- Euro area inflation increased by 0.5pp in December. This was largely due to base effects related to German government support measures in 2022. More encouragingly, the core measure continued to fall. Our view is that the uptick in headline inflation will be short-lived and the underlying trend of disinflation will continue.

- The latest PMI figures suggest slightly stronger momentum into 2024 but the immediate outlook remains tough with the euro area on the verge of a technical recession. The picture for the UK looks slightly better, though a mild recession remains very plausible. After a challenging start to the year we expect activity in both economies will pick up as households’ real purchasing power continues to recover and central banks shift into easing mode.

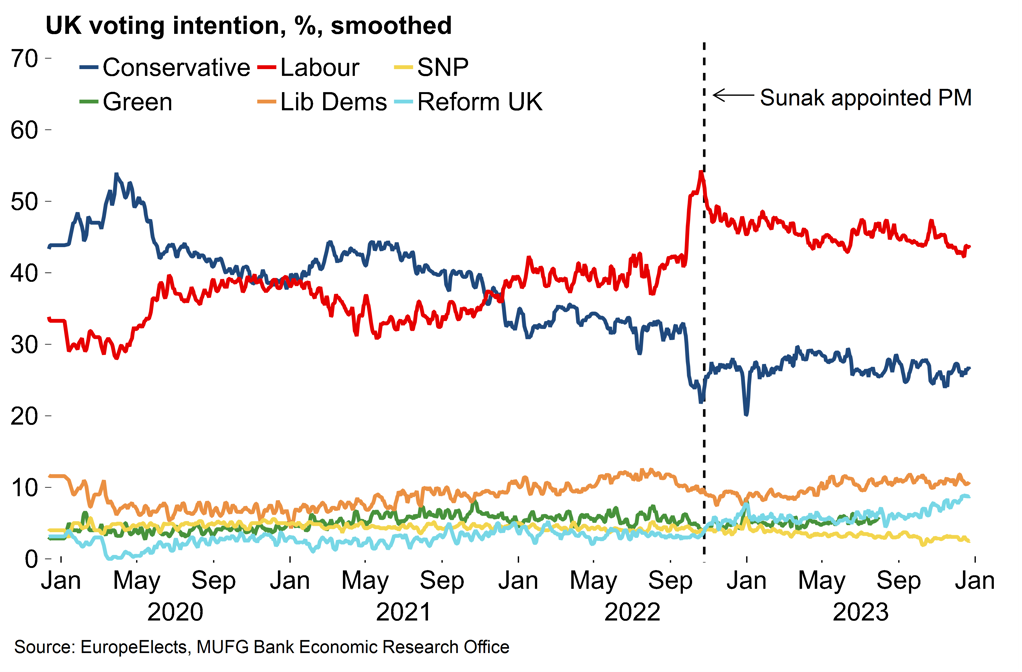

- UK PM Sunak has said that the next UK general election will be “in the second half of the year”, ending speculation about a spring vote. Sunak has struggled to improve his party’s standing in the polls and, as it stands, a Labour-led government remains the most likely outcome after the election.

