- The macro backdrop makes it a simple enough decision for the ECB to go ahead with another rate cut at next week’s meeting. Policymakers are likely to retain flexibility around the timing of future easing. We expect a gradual rate cut cycle with restrictiveness “dialled back” at a quarterly pace. Major revisions to the ECB’s inflation projections are not likely.

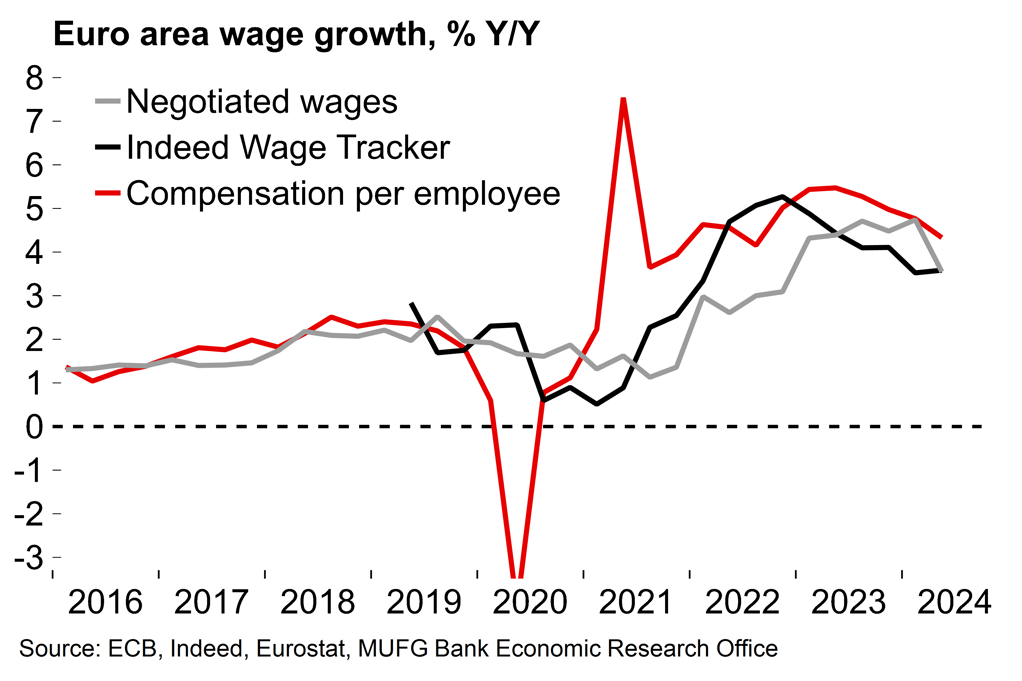

- More bad news for industry has raised the risk of a technical recession in Germany with the economy continuing to act as a brake on overall euro area activity. A perfect storm of challenging cyclical and structural conditions makes it hard to see much scope for any imminent turnaround in fortunes. We have revised our GDP forecasts lower (now 0.0% in 2024, 0.9% in 2025).

- France finally has a new prime minister but it remains to be seen whether Michel Barnier, as experienced as he is, can navigate the highly fragmented parliament to survive a no confidence vote and then pass a Budget before October. Le Pen’s RN party look set to act as kingmakers and any arrangement is likely to be fragile, leaving French political risk elevated.

ECB preview: Dialling back, gradually

After making the first move back in June the ECB is set to return from the summer break with another rate cut. The messaging since June has emphasised that the approach will remain “meeting-by-meeting” and “data dependent” going forward – and news over the summer has broadly moved to strengthen the case for further easing.

