- Survey evidence continues to suggest that the European recovery is building momentum in 2024. The euro area composite PMI is now firmly in expansion territory and more encouraging signals for the German economy point to fading cross-country divergence.

- The UK PMI numbers were notably upbeat, consistent with a meaningful bounce after the short and mild recession in H2 last year.

- Next week will be a busy one in terms of euro area data. GDP figures should show a return to growth in Q1 but inflation for April could look a little sticky with various effects set to disrupt the disinflation process.

The euro area economy has started the year on firmer footing

A slew of survey data for April supported our broadly positive view on the European recovery with signs that the improved momentum observed in Q1 has been carried forward into this quarter. Most notably, the flash euro area PMI now stands at 51.4 – up from 50.3 in March, and an 11-month high. This was a much stronger figure than expected and is consistent with a moderate GDP expansion in Q2.

The improvement was driven by an increasingly healthy services sector (52.9, from 51.5 in March). By contrast, the manufacturing gauge continues to languish in contraction territory, edging lower to 45.6. Not ideal – but, as noted here, we do expect that improving global conditions and the prospect of an ECB rate cut in June could lead to some improvement over coming months.

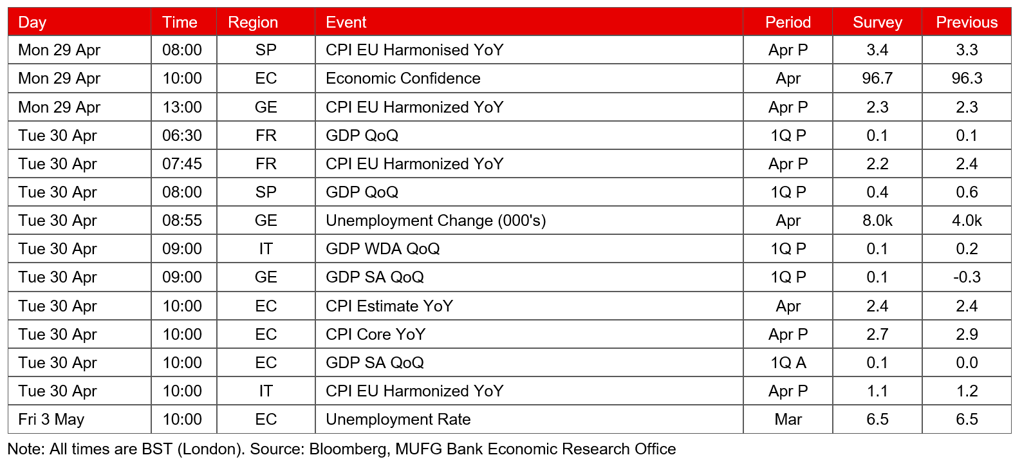

It's worth noting that, while the PMI series is seasonally-adjusted, there could be some residual seasonality in the numbers after the pandemic. Euro area sentiment generally improved in the first months of 2022 and 2023 before tailing off during the remainder of both years (Chart 1). While the pattern is similar so far this year, a slowdown is not our base case – the forward-looking survey components continue to look healthy and the ongoing recovery in real household income growth should support a consumer-led rebound (indeed there was another improvement in this week’s flash consumer confidence release).

Less encouragingly, the PMI survey did show signs of an increase in price pressures. The release noted that higher wage rates in the services sector were often cited by firms as the key driver, along with higher energy prices. At this stage it’s not unduly troubling from a monetary policy perspective – the composite output price index remains below the levels seen around the turn of the year – but suggests that domestically-generated price pressures could continue to look sticky (euro area services inflation has been stuck at 4% for the last five months). However, Christine Lagarde noted after the ECB’s April meeting that policymakers are “not going to wait until everything goes back to 2%”, highlighting the progress made on goods inflation. This week’s PMI release suggested that this trend of disinflation in the core goods component will continue – both input and output prices remain below the breakeven mark.

