Asia FX Talk - A significant shift in US rate cut outlook

- Apr 23, 2024

Ahead Today

G3: US PMIs, new home sales, Richmond Fed manufacturing index, eurozone PMI

Asia: India PMI, Singapore CPI, Taiwan industrial production

Market Highlights

Israel’s retaliatory military strike against Iran’s missiles attacks has raised fears of a full-blown war in the Middle East. But with Iran signaling no tit-for-tat being planned in response to Israeli’s latest attack, geopolitical risks have eased somewhat for now. Brent prices retreated to $86/barrel, while gold dropped after hitting $2400/ounce.

Still, the geopolitical situation there is fluid and could quickly deteriorate. A US$95bn worth of aid for Ukraine, Israel, and Taiwan has also been approved by the US House. This could keep geopolitical risk premium high for now.

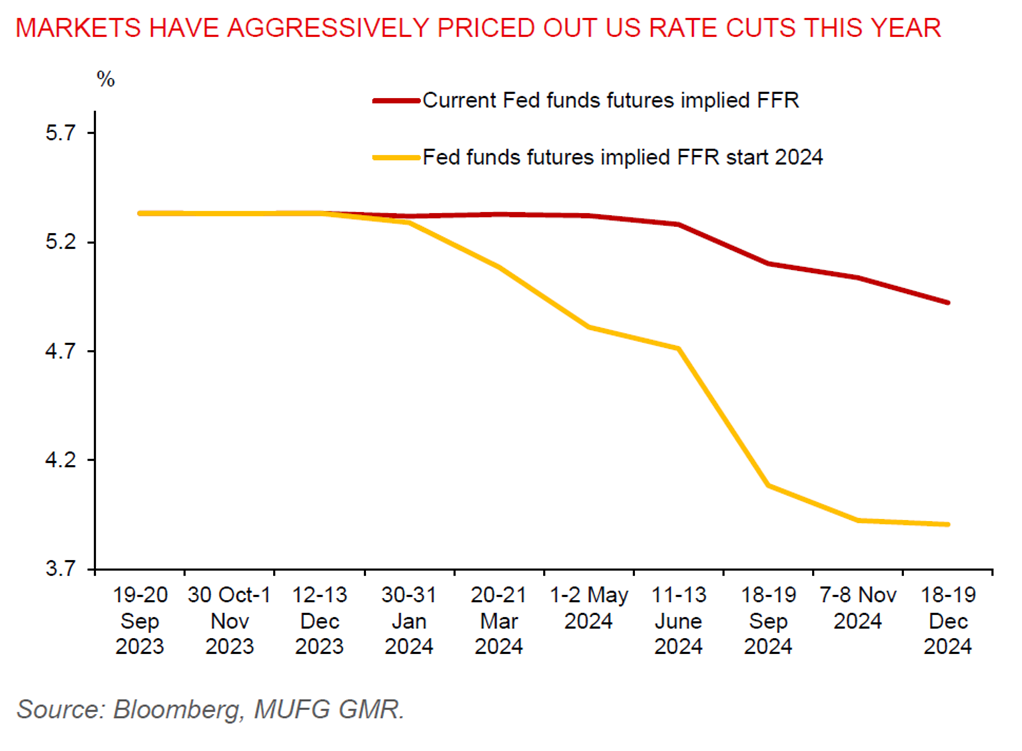

Meanwhile, markets expect only 1 or 2 US rate cuts this year, which is more hawkish than the Fed’s median dot plot of 3 cuts and a far cry from the 6 cuts that markets anticipated at the start of the year. The odds of a US rate hike have also increased. The US 10-year yield stayed elevated at 4.63%, hovering near to the year-to-date high of 4.67%, while FX hedging costs have picked up as markets price out US rate cuts.

The risk of FX intervention by Japanese authorities has been growing, with USJPY now trading at the 155 level and Japan’s finance minister voicing serious concerns about the yen weakness.

Regional FX

Asian FX markets traded mixed against the US dollar. TWD and THB fell by 0.4%. CNH and SGD were flat, while the rest made very modest gains.

The PBOC has kept its 1-year LPR at 3.45% and its 5-year LPR at 3.95%, after holding its 1-year medium-term lending facility rate (MLF) unchanged at 2.50% last week. However, we see scope for the PBOC to lower its LPRs amid low inflation and a gloomy real estate sector. Property investment fell 9.5%yoy YTD in March, worsening from 9%yoy YTD in February, while residential housing sales slumped by 30.7%yoy YTD in March.

Meanwhile, Indonesia’s exports fell 4.2%yoy in March, but imports declined by a faster pace, at -12.8%yoy, resulting in the monthly trade surplus widening to US$4.5bn, from US$2.8bn from a year ago. The recent weakening of the IDR past 16,000 versus the US dollar was mainly driven by rising geopolitical tensions, resulting in BI intervening in the FX market via spot FX and domestic NDF. The yields on BI’s rupiah securities have also been raised closer to 7% to protect the value of the rupiah ahead of the BI monetary policy on Wednesday.

Singapore’s inflation data will be released later today. We think MAS core inflation will likely stay above 3%yoy in March. And it will also remain elevated in the coming months, with water prices rising in April, along with a catch-up in the cost of education and healthcare. This informs our view for the MAS to maintain its tight exchange rate policy setting for now.