Europe Weekly Focus

- Mar 15, 2024

- The monthly estimate of UK GDP moved higher in January. While the series is volatile and prone to revision, the details support our view that the UK technical recession in H2 2023 will be mild and short-lived. We are tracking GDP growth at 0.2% Q/Q in Q1 and expect growth conditions will continue to improve over coming months as households benefit from easing inflationary pressures.

- The UK data flow has also been broadly positive from a monetary policy perspective with further signs of increased labour market slack. But wage growth is still too hot for comfort and policymakers will want to see clearer evidence that underlying price pressures are easing before laying the ground work for impending rate cuts. The BoE will likely maintain its current holding pattern at next week’s policy meeting – but we continue to see a path to rate cuts by the summer.

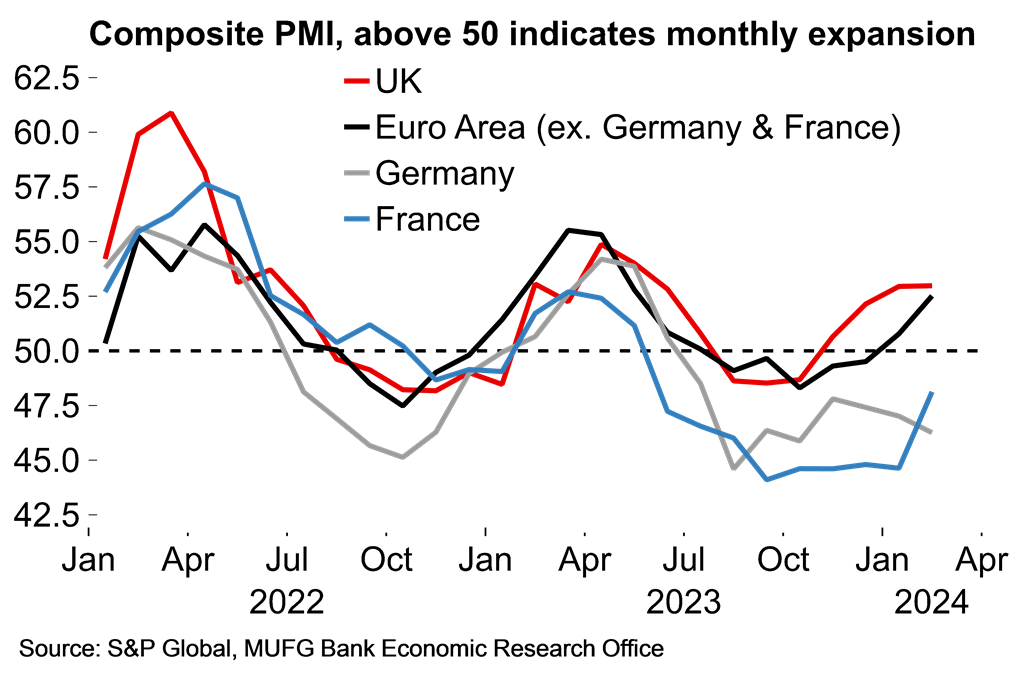

- There will also be a range of survey indicators for March released next week. The euro area PMIs have pointed to a two-speed economy at the start of 2024 – with activity in Germany and (to a lesser extent) France lagging behind peripheral countries. We expect slightly better news in the flash March figures as growth conditions continue to improve.

