• The ECB seems to have signposted June for its initial rate cut which means that the focus at next week’s meeting will likely be on any clues about the path for subsequent easing. We suspect that the ECB will retain its preference for short-term guidance only. Given ongoing reasons for caution around underlying price pressures, policymakers may also be wary about sounding overly dovish. That could mean officials emphasise that, while easing is now approaching, rate cuts can be seen as a ‘recalibration’ and that the overall policy setting will remain restrictive. However, further ahead, the path should be clear for several cuts in H2.

• Euro area inflation came in a little below consensus in March, falling to 2.4%. However, steadfast services inflation – stuck at 4.0% for five months now – remains a concern. We expect better news ahead given signs that wage pressures may now be easing and question marks over firms’ pricing power. All told, we look for average euro area inflation of 2.2% in 2024.

• We expect that activity data next week will reinforce our view that the UK economy has turned a corner. Survey indicators have continued to suggest that the H2 2023 recession was mild and short-lived.

ECB preview – The final hold?

The ECB seems to have steered expectations towards June for the first rate cut. The mention of the specific June meeting has been repeated several times since Philip Lane, ECB chief economist, first highlighted that more data on wage growth will be available then back in January (see here). More recently, Christine Lagarde ended her speech at the ECB Watchers conference two weeks ago with a smile, repeating that the ECB will know “a lot more in June”. A 25bp rate cut at the meeting is now fully priced by market participants and there has been no attempt from officials to push back against this prevailing narrative.

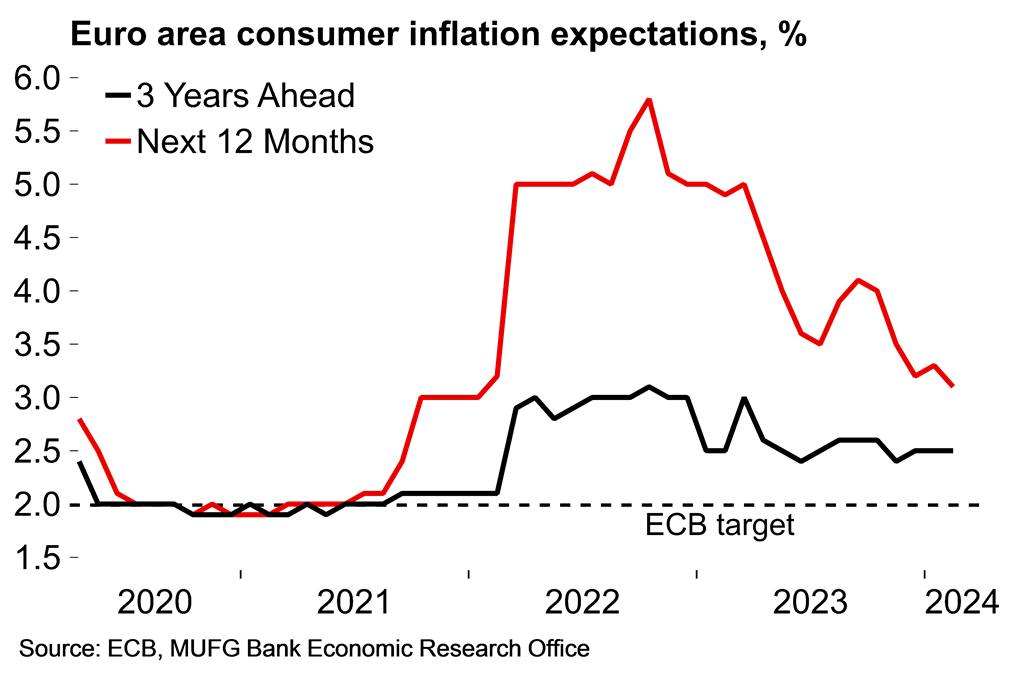

Next week’s policy meeting, just five weeks after the previous one, is therefore likely to be relatively low-key, with the current holding pattern set to be maintained for what looks like the final time. There have been no significant data shocks since the last outing – as we note below, headline euro area inflation, at 2.6% in Q1, has evolved as the ECB set out in its latest projections. Elsewhere, the further decline in consumer inflation expectations (Chart 1) was encouraging, but it is not a major surprise given the series’ recent trajectory. There have been no efforts from policymakers to suggest that this is a live policy meeting (only 2 bp of cuts are priced by market participants). Instead, we’re likely to see a bit more groundwork for a June cut. We expect that officials will underscore the intention to start cutting rates then with shifts in the statement language and perhaps some more explicit comments from Lagarde in the press conference.

