- With the ECB poised to get the ball rolling with rate cuts next week, attention has shifted to the path for subsequent easing. Policymakers clearly signposted this June meeting for the initial move but will likely prefer more flexibility in the future. Against a benign macro backdrop, a gradual easing cycle looks appropriate. That could mean cuts at the quarterly projection meetings this year.

- With a focus on wage growth, productivity and profits we doubt the ECB will react to individual HICP prints, and will be happy to look past the uptick seen today in the May numbers given the distortion from transport subsidies in Germany. We continue to expect that the disinflation process will reassert itself over coming months.

ECB preview: Arriving at the well-signposted rate cut

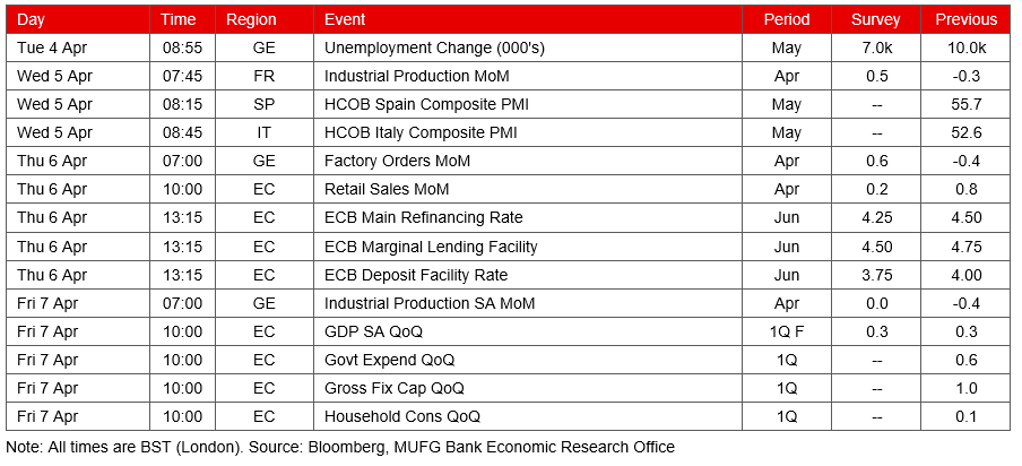

The ECB has all but pre-committed to an interest rate cut at next week’s meeting. Back in January, we highlighted that chief economist Philip Lane mentioned how key figures would available by the June policy meeting (see here). At the time, the mention of a specific month felt like a significant intervention – and indeed policymakers have proceeded to signpost the June meeting as the likely start of the easing cycle with increasing clarity.

