Key Points

- In a surprise move, Bank Indonesia (BI) raised the policy rate by 25bp to 6.25% in April to defend the Indonesian rupiah from geopolitical risks and to contain imported inflation. The surprise rate hike could help slow the pace of rupiah depreciation, but this will likely be at the expense of domestic growth.

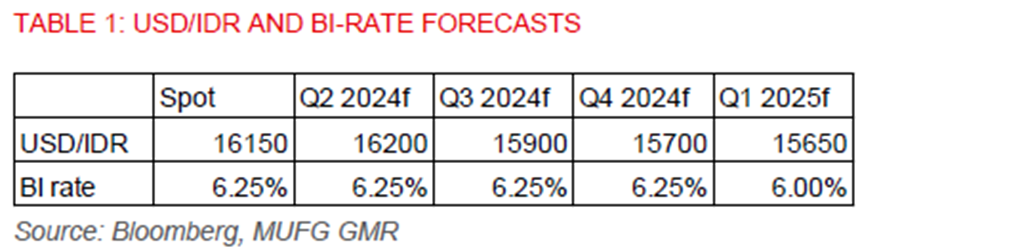

- We forecast the USD/IDR at 16,200 for the next 3 months. We also cut our GDP growth forecast by 0.3ppts to 4.8% in 2024, as we think monetary tightening is overdone, dragging on domestic demand. This would be a slowdown from 5.04% growth in 2023. BI rate cuts are also likely off the table this year, as policymakers prioritize rupiah stability. BI thinks the Fed could keep rates higher for longer.

- There is no catalyst for sustained gain in the Indonesian rupiah versus the US dollar. A scenario where there’s a sharp increase in global risk premium could still lead USD/IDR to test its peak of around 16,600, a level last seen during the Covid period in early 2020.

- There’s no change to BI’s growth outlook of 4.7%-5.5% this year. Credit growth was 12.4%yoy in Q1, above BI’s 10%-12% range for this year. We look for domestic credit growth to slow over the coming months. Macroprudential measures will have to be stepped up to sustain loan growth.

- We think inflation will remain within BI’s 1.5%-3.5% target this year amid elevated interest rates. Core inflation was just 1.8%yoy in March, and we expect softening growth would contain demand-pull inflation in the coming months. Meanwhile administrative prices stepped down to 1.4%yoy in March, from 1.7% in February. BI’s pre-emptive rate hike will also help contain the pass-through of a weaker currency to CPI inflation.

- BI has been intervening in the FX market via spot and DNDF, while yields on BI’s rupiah securities (SRBI) have moved higher to 6.85% at one point to help lure more foreign capital inflows.