The debate then moves on the subsequent path for rate cuts. Lagarde stressed that “even after the first rate cut, we cannot pre-commit to a particular rate path” in her ECB Watchers speech. We think the ECB will retain its preference for short-term guidance only. Policymakers may also be wary about sounding too dovish. That could mean officials emphasise that, while easing is now close, rate cuts can be seen as a ‘recalibration’ and that the overall policy setting will remain restrictive.

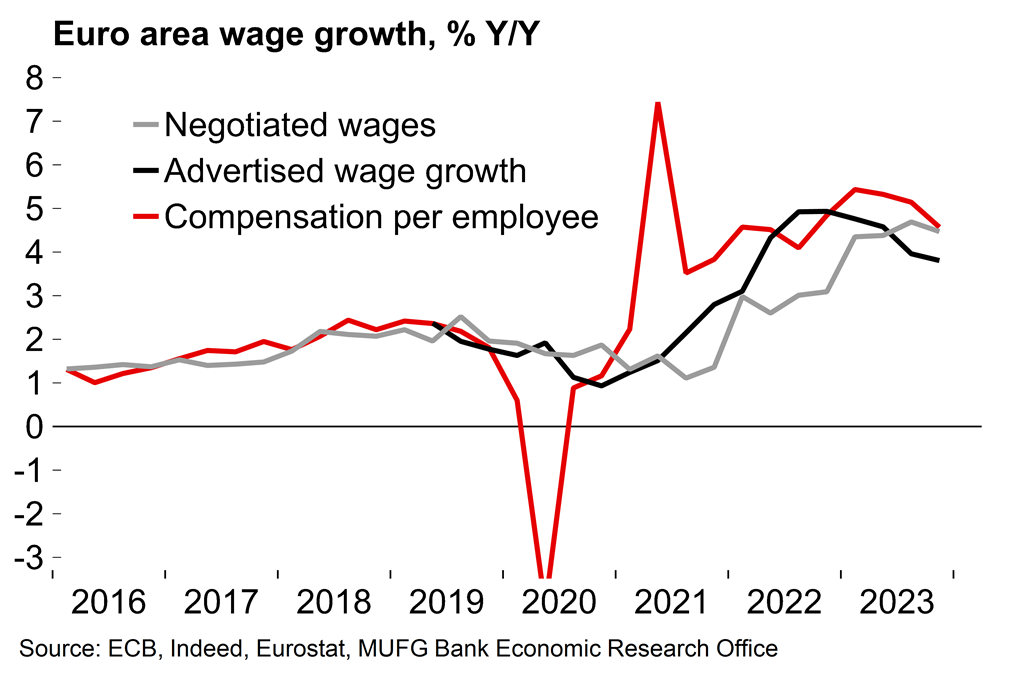

There are still valid reasons for caution, not least the persistence of services inflation (see below) and still-elevated wage growth (Chart 2). The minutes of the March meeting noted the importance of being “further along in the disinflation process” and accumulating “additional evidence for the Governing Council to be sufficiently confident that inflation was set to return to target in a timely and sustainable manner”. Despite lags in the figures there’s no obvious reason to depart from the data-dependent footing just yet.

Further ahead, we continue to expect 100bp of ECB easing in 2024 as a whole. At the March meeting Lagarde noted that market expectations for rate cuts seemed to be “converging better” with the ECB’s view. At the time, around 90bp of easing was priced in, which remains the case now. Four cuts this year, starting in June, would mean pausing the easing cycle at one meeting. To our minds, July seems the most likely candidate. Later in H2 there should be more concrete evidence that domestic underlying inflation pressures are easing, and the start of monetary easing elsewhere would relieve concerns about any increase in inflationary pressures from euro weakness. However, as officials have repeatedly said, there will be a lot more information available by the June meeting. If the upcoming data on wage growth highlighted by the ECB were to significantly surprise on the downside that could open the door to a back-to-back move in July given the long wait otherwise over the summer break before the September policy meeting.