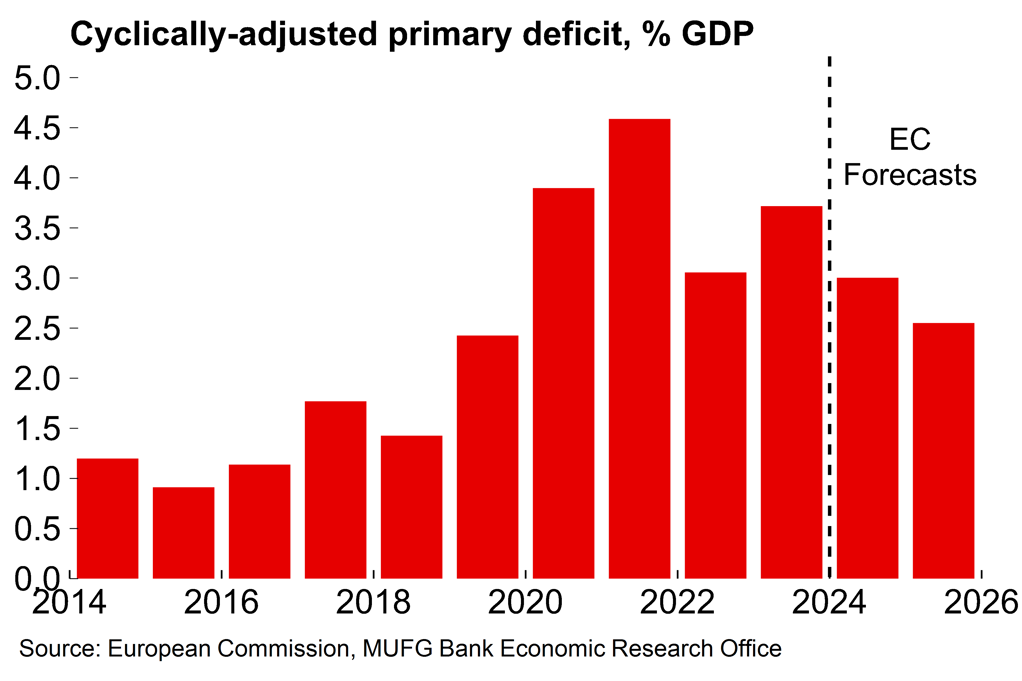

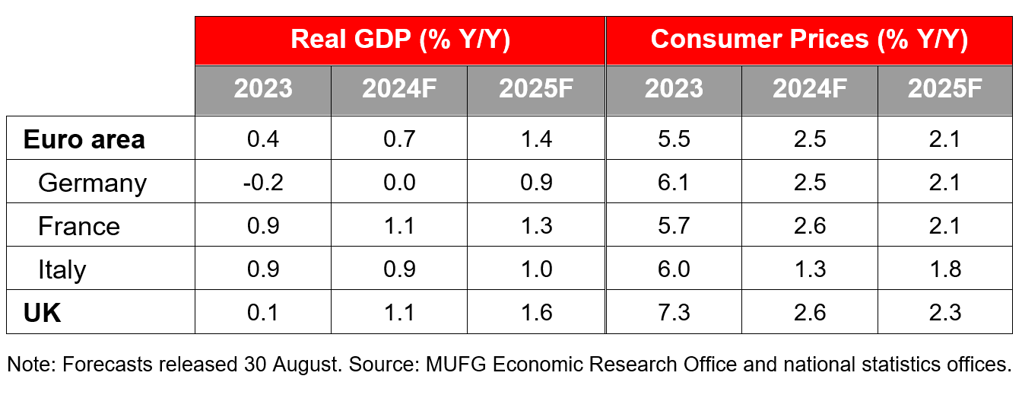

Policymakers are likely to be more reassured that pay growth will return to levels consistent with the inflation target. Growth in negotiated wages slowed sharply from 4.7% in Q1 to 3.6% in Q2, and data today showed that compensation per employee, a broader measure of pay pressures, slowed from 4.8% to 4.3% over the same period. Meanwhile, headline inflation fell to 2.2% in August (from 2.6%) and the core measure also edged lower, to 2.8%. The services component picked up from 4.0% to 4.2% but that may well be a temporary effect linked to the Olympic games.

In terms of growth, the first estimate of euro area GDP in Q2 was revised lower today to 0.2% Q/Q, and survey data over the summer does not suggest there will be a rapid acceleration from there. Our base case remains one of a ‘middling’ recovery for the euro area as a whole, with Germany acting as a brake on overall activity.