A pick-up in euro area inflation – but it's likely to be short-lived

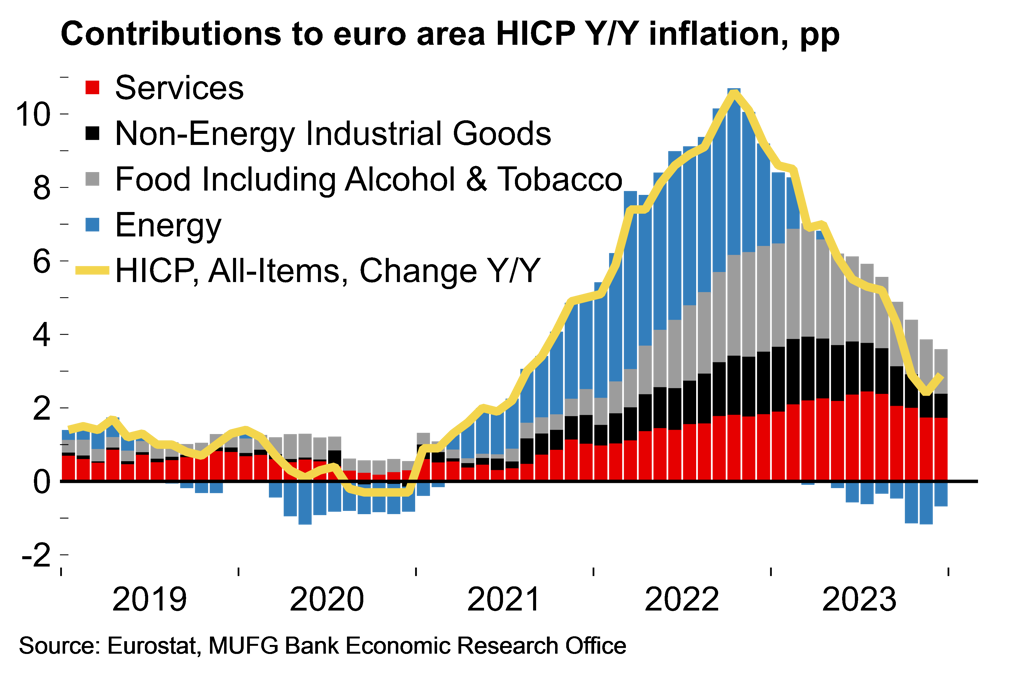

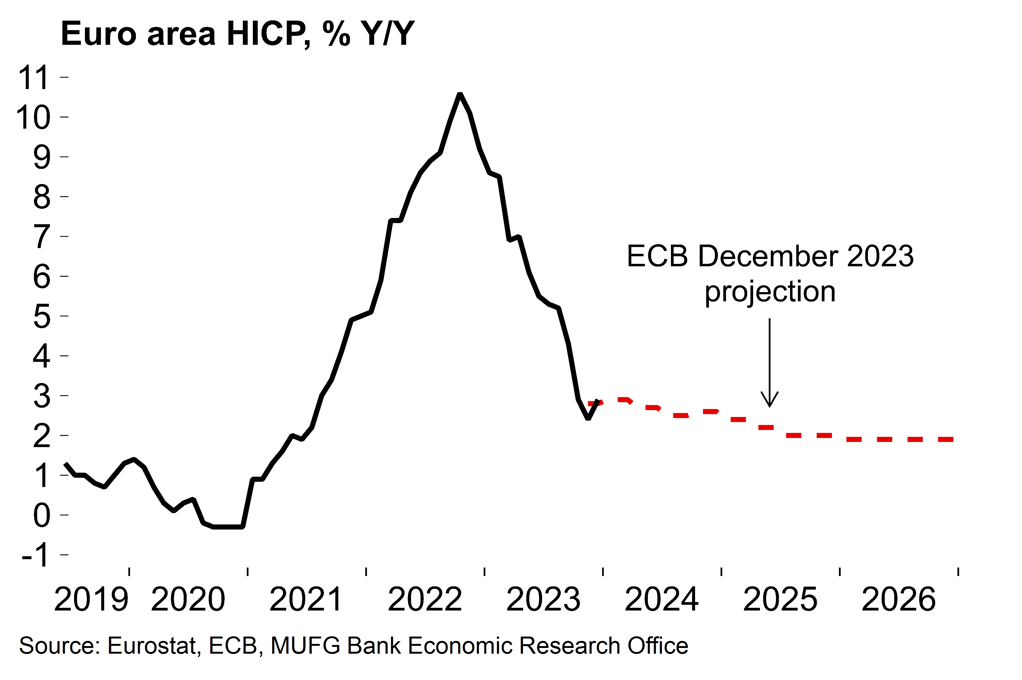

Euro area inflation picked up from 2.4% in November to 2.9% in December (Chart 1). This was largely due to base effects related to German government support for household energy bills in late 2022. German headline inflation rose to 3.8% (from 2.3% in November). The ECB had flagged the risk that inflation could “pick up again temporarily in the near term” due to these energy base effects and indeed the headline December HICP figure is in line with the ECB’s latest projections (Chart 2).

Chart 1: Euro area inflation ticked up in December

Chart 2: The Q4 average was in line with ECB projections

However, the ECB’s projections point to another, modest pick-up in the quarterly figures for Q1 2024. While the December figure served as a reminder that the disinflation process could be bumpy, this seems unlikely to our minds – we think the uptick in inflation will be short-lived. Energy base effects will be less relevant in 2024 and the trend in underlying inflation remains encouraging. Core inflation (ex. food and energy) continued to ease, edging lower to 3.9%. Against the backdrop of a weak euro area economy (see below), we expect the overall disinflation trend will remain in place. All told, it seems likely that the ECB will revise its inflation projections lower in the March update, which could help to tee up rate cuts in subsequent meetings.

