To read the full report, please download the PDF above.

MENA Monthly Compendium

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

MENA Monthly Compendium

We are pleased to share in the link our latest MUFG MENA monthly compendium which aims to organise and highlight the array of themes surrounding the MENA region, from standalone thought leadership research, market developments and events to MUFG’s involvement on MENA related transactions as well as broader activities.

MUFG’s leading MENA regional financing for our clients

Since January 2024, MUFG was involved in the following prominent capital markets transactions:

- MUFG acted as Active Bookrunner and Joint Green Structuring Agent for the Saudi Electricity Company ("SEC") USD2.75bn RegS only 5-and Green 10-year Sukuk offering. The transaction represents the first outing for SEC in the debt capital markets in 2025, and follows its February 2024 USD2.2bn dual tranche Sukuk offering (on which MUFG also acted as Active Bookrunner). The transaction was an outstanding success, as illustrated by multiple milestones and achievements:

1. Securing an extremely strong order book in excess of USD12bn representing a 4.3x oversubscription;

2. SEC secured funding with negative new issue concessions and flat to the outstanding KSA Sukuk curve – testament to the strong demand for its credit;

3. Strong moves from IPTs to final landing levels of 35bps – representing a very large move; and

4. Achieving the lowest absolute spreads for SEC for a new 5- and Green 10-year tranche in primary of T+85bps and T+95bps, respectively.

MENA market perspectives

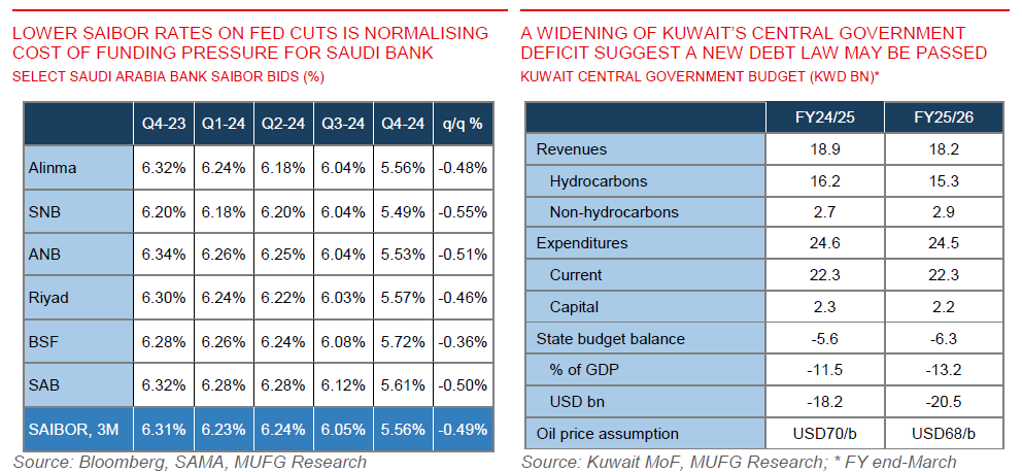

- Saudi banks print record profits in December 2024 as the cost of funds ease. According to the latest monthly statistics published by the Saudi Central Bank (SAMA), domestic banking sector profitability reached a record high of SAR8.8bn (USD2.4bn) – up 30% y/y. Part of this constructive reading was led by a reduction in the cost of time deposits with SAIBOR normalising following Fed-induced SAMA rate cuts at the back-end of 2024 (SAR is pegged to the USD). Looking ahead, Saudi banks are well-positioned to outperform given their robust asset quality (benefitting from high coverage and low NPL ratios), GEM funds’ markedly underweight Saudi banks and a stronger NIM trajectory (buttressed by higher CASA ratios).

-

Kuwait’s wide government in FY25/26 calls for a new debt law. The draft Kuwait budget for the fiscal year 25/26 (commencing April) foresees a central government deficit of KWD6.3bn (USD20.5bn). Authorities expect the deficit to widen compared to planned FY24/25 budget deficit for KWD5.6bn (USD18.1bn). The deterioration is related to lower oil revenues as authorities assume production unchanged and price averaging at USD68/b in the fiscal year (USD70/b assumption in FY24/25). Non-oil revenues are expected to increase and expenditures to remain flat owing to spending consolidation, although full details are yet to be published. According to the Minister of Finance, HE Dr. Al-Fassam, has stated that the country is preparing to return to international debt markets soon with a passage of a new debt law being discussed. As it stands, only one Eurobond (due in 2027) remains outstanding with very little local debt as well. We expect the new law would allow a return to the market, with articles pointing to a limit set as high as KWD20bn (USD65bn) over 50 years.