- Developments since the last ECB meeting have been almost uniformly dovish. Prior to ‘Liberation Day’, the ECB’s primary concerns around a shift in US trade policy related to EU retaliation and currency weakness. So far, the EU has been at pains to avoid escalation and the euro has appreciated markedly. A weaker growth outlook, lower energy prices and trade diversion are also set to weigh on price growth.

- This means that there are no obvious barriers to stop the ECB from continuing its steady easing cycle this week. We see three more rate cuts this year in total, which would take the deposit rate to 1.75%.

- While there may be small dovish tweaks to the statement language to reflect recent realities, officials are likely to want to retain plenty of flexibility given heightened uncertainty around trade policy and the timing of new fiscal support.

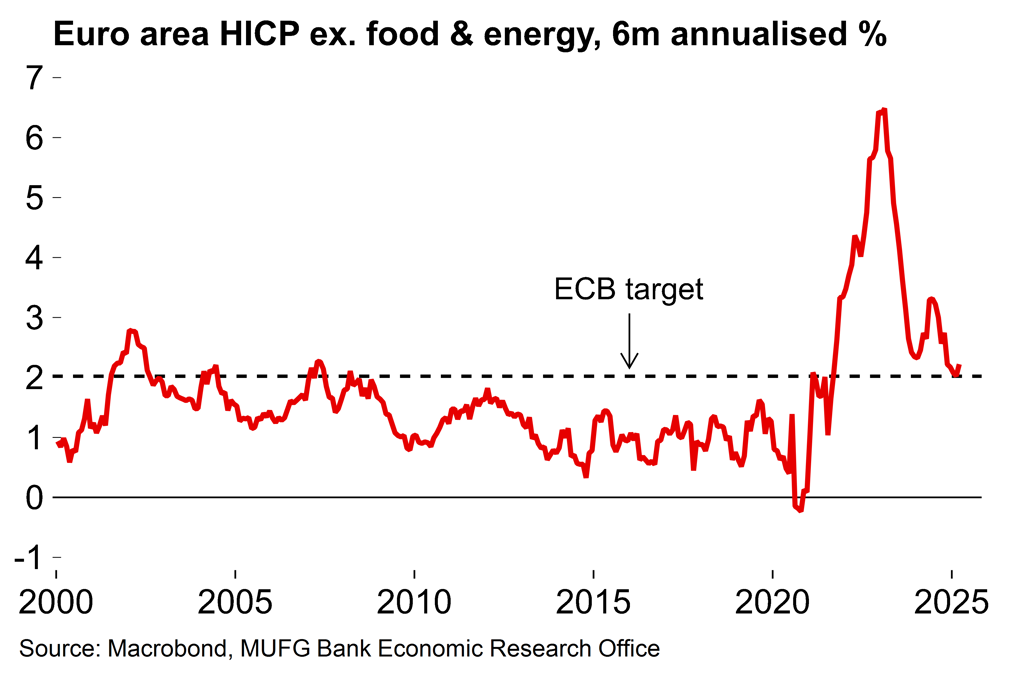

The tariff shock has not derailed the disinflation process

The last ECB meeting (6 March) came days after the initial announcement on German fiscal policy reform. The overall tone was mildly hawkish with a sense that policymakers were thinking about setting the stage for a pause in the rate cut cycle. The key change to the statement was the note that monetary policy was becoming “meaningfully” less restrictive”, which Lagarde acknowledged “had a certain meaning”. Another cut at the April meeting became a 50-50 call.

Since then, data and developments have been almost uniformly dovish and a 25bp cut on Thursday is now fully priced by market participants. The latest inflation data surprised slightly on the downside with headline March HICP edging lower to 2.2% Y/Y and the services aggregate falling to 3.4% from 3.7%.