The UK economy started 2024 on a firmer footing

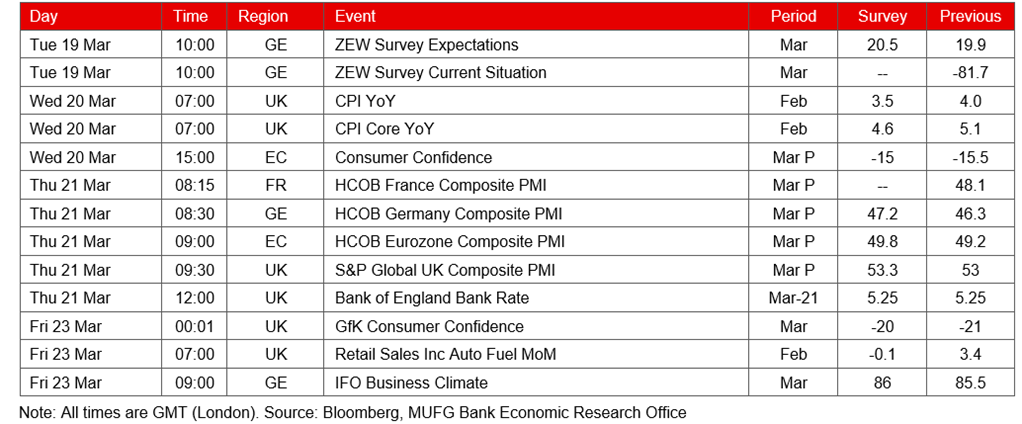

The monthly UK GDP estimate showed 0.2% M/M growth in January. While this represents a good start to the year after the deeper-than-expected 0.3% Q/Q contraction in Q4 2023, it’s still too early to definitively declare that the economy has turned a corner. The monthly growth numbers are both volatile – fluctuating around an essentially flat trend since 2022 – and prone to significant revision. The broader picture remains one of a stagnant UK economy: GDP was slightly down on a rolling three-month basis (-0.1% 3m/3m) and annually (-0.3% Y/Y).

That said, our view remains that the H2 2023 UK technical recession will be mild and short-lived. Across Q1 as a whole we are currently tracking GDP growth at 0.2% Q/Q. After a strong start to the year, there has been some signs of moderation in a few key surveys recently – both consumer confidence and the UK services PMI edged a little lower in February. But the overall picture from the soft data remains markedly stronger than it did in Q4 last year and is consistent with a return to growth this quarter.

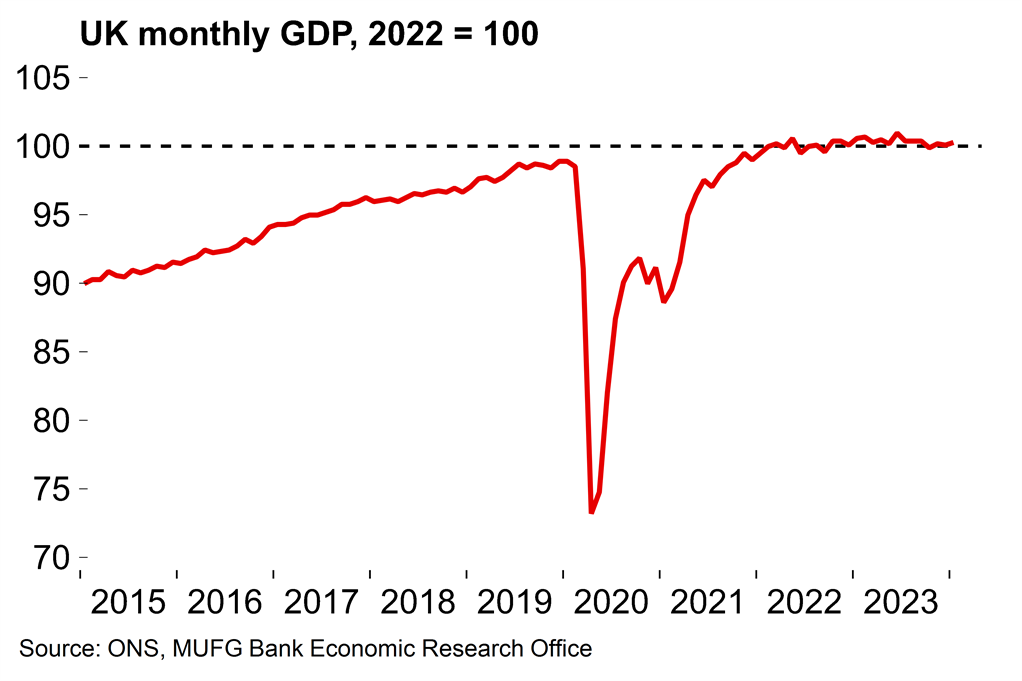

We continue to see consumer spending as the key growth engine. There was good news in the January retail sales numbers (+3.4% M/M) and there’s been nothing in weekly retail footfall or debit/credit card spending data to indicate a significant slowing in activity further ahead in Q1, despite the slightly weaker consumer confidence number in February. Further ahead, real household income will be boosted with headline inflation set to fall back significantly from April when the household energy price cap will be reduced by 12.3%, while the personal tax cuts announced at last week’s Budget will also come into force that month.

