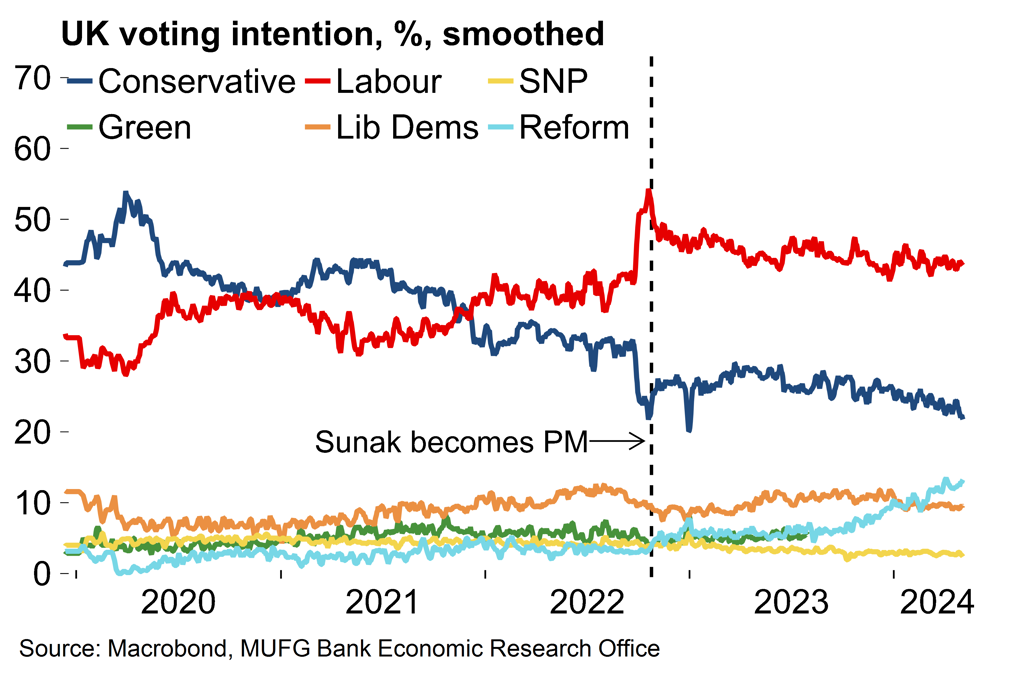

Chart 2: Investment is relatively low in the UK

Indeed, Labour has indicated that it will retain the current main fiscal rule that debt-to-GDP should be falling over the medium-term (see speech here). That said, it would look to alter the medium-term borrowing target (3% of GDP) by separating out investment from day-to-day spending. On paper this seems sensible – UK capital spending is low relative to other G7 economies (Chart 2) – but whether it would work in practice remains to be seen. Politically, it can be easier to focus on day-to-day spending and kick the can down the road on infrastructure projects, and Labour has already watered down its initial green investment plan earlier this year. The other significant policy proposal from Labour is that it would look to shake up planning restrictions to make it easier to build in the UK. Again, while this would be positive for growth, it might be trickier to implement in practice given seemingly deep-rooted and effective nimbyism at a local level. Lastly, a Labour-led government may also look to ease lingering tensions with Brussels, but there has been no indication of any desire to seek meaningful change in the current trading relationship between the UK and EU.

All told, we don’t see huge downside or upside risks to growth from policy shifts under a Labour government. However, the UK economy stands to benefit from the period of relative calm and stability that a new government with a sizeable majority would bring after the Brexit years and five prime ministers in eight years. Indeed, the risk scenario is a hung parliament and protracted period of policy uncertainty for the UK.

Sticky services inflation complicates the BoE outlook

From a monetary policy perspective, the earlier-than-expected UK election can be seen as good news: the BoE no longer faces the prospect of navigating the political sensitivities of an initial rate cut prior to the vote. While it has cancelled public statements and speeches by policymakers until after the election, inflation data for April had already nixed any chance of a policy change in June.