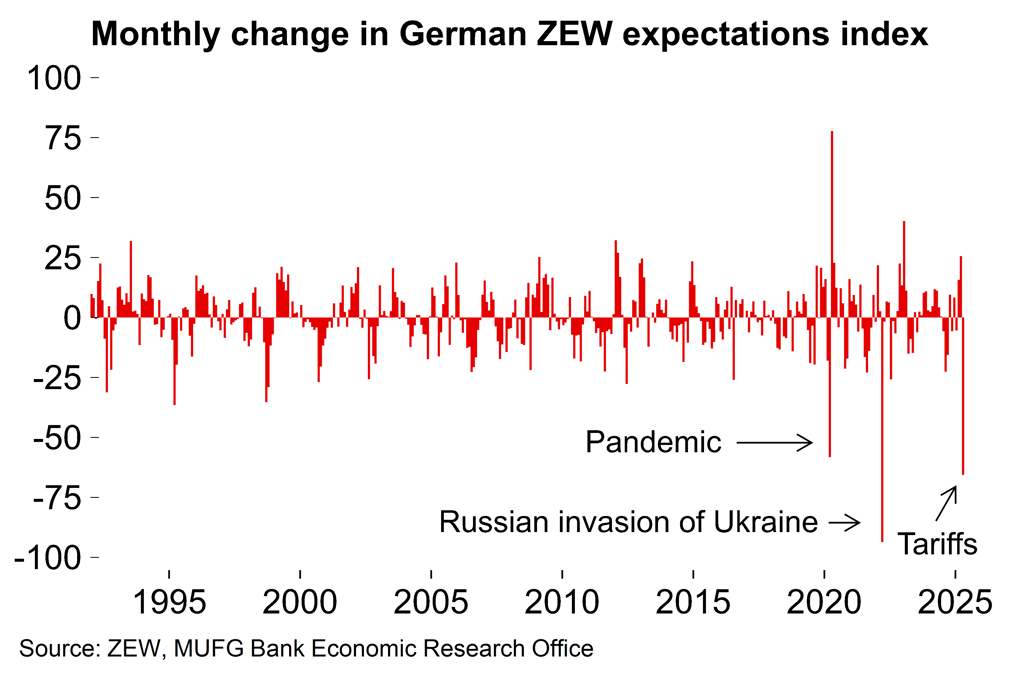

Initial releases show that confidence has plunged in April

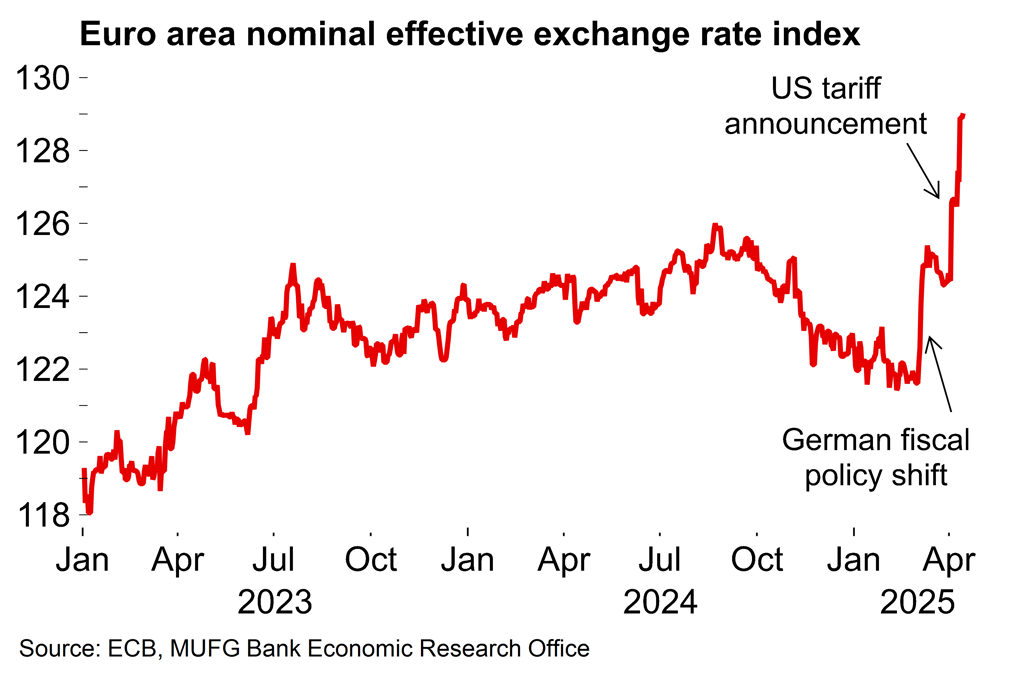

The euro area appreciated markedly since March

Our general sense is that policymakers have become more confident in the inflation normalisation process. We don’t think recent developments will derail that. In March, Lagarde said that 25% US tariffs could “lift inflation by around half a percentage point” due to EU retaliatory measures and a weaker euro exchange rate (see here). As it stands, the EU seems at pains to avoid escalation with the US – officials are treading a notably cautious path with regards to retaliation on tariffs.

On FX, hawkish concerns now look irrelevant. The EUR has reached a historical high on a trade-weighted basis. The ~5.5% EUR appreciation on a trade-weighted basis seen since 1 March would be consistent with a 20bp reduction in headline inflation within a year. Trade diversion and weaker energy/commodity prices could further add to disinflationary pressures over coming months.