Overall, the macro backdrop makes it simple enough for policymakers to continue the gradual easing cycle and a 25bp rate cut to 3.5% is fully priced in by market participants. Significant changes to the messaging seem unlikely so it’s set to be a relatively low-key meeting despite the probable change in policy setting. The June cut may have been well-telegraphed in advance but policymakers have been clear that there is no intention to set out any specific easing schedule – and there’s no obvious reason to shift from this current, flexible stance. Policymakers are also likely to emphasise that policy will remain restrictive even as the “dialling back phase” of the cycle continues.

Chart 1: Wage pressures have cooled

Chart 2: Headline inflation is close to target

Our base case is for cuts to continue at a quarterly pace into 2025, with projection meetings remaining the obvious point to do so. Despite soft survey data and some recent bad news out of Germany (see below) it looks likely that the easing cycle will be conducted against a fairly benign macro backdrop, at least for the for the euro area as a whole, given improving consumer conditions. On prices, nominal wage growth is still somewhat elevated improving data so it’s likely to be some time until ‘all clear’ can be declared on the persistence of underlying inflation pressures. It’s also worth noting that the ECB was fairly slow to start raising rates relative to other major central banks and has built in less in the way of ‘hawkish insurance’ so there is not a strong case to front-load rate cuts.

So in the absence of a sharp downturn or crisis, the ECB is unlikely to be in a rush to move to less restrictive levels. What exactly is a restrictive setting will become increasingly relevant as rates move closer towards upper estimates of neutral. Back in January, ECB research (here) showed recent estimates of r*, the real interest rate consistent with stable inflation and the economy operating a full capacity over the medium term. These ranged between -0.75% and +0.5% (excluding the more volatile DSGE estimate of around 1.0%), so 1.25% to 2.5% in nominal terms. A quarterly pace of rate cuts would take the deposit rate to 2.75% in June next year – absent a crisis it may be hard for policymakers to find a consensus to move much beyond that.

Lastly, we expect that the ECB’s updated GDP projections will be revised lower from the June figures of 0.9% in 2024 and 1.4% in 2025 (we have 0.7% and 1.3%). We don’t foresee major changes to the inflation outlook with better news on headline offset by slightly higher degree of persistence in the core component.

More bad news for German industry raises the risk of recession

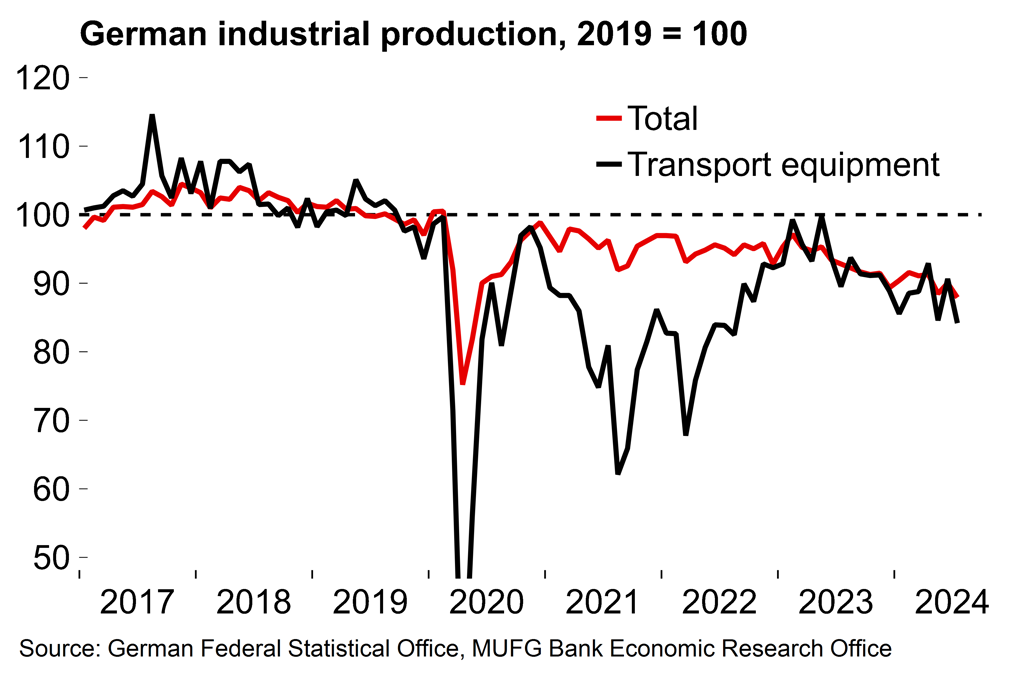

German industrial production fell by 2.4% M/M in July (-5.3% Y/Y). There was a broad-based decline across most areas of manufacturing with the plunge in automotive productive (-8.1% M/M) especially pronounced.