While our base case for the UK economy is a consumer-led recovery this year, there is a risk that sentiment, both for consumers and businesses, could be punctured somewhat if the BoE fails to deliver the expected degree of easing. The latest PMI release noted that optimism was, at least in part, linked to “lower borrowing costs” amid firmer expectations for BoE rate cuts. Market participants are currently pricing in around 65bp of cuts this year – down from around 160bp at the start of 2024.

Chart 1: The general UK growth trend remains flat

Chart 2: Consumer conditions continue to improve

BoE preview – Waiting for the path to clear

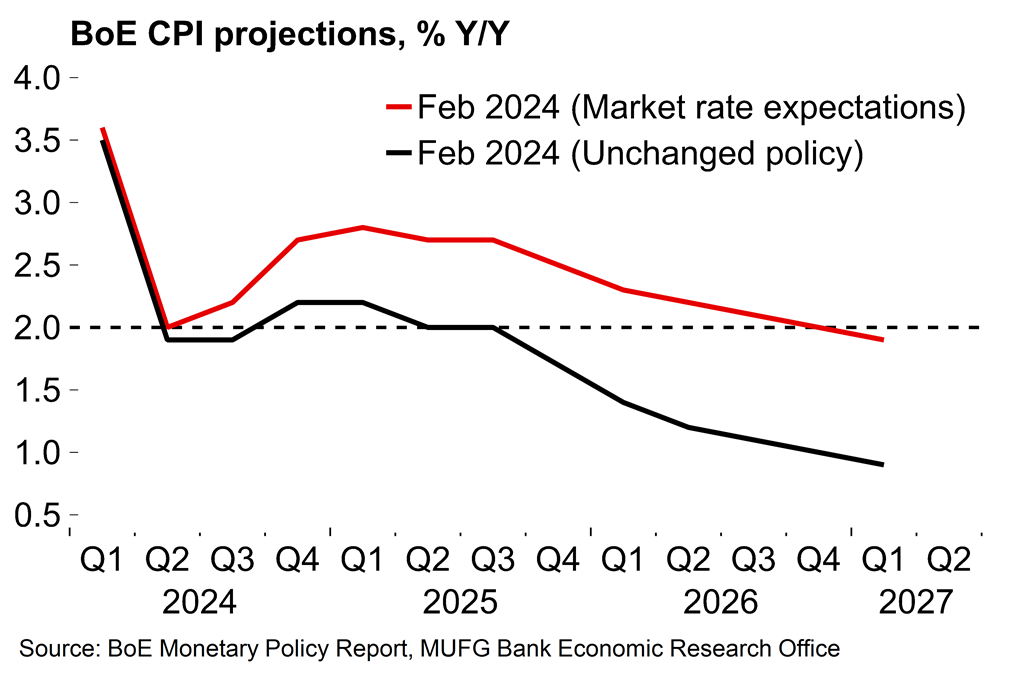

As with other major central banks, the BoE is edging towards rate cuts. At the last policy meeting the previous tightening bias was dropped and Governor Bailey noted that the “key question” is now “how long” the current restrictive policy setting will need to be maintained. Additionally, the updated BoE projections now have the headline CPI rate below 2% by 2025 if policy is left unchanged (i.e. rates remaining at 5.25%) – which can be seen as a tacit acknowledgement that some easing will be required to avoid undershooting the target.

