Asia FX Talk - Yen remains under depreciatory pressure

- Apr 25, 2024

Ahead Today

G3: US: GDP, core PCE price index, initial jobless claims, pending home sales; Japan leading and coincident index

Asia: Thailand car sales, Malaysia inflation, HK trade data

Market Highlights

US durable goods orders rose 2.6%mom in March, up from a revised 0.7% increase in February, reflecting a still resilient US economy. US Q1 GDP will be released later today. Bloomberg consensus is for US growth to slow to a still respectable 2.5%qoq annualized in Q1, from 3.4% in Q4. The core PCE price index is also expected to rise by 3.4%qoq on a seasonally adjusted annual basis in Q1, from 2% previously. Meanwhile, the 30-year US mortgage rate has risen to 7.24% in the week ending 19 April, dampening mortgage applications. The broad US dollar index (DXY) gained 0.2% yesterday, staying above the key support level of 105. US yields hovered around 4.6%, while the S&P500 index rose 0.9%.

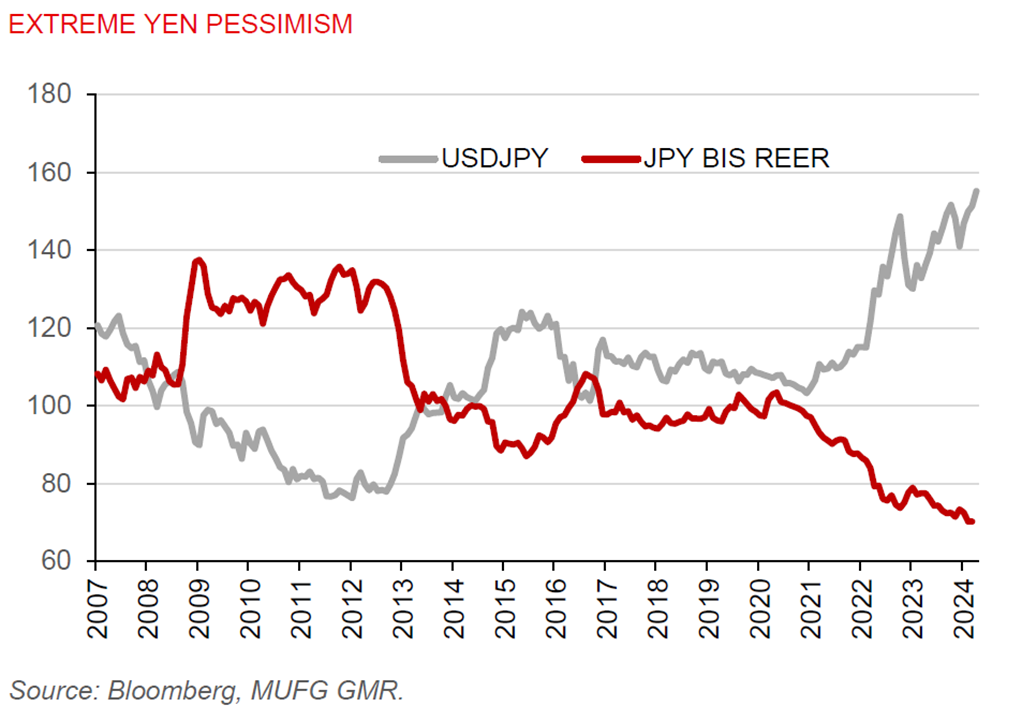

The yen has moved above 155.00 per US dollar. Apart from the risk of FX intervention and the yen being deeply undervalued, there seem to be no other major drivers to reverse the USDJPY uptrend for now. Japan’s real policy rate is negative, despite the exit from negative interest rate last month. And we expect the BOJ to stand pat at its upcoming meeting. The yen has also lost its appeal as a safe-haven currency, with a recent rise in geopolitical tensions not helping the yen.

Regional FX

Several Asian currencies strengthened against the US dollar yesterday. Notably, KRW (+0.7%) and IDR (+0.4%) were outperformers in the region. In a surprise move, Bank Indonesia (BI) raised the policy rate by 25bp to 6.25% in April to defend the Indonesian rupiah from geopolitical risks and to contain imported inflation. The surprise rate hike could help slow the pace of rupiah depreciation, but this will likely be at the expense of domestic growth. We forecast the USD/IDR at 16,200 for the next 3 months, cut our GDP growth forecast for Indonesia by 0.3ppts to 4.8% in 2024, and think BI rate cuts are likely off the table this year, as policymakers prioritize rupiah stability.

Advance estimates show South Korea’s GDP grew 1.3%qoq (3.4%yoy) in Q1, beating Bloomberg consensus for 0.6% growth. The growth pickup was driven by a recovery in exports and construction investment. Given South Korea’s economic resilience, we think the Bank of Korea will not be in a rush to cut interest rates, especially at a time of significant KRW weakness versus the US dollar.

Malaysia’s CPI data will be released later today. We think inflation could pick up somewhat due to the services tax hike starting in March, but it will remain manageable at around 2%.