EM EMEA Weekly

- Apr 22, 2024

To read the full report, please download the PDF above.

Creditors remain sanguine on EM spreads – less due to higher oil and more on firmer global growth

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

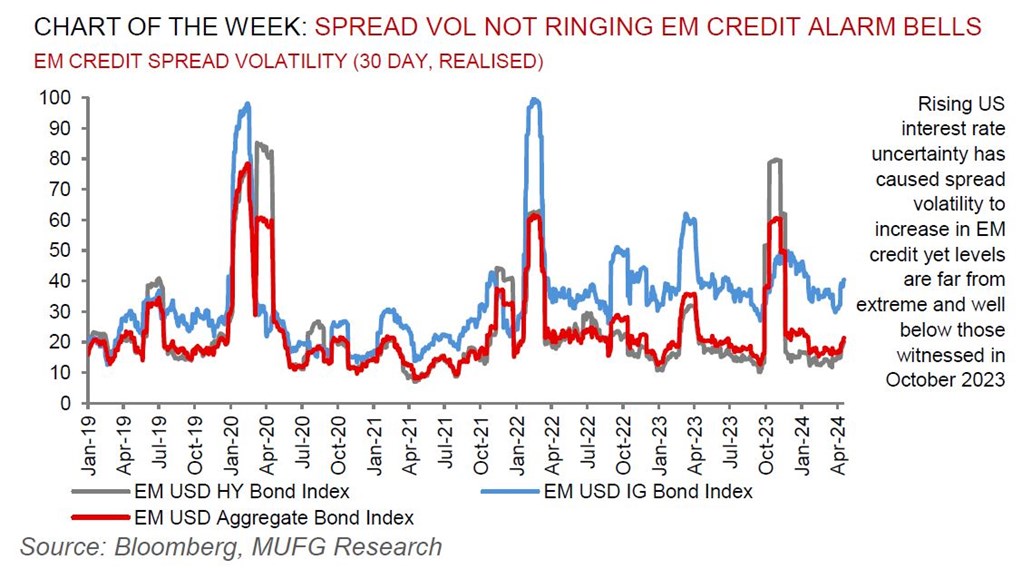

Notwithstanding heightened market volatility stemming from higher moves in US treasury yields and increased geopolitical risks, the EMBI Global Diversified index has displayed resilient spreads. Whilst such resiliency can be in part explained by the high share of oil exporters in the index that have benefitted for elevated oil prices (+14% year-to-date), our conviction is that this has more to do with the firming in global growth, which has been accompanied by a rise in US Treasury yields. Within the EMBI index, lower-rated credits have outperformed over the past few months, and on a rating neutral basis, our analysis points to sovereigns with weaker fiscal balances having outperformed sovereigns with stronger fiscal positions. This type of down in quality narrative is likely a function of strong growth, as the market discounts fiscal risks on the expectation of higher fiscal revenues. Looking ahead, if the strong growth backdrop continues and expectations for monetary easing perseveres, lower-rated EM sovereigns that have weaker fiscal metrics relative to their rating (Egypt, South Africa and the CEE economies) should continue to outperform.

FX views

EM currencies have become more volatile in recent weeks triggered both by the hawkish repricing of Fed rate cut expectations and heightened geopolitical risks in the Middle East. The pick-up in foreign exchange and bond market volatility this month has triggered at least a temporary squeeze of popular FX carry trade positions. Bloomberg’s EM FX carry trade index which measures the cumulative total return of a buy-and-hold carry trade position that is long eight emerging market currencies (BRL, MXN, INR, IDR, ZAR, TRY, HUF & PLN) funded with short positions in the USD.

Week in review

South Africa inflation eases in March but set to moderate on higher oil and weaker FX. Israel’s inflation hit a seven month high owing to higher tobacco prices (owing to higher excise duties). S&P downgraded Israel from AA- to A+ (negative) on heightened geopolitical tensions. Finally, Saudi Arabia’s FX reserves surged the most since 2008 last month.

Week ahead

In the coming week, there will be monetary policy meetings in Hungary (MUFG and consensus -50bps to 7.75%), Turkey (MUFG and consensus on hold at 50.00%) and Russia (MUFG and consensus on hold at 16.00%).

Forecasts at a glance

Growth across the EM universe is set to stabilise as domestic fundamentals offset external drags, with some rotation from the largest to smaller EMs. Inflation and interest rates are both “over the hump” – disinflation is progressing, and the decline in rates will continue and broaden in 2024 (see here).

Core indicators

According to the IIF, EM securities have now witnessed net outflows in the last five consecutive weeks on geopolitics and higher for longer.