Chart 1: Inflation expectations have continued to ease

Chart 2: Nominal wage growth may have peaked

Steadfast services inflation remains a concern

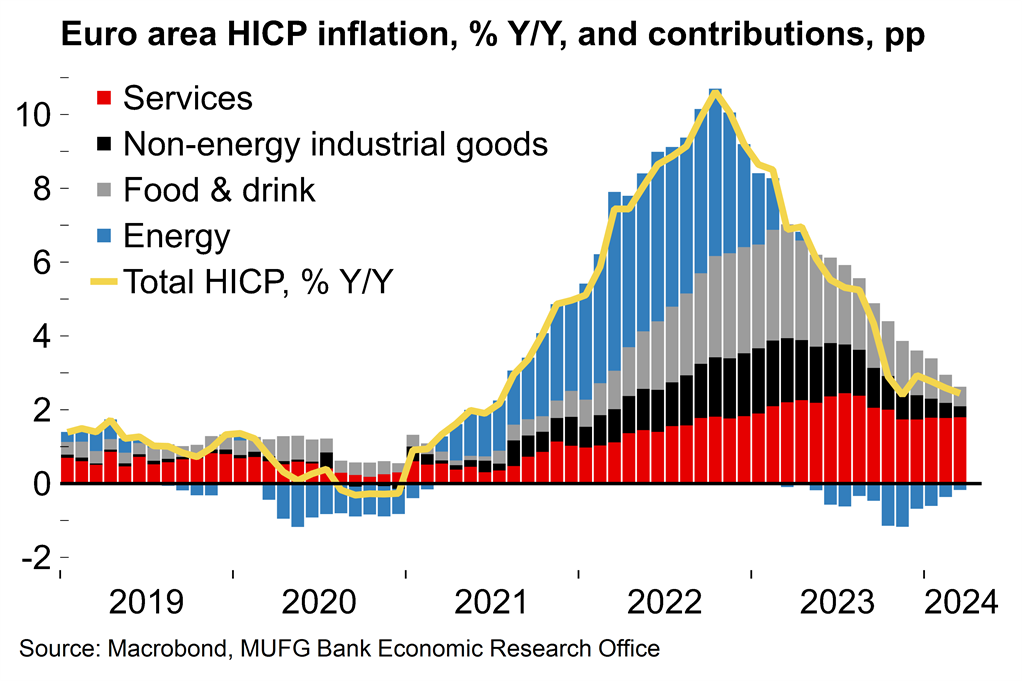

The initial estimate of euro area HICP inflation surprised slightly on the downside in March with the headline rate falling to 2.4%, from 2.6% in February. This puts the average Q1 rate at 2.6% – in line with the ECB’s latest batch of projections. By component, energy is still subtracting from the headline rate. Global food prices have fallen steadily since the peak recorded in 2022 and that is also now evident up in the euro area inflation data (unprocessed food: -0.4% Y/Y).