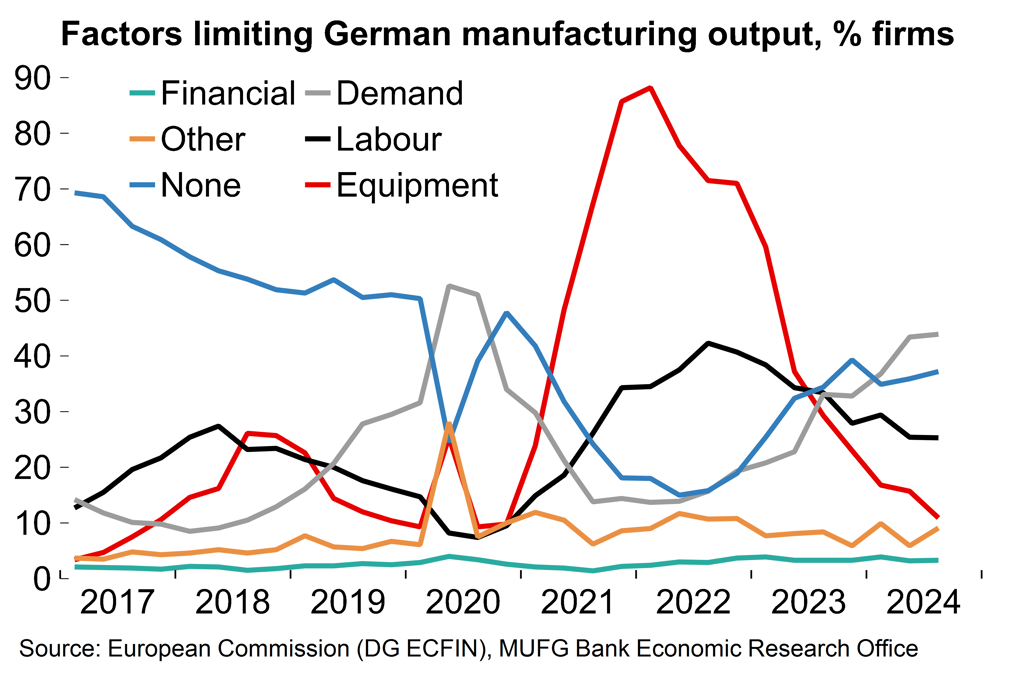

It's clear that the export-focused German manufacturing sector is facing a perfect storm of cyclical and structural headwinds. At the start of the year we said it was hard to make the case for a meaningful turnaround in the absence of a global upswing (see here). Since then external conditions have shifted in the wrong direction. The world manufacturing PMI (ex. euro area) has weakened notably in recent months and is now close to the breakeven mark. A fast turnaround is not our base case – in our latest global outlook (see summary here) we highlight our expectations for slower growth ahead in both China and the US. There could be some relief if the US election does not result in higher tariffs on European goods, but uncertainty related to the war in Ukraine is set to remain a medium-term drag on the German industrial sector.

Meanwhile, longer-term structural issues for German industry include increased competition for auto exports, relatively higher energy costs and a lack of skilled workers. The country is also lagging behind on digitalisation, and infrastructure problems are emerging after years of tight fiscal policy. The fragmented political landscape poses challenges to policymakers looking to develop a coherent response.