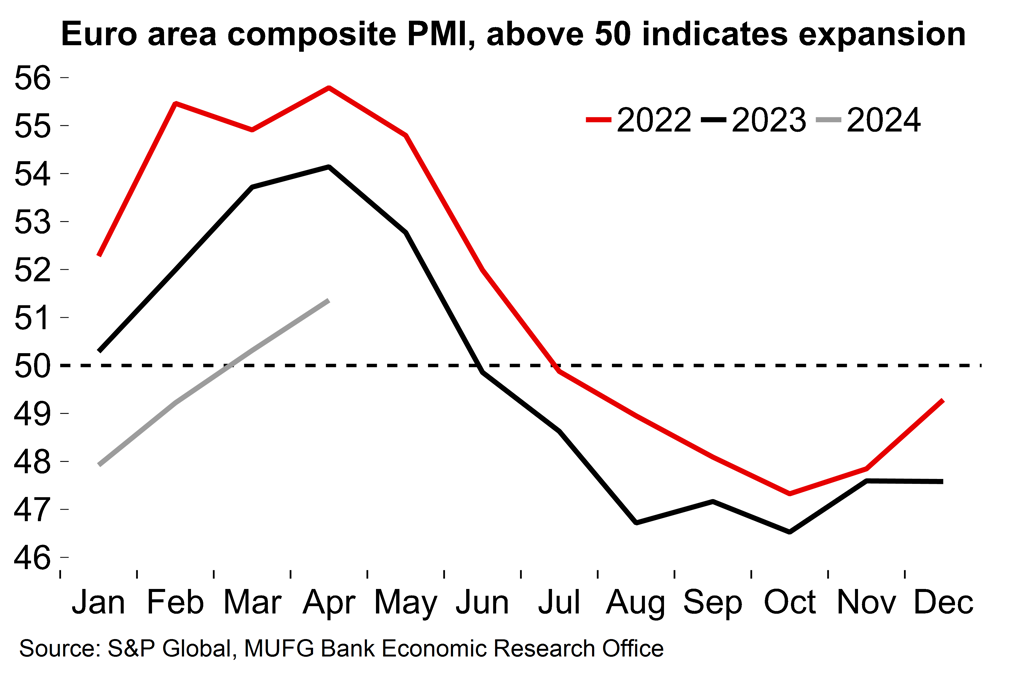

On a country-by-country basis, the narrative of divergence, with Germany and France lagging behind peripheral euro area countries in Q1, is now fading (Chart 2). The German composite figure is now at 50.5 (signalling a mild expansion) and the French figure is essentially at the breakeven mark, at 49.9. In the national surveys, the reliable German ifo measure also came in above expectations this week. The French INSEE survey weakened slightly, but the overall business confidence gauge remains close to its long-term average. The survey has been painting a more positive picture of the French economy than the PMIs since the turn of the year (earlier this week INSEE published this blog which makes a convincing argument that better response rates and other factors make national surveys a better point of reference). We expect activity growth in both Germany and France will steadily improve through the rest of 2024.

Chart 1: Will survey momentum tail off through the year again?

Chart 2: Less divergence in Q2 as sentiment in Germany continues to improve

The UK economy still looks in good shape

The UK PMI also came in well above expectations (composite: 54.0, from 52.8 in March). It’s a similar story to the euro area: an 11-month high which is also driven by the services sector, with weaker signals in industry. While price pressures increased sharply (reflecting the 10% increase in the minimum wage from this month), overall it was a very positive release. We are tracking UK GDP at 0.3% Q/Q in Q1 and it looks as though that pace of expansion should be maintained, if not improved upon, in Q2. We remain upbeat about the UK economy’s prospects through the rest of the year. Data this week also showed that consumer confidence has increased this month – it hasn’t been higher since December 2021 – and private consumption is likely to become an increasingly reliable growth engine as real wages recover.

