-

UK inflation surprised slightly to the upside in September with the headline rate unchanged at 6.7% Y/Y. The UK is still something of an international outlier on price pressures. The outlook for the next few months is more encouraging and we expect inflation to ease to around 5% by year-end.

-

The BoE would certainly have hoped for better news on inflation after its decision to leave rates unchanged last month. However, in isolation the September figures don’t change the picture that much and we expect the MPC will vote to leave rates unchanged at the next meeting in November.

-

UK growth concerns have persisted despite an upward revision to historical GDP data. A contraction in Q3 remains more likely than not, as it stands. We are tracking GDP growth to average 0.5% this year and only expect a modest acceleration to 0.6% next year.

Inflation was sticky in September but should still fall to 5% by year-end

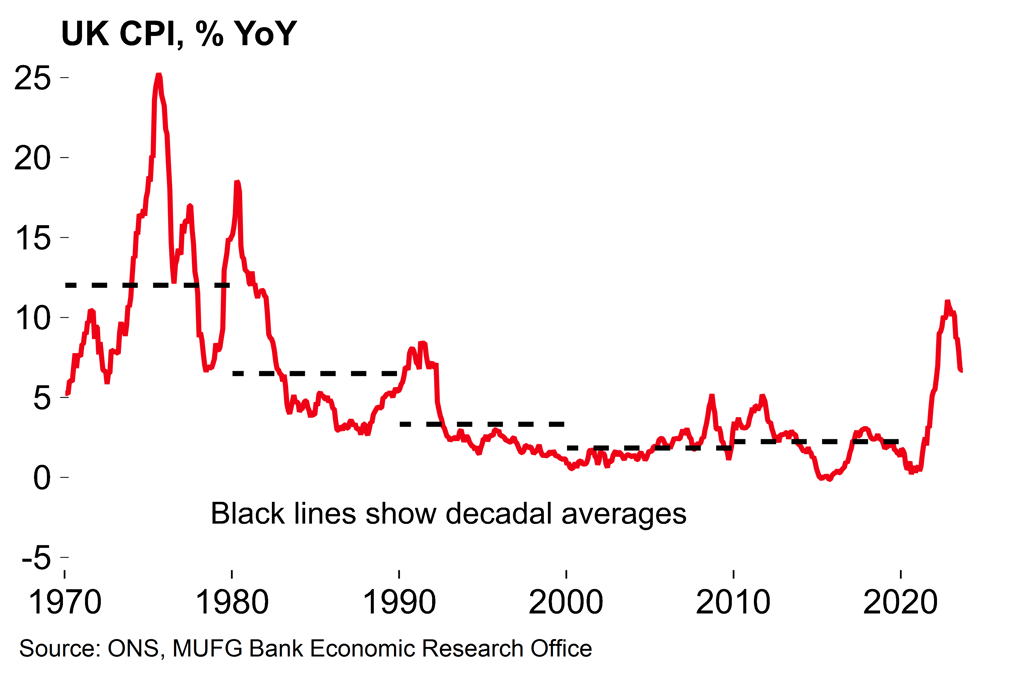

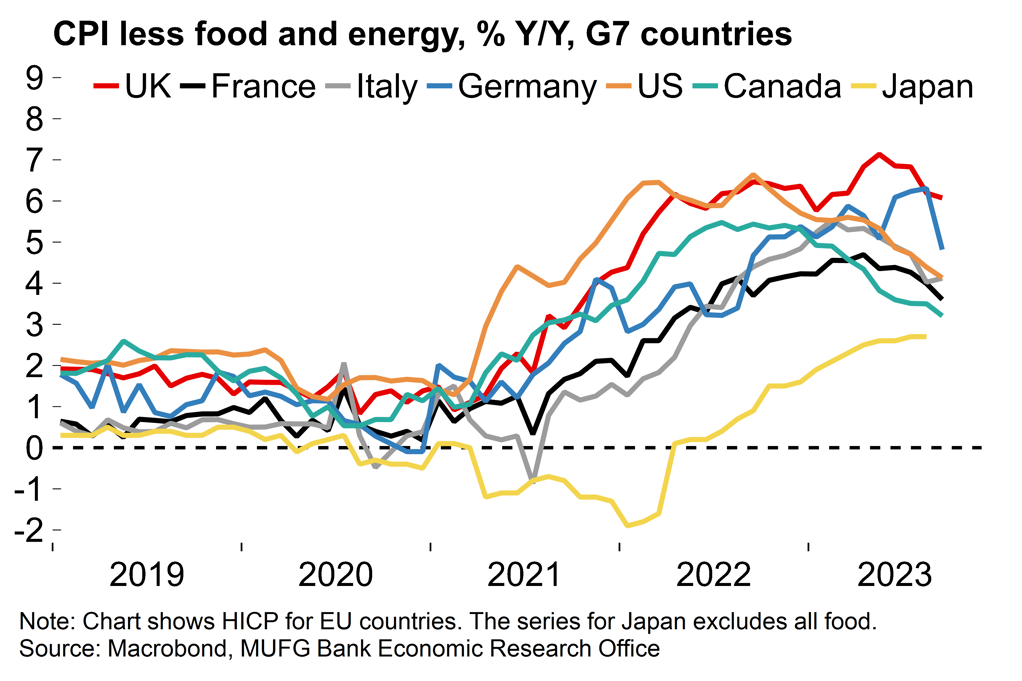

UK inflation data surprised slightly to the upside in September: the headline rate remained at 6.7% Y/Y rather than edging down as expected. Core inflation fell only slightly, from 6.2% to 6.1%. While not a severe shock by any means, the figures serve as a reminder that it’s probably still premature to declare victory over inflation, which remains too high for comfort (Chart 1). Back in May we wrote about the UK’s ‘persistent inflation problem’ (see here). Since then, the headline rate has fallen around 2pp but underlying price pressures remain uncomfortably high. The UK still looks like an outlier on core rates when compared with other G7 economies (Chart 2).

Chart 1: UK inflation has peaked, but remains too high for comfort

Chart 2: The UK remains an international outlier on core inflation

Looking ahead, we remain confident that the inflation numbers will improve over the coming months. There is set to be a steep fall in the headline rate from October’s figures following the fall in the UK energy regulator Ofgem’s household energy price cap from the start of this month (annual energy costs for a typical home have fallen to 1923 GBP from 2500 GBP last year). This alone should subtract more than 1pp from the headline rate of inflation – lags from the price cap system have significantly delayed the process of disinflation in the UK relative to other economies. At the same time, producer prices continue to suggest that pipeline pressures are easing, and forward-looking survey indicators are also encouraging.

UK headline inflation looks on course to fall to around 5% by year-end, with core rates likely to remain a little higher. We are tracking UK inflation to average 7.6% across the year as a whole and expect that will fall to around 3% in 2024.

