To read the full report, please download the PDF above.

Middle East - Monthly Composite Activity Indicator (CAI)

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Monthly Composite Activity Indicator (CAI) – February 2025

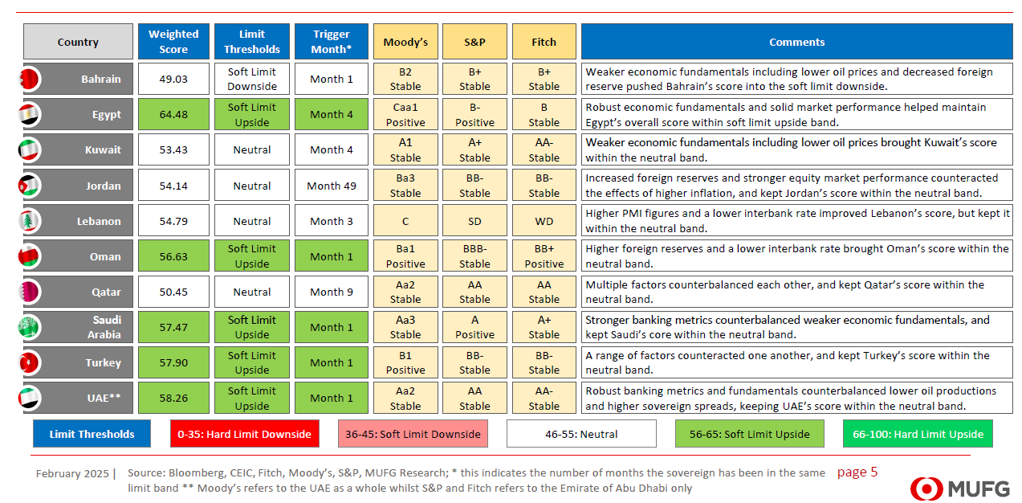

We are pleased to share our latest iteration of our MUFG Composite Activity Index (CAIs) – which distils a plethora of market, economic, political, banking, and credit indicators into a single measure to track monthly activity growth in real time.

Summary measures of economic activity are usually only available with a long lag. As they incorporate data from many different sources, they are only as timely as the slowest indicator. With this, we have created a Composite Activity Indicator (CAI), defined as the “first principal component” of a host real activity metrics to track monthly activity growth in real time through a single measure. The goal is not to forecast GDP, but to present the CAI as a mechanism to offer visibility on the variation in real activity indicators, with the approach involving mapping each metric to a mechanism to derive an overall weighted score which will be monitored on a monthly basis.

Our initial population target is the Middle East hydrocarbon exporters and importers, with the aim of broadening this out to a wider subset of countries within EMEA to capture sequential changes in similar metrics into a single measure to track monthly activity growth in real time.

In February 2025, we highlight the following considerations:

- Overall message. Juxtaposed against today’s geopolitical uncertainty, major energy exporting countries CAIs moved up to the “soft limit upside band” – a testament of the pragmatism in delicately balancing conflicts with inward-looking diversification strategies. Meanwhile, CAIs remain within the “neutral band” for energy importers.

- Bahrain. Pivot from the “soft limit downside band” into the “neutral band”. Weaker equity markets and lower FX reserves offset by higher oil and lower interbank rates.

- Egypt. Remains in the “soft limit upside band” (fourth month). Robust economic fundamentals and market performance maintained the score within the band.

- Oman. Pivot from the “neutral band” into the “soft limit upside band”. Strong economic fundamentals and a lower interbank rate raised the score.

- KSA. Pivot from the “neutral band” into the “soft limit upside band”. Strong market performance, economic fundamentals and banking metrics offered support.

- Turkey. Pivot from the “neutral band” into the “soft limit upside band”. Broad-based improvements across multiple indicators boosted the score.

- UAE. Pivot from the “neutral band” into the “soft limit upside band”. Sound economic fundamentals and robust market performance lifted the score.