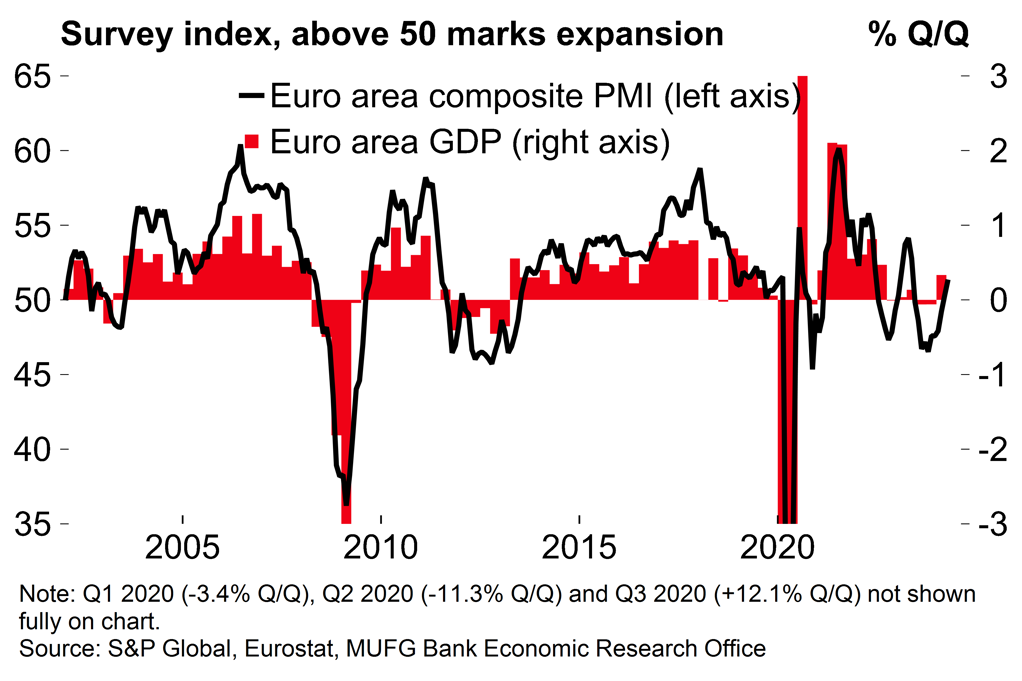

- The euro area economy expanded by a healthy 0.3% Q/Q in Q1. We see this as a sign that the recovery has materialised earlier than expected rather than the start of a great growth leap and we continue to expect a moderate expansion through the rest of the year. Better household income conditions are set to be supportive but this is likely to be offset by restrictive monetary policy continuing to weigh on activity.

- The Bank of England is set to remain on hold at next week’s meeting. Recent data has painted a mixed picture on the persistence of underlying inflation pressures which has caused some public divergence between MPC members. Overall, we suspect that policymakers will be content with leaving the door open to future cuts, but will want to retain flexibility over the timeframe for easing.

- Next week UK Q1 GDP will be released. Higher frequency data has already shown that the UK recession in H2 2023 was mild and short-lived. As is the case with the euro area it is likely that the UK economy has turned a corner at the start of the year.

The euro area recovery is now underway

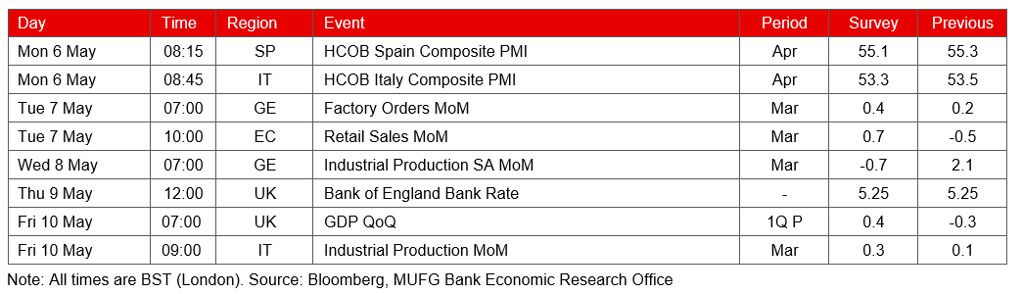

The euro area economy expanded by 0.3% Q/Q in the first quarter of the year. Our initial take can be found here. We had been feeling increasingly upbeat on the near-term prospects for growth but this figure was higher than our above-consensus estimate (0.2%).

In the absence of a shock it seems fair to expect that momentum will be maintained. With still-firm labour markets, the recovery in real incomes should see consumer spending become a reliable growth driver. A degree of monetary easing is set to provide further support. That’s essentially been our message for a while (see e.g. here from January). However, we had assumed a more gradually recovery through the year with quarterly growth rates only reaching potential in H2.

The question now is: is this a matter of timing – with the recovery starting earlier than we expected, but following a similar path – or is growth set to be fundamentally stronger than we had assumed? We still lean towards the former and expect moderate growth from here rather than a rapid recovery.

