- The 90-day tariff ‘pause’ by the US administration is clearly far from a stable equilibrium. Risks around tariffs from here still look two-sided around the original ‘reciprocal’ rate of 20% for the EU. For the purposes of our macro forecasts, our central scenario is that 20% US tariffs on EU goods will be reinstated by Q3.

- We estimate that the direct effect of tariffs on euro area GDP will be around -0.4% over the short-term through lower US import demand. This will be magnified by various factors, including a sizeable confidence shock amid heightened uncertainty and weaker external demand conditions.

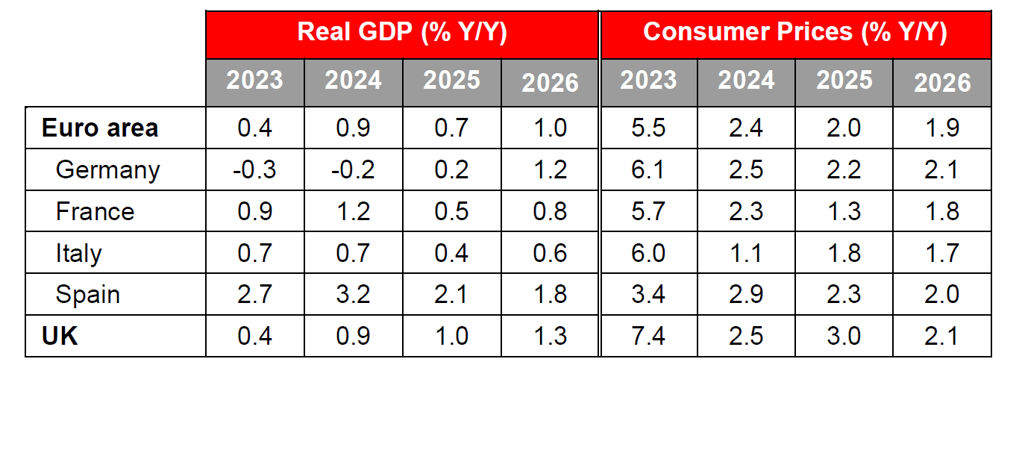

- Overall, we see a total short-term effect from tariffs and related uncertainty on euro area GDP of around -0.6%. Relative to our pre-Liberation Day forecast we have reduced our growth forecast from 0.9 to 0.7% in 2025 and from 1.4 to 1.0% in 2026.

- Policymakers have various levers to pull in the case of escalation. We assume that new German spending will now be more front-loaded than initially planned. In an escalation scenario, the EU could redirect tariff revenues to the most-affected sectors, while governments could dust off pandemic-era job retention schemes for certain industries if second-round labour market effects were to emerge.

- From a monetary policy perspective, the ECB’s earlier concerns around the inflationary consequences of retaliation and a weaker EUR have not yet materialised. The EU is treading carefully with countermeasures and the EUR has appreciated notably on a trade-weighted basis.