The immediate growth outlook remains challenging

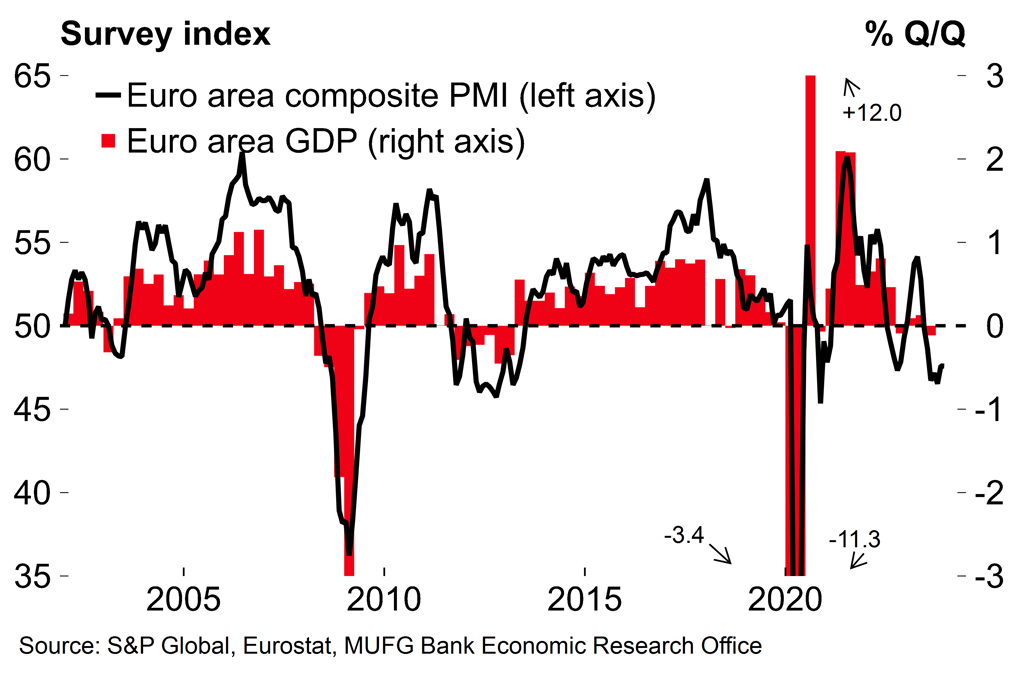

The final euro area composite PMI figure for December (47.6) remained unchanged at the November level after an improvement on the flash estimate. The PMI has not been stronger since July and the evidence from business surveys now points to a degree of improvement in cyclical momentum with signs in the sub-indices that firms are now expecting better conditions ahead. To be clear, this is still a weak headline number which is consistent with another contraction in Q4 2023 after GDP growth of -0.1% Q/Q in Q3 (Chart 3). That would see the euro area economy in a technical recession, albeit a mild one.

However, we continue to expect an improvement in growth through 2024 towards potential rates on a quarterly basis with the main driver being the improvement in households’ real purchasing power as the disinflation process continues. ECB rate cuts should also support activity and confidence and the shift in expectations towards an earlier pivot may already be supporting forward-looking business survey components. Overall, we look for annual average euro area growth of 0.7% in 2024 which is slightly above consensus.

Chart 3: The euro area PMI has improved slightly but remains consistent with another GDP contraction in Q4

