ChinaPulse - How to understand Q1 and March data?

- Apr 19, 2024

How to understand Q1 and March data

Key Points

China economic data indicated a good start of year 2024 in Q1. However, the softer March data and the negative GDP deflator made market participants less enthusiastic. It is fair to say that Chinese economy was on a modest expansionary path in both Q1 and March, in our view. Look forward, for Q2, we see potential drags caused by the low capacity utilization rate of the industrial and recent declining money supply growths. The sequential large rebound of property sales and investment in March shall give some comfort that households have been responding to the policy stimulus. In Q2, the potential faster issuance of budgeted government bonds could also help boost the economic recovery. It is likely for Chinese economy to deliver an above 5.2% growth in H1, given Q1’s high base and continued policy stimulus.

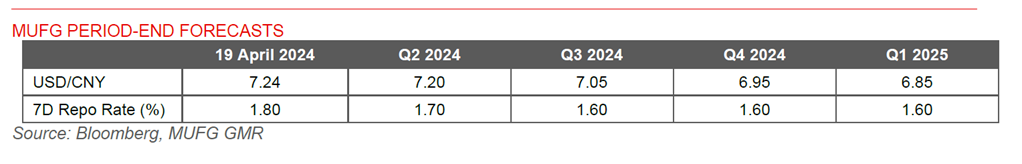

As for USD/CNY, we think that PBOC likely maintains stable USD/CNY fixings close to 7.1 in near term.

We revise up USD/CNY forecast slightly to 7.20 for the end of Q2, due to the views of a stronger US dollar in near term. We still think that with potential more stable China growth, USD/CNY would decline moderately to 6.90 by the year end.

MUFG PERIOD-END FORECASTS