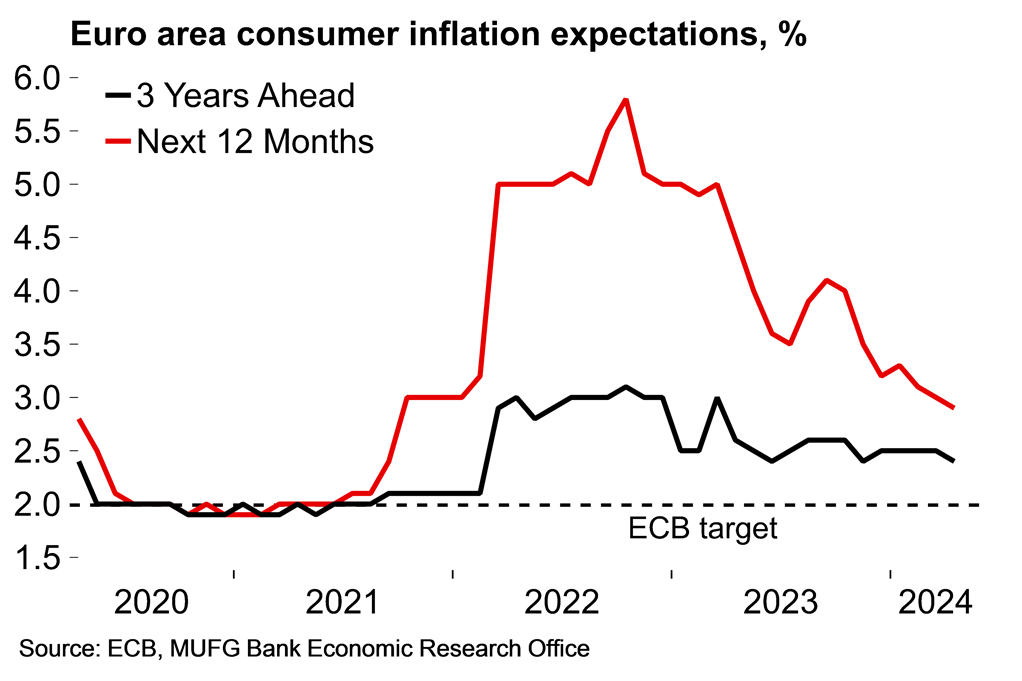

In fact, some of the “important data” mentioned by Lane wasn’t exactly good news on paper for the ECB. Negotiated wage growth increased from 4.5% to 4.7% Y/Y in Q1. But a quickly-released ECB blog ("Tracking euro area wages in exceptional times") emphasised that one-off factors (especially in the German public sector) have contributed to this stronger rise in the negotiated wage index. The ECB’s own ‘wage tracker’, which smooths one-off factors across a 12-month period, shows a much more supportive situation. Unfortunately this series, which is seemingly an important part of the ECB’s reaction function, has not yet been released to the public. But the message is clear: this small increase in headline negotiated wage growth will not derail the ECB’s June rate cut.