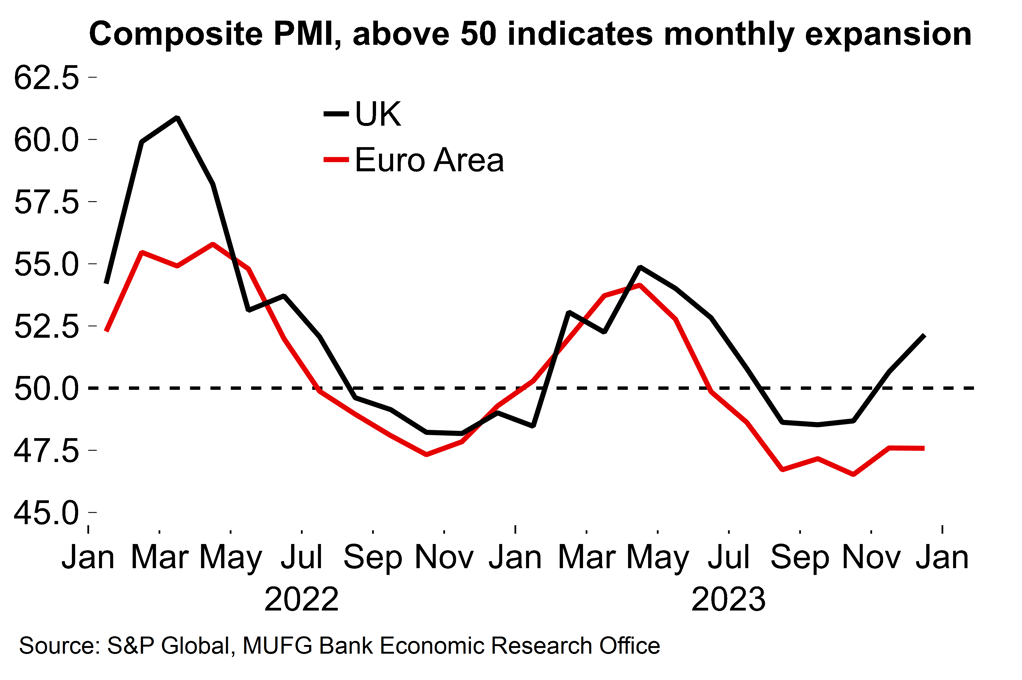

Chart 4: There are signs that the UK economy has carried more momentum into 2024

Meanwhile, there is now clear divergence between the UK and the euro area PMI figures (Chart 4). The UK composite PMI (also revised up) stood at 52.1 in December, up from 50.7 in November and comfortably in expansionary territory. This improvement in the UK index was driven by the services sector with manufacturing still markedly weaker (46.2 in December). Overall it is good news and points to improving momentum around the turn of the year.

The UK economy contracted in Q3 (-0.1% Q/Q) and the monthly output estimate for October (-0.3% M/M) means that a technical recession clearly can’t be ruled out. Our base case is flat growth across Q4 2023 and then a gradual improvement in quarterly growth figures through this year. As with the euro area, we are slightly above consensus on UK growth this year (0.6%) with better news for household real incomes similarly supporting overall activity.

The UK election will be in H2 2024

UK PM Sunak has suggested that the general election will be “in the second half of the year”, ending speculation about a spring vote after some tax cuts were announced in late 2023. The governing Conservative party have trailed behind opposition Labour in the polls since the end of 2021. Sunak will hope that by waiting he can turn things around during the year as easing inflation pressures support a recovery in real household disposable incomes. Further tax cuts may come at the Spring Budget (6 March) with increased scope for fiscal easing now following the shift in market expectations towards an earlier BoE pivot. However, our view is that the UK economy will continue to struggle in 2024. As noted above, we expect activity will pick up somewhat but growth rates are likely to remain muted. Meanwhile, there’s been little sign of any shift in voter preferences, and local and special election results last year were broadly consistent with the national polling trends.

Chart 5: Labour’s polling lead has held steady for over a year

So our base case at this stage is a Labour government after the next election. Indeed, as it stands, the wide gulf in the polls means that there is less uncertainty around the upcoming UK election than has been the case in recent votes.

Policy risk around the election also seems relatively low. Keir Starmer, the Labour leader, and Rachel Reeves, his shadow chancellor, have repeatedly emphasised that Labour would follow a pro-business approach and err on the side of caution when it comes to public finances. ‘Market unfriendly’ policies (of the sort proposed by some previous Labour leaders or actually implemented in the Liz Truss government’s ill-fated ‘mini Budget’) seem unlikely following this election. All told, it does not seem to be a significant risk event.

Indeed, taking a wider view, the UK economy would benefit from the period of relative calm and stability that a new government with a sizeable majority would bring after the Brexit years and five prime ministers in eight years.

The week ahead – euro area industry, UK GDP & jobs in focus

Next week, national industrial production data and German factory orders will provide a gauge of the strength of the euro area manufacturing sector in November. Weak figures would harden expectations for a euro area recession in Q4 after the Q3 contraction. There will also be a first look at sentiment in 2024 with the Sentix index for January.

In the UK, monthly output figures for November will also guide expectations for activity across Q4 as a whole. GDP contracted by 0.3% M/M in October and, despite better news on the survey front, the UK economy is also teetering close to a technical recession after Q3 GDP was revised into negative territory. There will also be the release of the REC/KPMG jobs report which has increased in salience following concerns about the quality of official ONS labour market data. The BoE has referenced the REC/KPMG in recent monetary policy reports and clear signs of easing labour market conditions would harden expectations for an earlier BoE pivot.

Key data releases and events (week commencing Monday 8 January)