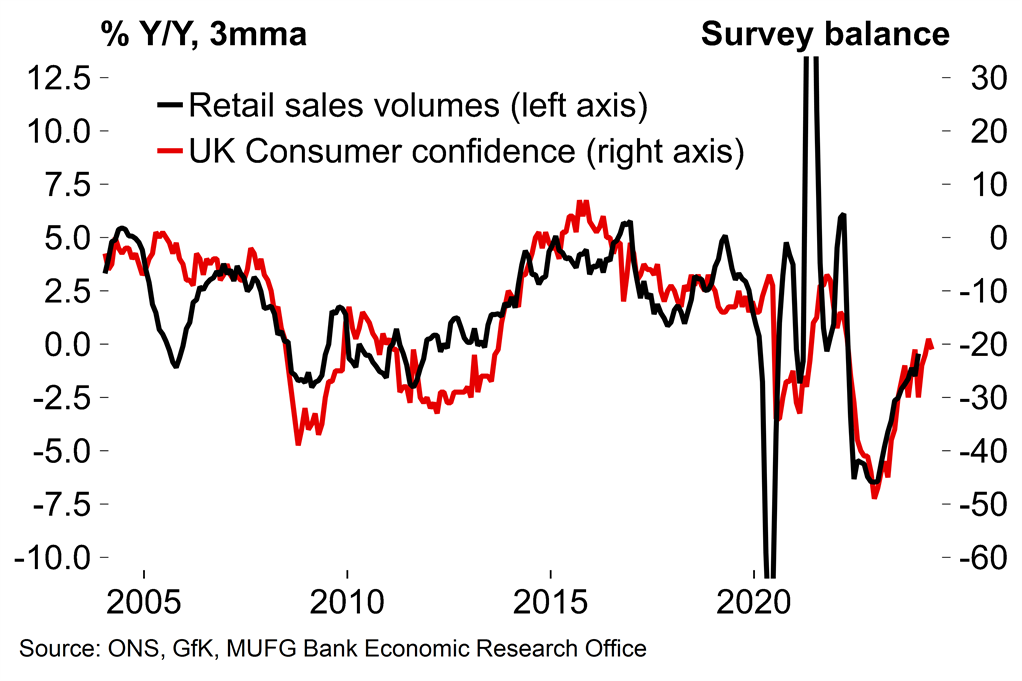

The question is now one of timing. The BoE seems somewhat confident that inflation is converging sustainably towards target, but wants more concrete evidence that the key indicators at this point in the disinflation process, namely wage growth and services inflation, are cooling before starting to ease policy.

The data since February has been broadly encouraging. Headline inflation did remain unchanged at 4.0% in January, and the services component edged up to 6.5% - but this was lower than the consensus (6.8%) and not as bad as the BoE feared after previously flagging that a “temporary spike” was likely due to base effects. There will be another CPI release next Wednesday ahead of the BoE meeting – the consensus is for a 0.5pp fall in the headline rate.

Meanwhile the news on labour market slack has been broadly positive from a monetary policy perspective. The official unemployment rate edged up to 3.9% in the three months to January, while the number of unfilled vacancies has fallen for 21 consecutive months now. The BoE will be sensitive to ongoing issues around the veracity of the official labour force survey data (the main issue is falling response rates - see here). But the KPMG/REC UK jobs survey this week (see here) and Xpert HR pay growth measures, both of which have been mentioned by the BoE previously, also suggest cooling labour market pressures.

