To read the full report, please download the PDF above.

Gauging the geopolitical risk premium from heightened animosities in the Middle East

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

RAMYA RS

Analyst

DIFC Branch – Dubai

T:+971 (4)387 5031

E: ramya.rs@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

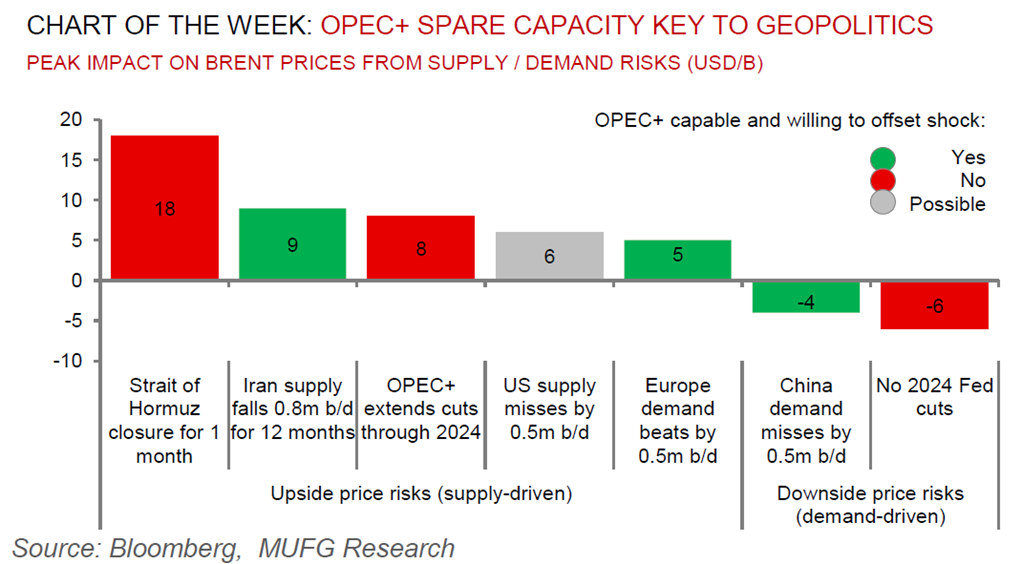

The global oil markets is on tenterhooks as the world awaits Israel’s response to Iran’s weekend drone-and-missile attack. While the scope of the geopolitical risk premium – the compensation investors demand for the risk that geopolitical shocks reduce oil supply – is challenging to estimate, a combination of historical episodes, the cost of hedging as well as our own modelling pricing framework suggests a wider conflict could send crude oil prices higher by a wide deviation of USD5-20+/b. Its important to note that the geopolitical risk premium has already been at least partially priced in with Brent crude climbing above USD90/b after the strike on Iran’s diplomatic compound in Syria on 1 April (on top of recent attacks on Russian refineries and ongoing shipping disruptions in the Red Sea) – taking its gains to ~16% year-to-date. Going forward, with bellicose rhetoric coming from both Israel and Iran, markets may continue to place a sizable premium on the price of oil in the coming days and weeks. Yet, such geopolitical risk premium needs to be put into context of the availability of spare capacity in the system. Given OPEC+ spare capacity at ~6.5m b/d remains so elevated, we anticipate that geopolitical impediments to the capability or willingness of OPEC+ to deploy its ample buffers as the key upside risk to send oil prices north of USD100/b for a sustained period (in the absence of material demand destruction).

Energy

Oil has shrugged off Iran’s attack on Israel given investor comfort that no physical barrels having been taken off global markets as well as significant OPEC+ spare capacity available at hand. We continue to hold conviction that effective OPEC+ market management will ensure Brent crude remains in a USD80-100/b range in 2024, with a USD80/b OPEC+ put from the group leveraging its inelastic pricing power, and a USD100/b ceiling from ample spare capacity to handle tightening shocks. The largest upside risk to oil prices would be geopolitical impediments to the capability or willingness of OPEC+ to deploy its ample ~6.5m b/d of spare capacity.

Base metals

Base metals are roaring this week following new US and UK restrictions on Russian copper, aluminium and nickel, with Western exchanges (LME and CME) banning delivery of new output from the country. From a fundamental perspective, it is critical to recognise that these exchange focused rule adjustments will not generate a necessary supply-demand shock. Russian producers can continue to sell metal to non-UK/US markets – and thus, there is no immediate tightening implication or trade flow dislocation to Western markets, in the way there was with Rusal’s sanctions in 2018.

Precious metals

Despite the market pricing progressively fewer Fed cuts, stronger growth trends and record equity markets, gold has rallied ~15% year-to-date. The traditional fair value of gold would connect the usual catalysts – real rates, growth expectations and the US dollar – to flows and the price. Yet, none of those traditional factors adequately explain the velocity and scale of the gold price move so far this year. We reiterate our 2024 commodities views that gold is our most bullish call this year (we recognise that our above consensus year-end forecast of USD2,350/oz that we laid out at the start of the year, now look modest), on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Iron ore – the most China centric industrial commodity – is facing a renewed downdraft after China’s latest data readings underlined just how tepid the nation’s steel industry remains in. Steel production in March came in slightly north of 88m tons, ~8% lower than the same month last year.

Agriculture

Wheat prices are falling as favourable weather over key US growing regions is supporting crop growth. Increased rainfall in the Midwest is encouraging for winter wheat growth with drier weather in the Mississippi Delta region also relieving some of the soaking conditions.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.