FX Daily Snapshot

- Apr 23, 2024

USD & US yields consolidating close to recent highs ahead of UST auctions

G10 FX: Managing the fallout from monetary policy divergence with the Fed

The major foreign exchange rates have remained relatively stable overnight ahead of the two main event risks at the end of this week when the latest US PCE deflator report for March is released on Friday just after the BoJ’s upcoming policy meeting. USD/JPY continues to trade just below the 155.00-level and has traded within a narrow range at the start of this week between 154.46 and 154.85. Similarly, US yields have been consolidating at higher levels over the past week with the 2-year and 10-year US Treasury yields trading at around 5.00% and 4.60% respectively. After the recent adjustment higher in US yields, market participants will be watching closely to see how the Treasury market absorbs a combined USD183 billion of two-, five- and seven-year bond sales scheduled for this week.

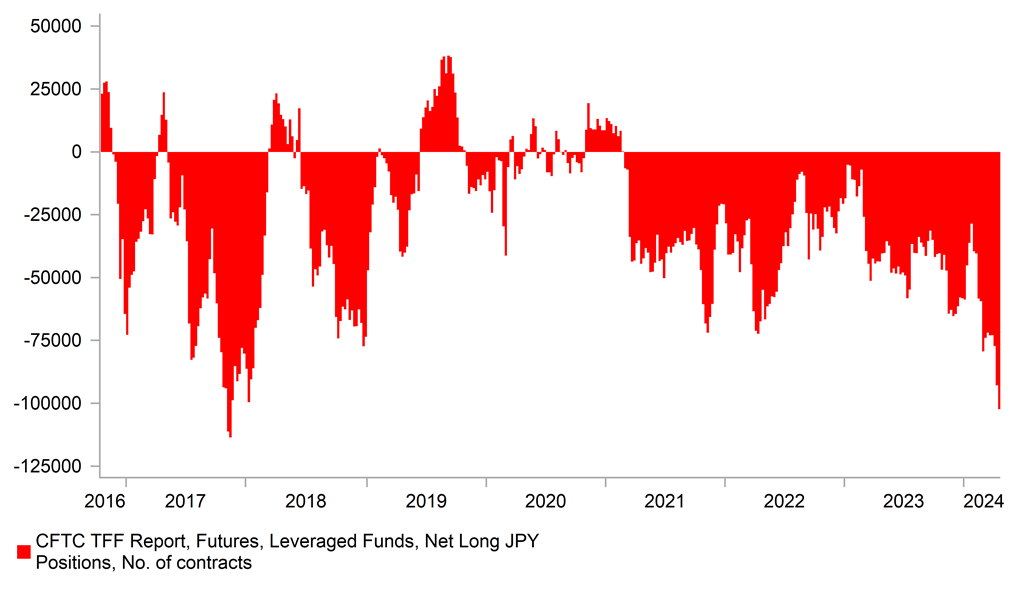

Another reason why USD/JPY has continued to trade just below the 155.00-level reflects in part the heightened risk of imminent intervention from Japan to support the yen ahead of this week’s BoJ policy meeting. The risk of imminent intervention was heightened further overnight after Japan’s Finance Minister Suzuki provided the strongest warning yet that they are moving closer to intervening. He emphasized that last week’s FX agreement between Japan, South Korea and the US in which all three countries acknowledged concerns over recent yen and won weakness was a milestone. He signalled that Japanese officials continue to watch FX moves with a high sense of urgency and won’t rule out any options against excessive FX moves. Importantly he went one step further than in the past by stating clearly that the “environment is in pace for intervention if needed”. Japanese officials remain concerned that recent yen weakness is not fully in line with recent changes in economic fundamentals since the BoJ’s last meeting in March when they exited negative rates and yield curve control. The release of the latest IMM report revealed further evidence of elevated levels of speculative yen selling in recent weeks. Speculative yen shorts have increased for the last three weeks to the week ending 16th April, and yen short positioning has reached the highest level since November 2017. Japan’s reluctance to intervene may reflect concerns over timing. If US yields continue to push higher in the near-term encouraging a stronger US dollar it would undermine the effectiveness of intervention.

At the same time, EUR/JPY is threatening to break above the 165.00-level which has held since 20th March. Yields in the euro-zone have also rebounded further this month but by much less than in the US. The scaling back of Fed rate cuts expectations has spilled over into the euro-zone rate market even though slowing inflation and weak growth in the region is keeping the ECB on course to begin cutting rates in June. A view expressed again by ECB Vice President Luis de Guindos today who stated that “if things move in the same direction as they have in recent weeks, we will loosen our restrictive monetary policy stance in June. Assuming there are no surprises between now and then”. The recent pick-up in geopolitical tensions in the Middle East does not appear to have altered the ECB’s plans for monetary easing at the current juncture. However, he did note that “as for what happens afterwards, I’m inclined to be very cautious”. A view that supports the recent adjustment in the euro-zone rate market that has moved to scale back the amount of ECB rate cuts expected this year to around 75bps. While ECB officials have stated recently that they will set monetary policy based on economic developments in the euro-zone and will not be impacted by the Fed’s policy actions, the euro-zone rate market is partly taking the view that a delayed start to the Fed’s easing cycle could encourage the ECB to be more cautious over the pace of rate cuts beyond June. A faster pace of ECB rate cuts while the Fed remains on hold would increase upside inflation risks from a weaker euro.