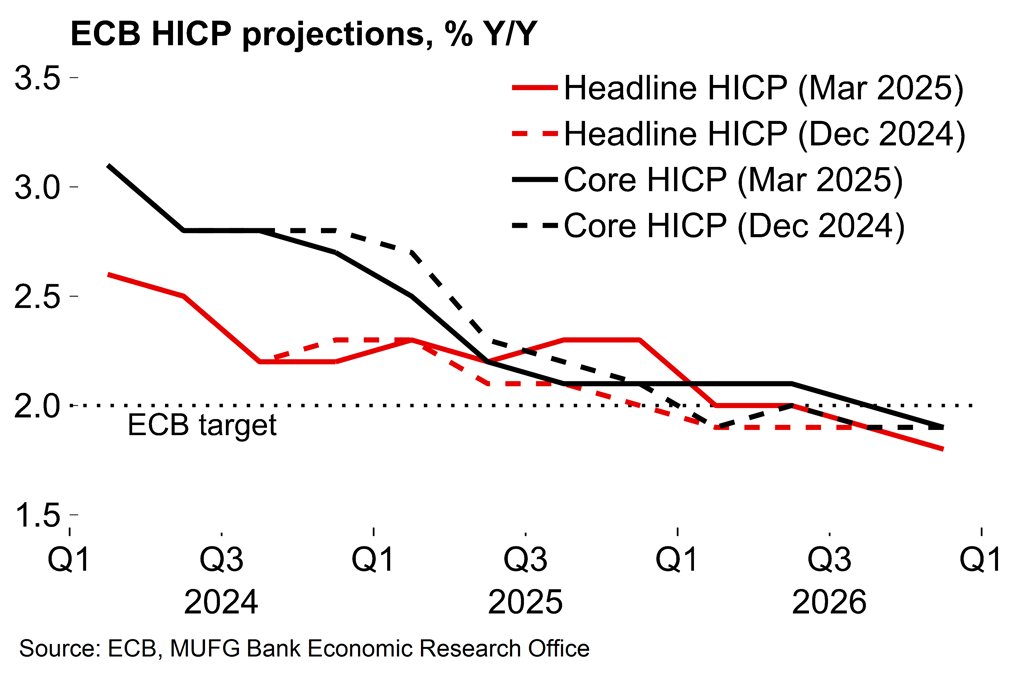

- We continue to see the tariff shock as disinflationary due to weaker demand and trade diversion. In our main scenario, we see headline inflation falling below target by end-2025.

- For the ECB, our assumption is that its immediate focus will be on the trade/confidence demand shock, which is the most clearly defined factor at this stage. This supports a continuation of the easing cycle and a move into accommodative territory (i.e. <2%) this year.

Just how stable is the new equilibrium?

A week after the ‘Liberation Day’ announcement, the US administration backtracked on its policy. The 10% base level tariff on trading partners will be maintained but the higher ‘reciprocal’ rates will be paused for 90 days. Higher tariffs on steel/aluminium and autos remain in place. Tariffs on China, which had retaliated promptly, were raised again to 145% in total.

It’s clearly positive for the outlook that the US administration used an off-ramp. But Trump later indicated that Wednesday’s climbdown was in response to market pressures rather than a predetermined strategy, which limits how much we can read into the implications for broader US trade strategy at this stage. Ostensibly there is now time for negotiation (which will likely be slow given the number of bilateral talks).

Using tariffs as leverage for geopolitical concessions is only part of the story for the US administration. The ‘corrective’ aim to restore manufacturing jobs, as well as generate tariff revenue, still seems genuine. In terms of the eventual equilibrium, we still see the 10% baseline as a hard floor to US tariffs, with higher rates in certain strategic sectors (e.g. autos) and on certain strategic rivals (e.g. China).

The question for Europe is whether or not it would also fall into the latter category if indeed the US does revert back to differentiated tariff rates.

Unlike China, the response from Brussels has so far been decidedly measured and gradual. Countermeasures to the US tariffs on steel and aluminium, which took effect on 12 March, were only agreed this week, and were to be phased in slowly. The European Commission has now announced that these measures will be put on hold for 90 days to “give negotiations a chance”.