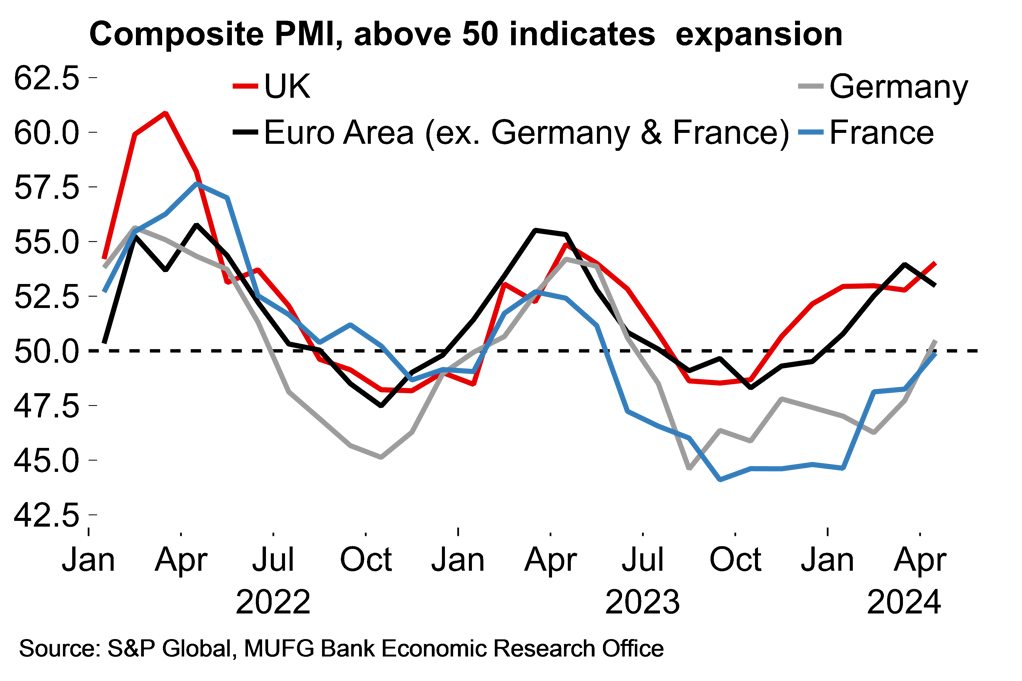

It’s worth noting that the relationship between the UK PMIs and actual activity has broken down slightly in recent years (Chart 3), which may reflect the rise in industrial action over following the surge in inflation (the PMI does not cover the public sector). However, days lost to strike action is now decreasing (Chart 4) and we suspect that the PMIs and other surveys will start to provide a more reliable growth signal again.

Chart 3: The relationship between the UK PMI and GDP has weakened

Chart 4: Distortion from industrial action is set to decrease

Next week: The euro area is set to return to growth – but inflation might look sticky

Next week will be a big one for euro area data. The economy slipped into a technical recession in H2 2023 – by the slimmest of margins (Chart 5) – but the preliminary Q1 GDP numbers are likely to show a return to growth. We are tracking the aggregate euro area figure at 0.2% Q/Q (cons: 0.1%). As noted above, recent survey data suggests that this better growth momentum is likely to have been maintained into Q2.

Inflation data will also be released on the same day. The consensus is for an unchanged headline rate of 2.4% with an acceleration in energy prices offset by some progress on underlying inflation. Stalling disinflation is unlikely to matter much from a monetary policy perspective. The ECB has clearly signposted a June cut and it would likely take large, back-to-back upside surprises on inflation to derail that (May inflation data will be released a week before the next policy meeting on 6 June). There are various distortions and base effects at play over coming months (e.g. increases in VAT on energy in Spain and Germany this month, base effects related to the introduction of the national travel pass in Germany in May last year) and these would give policymakers reasons to look through some temporary deviations from the overall disinflation trend.

Chart 5: ‘Two speed’ Europe? Germany and France acted as brakes on overall euro area activity in H2 2023

