Asia FX Talk - Weak US PMI data gives markets a reason to sell the US dollar

- Apr 24, 2024

Ahead Today

G3: US MBA mortgage applications, US durable goods orders, Germany IFO business expectation

Asia: Bank Indonesia policy decision

Market Highlights

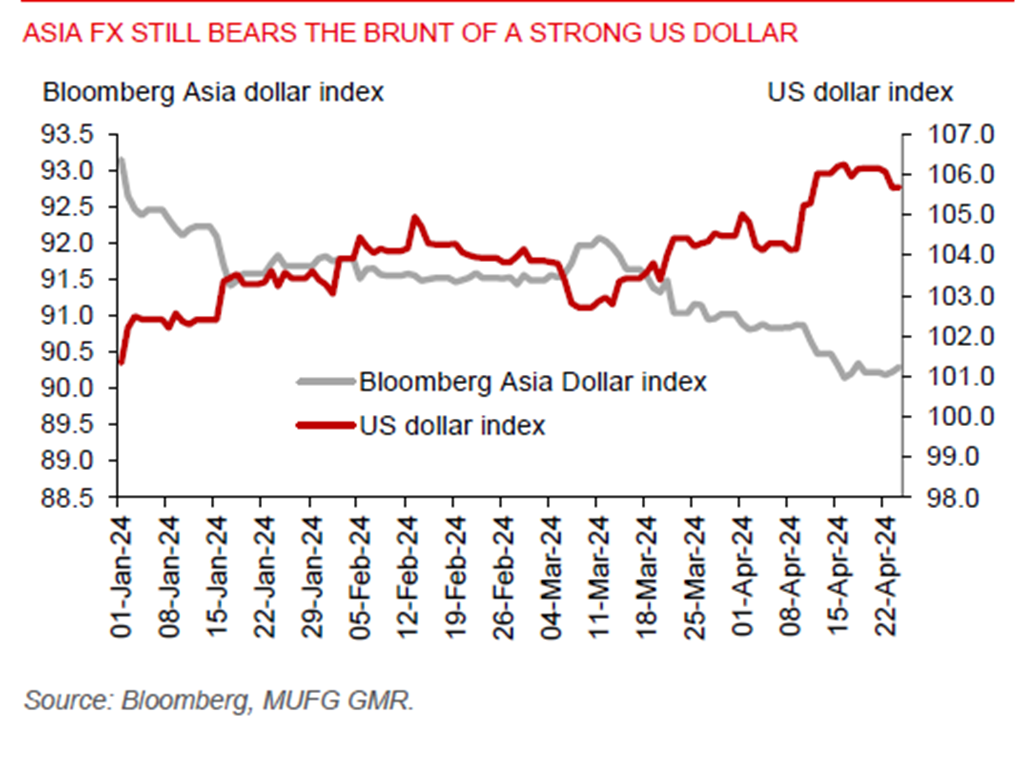

US new home sales rose to 693k annualized, the fastest pace since September 2023. But the sluggish US manufacturing PMI (which shows a slight contraction) and Richmond Fed manufacturing index gave markets a reason to sell the US dollar. The broad US dollar index (DXY) fell by 0.4%, but still stayed above the key support level of 105. US yields were lower, the S&P500 index rose 1.2%, while NASDAQ was up by 1.6% as markets await big tech earnings this week.

A slight pickup in German factory activity, coupled with a continued expansion of services activity in the euro area, pushed the eurozone composite PMI to 51.4 (above 50 indicates expansion) in April. This marks the highest level in 11 months. Markets are still pricing in an ECB rate cut in June.

Meanwhile, the risk of yen intervention is growing with USDJPY trading near the 155 level. Geopolitical tensions also look to persist. Russia has threatened to step up the offensive against Ukraine in response to recent US approval for providing new military aid to Ukraine. Brent price is still up about 14% year to date.

Regional FX

Most Asian currencies strengthened a bit against the US dollar yesterday, following broad US dollar weakness.

Bank Indonesia will announce its policy decision later today. We think the BI will keep the policy rate at 6%, with the US Fed likely to have ended its rate hiking cycle, while BI has several other FX tools to help stabilize the rupiah amid geopolitical tensions in the Middle East. That said, the odds of a 25bp BI rate hike have risen.

Singapore’s headline CPI inflation cooled to 2.7%yoy in March, from 3.4% in February and below Bloomberg consensus of 3.1%. Lower inflation was seen broadly across key categories. Indeed, MAS core inflation softened to 3.1% in March from 3.6% in February, underpinned by lower prices of food and services. Private transportation prices fell 0.3%yoy, as car prices declined in tandem with lower COE premiums. But with core inflation still above the MAS soft inflation target of “just under 2%”, we maintain our outlook for the MAS to keep its tight exchange rate policy setting for now.