Asia FX Talk - Settling down

- Apr 22, 2024

Ahead Today

G3: US Chicago Fed Activity

Asia: China loan prime rate, Indonesia trade balance, Taiwan export orders

Market Highlights

Brent oil prices settled down further to US$87 from more than US$90 at one point, as markets further digested the impact of Israel’s retaliatory strike on Iran. The latest news reports suggest Iran was downplaying the latest strike, while also signalling no plan to retaliate against Israel. All these points in the near-term towards de-escalation but obviously the situation is still fluid and the situation could change quickly.

Risk assets sold off with the S&P500 declining 0.9% into the weekend, and ahead of key earnings reports by Big Tech companies this week, with AI-personified Nvidia declining sharply by 10%. Certainly valuations are high across the board, and it’ll be important to justify these an earnings perspective. From a macro perspective, the nascent turn in the global tech and manufacturing cycle we are seeing should help support global growth, and limit the extent of Dollar strength over the medium term, assuming tail risks such as in the Middle East conflict do not materialize.

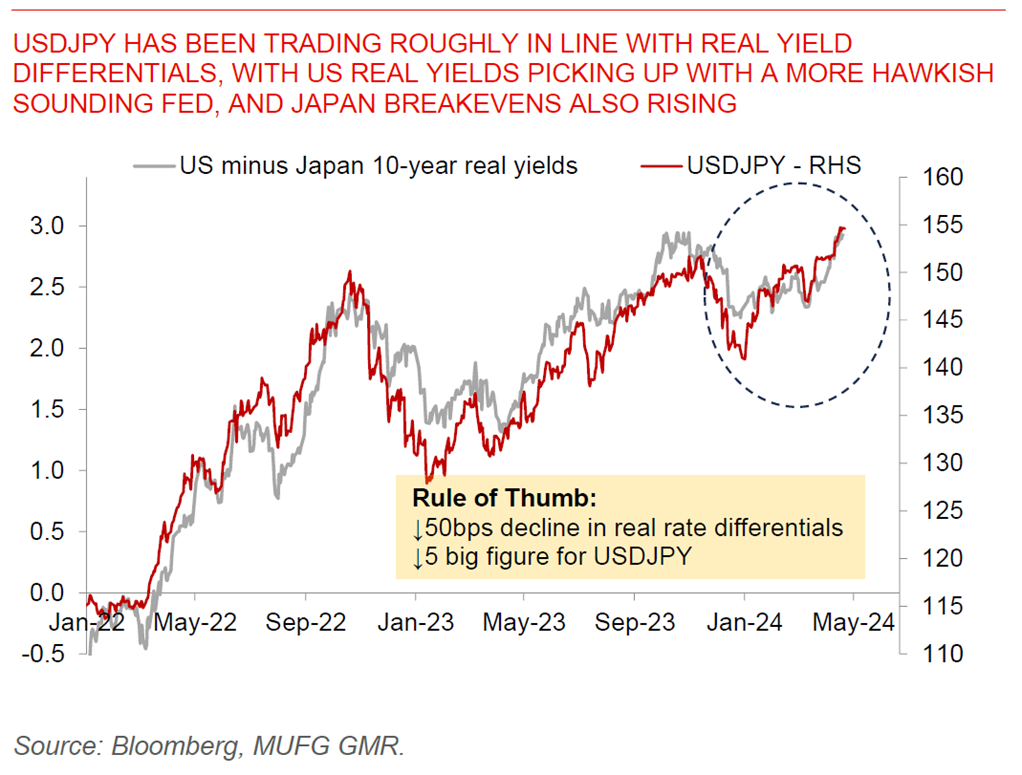

Markets will also watch closely for any signs of FX intervention by Japan, and also ahead of the Bank of Japan policy meeting later this week. While BOJ is expected to keep rates on hold, it is also expected to publish FY26 inflation estimates for the 1st time, which is likely to show an inflation rate of at least 2%.

Regional FX

Asian FX markets traded somewhat stronger with the weaker Dollar during the Asia open, with USDCNH at 7.251, USDKRW at 1377, and USDSGD at 1.361. The key event in Asia is China’s loan prime rate decision, where consensus is expecting no change in both the 5-year and 1-year rate for this meeting. Over the course of this year, we do expect Chinese authorities to cut rates by around 20-30bps, in part to help support bank NIMs and as such filter through the China’s economic growth. The Philippines released its March Balance of Payments data, which showed a strong surplus inflow of US$1.1bn, helped in part by the government’s Dollar borrowing together with other inflows such as the remittances and FDI. The recent sharp weakness in the PHP was likely driven by the sharp risk-off mood, fears of rising oil prices and unwind of EM carry trades, but seems a little excessive to our minds. The BSP has been surprisingly hands-off thus far in intervening, but will likely step in if these FX moves continue.