Chart 3: Services inflation remains sticky

Chart 4: Signs that UK pay pressures are now easing

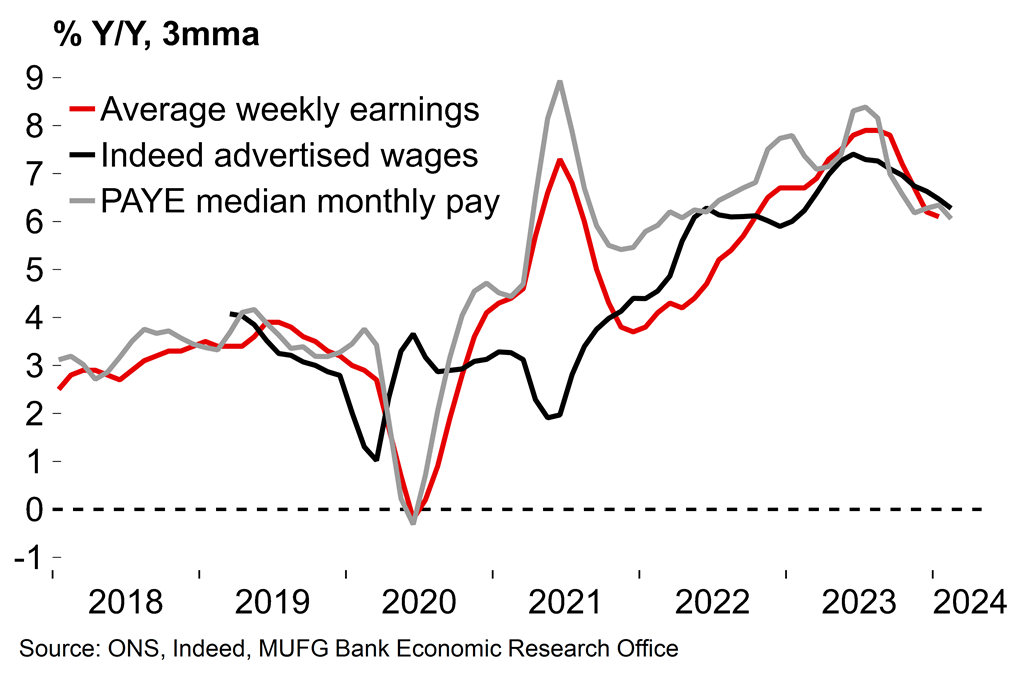

Against that background, annual growth in regular earnings (ex. bonuses) slowed to 6.1% Y/Y in the three months to January. The single month figure for private sector wage growth stood at 5.8% Y/Y in January, and will probably undershoot the BoE’s latest estimate of 5.7% Y/Y in Q1 as a whole. Again, while there are issues around the accuracy of the ONS numbers, it’s a similar story in other data such as the Indeed negotiated wage tracker which continued to show easing pay pressures in February. The flash PAYE estimate of median pay growth also fell sharply in February (from 6.4 to 5.5% Y/Y).

At the last meeting Bailey said “we will have plenty more data to work with by the time we next meet”, and our view is that things have generally moved in the right direction for the BoE. The MPC was notably divided last time out – six members voted for no change, one for a cut and two for another hike. It’s possible that one, or both, of the hawkish pair could vote for no change this time given the general trend of gradually favourable data developments. Nonetheless, pay growth is clearly still hot and much higher than would be consistent with the 2% inflation target. There are some other reasons for caution. The UK minimum wage will increase by 9.8% from April. Many mobile and broadband contracts will also increase in April by the December rate of CPI plus 3.9pp (i.e. 7.9%) which could push up the rate of services inflation. Policymakers may want to wait to see the effect of these developments in the CPI before having more confidence in the outlook. The April CPI numbers will not be released until after the BoE’s policy 9 May meeting, while the May CPI numbers will be out just before the 20 June meeting.