In terms of the overall growth outlook, the weak start to Q3 for manufacturing (which accounts for ~20% of total value added) has raised the risk of the German economy slipping into a technical recession after a small GDP contraction in Q2 (-0.1% Q/Q). The near-term picture remains challenging with survey data over the summer showing no sign of any imminent turnaround in fortunes. We have revised our GDP forecasts lower and now see flat annual average growth (0.0%) in 2024 and then a slow recovery to 0.9% in 2025. That would be below potential but any sustained, positive growth would still be better news after the economy has essentially drifted sideways since the pandemic.

Our base case is that growth will be supported by better consumer dynamics following a recovery in real wages, but risks are tilted to the downside. One area of particular concern is the labour market. After pandemic-related distortions faded, the unemployment rate has risen slowly to 6% (from an average of 5% in 2019). This is not a terrible outcome given the challenging macro backdrop. The trend for firms to ‘hoard’ employees due to difficulties in hiring appropriately skilled workers (in the hope that production can then be ramped up more quickly when economic conditions improve) has likely had a cushioning effect. The risk is that an extended period of stagnation might convince more and more firms to push ahead with costly redundancies, which would exacerbate the malaise facing the economy as a whole.

Chart 3: Still no sign of any reversal in fortunes for the beleaguered German industrial sector

Chart 4: Weak demand and hiring difficulties continue to weigh on production

Too soon to declare an end to the political impasse in France

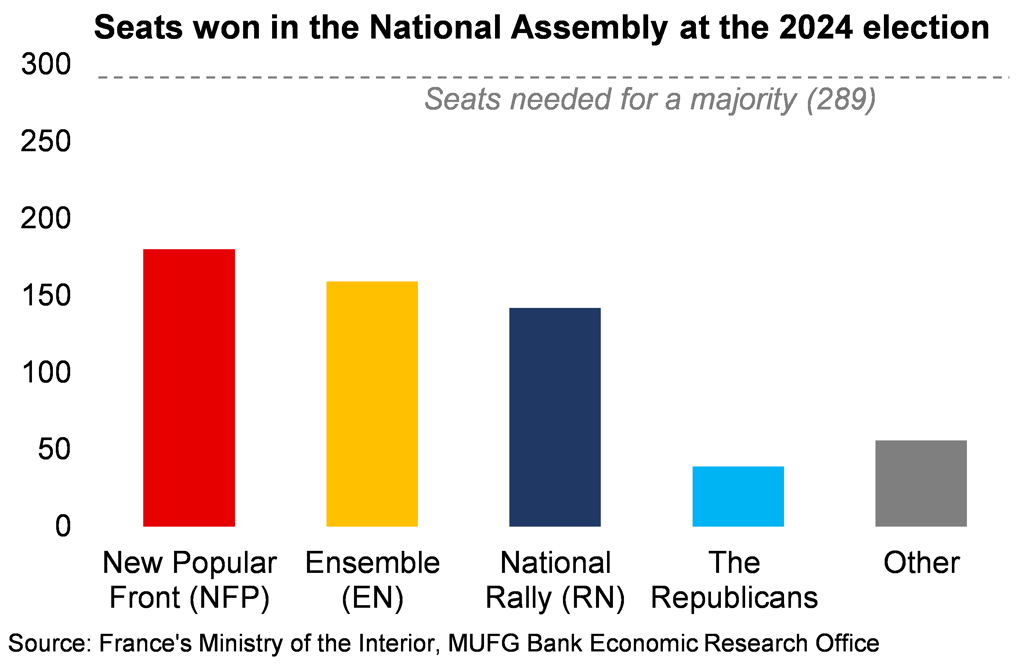

Almost two months after the 7 July parliamentary elections President Macron has moved to end the political gridlock in France with the appointment of veteran politician Michel Barnier as prime minister. Barnier, a centrist in the Républicains party, is an experienced and pragmatic operator. He also has a strong international profile after his role as the EU’s chief Brexit negotiator. The hope is that he will be a calm hand at the tiller in an extremely fragmented National Assembly (which does not vote on the appointment).

It’s still too early to say that the impasse is over. Barnier’s first task will be to form a cross-party government which can survive any vote of no confidence. As the Left looks set to oppose Barnier, this will require the support of Marine Le Pen’s hard-right RN party. The message from RN so far is that it will reserve judgement, with Barnier’s first policy speech (no date yet) likely to be key. Bardella, the RN president, said that issues around “the cost of living, security [and] immigration” need to be addressed. Some compromises on these topics are plausible – when Barnier ran to be candidate in the 2022 presidential election he took a harder line on immigration than many expected.

