To read the full report, please download the PDF above.

Middle East - Monthly Composite Activity Indicator (CAI)

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Monthly Composite Activity Indicator (CAI) – April 2025

We are pleased to share our latest iteration of our MUFG Composite Activity Index (CAIs) – which distils a plethora of market, economic, political, banking, and credit indicators into a single measure to track monthly activity growth in real time.

Summary measures of economic activity are usually only available with a long lag. As they incorporate data from many different sources, they are only as timely as the slowest indicator. With this, we have created a Composite Activity Indicator (CAI), defined as the “first principal component” of a host real activity metrics to track monthly activity growth in real time through a single measure. The goal is not to forecast GDP, but to present the CAI as a mechanism to offer visibility on the variation in real activity indicators, with the approach involving mapping each metric to a mechanism to derive an overall weighted score which will be monitored on a monthly basis.

Our initial population target remains the Middle East hydrocarbon exporters and importers, with the aim of broadening this out to a wider subset of countries within EMEA to capture sequential changes in similar metrics into a single measure to track monthly activity growth in real time.

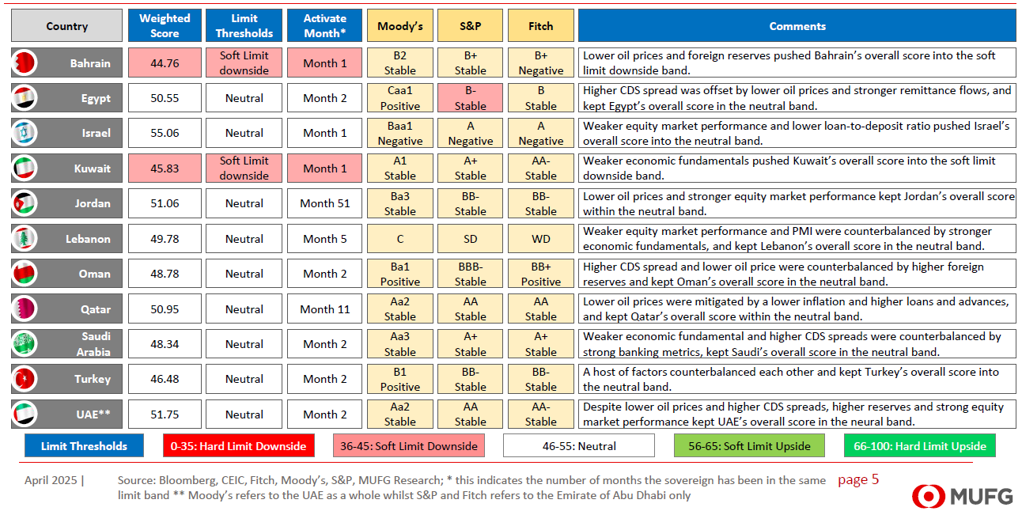

In April 2025, we highlight the following considerations:

- Overall message. Juxtaposed against today’s geopolitical uncertainty, most major energy exporting countries CAIs stayed in the “neutral band” predominantly on lower energy prices though these countries pragmatism in balancing external uncertainties with inward-looking diversification strategies, remains resolute. Also, CAIs remain within the “neutral band” for energy importers.

- Bahrain. Pivot from “neutral” to “soft limit downside”, predominantly led by lower oil prices and weaker foreign reserves.

- Kuwait. Pivot from “neutral” to “soft limit downside”, led by weaker economic fundamentals and lower oil prices.

- Israel. Pivot from “soft limit upside” to “neutral”, led by weakening banking metrics

- S&P revised Egypt’s outlook from “positive” to “stable” citing “elevated external and domestic financing requirements make it susceptible to current global financial market headwinds. Egypt has one of the highest interest-to-government revenue burdens of all sovereigns, while external accounts are vulnerable to global financing conditions and portfolio flows”