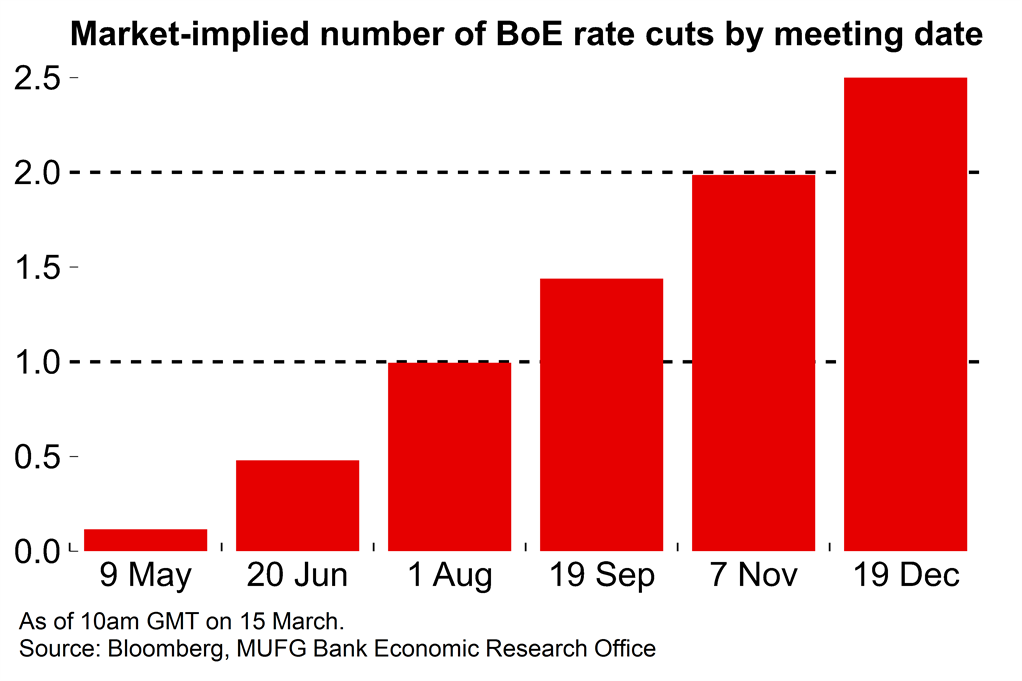

Chart 5: Market participants have priced in a full cut by the August meeting

Chart 6: The BoE’s latest projections suggest cuts are needed to prevent inflation undershooting the target

So, any shift in tone at this meeting is likely to be gradual. The BoE is probably content with its current holding pattern and will want to retain as much flexibility as it can over the timing of rate cuts. Market pricing currently suggests it’s a 50-50 call between June and August for the first rate cut. That feels broadly appropriate to our minds. The last hike was in August 2023 and, historically, it’s highly unusual for peak rates to be maintained for over a year. Meanwhile, the real policy rate will continue to rise over coming months as the disinflation process continues.

There’s also a window before conditions might make it tougher to embark on an easing cycle. The BoE’s latest projections suggest that inflation will fall sharply to below target in Q2 (following the fall in household energy prices from April) before edging up again later in the year due to the persistence of some underlying price pressures. Our view is that inflation will prove to be a little less sticky than the BoE set out in the last batch of projections. Nonetheless, policymakers will be mindful of the numbers as they stand and that it would be a communication challenge to start the ball rolling on rate cuts when headline inflation is moving higher.

There’s also the extra complication of it being an election year in the UK – our base case is that the vote will be held in the autumn. The BoE did cut rates just 20 days prior to the 2001 general election, but that was another step in an already-established easing cycle. Starting the rate cut process close to the election this time would be especially sensitive, politically, and we suspect that policymakers will want to have kicked off by the summer for that reason.

Overall, we expect that the path to rate cuts should look increasingly clear over coming months. As it stands we are leaning towards August for the first move given still-high pay growth numbers, but it’s a close call.

Next week – PMIs may provide further evidence of gradually improving growth conditions

Chart 7: Sentiment has looked stronger in the UK and peripheral euro area economies

