To read the full report, please download the PDF above.

Global inflation implications from commodities’ late-cycle and geopolitical tailwinds

EHSAN KHOMAN

Head of Commodities, ESG and

Emerging Markets Research –

EMEA

DIFC Branch – Dubai

T:+971 (4)387 5033

E: ehsan.khoman@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

Global commodities

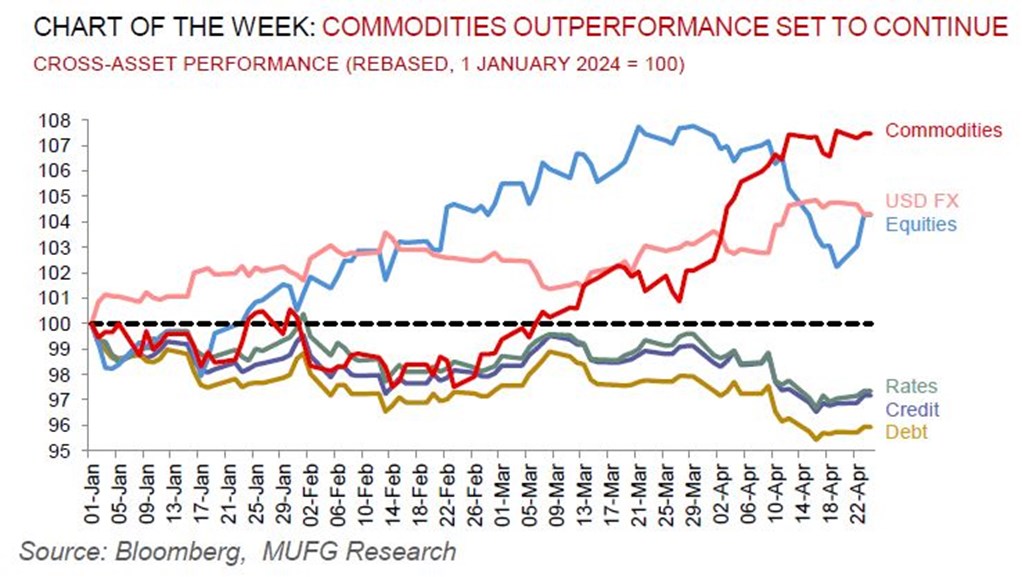

Commodities are stirring. The complex is the best performing cross-asset class year-to-date (+5.0%) owing to a combination of classic late cycle dynamics (see here) and geopolitical tailwinds (see here). We hold conviction this stellar commodities outperformance has further room to run, which is raising questions about whether it could prompt a pickup in global inflation (and a more hawkish policy shift). Our examination implies that historically a ~10% increase in commodity prices leads to ~40-45 basis point upward pressure on global annualised headline inflation (the pass-through to core inflation is much smaller and more uncertain). From this, using a Taylor rule to construct proxies for the impact of commodity prices on interest rates, suggest that historically a ~10% increase in commodities leads to a 25bp hike in commodity-centric economies and a near-negligible effect in major developed market economies (where growth costs somewhat offsets the policy impact of higher inflation). Looking ahead, interest rate reaction functions in the current environment may skew more hawkish than our Taylor rule analysis suggests given central banks are laser focused on bring inflation sustainably back to target.

Energy

Reduced geopolitical risk premium for oil and a broader risk-off tone is being overshadowed by bullish US crude inventory numbers, with front-end Brent pricing consolidating below the USD90/b handle. We continue to hold conviction that effective OPEC+ market management will ensure Brent crude remains in a USD80-100/b range in 2024, with a USD80/b OPEC+ put from the group leveraging its inelastic pricing power, and a USD100/b ceiling from ample spare capacity to handle tightening shocks.

Base metals

While we do not expect the US Treasury and UK governments’ recent move to prohibit developed market metals exchanges from accepting new Russian aluminium, copper and nickel to immediately impact the markets’ supply-demand balance, an already tight fundamental backdrop in copper and aluminium signals that these base metals will remain in a structural bull market. All in, the base metals squeeze continues.

Precious metals

Gold’s recent leg lower suggests at least some of the recent strength were due to a flight to safety that may be waning. Nevertheless, despite the market pricing progressively fewer Fed cuts, stronger growth trends and record equity markets, gold has rallied 15% year-to-date and we hold conviction that has further room to run. We reiterate our 2024 commodities views that gold is our most bullish call this year (we recognise that our above consensus year-end forecast of USD2,350/oz that we laid out at the start of the year, now look modest), on a trifecta of Fed cuts, supportive central bank demand and bullion’s role as the geopolitical hedge of last resort (see here).

Bulk commodities

Iron ore – the most China centric industrial commodity – has climbed to the highest level in seven weeks as Fortescue (the world’s fourth largest producer) stated full-year shipments are likely to be at the lower end of guidance following disruptions hit supplies at mines in Western Australia.

Agriculture

Wheat prices are at two month highs with an attack by Russia in Ukraine and a lack of rain in the US is prompting traders to cover part of a sizable net short position. Granted, a threat is just that at this juncture but fund managers are easing up on their risk exposures once again.

Core indicators

Price performance and forecasts, flows, market positioning, timespreads, futures, inventories, storage and products performance are covered in the report.