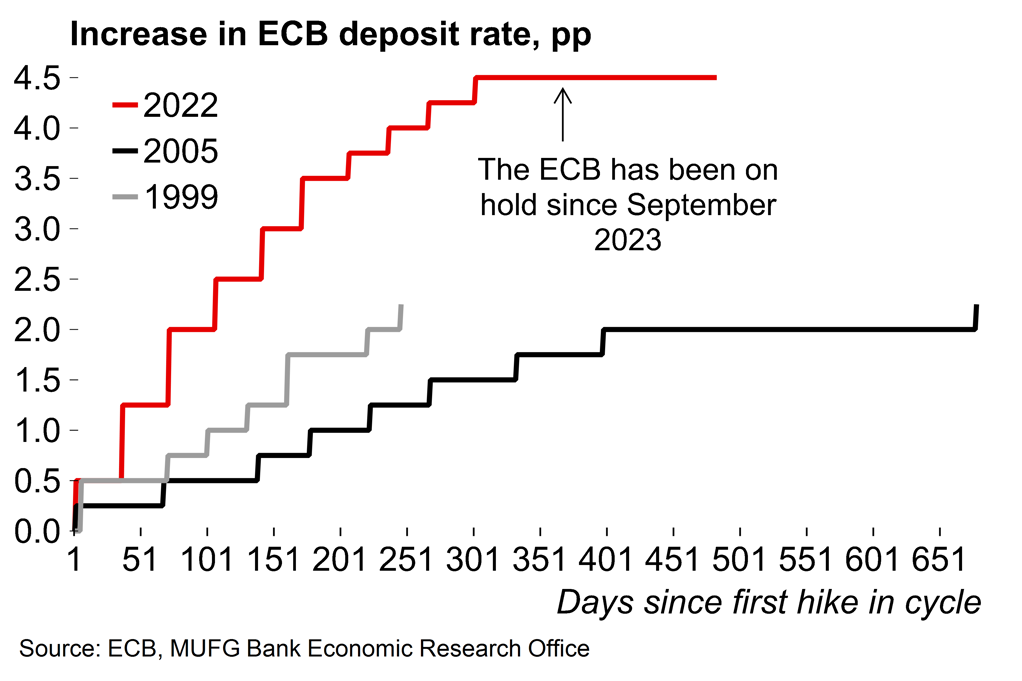

Policymakers will also be willing to look past today’s inflation figures. The headline rate surprised to the upside, accelerating from 2.4% in April to 2.6% in May. This was driven by the services component which increased to 4.1% on the back of base effects related to the introduction of subsidised public transport tickets in Germany last year. We see this as a temporary blip and we continue to expect the euro area disinflation process will reassert itself over coming months given signs of cooling price pressures in the services sector. This week the European Commission’s ESI survey showed that three-month price expectations in the services sector have eased every month this year, which follows the sizeable fall in the services PMI output price component last week. Meanwhile, forward-looking inflation expectations remain well-anchored. The ECB’s measure of household expectations fell further this week, for both the one- and three-year horizons.

Chart 1: The ECB has been on hold since September last year after a rapid tightening cycle

Chart 2: Household inflation expectations have continued to moderate

Caution and flexibility

So, June is all but a done deal. The debate has shifted to the speed of the easing cycle – which will be somewhat unusual for the ECB in that it is set to be conducted against a benign macro backdrop instead of a sharp downturn or crisis. Growth conditions at the start of the year have been stronger than expected, while euro area unemployment has fallen to 6.4% - and all-time low. Our view remains that, despite the better-than-expected Q1 growth of 0.3% Q/Q, it’s likely to be a case of moderate euro area growth rather than a spectacular expansion (see here).

Against that background we expect the ECB will want to gradually move to less restrictive levels. A back-to-back move with another cut in July looks unlikely given recent data and comments from policymakers, but we do think that the path will be clear for further easing after the summer.

More fundamentally, we don’t expect the ECB will react to individual HICP prints over coming months. Christine Lagarde previously stated that it will be three domestic factors – wage growth, profit margins, productivity growth – which are “decisive” in allowing the ECB to dial back its restrictive stance (see here). Crucially, the majority of the data on these is released quarterly. Earlier this month, Philip Lane also highlighted the importance of the ECB’s quarterly projection meetings (which fall in March, June, September, December), stating that the information provides “helpful guidance to the Governing Council”. As was the case with Lane’s specific mention of the June meeting earlier this year, this feels like a significant comment. While we expect the ECB will want to retain optionality around the path for easing through the rest of the year, a cut each quarter at the projection meetings still feels like a reasonable base case at this juncture.