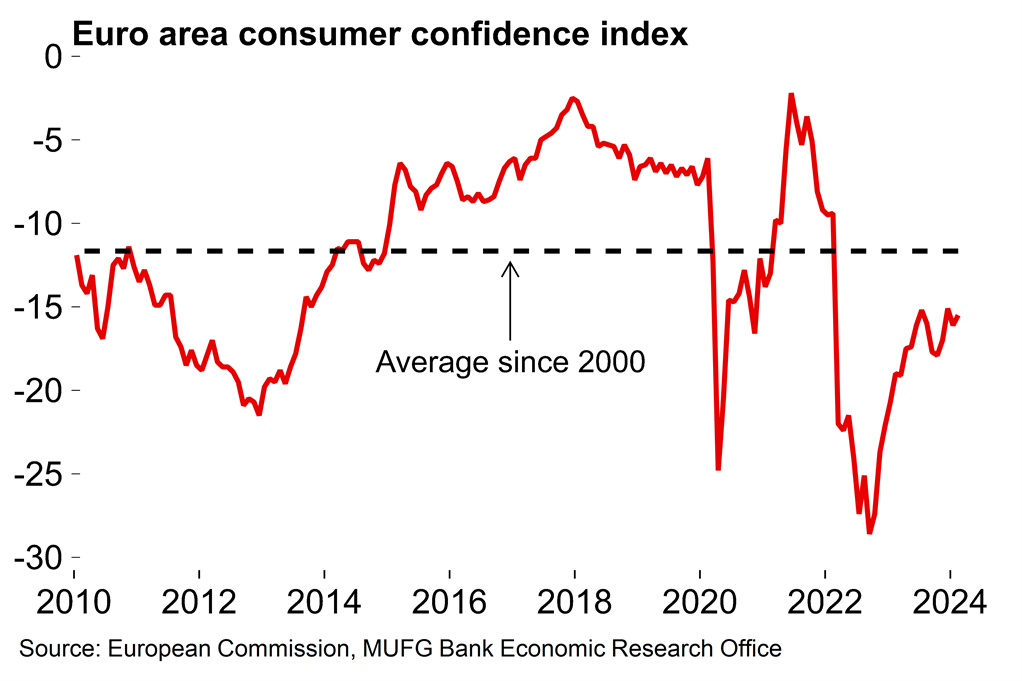

Chart 8: Euro area consumer confidence has scope for further gains

As well as the BoE meeting and UK CPI data mentioned above, there will be a range of key European survey data for March released next week. The focus will be on the flash PMIs for March.

So far this year the PMIs have painted a picture of a two-speed euro area economy in 2024, with activity growth in Germany and France lagging behind that of peripheral countries (Chart 7). While there was decent improvement in the French numbers in February, the composite figure remained in contraction territory. The German PMI weakened further, however, but this came in contrast to slightly better news in the national ifo and ZEW surveys (both of which will also be released next week). We expect to see further signs of stabilisation for the German economy in the March number with a slightly better PMI figure. For the euro area as a whole, there should be stronger signs that growth could pick up after the flat Q/Q GDP reading for Q4 last year as inflationary pressures continue to fade. There will also be consumer confidence numbers released for the euro area and UK next week – again, it should be a story of mild improvement but with overall levels remaining weak by historical standards.

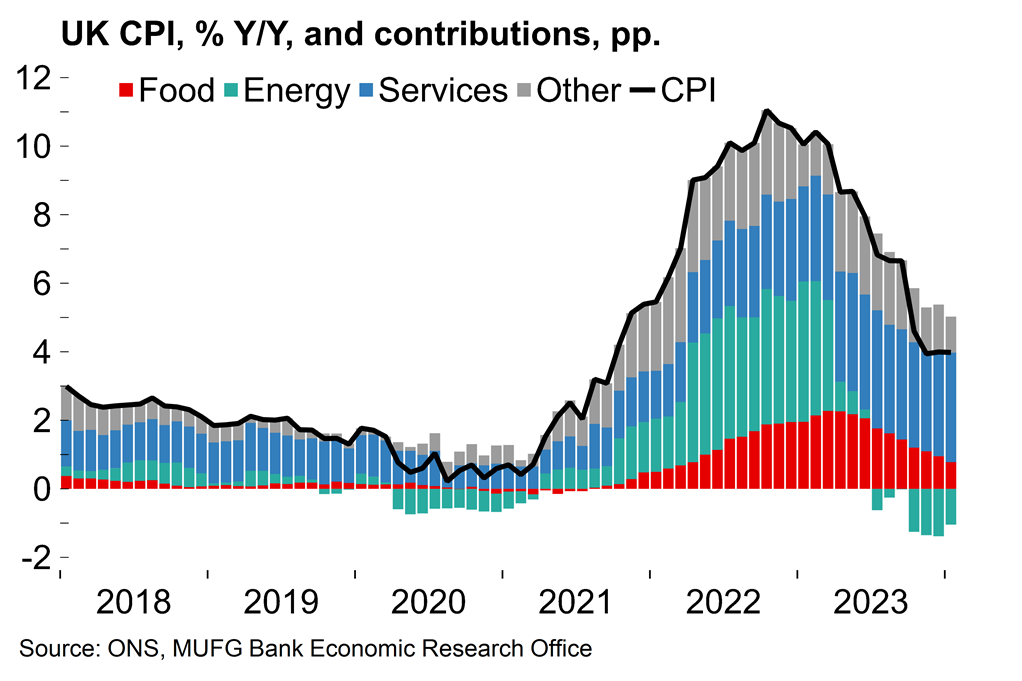

Key data releases and events (week commencing Monday 18 March)