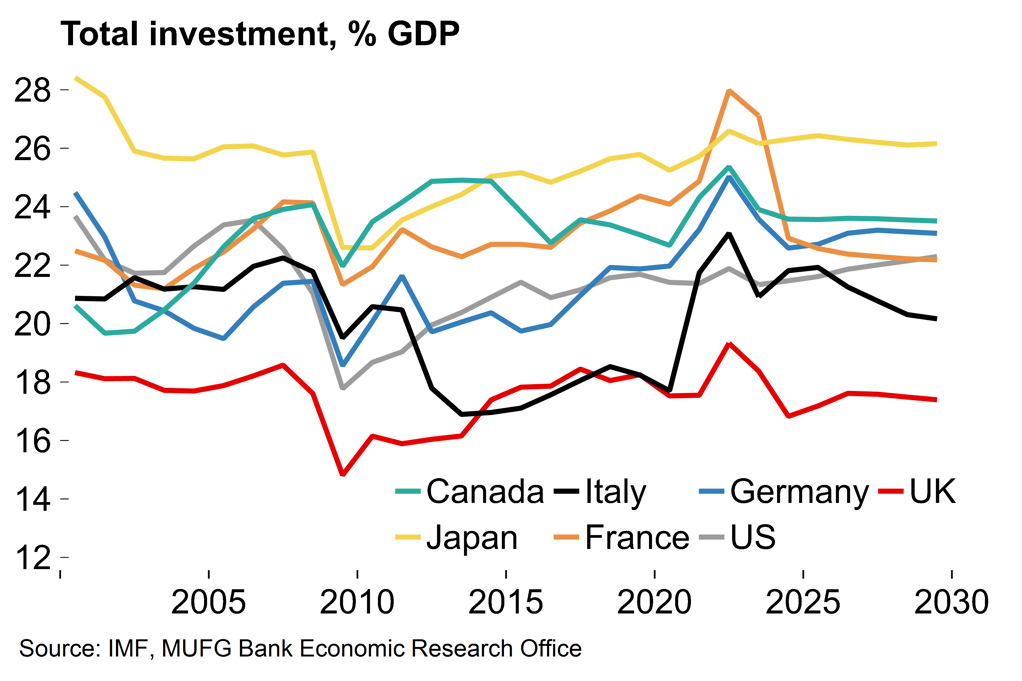

Headline CPI came in at 2.3%, down from 3.2% but above consensus and the BoE’s latest short-term projection (both 2.1%). The fall in the headline rate was mostly driven by the energy component following the fall in the household price cap. However, it was the services component that was most concerning at 5.9%, from 6.0% previously (cons: 5.4%, BoE: 5.5%). The details showed that inflation stickiness was broad-based across sub-components and would have been uncomfortable reading for BoE policymakers.

We continue to expect inflation will ease over coming months. Today it was announced that the energy price cap will fall again, by 7%, in July, which will help with the headline rate. On underlying price pressures, there was more encouraging news in this week’s PMI release with the services input price component falling sharply from 67.1 to 61.6. The composite output gauge also eased, from 54.1 to 52.8. That supports our view that, despite the strong start to the year in the Q1 GDP figures, the UK recovery will be solid rather than spectacular. Retail sales for April, also released today, were disappointing (a 2.0% M/M contraction). That was likely related to damp weather during the month and we’d expect bounce-back in May, but nonetheless it is a poor start to the quarter. We are now tracking GDP growth at 0.2% Q/Q in Q2.

In our review of the last BoE meeting (see here) we noted that, while policymakers have now opened the door to a cut, there was a preference to retain a degree of flexibility over the timing (rather than signpost a specific meeting as the ECB has done). This week’s CPI data validates that decision. Nonetheless, the data-dependent approach remains and we believe that the BoE remains on track to cut rates in Q3 if inflation and wage data evolves favourably (as we expect).