Over the near term, our view is that growth is likely to continue at a similar pace in Q2 (~0.3% Q/Q). While there is no expenditure breakdown for the euro area as a whole yet we do have some clues from the national releases that better exports and construction investment supported activity growth at the start of the year. Both factors may reverse somewhat on a quarterly basis: the early timing of Easter probably boosted tourism (Spain’s services exports expanded by 11.1% in Q1), while mild weather in Germany likely helped construction. However, we suspect that better consumer spending should offset these possible sources of downward pressure in Q2. The German Q1 GDP release noted a decline in household spending but the March retail sales figure (1.8% M/M) suggests stronger momentum into Q2, with clear scope for ongoing improvement ahead as households’ real incomes continue to recover.

Chart 1: The PMI points to continued growth momentum

Chart 2: The disinflation process has resumed

More broadly, our take is that these Q1 figures could well be an inflection point after an extended period of stagnation – but the euro area is probably not on the cusp of a great growth leap. Monetary policy will remain restrictive even if policymakers start to cut rates, and there is pressure on some governments to implement a degree of fiscal consolidation after support measures shielded households and firms from the energy shock. While there are encouraging signs of a cyclical improvement in industry – as well as trade globally – longer-term structural pressures such as labour shortages and increased global competition are likely to continue to weigh on European manufacturing. All told, our view is that the recovery may have materialised slightly sooner than we expected but growth rates are unlikely to significantly exceed potential over coming quarters.

Bank of England preview: How divided is the MPC?

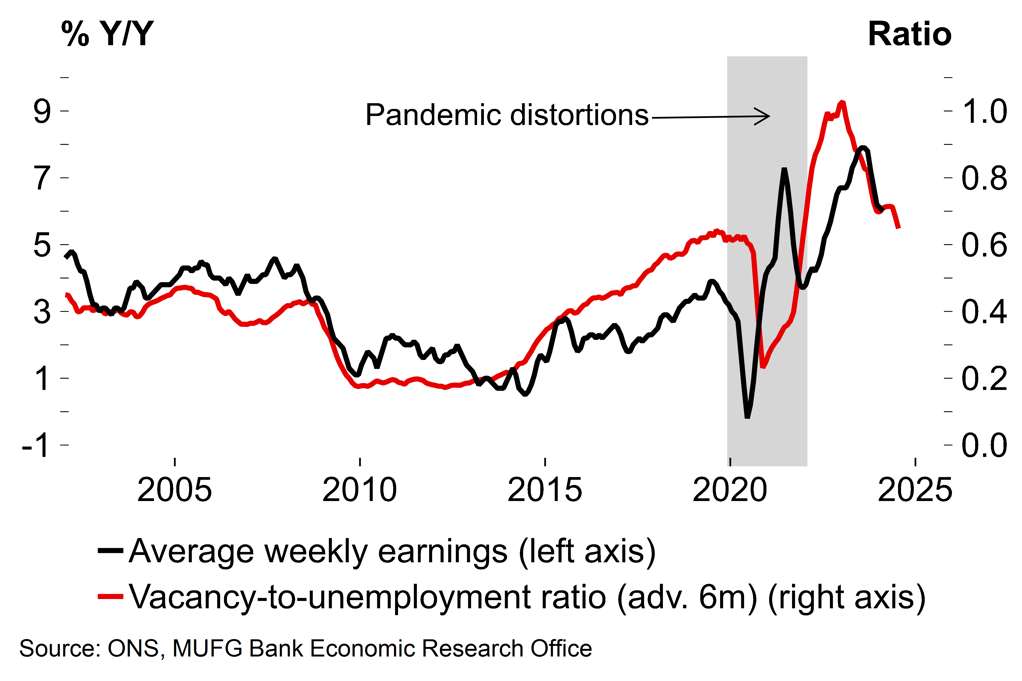

The BoE’s meeting next week (which comes with fresh forecasts and a press conference) is likely to result in no change in policy and only limited tweaks to the guidance. Since the last meeting, data releases have painted a mixed picture on the persistence of underlying inflation pressures. CPI and wage growth numbers have come in slightly above the BoE’s February projections. This comes in contrast with signs of a cooling labour market: the headline unemployment rate increased from 3.9% to 4.2% with employment falling sharply over the same period, by 156,000.

Against that background we suspect that the BoE is probably content with its current holding pattern. In aggregate, policymakers are likely to be somewhat confident that inflation is converging sustainably towards target – but will want to see more concrete evidence that key indicators at this point in the disinflation process (namely wage growth and services inflation) are cooling.

In terms of guidance, the BoE continued to lay foundations for an initial rate cut last time out. Most notably, it highlighted that policy would remain restrictive even if rates were reduced. It’s possible that there will be further shifts in communication next week to further tee up future rate cuts, but a lot of the groundwork has already been laid. The door is probably sufficiently open to easing already, and we suspect that policymakers will want to retain a degree of flexibility over timing. That means that a significant shift in guidance looks unlikely and the current data dependent approach is set to continue.