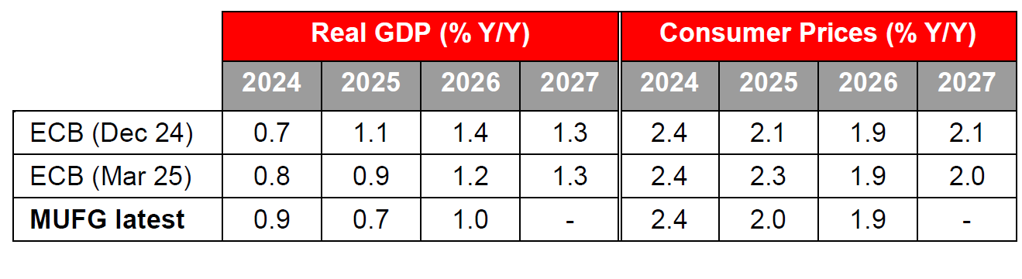

This is not a forecast meeting so there will be no immediate official reflection of these shifts. Indeed, the ECB’s last projections from March seemed redundant on release as they did not incorporate the German fiscal policy announcement – and look even more stale now.

As we set out last week in our updated euro area forecasts, we see the tariff demand shock as ultimately disinflationary for Europe and expect it will more than offset the inflationary effects of new government spending. Indeed, today’s ZEW survey release was not pretty with the expectations component recording the third largest monthly fall in the survey’s history. In our main scenario, we now have headline inflation falling below target by end-2025 (the ECB’s March projections put the rate at 2.2%).

More cuts to come

We expect that there will be mildly dovish tweaks in the statement language to reflect recent developments, perhaps by emphasising downside risks, but there’s unlikely to be much in the way of new policy signals. In the absence of clearer shifts in the hard data, policymakers will probably want to retain plenty of flexibility given high uncertainty around trade policy and the timing of new fiscal stimulus. That said, another cut will take rates down to the upper end of ECB’s estimated range of ‘neutral’ (1.75 – 2.25%) which could force another shift in the statement language (will the ‘restrictive’ tag be retained?).

In terms of the outlook, it looks a straightforward decision to cut rates at this meeting and that will likely be the case in June as well (especially if HICP projections are downgraded as we expect). We see three more rate cuts this year in total. That would take the deposit rate to 1.75%.

Taking a longer view, a non-linear path for rates is certainly plausible now given the dynamic risks. We assume that the ECB’s immediate focus will be on the trade/confidence demand shock, which is the most clearly defined factor at this stage. But there could be an upwards ‘calibration’ in 2026 if trade barriers are reduced and/or fiscal support is significantly front-loaded.

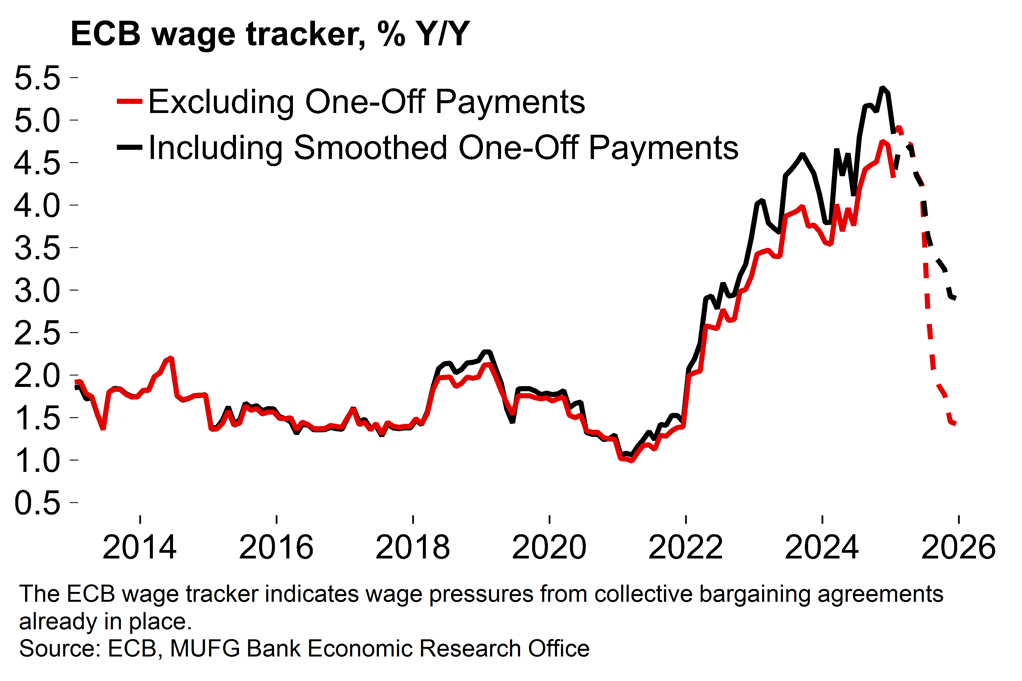

Wage pressures from collective bargaining agreements are fading

Core inflation momentum has slowed