Labour market slack vindicates the BoE’s decision to leave rates on hold

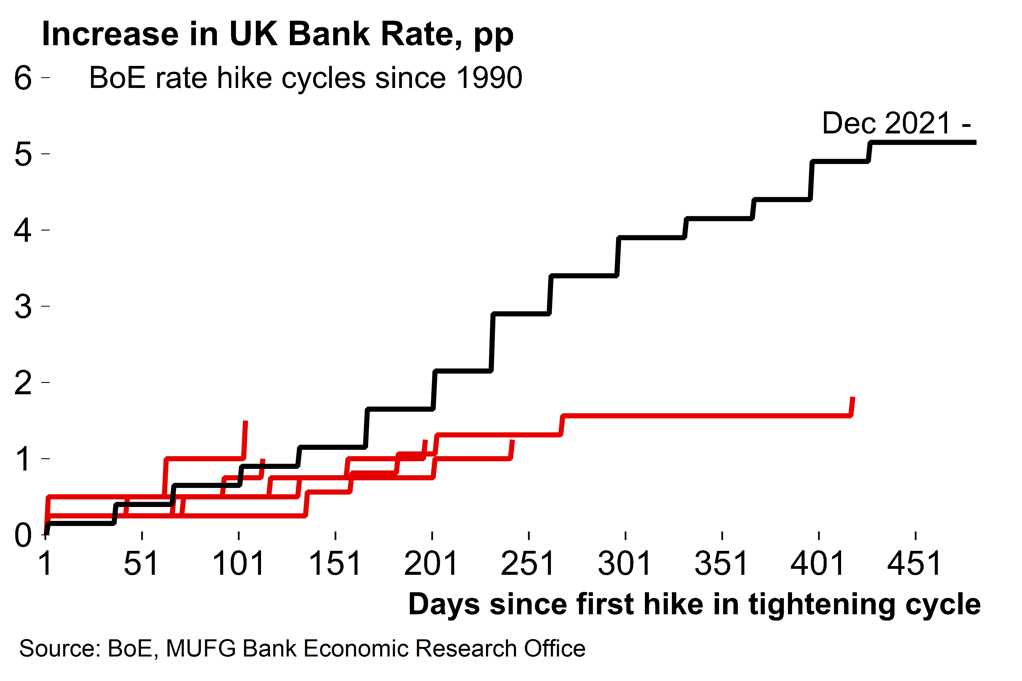

While we are optimistic that UK inflation numbers will improve over coming months, the BoE would certainly have hoped for better CPI numbers today to vindicate the surprise decision to leave rates unchanged at last month’s MPC meeting (see here). That said, the September CPI numbers are highly unlikely to be enough in isolation to change the outlook for monetary policy. Another rate increase can’t be entirely discounted (market participants are pricing in around half a hike by early next year) but we still think that the BoE’s work is probably done now. The lagged effects of its tightening efforts since late 2021 (Chart 3) continue to pass through to the economy.

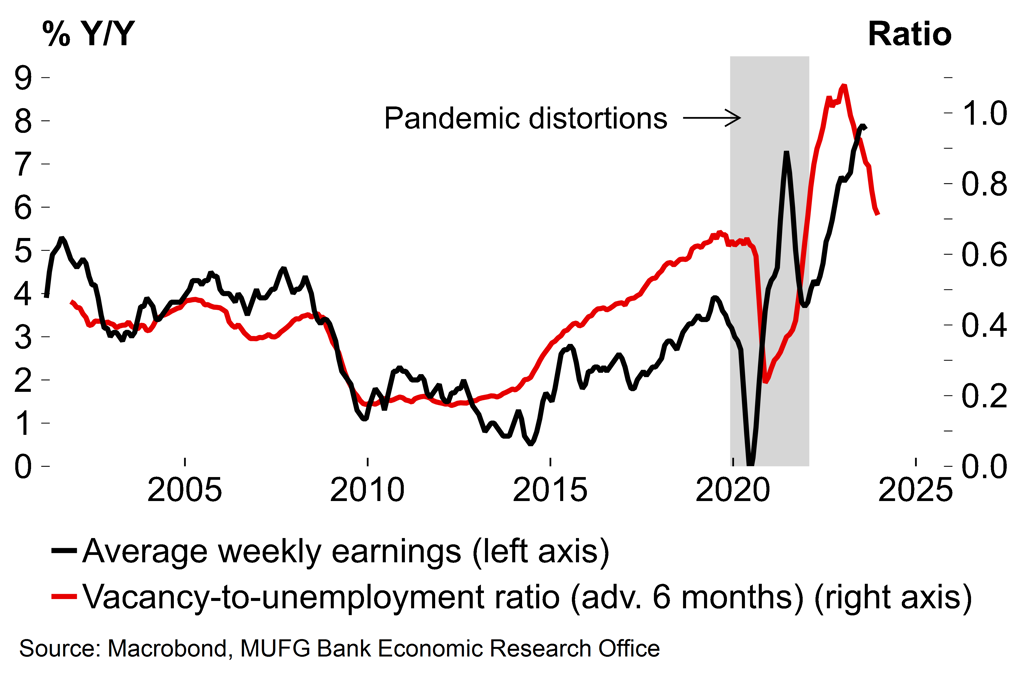

In particular, it's increasingly clear now that the labour market is now weakening (Chart 4). The unemployment rate (4.3%) has steadily increased through the year to the BoE’s equilibrium estimate (“just above 4%”). Yes, the official figures on wage growth – the key driver of services inflation – remain high: the ONS data this week showed that annual growth in regular pay (excluding bonuses) was 7.8% Y/Y in the three months to August. However, more timely payroll figures from HMRC suggests that pay growth fell to 5.7% Y/Y in September. The KPMG/REC report on jobs this month also suggested that wage inflation is cooling in the UK (this data was cited in the minutes from the last BoE meeting so we know it’s something that policymakers are watching). Evidence of labour market slack is likely to increase over coming months. With economic growth also set to remain sluggish over coming quarters (see below) we are still confident that the BoE will remain on hold at its next meeting on 2 November.

Chart 3: After 14 rate hikes the BoE has pressed ‘pause’ on its rapid tightening cycle

Chart 4: Wage growth is a lagging indicator – increased slack in the labour market suggests it should soon ease

The UK economy is teetering close to contraction territory

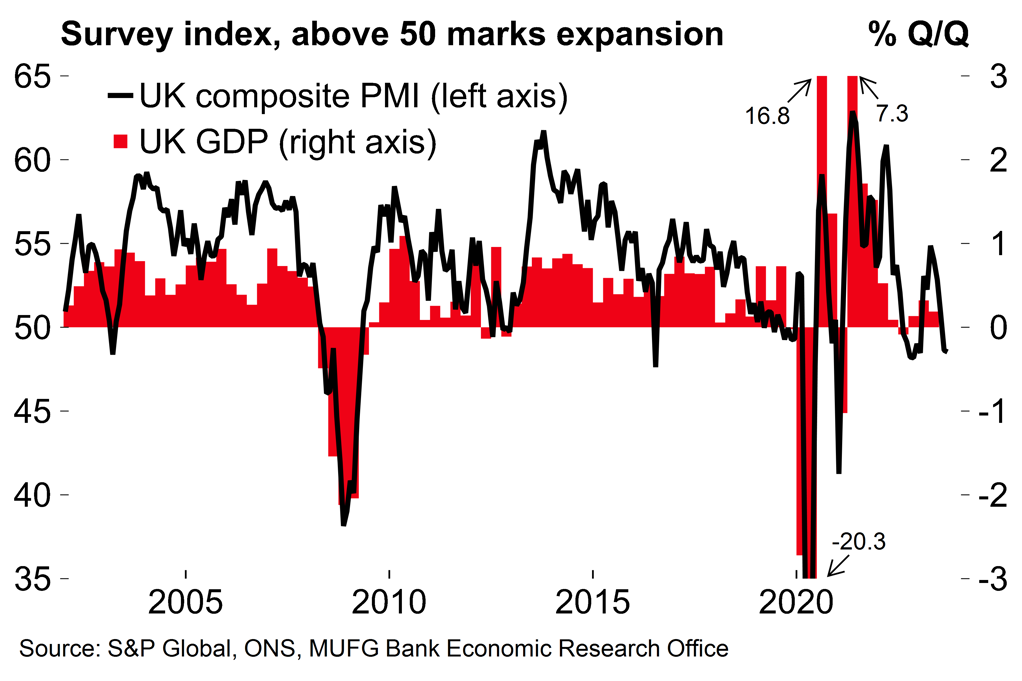

The UK economy grew by 0.2% M/M in August, in line with expectations. This represented a modest recovery after the sharp 0.6% M/M fall in July, a month of bad weather and public sector strike action. Despite the small expansion, a GDP contraction across Q3 as a whole is now looking more likely than not. Assuming no revisions to the estimates for the previous months, we would need to see monthly growth of at least 0.4% in September to avoid a negative Q3 number. The signal from business surveys suggests this is unlikely: the composite PMI fell to the lowest level since January last month (Chart 5). As it stands a growth figure of around -0.1% Q/Q in Q3 looks most likely to our minds, even when taking into account the reduction in industrial action since the summer.