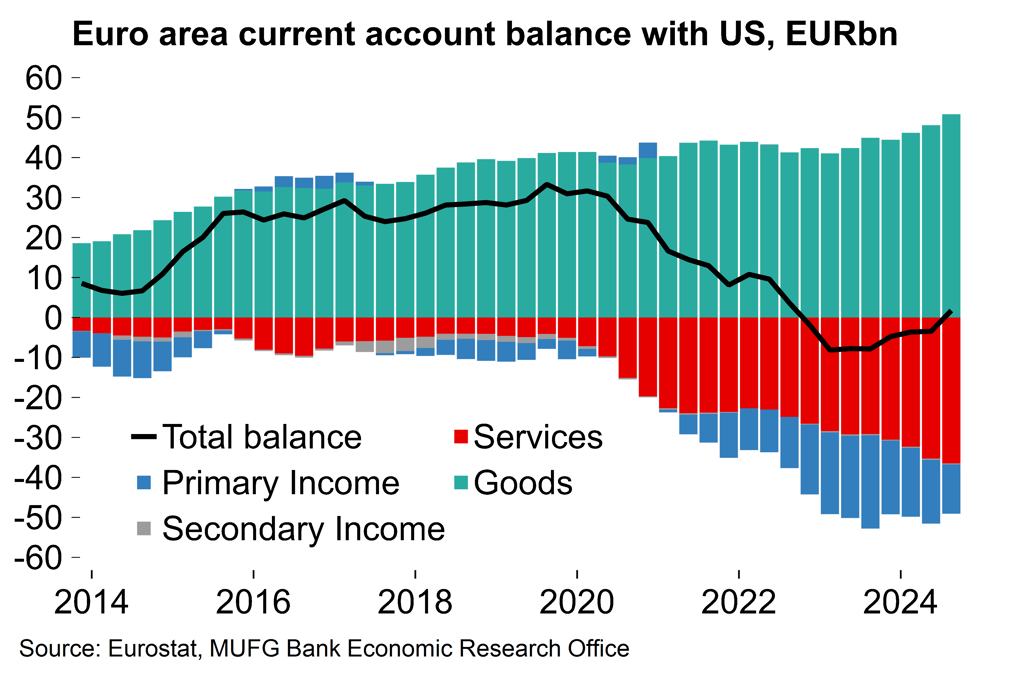

But Trump has long-singled out the EU as a key target and his focus on that goods trade deficit (200bn EUR in 2024) will remain. It’s not just a tariff story – the European Commission’s ‘zero-for-zero’ offer on industrial goods and autos was rejected out of hand by the US. Many of the wider US demands (e.g. reducing regulatory differences) seem unlikely to be palatable for European policymakers and the practical reality of others (e.g. purchasing more US energy) is not obvious.

How long will the EU defer retaliation if talks don’t lead anywhere? We’d assume that the bloc’s usual difficulties in finding a consensus would prevent a radical U-turn from the gradual approach seen so far, and plenty of off-ramps will be left. But significant escalation, as we’ve seen between the US and China, will clearly remain a possibility.

The 90-day ‘pause’ is clearly far from a stable equilibrium and risks around tariffs from here look very much two-sided for the EU around the original ‘reciprocal’ rate of 20%. For the purposes of our macro forecasts, our central scenario is that 20% US tariffs on EU goods will be reinstated by Q3, although we accept that the overall balance of risks tilted towards a reduction in rates to 10% after Wednesday’s climbdown revealed Trump’s sensitivity to market pressures.

Macro base case: slower growth, but no deep downturn

We set out our initial take on the implications for Europe here after the initial announcement and are broadly sticking with those views:

- We estimate that the direct effect of tariffs on euro area GDP will be around -0.4% over the short-term through lower US import demand. This will be magnified by various factors. First, weaker sentiment is likely to weigh meaningfully on private investment and employment growth over coming quarters. There have been signs of this already with the Sentix index, a first look at confidence in April, falling sharply. We doubt there will be much of a boost to sentiment from the US ‘pause’ given heightened uncertainty.

- External demand conditions are also set to deteriorate following this paradigm shift in global trade, with both the US and China now facing a tougher growth outlook. At the same time, European producers will face increased competition in non-US markets. Global supply-chain disruption also looks likely. As well as the post-tariff re-routing of goods, there are clear risks from other policy shifts such as US plans to force trade onto currently non-existent US-made ships.

- There will be some mitigating factors. We continue to see the tariff demand shock as ultimately disinflationary for Europe. Trade diversion and lower energy prices related to slower global growth is likely to support this further. There may also be an FX effect – if maintained, the ~4% EUR appreciation on a trade-weighted basis seen since 1 March would be consistent with a 15bp reduction in headline inflation within a year. This will all help to support real household income growth and also encourage the ECB to continue its easing cycle (more on that below).