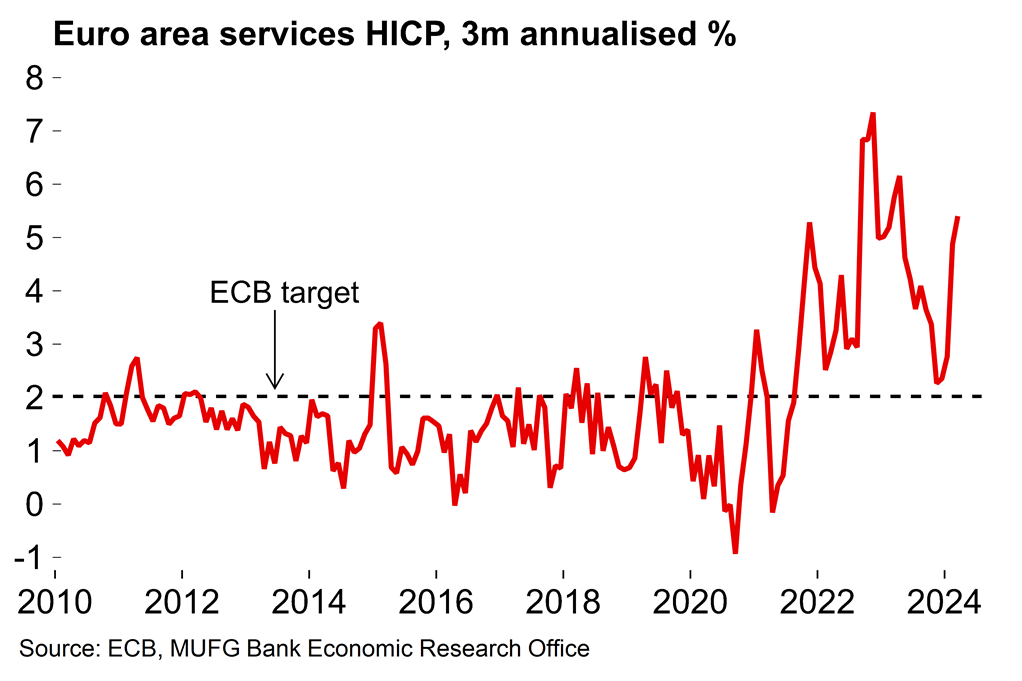

In terms of core price pressures, the good news is that non-energy industrial goods inflation continues to ease (now 1.1% Y/Y). More concerning is the ongoing stickiness of services inflation, which has steadfastly remained at exactly 4.0% Y/Y for five straight months now. The component contributed 1.8pp to the headline rate of 2.4% in March. On a three-month annualised basis, the rate rose again suggesting ongoing momentum in the services component, which is likely to be in part related to the early timing of Easter this year. That said, the suggestion from national data is that there was perhaps less of a boost from Easter-related tourism price increases than feared (we won’t know precisely until the full HICP release on 17 April). Nonetheless, the average rate of core inflation in Q1 (3.1%) still came in slightly above the ECB forecast (3.0%).

Our broader view is that, after some distortions around the turn of the year, these latest figures show that disinflation process remains on track. While progress may be slow, services inflation should soon move below its current floor of 4%. A large share of services costs relates to labour, and a range of estimates indicates that the peak may now have been passed for nominal wage growth (e.g. Chart 2, above). Meanwhile, recent weakness in the German retail sales figures (-1.9% M/M in February, on the back of another contraction the previous month) suggests that firms’ pricing power may be becoming more limited. Overall, we see the headline HICP rate moving back towards the ECB’s target in Q3, before moving up slightly higher by year-end as the drag from the energy component fades (oil prices have risen above 90 USD/bbl this week amid rising concerns that Middle East tensions could evolve into a broader regional conflict). We expect an annual average headline rate of euro area inflation of 2.2% across 2024 as a whole.

Chart 3: The overall disinflation process is back on track

Chart 4: Increased momentum in services inflation

Next week – Has the UK economy turned a corner?

The monthly series of UK GDP showed 0.2% M/M growth in January – a good start to the year but it should always be stressed that the monthly numbers are volatile and prone to revision. That means that the February data, released next week, will give a clearer indication of whether the UK economy has turned a corner after the technical recession recorded in H2 2023. Our view remains that the downturn will be mild and short-lived. While there have been some signs of moderation in a few key surveys recently (the composite PMI edged lower in April), the overall picture from the soft data remains markedly stronger than it did in Q4 last year and is consistent with a return to growth at the start of 2024. Across Q1 as a whole we are tracking GDP growth at 0.2% Q/Q.

Next week will also see the release of German industrial production for February. Data on the manufacturing sector has been mixed with better news in the Ifo survey contrasting with a weaker figure in the latest PMI.

Key data releases and events (week commencing Monday 8 April)