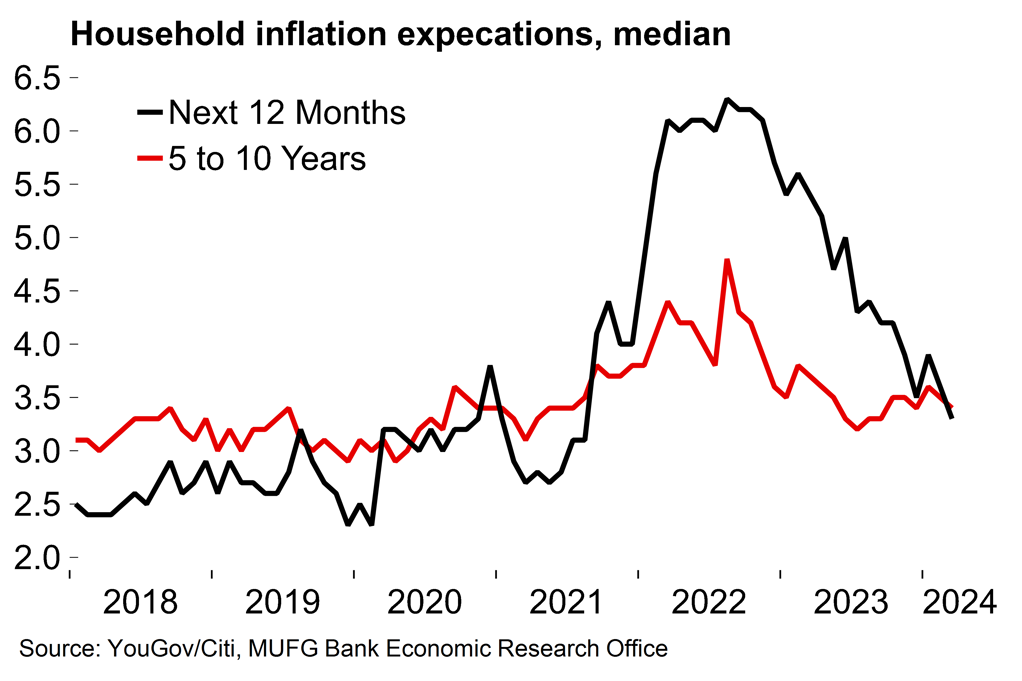

Chart 3: Inflation expectations remain well-anchored

Chart 4: Clear signs of labour market slack emerging

We noted after the March meeting that the MPC seemed less fragmented, with the previous three-way split in the vote shifting to 8-1 in favour of remaining on hold (see here). However, recent comments from officials suggest that not everyone is on the same page about how to proceed from here. Governor Bailey claimed that the BoE is “pretty much on track” and noted that the labour market seemed to be loosening. Deputy Governor Ramsden, who has previously had a hawkish tilt, said last month that he is more confident that “risks to persistence in domestic inflation pressures are receding”. However, Huw Pill, the BoE’s chief economist, stated a few days later that there is still a “reasonable way to go” before he is convinced that underlying inflation momentum has stabilised at rates consistent with the 2% target.

This sort of public division among internal MPC members is relatively uncommon. Our suspicion is that some of the more hawkish comments around persistence in underlying inflation pressures are designed to highlight that there are domestic reasons to hold off on rate cuts for now, as noted above – and that the BoE is not ‘Fed-dependent’ after the recent hawkish repricing of US rates expectations. So perhaps internal divisions are not as significant as it may seem. On the prospect of divergence, our view remains that the BoE would be comfortable with making the first step alone. After all, it did raise rates before the Fed at the start of this hiking cycle. We suspect that some members would be keen to make another statement of ‘Fed independence’ by easing first too – but some more progress on key inflation indicators is probably still needed to support that decision.

Some caution is understandable with nominal pay growth still uncomfortably high from a monetary policy perspective at around 6% Y/Y. The domestic growth environment has also improved since the turn of the year with Q1 GDP growth set to exceed the BoE’s February projection of 0.1% Q/Q (see below for our comment on next week’s release). However, to our minds, the slightly higher-than-expected numbers on inflation and pay should be kept in perspective: the longer-term trend of disinflation remains intact and wage growth is a lagging indicator. Household inflation expectations also remain well-anchored. Current market pricing is for around two rate cuts this year. We think there is scope for more if policymakers start the ball rolling in June or August as we currently expect.

Next week: The UK economy bounces back

After a busy week of euro area data, the focus turns to the UK economy. Q1 GDP data will be released on Friday. We’ve already seen the monthly estimates for January and February. As we noted here, these have made it clear that the UK recession in H2 2023 was mild and short-lived and, as is the case with the euro area, it is likely that the UK economy has turned a corner at the start of the year. We look for moderate growth in Q1 (0.3% Q/Q) and expect that sort of rate will be maintained over coming quarters as households’ real income situations continue to improve.

Key data releases and events (week commencing Monday 6 May)