Commodities Weekly

- Mar 07, 2024

To read the full report, please download the PDF above.

OPEC+ demonstrates that boring can be beautiful

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

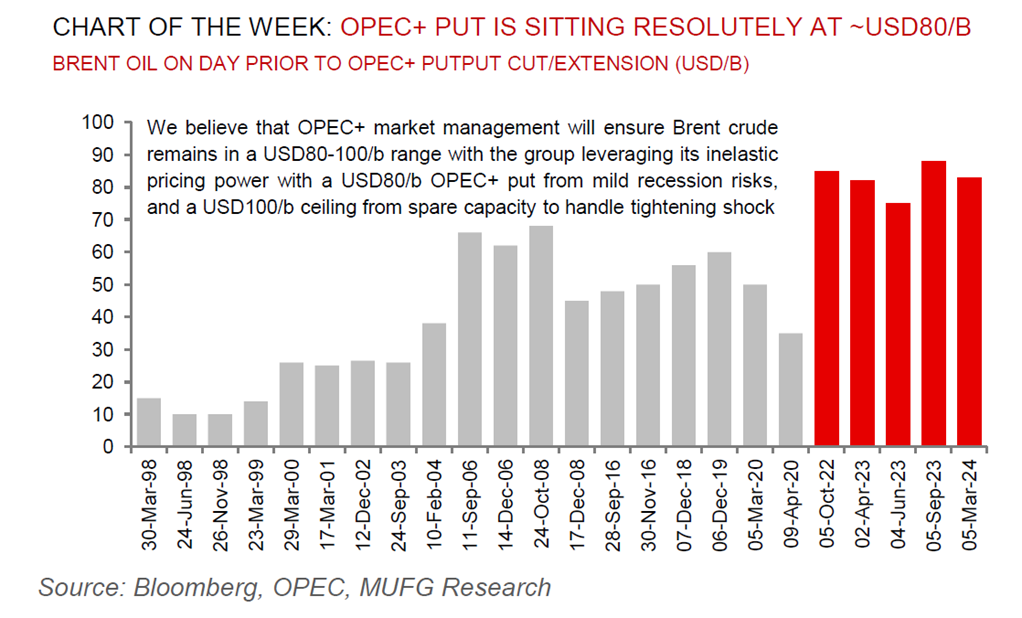

As had been widely anticipated, OPEC+ announced at its 3 March meeting a three month extension of its existing production cuts until the end of June. For context, the existing 2.2m b/d of cuts include Saudi Arabia’s voluntary 1m b/d (in place since July 2023), 0.5m b/d from Russia and an extra 0.7m b/d across six members (Algeria, Kuwait Iraq, Kazakhstan, Oman and the UAE). Given the group’s historical track record of erring on the side of caution, we continue to believe it will be cognisant of adding barrels to global markets unless conditions warrant it. Indeed, despite current futures trading in backwardation (signalling market tightness), the upcoming second quarter planned refinery maintenance season reduces the need for marginal volumes. As we catalogued in our 2024 energy outlook, we believe that OPEC+ market management will ensure Brent crude remains in a USD80-100/b range with the group leveraging its inelastic pricing power with a USD80/b OPEC+ put from mild recession risks, and a USD100/b ceiling from spare capacity to handle tightening shocks (see here). Looking ahead, whilst we expect OPEC+ unity and supply discipline to remain resolute this year, we flag two key risks in 2025 for the group – (i) a US shale pivot back towards “volume over value”; and (ii) slowing global oil demand due to vehicle electrification. More critically, we remain of the view that OPEC+ lacks a credible exit strategy with little space to fully unwind its existing cuts in the medium term.

Energy

Oil’s slow-but-steady advance this year still has further to run in the near term in the wake of the OPEC+ decision to rollover its output cuts to June, and we reiterate our forecasts for Brent to rise and average USD88/b in H2 2024. While oil’s often given to haring around, it’s the snails slow-and-steady pace that we are convinced will be more effective as the year further advances, than the animal spirits at the current juncture.

Base metals

Base metals had a tame February as China’s Lunar New Year holiday brought seasonal slowdowns. As March advances, attention remains laser focused on China after it kicked-off annual parliamentary sessions with ambitious growth goals and the base metals complex is looking for further stimulus measures to alleviate some uncertainty over China’s economic prospects.

Precious metals

Notwithstanding the significant velocity of gold’s recent gains, the case for further patient advance with each passing day looks intact. We reiterate our 2024 commodities views that gold is our most bullish call this year (year-end forecast of USD2,350/oz), on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Iron ore prices continue to oscillate as investors remain undecided about the strength of China’s demand for steel ahead of the country’s normal peak construction season. Mills could take to replenishing iron ore inventories if profit margins improve, though the pace of replenishment still hinges upon steel demand.

Agriculture

Palm oil has climbed to its highest level in more than six months on apprehensions surrounding stagnating production in Southeast Asia and a surge in Malaysian exports.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.