On paper Barnier looks a reasonable choice but the parliamentary arithmetic means that any arrangement would inevitably be a fragile one. There’s no guarantee of lasting RN support, if it is indeed achieved. Le Pen would hold kingmaker status and will likely be able to topple a Barnier-led government at any point in the absence of support from the Left. RN will likely look to use this leverage to extract concessions – perhaps in the way of electoral reform – which may not be palatable to centrists.

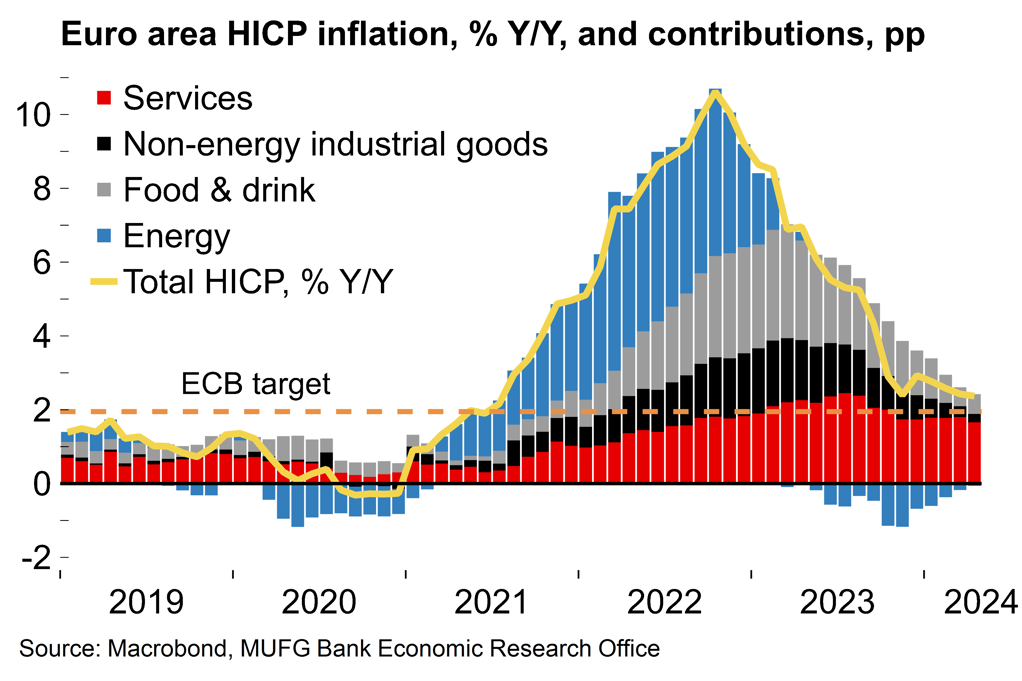

If Barnier does manage to navigate any no confidence vote his immediate priority will be to pass the 2025 budget, which could further raise tensions. The draft is required by 1 October under French law, before the EU deadline of 15 October. The deficit stood at 5.5% of GDP in 2023 and fiscal consolidation is required. At a minimum this could mean rolling over the previous budget with spending caps left unadjusted for inflation, but more painful measures would likely be required to put France credibly on course to meet the EU’s 3% deficit target.

In terms of the macro backdrop, the French economy is set to have received a temporary Olympic boost in Q3 (perhaps to the tune of around 0.3pp to Q/Q growth) but some payback in Q4 is then likely. Distortions aside, the underlying picture is not especially alarming – we are tracking growth at 1.1% this year and 1.3% in 2025 (see here) as consumer conditions improve – but political uncertainty is set to remain a drag on activity due to the difficult parliamentary mix. Risks around the next presidential election (scheduled for 2027) will also remain in focus given RN’s current status as the major player in French politics.

Chart 5: Barnier will need to cobble together support in a highly fragmented parliament

Chart 6: Will a fragile coalition be able to deliver any meaningful fiscal consolidation?