- The ECB cut the deposit rate to 2.25% in what looks like a straightforward decision. Rates are now close to neutral territory and the mention of “restrictiveness” was dropped from the statement.

- There are a wide range of disinflationary forces facing the euro area post-‘liberation day’ (e.g. weaker demand, lower energy prices, stronger currency) and these were reflected through some dovish tweaks to both the statement language and in the Q&A.

- But policymakers stopped well short of providing any new policy signals. There’s a clear desire to retain flexibility given volatility around the US administration’s decision making and uncertainty around the timing of new domestic fiscal stimulus measures.

- We expect that the easing cycle will be continued at the next meeting in June (at which point official HICP projections are likely to be lowered). We see two more cuts this year in total, which would take the deposit rate to 1.75% and into slightly accommodative territory.

The focus remains on agility against a backdrop of heightened uncertainty

The ECB cut the deposit rate by 25bp, as expected, to 2.25%. As we said in our preview, there were no obvious barriers to stop policymakers from continuing its easing cycle and it was likely a straightforward decision to cut again. This represents a clear shift from March when it seemed as though policymakers were setting the stage for a pause. Indeed, Lagarde noted that “there were a number of governors who would have argued in favour of a skip” just a few weeks ago.

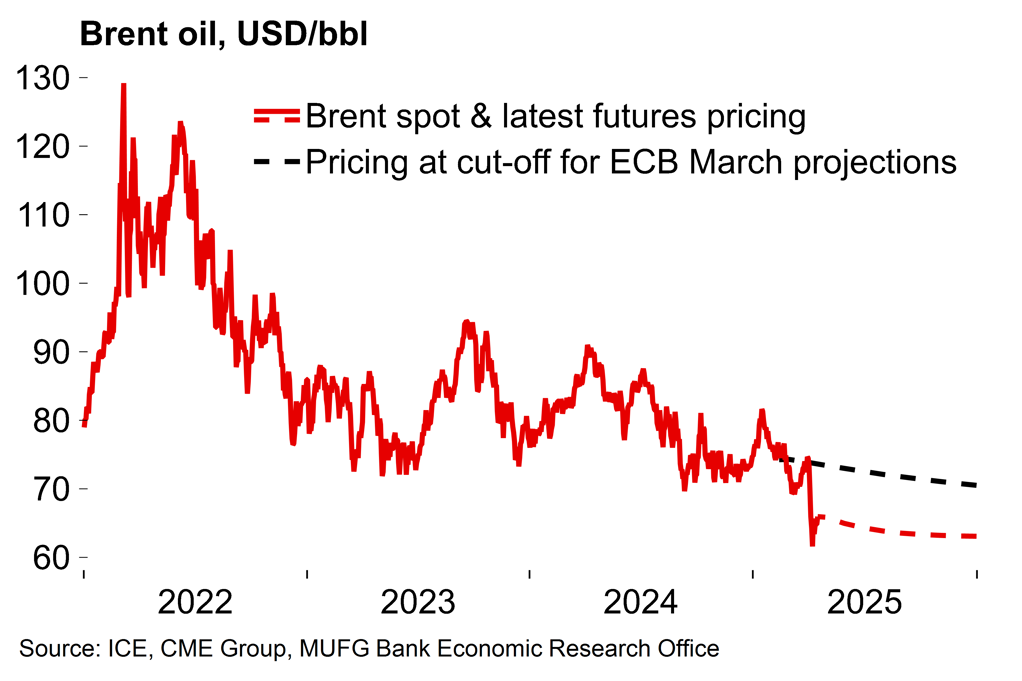

The news flow since the last ECB meeting (when the German fiscal shift had already been announced) has almost uniformly pointed to increased disinflationary pressures. As well as the negative demand shock of the US tariff announcement, March inflation numbers came in weaker than expected, the euro has strengthened markedly and energy futures have shifted lower. Meanwhile, the EU is giving every indication that it wants to avoid the sort of tit-for-tat tariff escalation scenario seen between the US and China. That development also points to trade diversion effects weighing on euro area inflation.

Today’s ECB update only goes part way towards reflecting all this. As expected, there were some changes to the statement which were mildly dovish: it was noted that services inflation has “eased markedly over recent months” and that the “outlook for growth has deteriorated owing to rising trade tensions”. The word “restrictive” was also dropped from the statement, which tracks with the deposit rate now at the top of the ECB’s estimated range of ‘neutral’ (1.75 – 2.25%).

But otherwise there were no new policy signals. With uncertainty now at “exceptional” levels, the ECB again emphasised that it has no intention of pre-committing to any particular rate path. There’s a clear desire to retain flexibility given volatility around the US administration’s policy decisions and uncertainty around the timing of new domestic fiscal stimulus.

Market inflation expectations have eased since March

Lower energy prices will likely support a downgrade to the ECB’s HICP projections in June

Outlook – more easing to come with inflation projections set to be lowered

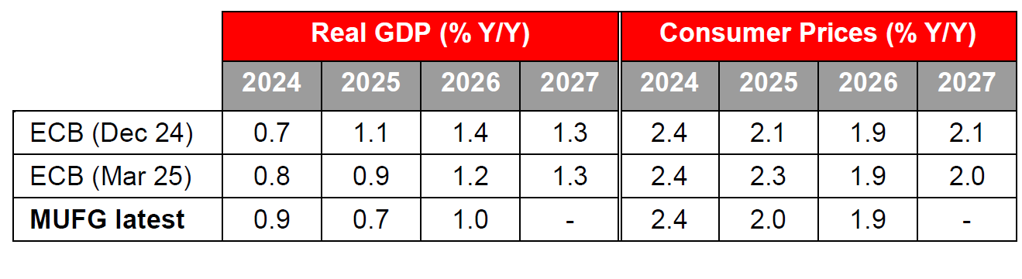

We can’t see any obvious reason to delay getting rates back to at least neutral (i.e. 2%) from here given the wide range of known disinflationary pressures now facing the euro area. Lagarde acknowledged the downside risks to inflation projections from weaker demand, lower energy prices and trade diversion. These factors are more clearly defined than risks around supply-chain disruption, while there is still plenty of uncertainty regarding both timing and scope around new fiscal measures in Europe. This points to a small dovish bias, over the short term at least. We expect another cut in June, which will likely be supported by lower official HICP projections.

We then see one more cut in H2, which would take the deposit rate to 1.75% (i.e. neutral or slightly accommodative territory). By year-end there will be more clarity around the profile for new German fiscal stimulus (and perhaps also increased European defence spending) which is likely to bolster the case for calling a halt to the easing cycle.