Overall, we see a total short-term effect from tariffs and related uncertainty on euro area GDP of around -0.6%. Relative to our pre-Liberation Day forecast (here) we have reduced our growth forecast from 0.9 to 0.7% in 2025 and from 1.4 to 1.0% in 2026.

Policy support can help to offset the drag

We continue to emphasise that risks around the growth outlook became significantly more balanced following the blockbuster fiscal stimulus shift in Germany. As we’ve noted before, we assume that new German spending will now be more front-loaded than initially planned. Business-friendly reforms could also be fast-tracked, while European policymakers may bring forward higher defence spending targets.

Governments may also announce more specific measures. In the case of escalation, it’s plausible that mechanisms will be created to redirect any tariff revenue from retaliatory countermeasures to the most-affected industries. Even assuming fairly elastic demand for US products, 20% EU tariffs on non-energy US goods could generate something in the region of 40-50bn EUR (not an insignificant amount if used smartly).

On labour market risks, we have warned before (e.g. here) about the possibility of second-round effects from tariffs given earlier jobs market ‘hoarding’ by firms hoping for an improvement in demand conditions. If US tariffs do prove to be a trigger for some firms to go ahead with lay-offs, European governments might consider using targeted variants of the job retention schemes used during the pandemic.

In short, there are several mitigating factors which are set to cushion the shock, with several plausible policy levers to pull in the case of further escalation.

How will the ECB navigate the trade tides?

In March, Lagarde said that 25% US tariffs could “lift inflation by around half a percentage point” due to EU retaliatory measures and a weaker euro exchange rate (see here). As noted above, we have actually seen a notably stronger EUR on a trade-weighted basis so far. That could well reverse but, right now, hawkish concerns about the FX impact look less relevant.

The path for retaliation also remains highly unclear. The European Commission has deferred its planned countermeasures for now. In the case of escalation, the EU may take a wider view of its trading relationship with the US and target services (where the US has a large surplus) to fully match the US policy. The legal framework is there with the ‘Anti-Coercion Instrument’ created since Trump’s first term. Compared to goods tariffs, this route would likely be 1) a slower process and 2) have less direct consequences on consumer prices (with measures more likely to be absorbed through lower profit margins).

Would the EU target the US services surplus?

The ECB has been increasingly confident on inflation

Meanwhile, any policies to protect against trade diversion will also have a material impact on inflation. The US has now imposed 145% tariffs on imports from China and China has since responded by raising tariffs to 125%. The world’s largest economies are now in de facto trade embargo territory and there will be a lot of goods seeking other markets – US imports from China last year totalled 440bn USD.

European Commission President von der Leyen said that the EU “cannot absorb global overcapacity” and will not “accept dumping on our market”. Again, it is not known what scope any protective measures (e.g. import quotas, anti-dumping duties) will have at this stage, but our assumption is that they will only apply to areas where there is EU production domestically. That means that there is still likely to be significant downward pressure on prices in areas such a low-cost consumer goods as well as certain foods and raw materials.

All told, our view remains that the tariff shift will ultimately prove to be disinflationary with the demand shock and effect of trade diversion dominating any impact from retaliatory measures. In our main scenario, we see headline inflation falling below target by end-2025.

Policymakers will still have to balance the short-term drag on demand from new US tariffs with the more medium-term boost from greater public investment. Uncertainty around the scope or timing of the EU’s retaliatory measures further complicates the task.

Weighing it all up, our assumption is that the ECB’s immediate focus will be on the trade/confidence demand shock, which is the most clearly defined factor at this stage. That supports a continuation of the easing cycle and a move into accommodative territory (i.e. <2%) this year. Indeed, interventions from Governing Council members have, for the most part, been on the dovish side ahead of next week’s policy meeting. But a non-linear path for rates is certainly plausible now. There could be an upwards ‘calibration’ to neutral – or even above – in 2026 if trade barriers are reduced and/or fiscal support is significantly front-loaded. Given the breadth of uncertainty right now it would be hard to label that a policy mistake.