SPECULATIVE JPY SHORTS CONTINUE TO BUILD

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Hawkish Fed repricing & geopolitical risks undermine carry trades

Emerging market currencies have become more volatile in recent weeks triggered both by the hawkish repricing of Fed rate cut expectations and heightened geopolitical risks in the Middle East. The IDR, MXN and PHP all suffered sharp sell-offs over the past week. In contrast, the CLP and the PEN have staged stronger rebounds over the past week against the USD. While EM FX performance was mixed over the past week, the weakening trend that has been in place so far this month remains in place for most currencies. The worst performing emerging currencies so far this month have been the MXN (-3.2% vs USD), BRL (-3.0%), IDR (-2.4%), KRW (-2.3%) and PHP (-2.2%).

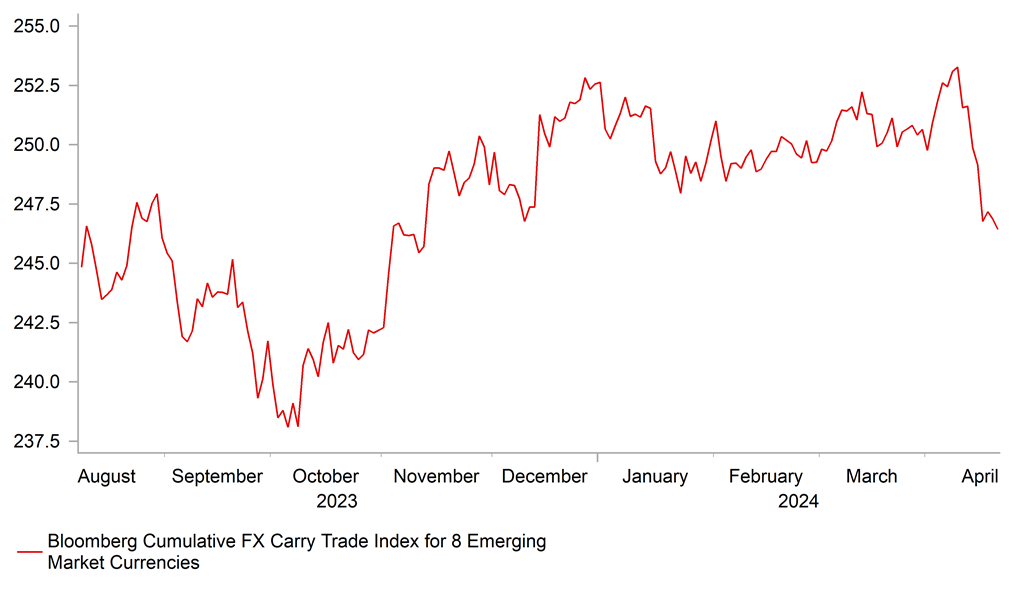

The pick-up in foreign exchange and bond market volatility this month has triggered at least a temporary squeeze of popular FX carry trade positions. Bloomberg’s EM FX carry trade index which measures the cumulative total return of a buy-and-hold carry trade position that is long eight emerging market currencies (BRL, MXN, INR, IDR, ZAR, TRY, HUF & PLN) funded with short positions in the USD. It appears that the MXN suffered a flash crash during Asian trading hours when USD/MXN jumped sharply to a high of 18.214 after it was reported that Israel had launched a retaliatory strike against Israel. Our internal JPY flows revealed that Japanese retail investors were heavy sellers of the MXN during the Tokyo trading session on Friday. Our MXN/JPY sales were over 50 times larger than the median selling flow over the last year. However, the MXN sell-off has proven short-lived with USD/MXN moving quickly back below the 200-day moving average at around 17.200 where it has been trading since last autumn. At the same time the ongoing adjustment higher in US yields which are pricing in the Fed keeping higher rates in place for longer is encouraging a stronger USD as the Fed is likely to lag behind other major central banks in cutting rates. Chair Powell signalled last week that rate cut plans are likely to be delayed beyond June.

Within EMEA, the CZK and HUF have performed relatively better over the past week while the PLN has underperformed. It marks a reversal of price action that has been in place for most of this year. The HUF has been supported by the paring back of NBH rate cut expectations ahead of today’s policy meeting. It was reported that the role of the HUF and its effect on the economy is becoming more important in setting monetary policy. It has encouraged expectations that the NBH will deliver a smaller 50bps rate cut this week and signal less easing ahead. It has helped the HUF to hold up better even as conditions for carry trades have deteriorated more broadly. Please see our latest EM EMEA weekly for more details (click here).

EM FX CARRY TRADES SUFFER SETBACK

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

MPC Member Haskel Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

S&P Global Composite PMI |

Apr |

50.8 |

50.3 |

!! |

|

EC |

09:15 |

ECB Supervisory Board Member Fernandez-Bollo Speaks |

-- |

-- |

-- |

!! |

|

UK |

09:30 |

Composite PMI |

-- |

-- |

52.8 |

!!! |

|

UK |

12:15 |

BoE MPC Member Pill Speaks |

-- |

-- |

-- |

!! |

|

GE |

12:30 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

13:00 |

Building Permits |

-- |

1.458M |

1.524M |

!! |

|

US |

14:45 |

S&P Global Composite PMI |

Apr |

-- |

52.1 |

!! |

|

US |

18:00 |

2-Year Note Auction |

-- |

-- |

4.595% |

!! |

Source: Bloomberg