To read the full report, please download the PDF above.

Why is inflation in EM generally in a better position than DM economies?

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

SOOJIN KIM

Research Analyst

DIFC Branch – Dubai

T: +44(4)387 5031

E: soojin.kim@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

T: +44(0)20 577 1968

E: lee.hardman@uk.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Macro focus

We are frequently being asked by clients as to the rationale behind the divergence between emerging market (EM) and developed market (DM) inflation rates. We hone in on this theme for this week’s macro focus and ask why is inflation in EM generally in a better position (relative to central bank targets) than DM countries? We believe there are two key explanations. First, EMs have on average a higher weight of goods in their CPI baskets, and global disinflation has been goods-centric to date, owing to supply chain de-bottlenecking. Second, major EM EMEA and LatAm economies were early to the party in hiking rates (and more aggressively) than DM central banks. Looking ahead, notwithstanding existing challenges, with EM inflation making considerable progress back to target, and global monetary conditions easing, we envisage lower policy rates across the EM complex over the next 18 months.

FX views

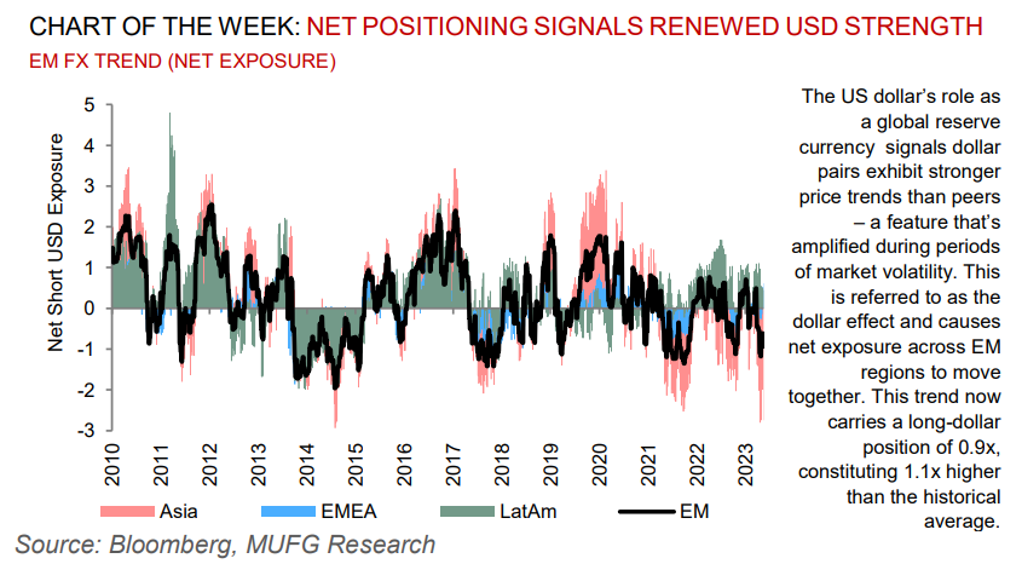

The EM FX complex has found some stability with the USD taking a breather and Fed rate hikes now firmly off the table, as well as some EM central banks are sounding hawkish. What is marked is how EM currencies have defied expectations compared to one of their more dominant forces, namely the shift in pricing of Fed rate expectations.

Week in review

Inflation in Poland edged higher in May but a re-commencement of rate cuts by Q4 2024 is still on track. South Africa kept rates on hold at 8.25%, though political uncertainty abound in the country following ANC parliamentary losses. Turkey’s Q1 2024 GDP surges on higher consumption. Finally, Saudi Arabia raised USD5bn from the international sukuk market.

Week ahead

This week, there will be rates meetings in Poland (5 June), Kenya (5 June) and Russia (7 June). CPI data will be released in Turkey (3 June) and South Africa will release both Q2 2024 GDP (4 June) and current account data (6 June). Furthermore, PMIs will be released across the region for the month of May which will offer visibility on the health of corporate activity. South Africa will hold general elections (29 May) and an MPC meeting (30 May). The preliminary inflation print for May will be released in Poland (31 May). Finally, Q1 GDP data will be released in Turkey (31 May).

Forecasts at a glance

Growth across the EM universe is set to stabilise as domestic fundamentals offset external drags, with some rotation from the largest to smaller EMs. Inflation and interest rates are both “over the hump” – disinflation is progressing, and the decline in rates will continue and broaden in 2024 (see here).

Core indicators

According to the IIF, EM funds witnessed the first weekly outflow (USD-4.1bn) is six weeks.