Asia FX Talk - Qualitative evidence of softer US

- Apr 18, 2024

Ahead Today

G3: US existing home sales, US Initial Jobless Claims, Fed’s Wiliams, Bowman and Bostic speaks, Australia Employment Change, Japan National CPI

Asia:

Market Highlights

The US Fed Beige Book provided some qualitative evidence of a US economy that is moving towards better balance and softer demand that the Fed wants to see. It highlighted that firms ability to pass on cost increases to consumers had ‘weakened considerably in recent months. There were also several reports of weakness in discretionary spending with consumers’ price sensitivity remaining elevated, even as firms were cautiously optimistic overall. Meanwhile, firms reported increases in labour supply with wage growth returning to their historical averages, while also highlighting that price increases were modest on average notwithstanding some sharp increase in insurance rates.

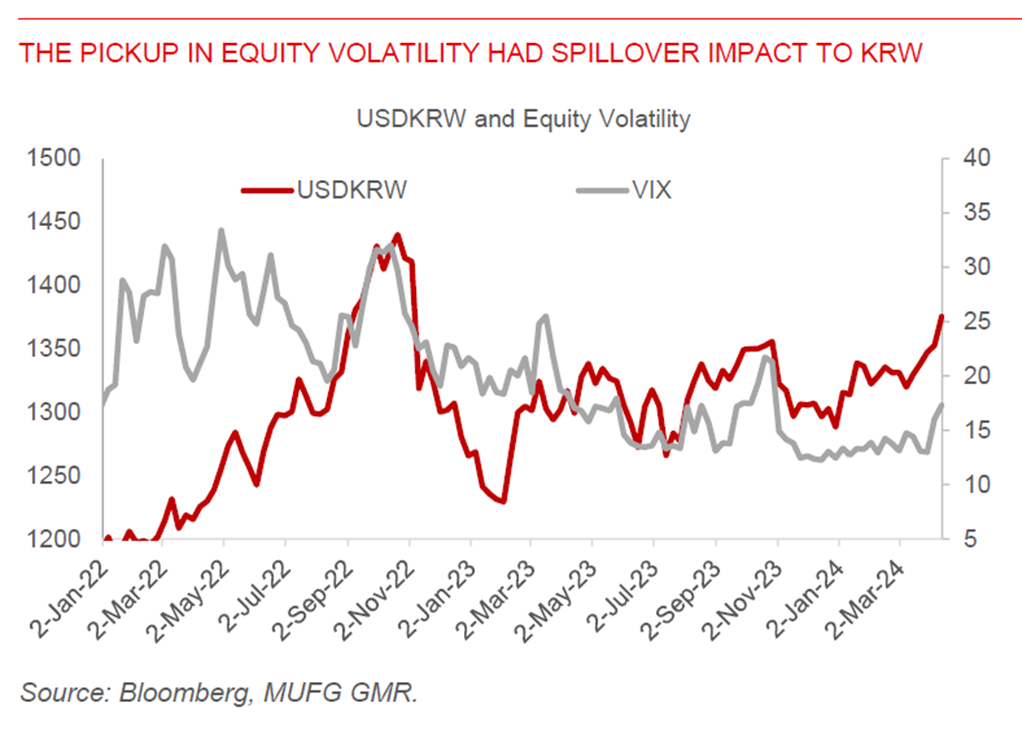

The stronger Dollar trend has certainly added to consternation among officials overseas, with the US to some extent exporting its inflation problem to other countries through the Dollar. Japanese Finance Minister and South Korea Finance Minister discussed currencies and noted serious concerns of Japan and South Korea on the sharp depreciation of the Japanese Yen and the Korean won, which US Treasury Secretary Yellen acknowledged.

Overnight, markets staged a relief rally with US 10-year yields falling to 4.6%, the Dollar weakening by 0.2%, while US equity markets declined by 0.6% although this was more controlled with the Vix coming off from elevated levels.

Regional FX

Asian FX markets traded somewhat stronger with the weaker Dollar, with USDCNH at 7.245, USDSGD at 1.360, and USDKRW at 1379 following the joint comments between Japan, South Korea and the US on JPY and KRW currency weakness. While all Asian currencies have been impacted by the stronger Dollar, the Vietnam Dong in particular seems to have been hit quite hard by its own historical standards. We revised up our USDVND forecasts to 25,800 for 2Q2024 and 26,000 for 1Q2025 (up from 24,8000 previously), given our expectation for a stronger Dollar near-term, coupled with more persistent than expected domestic capital outflows. Our forecasts imply front-loaded VND weakness and underperformance against other Asian currencies. The bias of risk is tilted towards VND weakness, especially if the State Bank of Vietnam chooses to adjust the ceiling of the trading band upwards, which we stress is not our base case right now (see VND – Caught between a rock and a hard place). Meanwhile, BSP Governor Remolona said that the central scenario would be for rate cuts in 4Q, but if things turn out worse, the BSP may postpone rate cuts to 1Q2025, with the recent PHP movement so far not going to change what the BSP might be doing at the next policy meeting on 16 May.