Focus turning back to monetary policy divergence as geopolitcal tensions ease

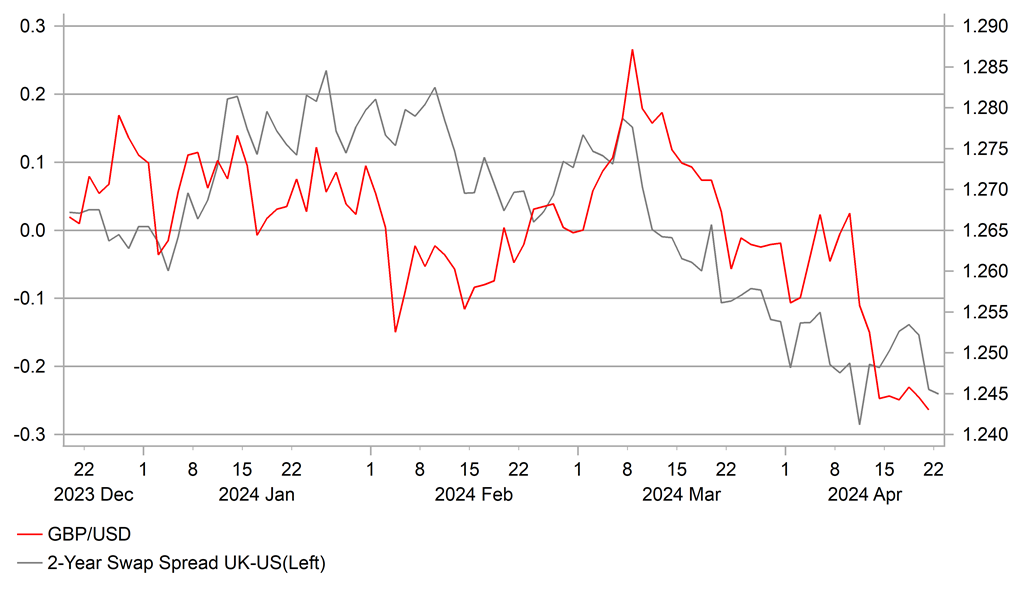

GBP: Dovish shift in BoE communication weighs down on pound

The pound has continued to trade at weaker levels during the Asian trading session following the sell-off at the end of last week. After hitting an intra-day high of 1.2468 on Friday, cable has since fallen to a low of 1.2366. Similarly, EUR/GBP closed back above its 200-day moving average on Friday for the first time since the start of this year and hit a high of 0.8618 overnight. The main trigger for the pound sell-off at the end of last week were dovish comments from BoE Deputy Governor David Ramsden who delivered a speech in Washington on Friday. He stated that risks to the BoE’s inflation forecasts are now “tilted to the downside”, and he believes that consumer prices may rise to around the BoE’s target of 2.0% in 2025 rather than accelerate to 3.0% as the BoE’s latest forecasts are expecting. A more benign inflation outlook could prompt a change in the BoE’s policy setting as he emphasized that “I will continue to take watchful and responsive approach to my policy decision. Watchful, in terms of assessing the evidence as it accumulates, and responsive in terms of the stance of monetary policy warranted by evidence”. One of the main reasons that he is less concerned by upside risks to inflation is that he believes that “the restrictive stance of policy and the more symmetric unwinding of second-round effects are also reducing the more persistent components of inflation such as services inflation”. As a result, he highlighted that the UK looks like less of an outlier in terms of recent inflation performance and more of a laggard…and one that is catching up fast”.

The comments follow on from dovish comments delivered by BoE Governor Bailey after the last MPC meeting just over a month ago in which he emphasized that rate cuts are “ in play” at all our meetings. It appears that the Governor and Deputy Governor are both shifting in a more dovish policy direction and more towards arch dove MPC member Swati Dhingra who voted for a rate cut in March. The developments are increasing the likelihood that the BoE will cut rates before the Fed. While we don’t expect a rate cut as soon as at the next MPC meeting in May unless there is a significant downward revision to the BoE’s inflation forecasts, there appears to be a higher probability that the first rate cut could be delivered at the following MPC meeting in June rather than waiting until August. It would bring the timing of the BoE’s first rate cut more into line with the ECB. The UK rate market has moved accordingly to price in around a 50:50 probability of the first BoE rate cut being delivered in June. The dovish shift in BoE rate cut expectations is beginning to have more of a negative impact on the pound in the near-term. It provides further encouragement for cable to extend the recent adjustment lower towards last year’s lows at just above the 1.2000-level while EUR/GBP could grind back up towards the 0.8700-level.

