Commodities Weekly

- Jan 18, 2024

To read the full report, please download the PDF above.

Early assessment of the US presidential elections on commodities

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

Uncertainty tends to rise at the start of US presidential election years, and that pattern looks particularly likely to hold in 2024 given a number of important events to start the year and the presidential election in November. From a commodities dimension, we envisage the most significant reverberations of the US elections to play out in the energy complex. First, on US energy supply, federal regulations mostly affect midstream (pipelines and broader infrastructure) growth via the stringency of environmental regulations, rather than upstream (production) growth, which is largely driven by market conditions. Second, on global energy supply, the drop in Iranian oil supply following the US withdrawal from the JCPOA deal in 2018 followed by the rise in Iranian production in 2023 may skew the risks to Iran crude supply to the downside in a more hawkish US administration. Finally, on the demand side, potential escalation of US-China relations may slow long-run US natural gas export demand growth if any reduction in long-term LNG contracts between China buyers and proposed US export facilities slows the financing of these facilities.

Energy

Oil’s range bound trading in recent days reinforces the narrative that investors are shrugging off apprehensions that tankers may be at risk from attacks around the Red Sea. Meanwhile, the ongoing winter storm in the US is likely to have reached its peak reverberations on US gas production – on net, the colder spell is unlikely to materially tighten 2024 balances (US Henry Hub remains one of most bearish 2024 commodities calls), see here.

Base metals

Copper has been trading lower in recent sessions, as the latest economic data from top consumer China is underwhelming investors. The data contributed to a downbeat mood across base metals, with aluminium and zinc pacing losses.

Precious metals

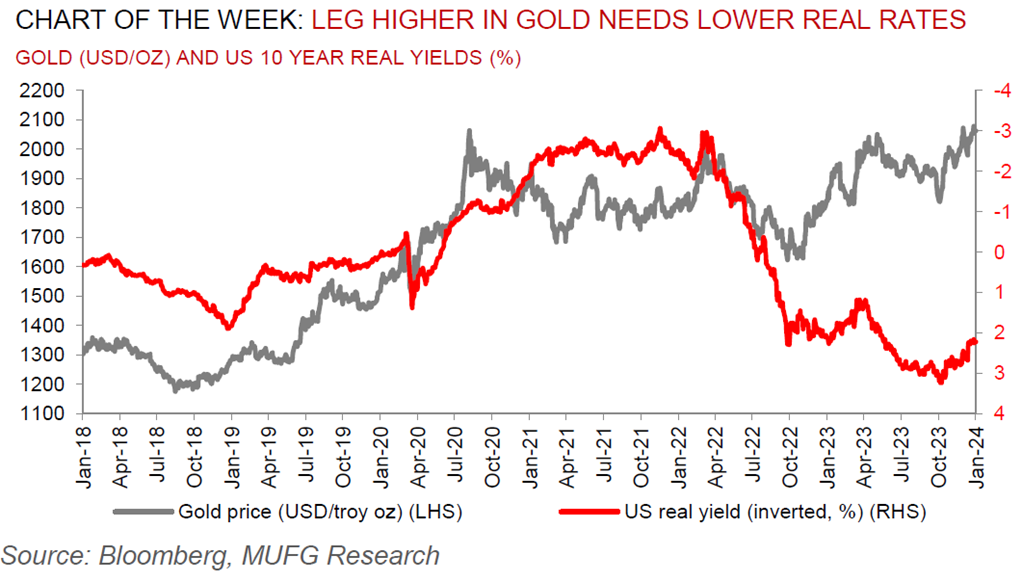

Gold is trading slightly lower following a hotter-than-estimated US retail sales report reinforced views that bets on aggressive easing by the Fed are overdone. Having said that, gold remains an attractive asset in current macro setting where a decline in real rates boosts gold demand on falling opportunity cost of holding gold and higher rates can lead to a haven bid.

Bulk commodities

Iron ore may have scope for further downside following China’s weak industrial production data that confirmed a collapse in steel production in December 2023. Data is showing homebuyers are backing away from developers’ presold homes on fears on construction halts, according to reports.

Agriculture

Wheat prices are rising with the market weighing the risks brought by freezing weather in the US and signs of returning demand from key global importers.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.