Chart 3: Sticky services prices are slowing the disinflation process

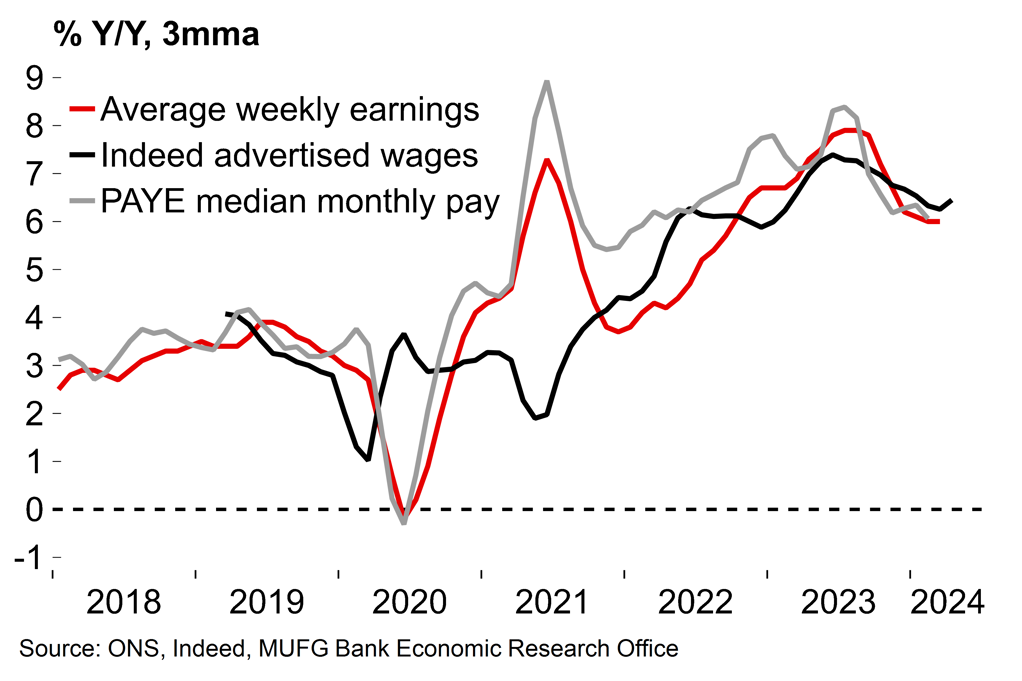

Chart 4: Pay growth remains high from a monetary policy perspective

An acceleration in negotiated wage growth has not derailed the ECB’s plans

The ECB has long flagged the importance of Q1 wage data for its policy decisions. We highlighted chief economist Philip Lane mentioning that key figures would available by the June meeting back in January (see here). At the time that felt like a significant intervention, and policymakers continued to mention these numbers as they increasingly signposted the June meeting as the start of the easing cycle.

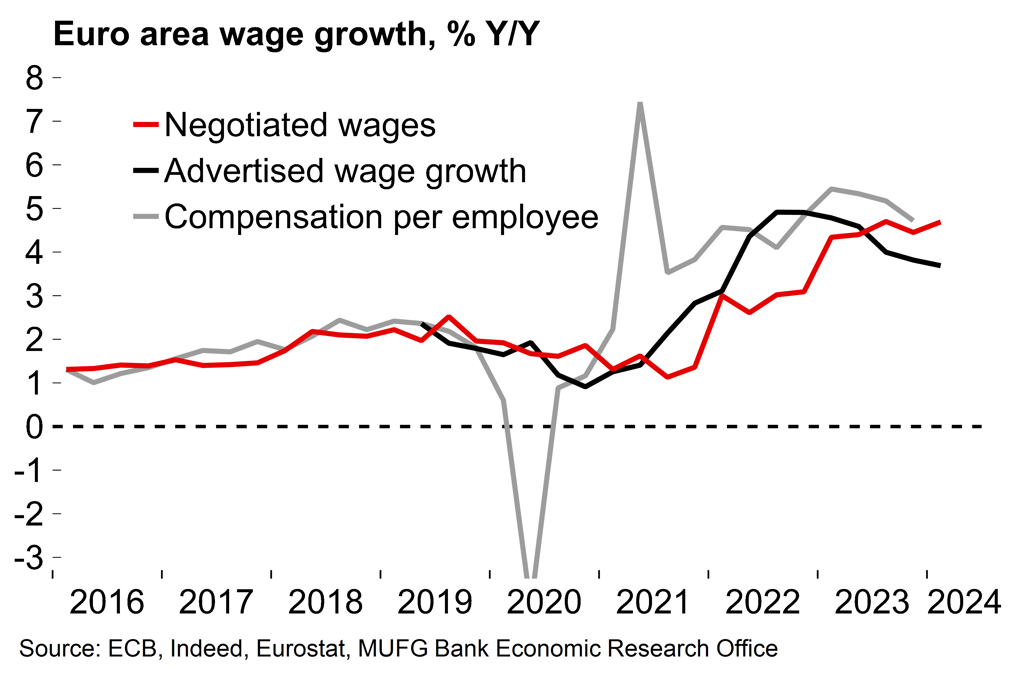

The negotiated wage growth figure for Q1 was duly released yesterday – and it wasn’t good news for the ECB, increasing from 4.5% to 4.7% Y/Y. However, the ECB quickly released a blog ("Tracking euro area wages in exceptional times") which emphasised that one-off factors (especially in the German public sector) have contributed to this stronger rise in the negotiated wage index. The ECB’s new ‘wage tracker’, which smooths one-off factors across a 12-month period, shows a much more benign picture (unfortunately this series, which is seemingly an important part of the ECB’s reaction function, has not yet been released to the public). The message is clear: this small increase in headline negotiated wage growth will not derail the ECB’s June rate cut. Beyond that, we suspect there will be some caution – a back-to-back move in July does not seem likely – but the path should be clear for further easing after the summer.

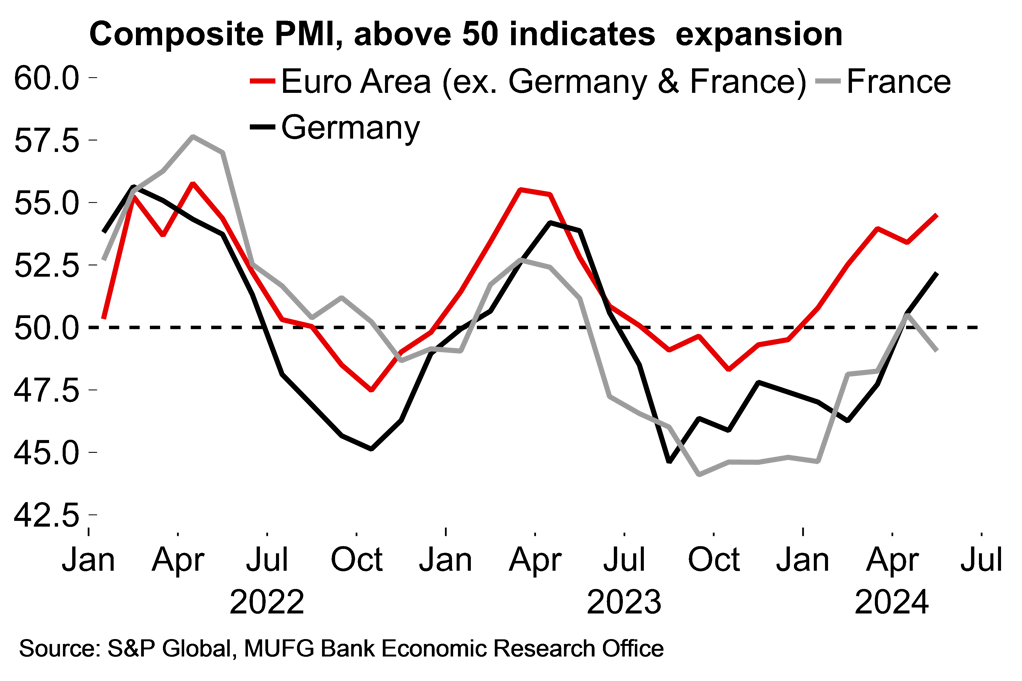

Meanwhile, there was better news in the input and output price components of the euro area PMIs in the flash May release, in both the manufacturing and services components. On growth, the headline composite number came in slightly above expectations at 52.3, with clear signs of an ongoing recovery in the manufacturing sector. We continue to expect a moderate euro area recovery through the rest of the year.

Chart 5: Negotiated wage growth edged higher in Q1

Chart 6: Surveys point to ongoing growth momentum

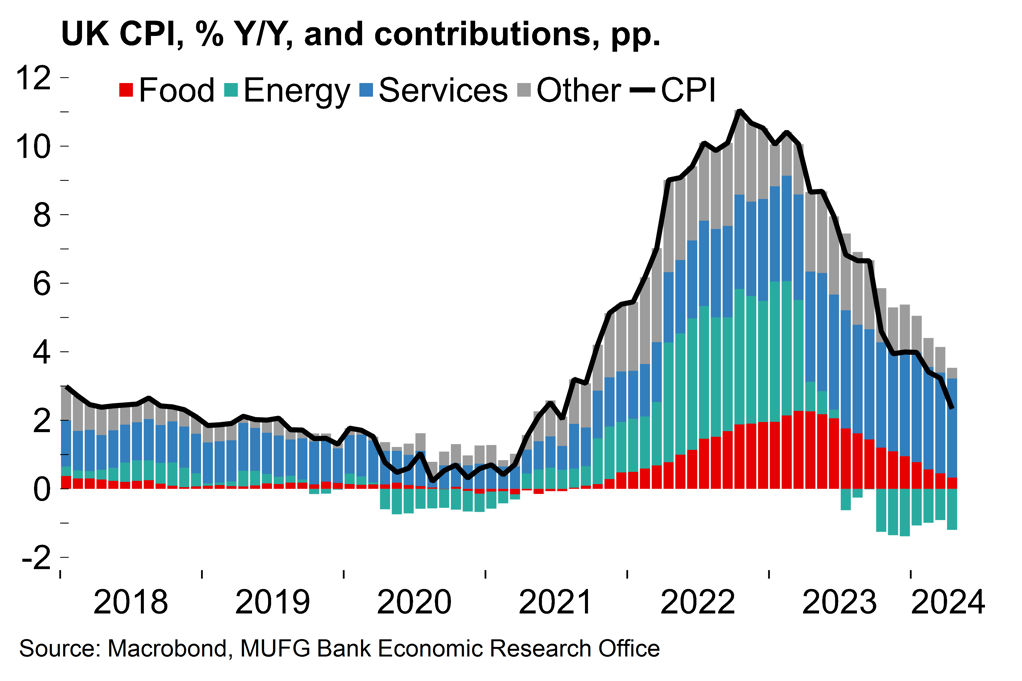

Next week: Higher euro area inflation unlikely to be cause for concern

The focus next week will be on flash euro area inflation data for May. The headline figure may have edged up on the back of base effects in Germany following the introduction of subsidised public transport tickets last year. As mentioned above, the ECB has clearly signposted the 6 June meeting for its initial rate cut and will look past any temporary distortions that raise the headline inflation rate. We continue to expect that the gradual disinflation process will reassert itself over coming months.

As well as the European Commission’s sentiment indicator, the reliable German ifo survey and a range of national consumer confidence numbers will also be released. We expect that these will continue to paint a picture of a gradually recovering euro area economy with further signs of better consumer conditions.

Key data releases and events (week commencing Monday 27 May)