YIELDS SPREADS HAVE BEEN MOVING AGAINST THE GBP

Source: Bloomberg, Macrobond & MUFG GMR

G10 FX: Geopolitical risks in the Middle East have eased at start of the week

The foreign exchange market has remined relatively stable at the start of this week. The Swiss franc has given back some of last week’s gains that were driven by the pick-up in safe haven demand triggered by escalating geopolitical tensions in the Middle East. At the same time the price of oil has continued to adjust lower at the start of this week resulting in the price of Brent hitting a low overnight of USD86.24/barrel, and is now trading around -4.6% lower than prior to Iran’s attack on Israel from last week. Market participants have drawn comfort at the start of this week from comments by Iran’s Supreme Leader Ayatollah Ali Khamenei over the weekend who praised the country’s armed forces for their “success in recent events”. H emphasized that “in the recent operation, the armed forces manged to minimise costs and maximise gains. How many missiles were launched and how many of them hit their target is not the primary question, what really matters is that Iran demonstrated its power during that operation”. He did not comment on the apparent Israeli retaliatory strike on the central city of Isfahan on Friday which has helped to ease fears over further tit-for-tat retaliatory military action.

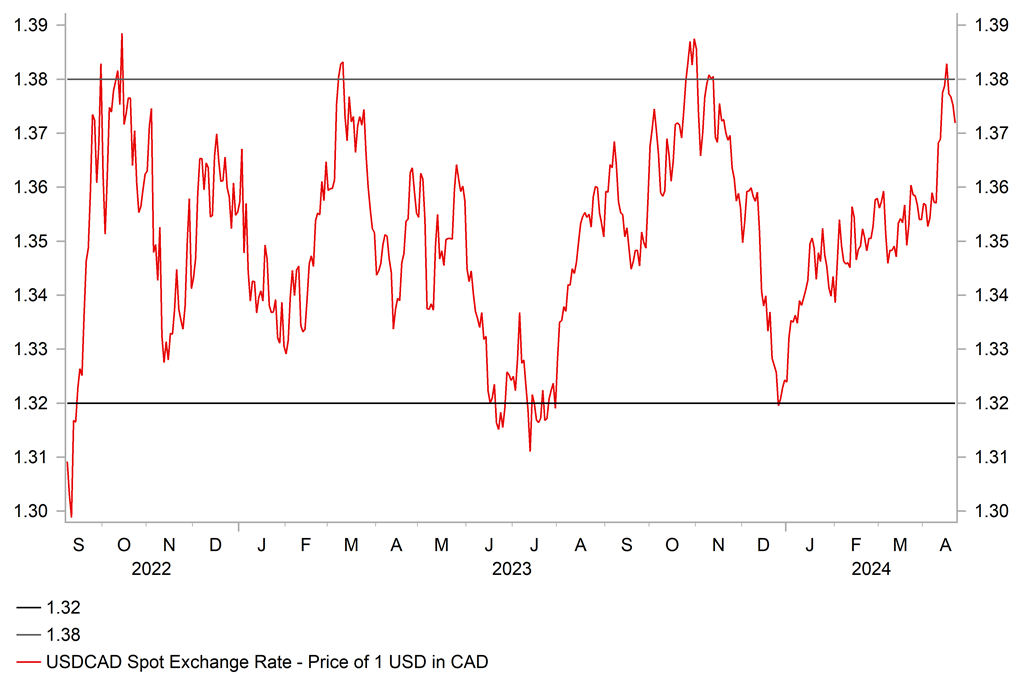

One of the other G10 currencies that outperformed alongside the Swiss franc last week was the Canadian dollar. However, we do not expect those gains to extend much further in the near-term. As we highlighted in our latest FX Weekly report (click here), we expect USD/CAD to continue to trade in the high 1.3000’s in the coming months. One of the main fundamental drivers for the move higher in USD/CAD at the start of this year has been the diverging paths for inflation in Canada and the US. Core inflation in Canada has surprised to the downside in the first three months of this year which stands in marked contrast to the recent run of upside inflation surprises in the US. After core inflation in Canada proved frustratingly persistent in the second half of last year, it has resumed its decent at the start of this year which is opening the door for the BoC to begin lowering interest rates. The BoC’s preferred measure of core inflation that is an average of the median and trimmed measures slowed to an annual rate of 3.0% in March. The slowdown in core inflation appears even more abrupt over the last six months when it has increased by an annualized rate of 2.5% after applying seasonal adjustments (Census X-13) to the data series.

At the BoC’s last policy meeting, Governor Macklem stated that “we are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained. The softer March core CPI readings have increased the likelihood that the BoC will begin cutting rates at their next meeting in June and importantly ahead of the Fed.

USD/CAD HAS BEEN TESTING TOP OF TRADING RANGE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

11:00 |

CBI Industrial Trends Orders |

Apr |

-15 |

-18 |

!! |

|

GE |

11:00 |

German Buba Monthly Report |

-- |

-- |

-- |

! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Chicago Fed National Activity |

Mar |

-- |

0.05 |

! |

|

CA |

13:30 |

New Housing Price Index (MoM) |

Mar |

0.1% |

0.1% |

!! |

|

EC |

15:00 |

Consumer Confidence |

Apr |

-14.0 |

-14.9 |

! |

|

EC |

16:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg