To read the full report, please download the PDF above.

Middle East - Monthly Composite Activity Indicator (CAI)

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Monthly Composite Activity Indicator (CAI) – January 2025

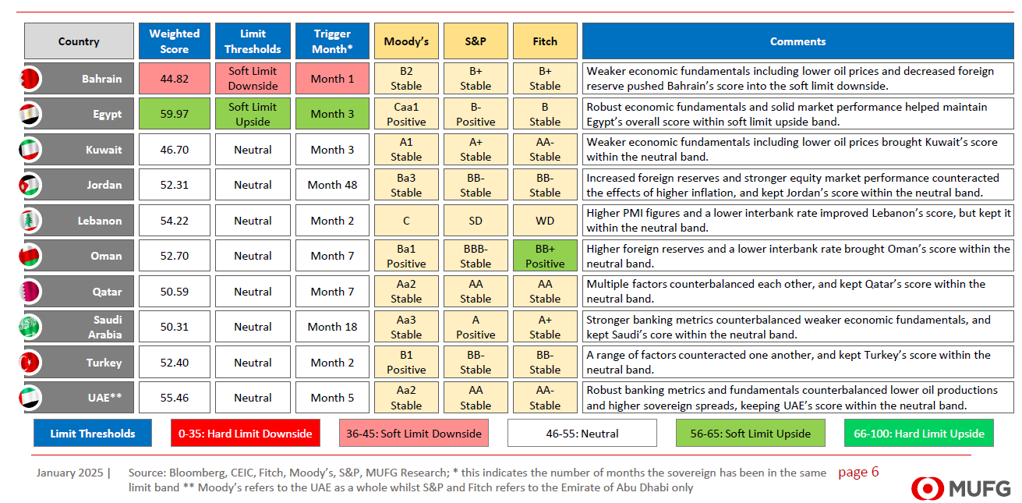

We are pleased to share our inaugural MUFG Composite Activity Index (CAIs) – which distils a plethora of market, economic, political, banking, and credit indicators into a single measure to track monthly activity growth in real time.

Summary measures of economic activity are usually only available with a long lag. As they incorporate data from many different sources, they are only as timely as the slowest indicator. With this, we have created a Composite Activity Indicator (CAI), defined as the “first principal component” of a host real activity metrics to track monthly activity growth in real time through a single measure. The goal is not to forecast GDP, but to present the CAI as a mechanism to offer visibility on the variation in real activity indicators, with the approach involving mapping each metric to a mechanism to derive an overall weighted score which will be monitored on a monthly basis.

Our initial population target is the Middle East hydrocarbon exporters and importers, with the aim of broadening this out to a wider subset of countries within EMEA to capture sequential changes in similar metrics into a single measure to track monthly activity growth in real time.

In January 2025, we highlight the following considerations:

- Overall message. Juxtaposed against today’s geopolitical uncertainty, all Middle East energy exporting countries CAIs remain within the “neutral band” – a testament of the pragmatism in delicately balancing conflicts with inward-looking diversification strategies. Meanwhile, CAIs were mixed for Middle East energy importers.

- Bahrain. The country has moved from the “neutral band” last month into the “soft limit downside band” this month. Weaker economic fundamentals including lower oil prices and decreased foreign reserve pushed Bahrain’s overall score down.

- Egypt. The country remains in the “soft limit upside band” for the third consecutive month. Robust economic fundamentals and solid market performance helped maintain Egypt’s overall score in the soft limit upside band.

- Fitch Rating’s upgraded Oman’s outlook to “positive” from “stable”, maintaining the BB+ rating. The positive outlook reflects “the continued reduction of government and state-owned entities (SOEs) debt/GDP, lower net external debt and the accumulation of net sovereign foreign assets” according to Fitch Ratings. Also, it reflects “greater confidence in the resilience of public finances, evidenced by a growing record of fiscal prudence, a lower fiscal break-even oil price (below USD70/b), and the availability of more fiscal tools to respond to shocks than in the past”.