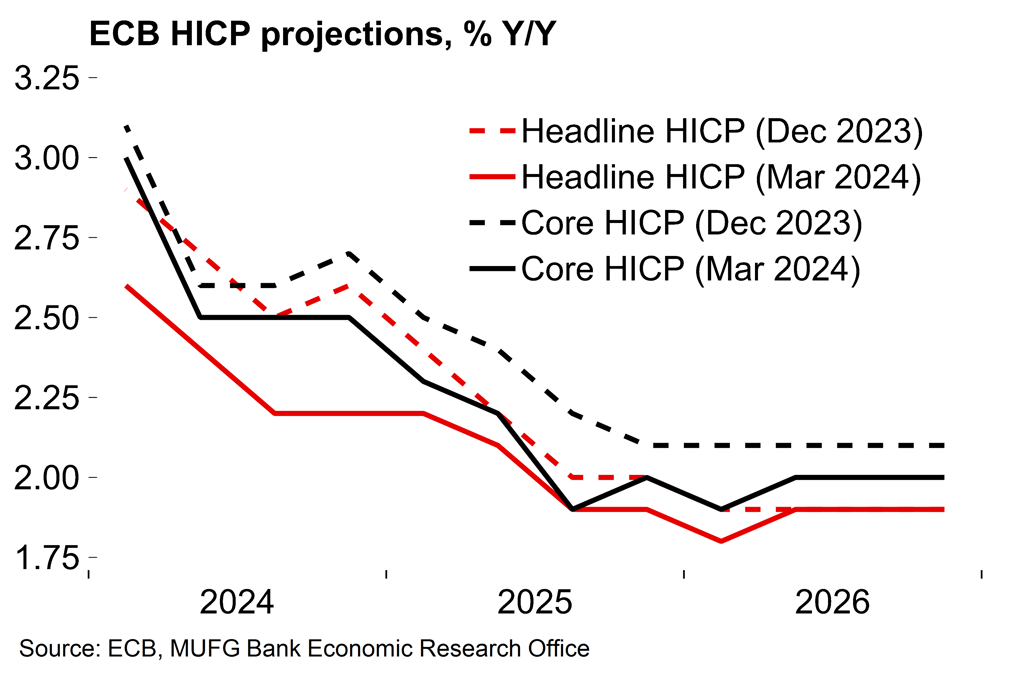

In terms of changes to the March projections, the 2024 inflation number (2.3%) could be increased on the back of higher energy costs, but we can’t see any reason to change the 2025-26 numbers. On growth, as mentioned above, the Q1 figures surprised to the upside, so an upward revision is also likely. We are now tracking the 2024 annual average at 0.7%, while the ECB previously had 0.6%.

Chart 3: Negotiated wage growth edged higher in Q1

Chart 4: The ECB revised its inflation projections lower in March. The near-term numbers may be increased in June

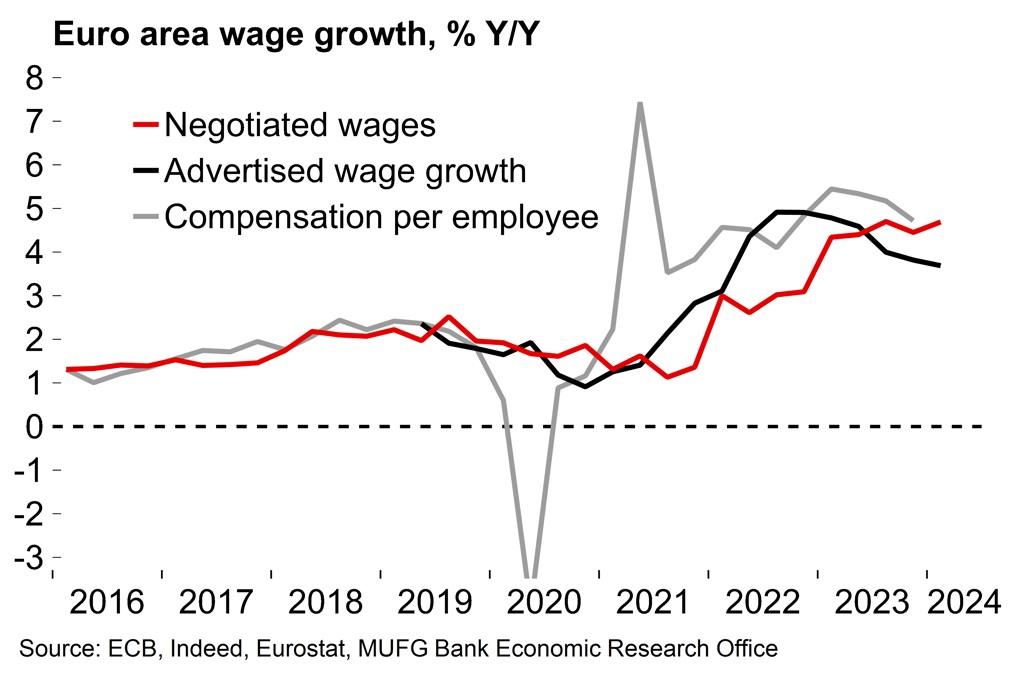

Next week: Looking for further signs of recovery in German industry

Aside from the ECB meeting it will be a fairly quiet week. On the data front, there will be some focus on industrial production figures after tentative signs at the start of the year that conditions are improving for the manufacturing sector. The first expenditure breakdown of Q1 GDP will also be released – already-available national releases point to improving household consumption but a drag from net trade.

Key data releases and events (week commencing Monday 31 May)