Chart 5: Business surveys are consistent with a GDP contraction in Q3

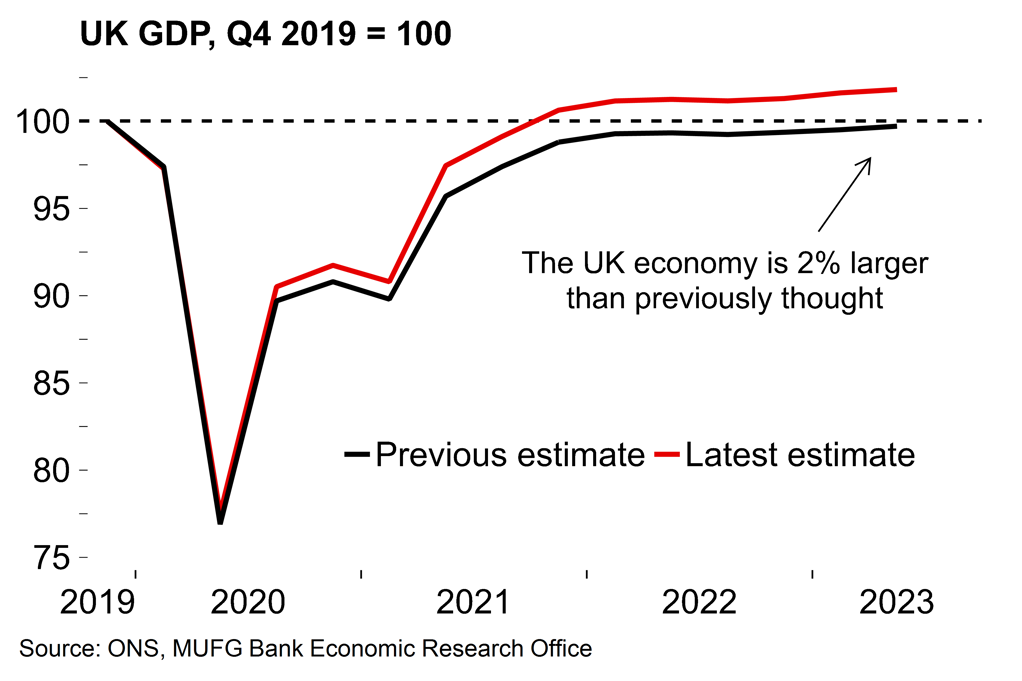

Chart 6: Output since 2022 remains broadly horizontal despite a significant revision to the historical data

The bigger picture remains one of stagnation, despite last month’s significant revision to UK historical GDP. Previously, the economy was estimated to be below the pre-pandemic level in Q2 this year. Now, GDP is judged to be around 2% above that mark. That is plainly good news for the UK. However, while the starting level may be judged as higher now, the trajectory since 2022 remains broadly horizontal (Chart 5) with growth of just 0.6% over the last six quarters.

The hope for an acceleration from here hinges on the real income recovery. While we are confident that inflation will continue to fall, we doubt that household spending will prove to be a major growth driver over coming quarters. Higher mortgage payments, fiscal drag and a looser labour market is likely to offset the boost from recovering real income growth. Overall, we expect that GDP growth is likely to continue to bump along a fairly flat path over coming quarters. We are tracking annual average growth at 0.5% in 2023 and expect only a modest improvement to 0.6% in 2024.