To read the full report, please download the PDF above.

MENA Monthly Compendium

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

MENA Monthly Compendium

We are pleased to share in the link our latest MUFG MENA monthly compendium which aims to organise and highlight the array of themes surrounding the MENA region, from standalone thought leadership research, market developments and events to MUFG’s involvement on MENA related transactions as well as broader activities.

MUFG’s leading MENA regional financing for our clients

Since February 2024, MUFG was involved in the following prominent capital markets transactions:

- MUFG acted as Joint Lead Manager and Active Bookrunner for the Doha Bank PSQC ("Doha Bank") USD 500m RegS only 5-year bond offering. The transaction was an outstanding success, as illustrated by multiple milestones and achievements:

1. Securing a resoundingly strong order book of c. USD2.5bn (5x oversubscribed);

2. Healthy moves from IPTs to final landing levels of 35bps;

3. Pricing with a negative new issue premium; and

4. Attracting strong interest from high-quality international investors and thereby allocating more than half of the transaction with non-GCC accounts - including a robust interest from Asia with 18%.

MENA market perspectives

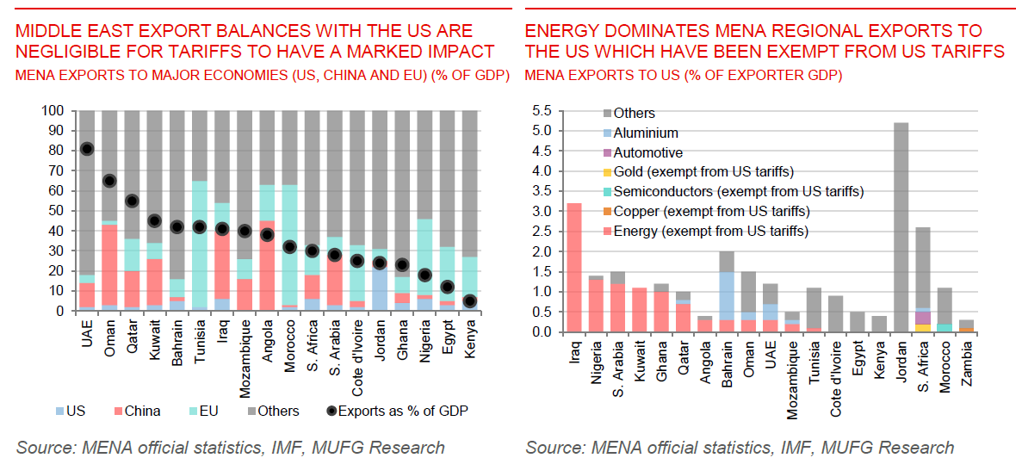

- Limited direct “first order” impact to the MENA region from US tariffs. The direct exposure of the Middle East energy exporters to US exports is limited – these countries runs a trade deficit with the US, volumes are low and dominated by tariff-exempt energy sales – as such, only the universal 10% tariff rate was imposed. Meanwhile, For Middle East energy imports, Jordan is the country with the largest direct exposure to tariff as exports to the US are worth over 5% of GDP. Also, whilst Tunisia received the largest tariff at 28%, although exports to the US account for only 1.3% of GDP What’s more, a quarter of Tunisia’s total exports is linked to olive oil, a food item which could be procured from a limited amount of countries (mostly within Europe). Exports to the US account for about 1.3% of GDP.

-

Pronounced indirect “second order” impact to the MENA region from US tariffs. The MENA region’s second order exports to tariff-led shifts in the global growth outlook are more considerable. This comes predominantly from prospects for crude oil which generates ~55% of exports, ~65% of fiscal revenues and ~35% of GDP, for the region, in aggregate. Based on our estimates, each USD10/b decline in oil prices – holding production constant – reduced export earnings by ~USD70bn and fiscal revenues by ~USD60bn. Granted, regional diversification strategies have reduced this reliance, but near-term, the dependency on energy revenues to fund long-term transformation programmes has intensified the region’s exposure to global energy markets. OPEC+ driven volumetric production increases (that commenced this month) will offset some of the reductions in price levels, but we are cognisant that further increases in supply to a markets where tariff-induced demand pressures looks tepid may exacerbate price pressures even further. Taken together, despite heightened risks, regional policymakers are well-experienced in managing the ebbs and flows of energy receipts without compromising stability. Beyond this willingness, the region’s capability in guarding economic order is resolute – debt is low, savings rates are high and credit ratings are strong with access to international capital markets comfortable at favourable interest rates (see here).