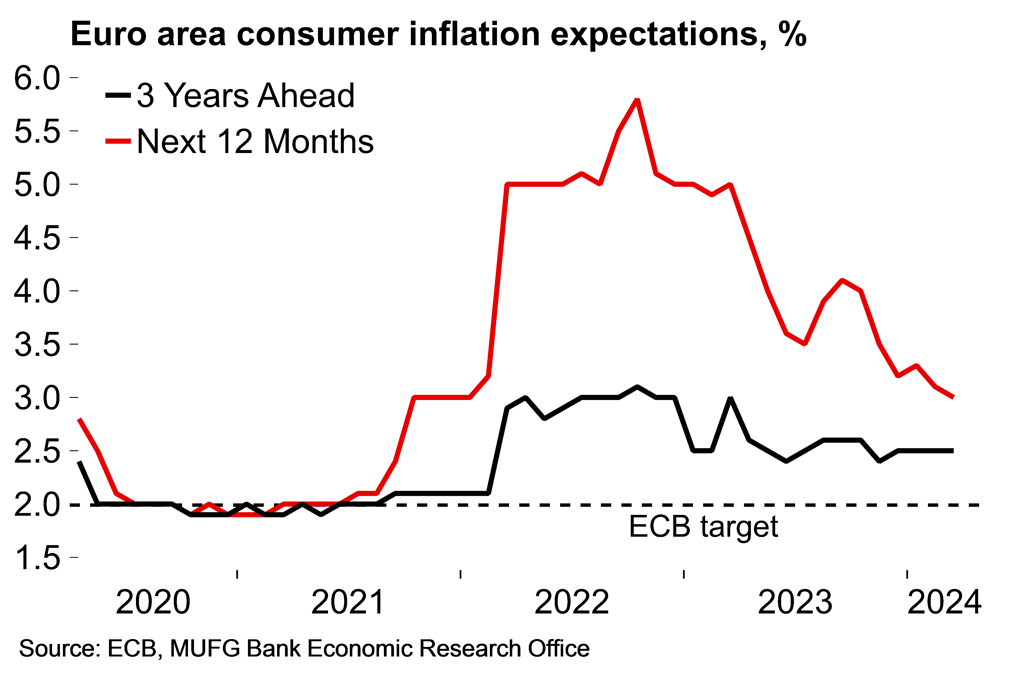

Chart 6: Household inflation expectations continue to edge lower

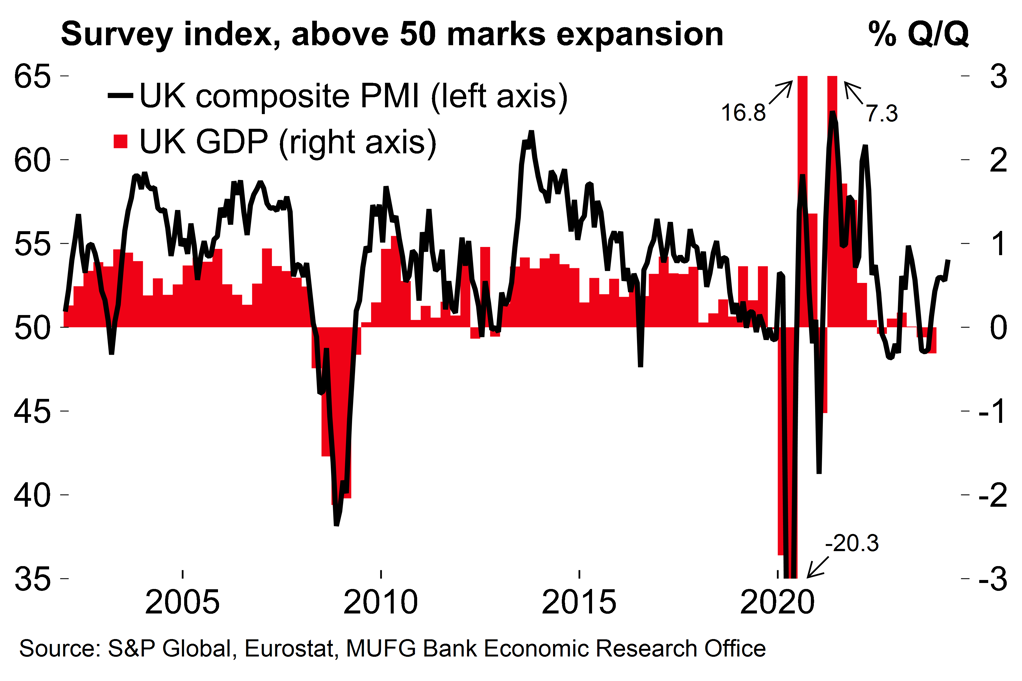

Key data releases and events (week commencing Monday 29 April)